|

市场调查报告书

商品编码

1686203

越南塑胶:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Vietnam Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

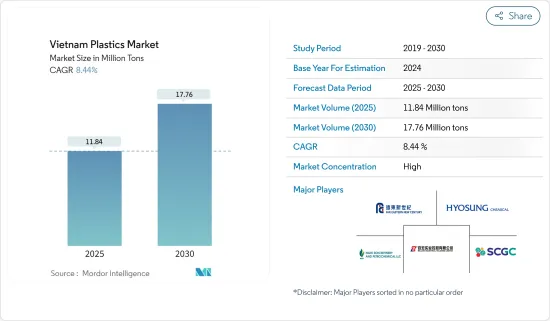

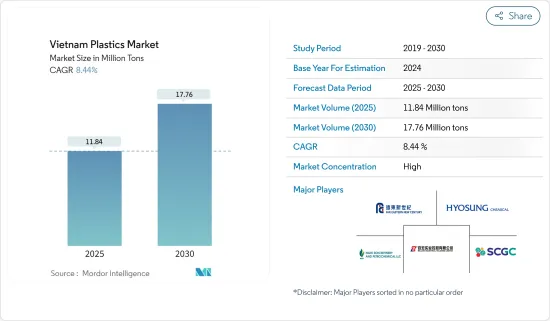

2025年越南塑胶市场规模预估为1,184万吨,预计2030年将达到1,776万吨,预测期(2025-2030年)复合年增长率为8.44%。

新冠肺炎疫情为越南市场带来了负面影响。但随着主要终端用户产业復工,市场估计已恢復至疫情前的水准。

主要亮点

- 短期内,预计建设产业需求的增加将推动市场成长。

- 过度依赖原材料和成品塑胶的进口预计会阻碍市场的成长。

- 预计增加的外国投资将为市场成长提供各种机会。

越南塑胶市场的趋势

挤压技术占据市场主导地位

- 在越南,挤压技术用于製造PVC、PE管、铝和塑胶管、纺织品、PVC门、框架、屋顶和墙壁材料等产品。挤压製程生产成本低,设置时间短。但精度一般,且主要适用于截面均匀的零件,不适用于复杂零件。

- 此技术主要用于建设活动,主要产品包括PVC、HDPE、PPR管道、型材、塑胶门窗、板材、家具等。

- 根据2020年塑胶工业发展规划,塑胶工业将向减少包装和消费塑胶比重、增加建筑和技术塑胶比重的方向进行结构调整。

- 越南建筑塑胶产业约占整个塑胶产业的四分之一。建筑和房地产行业的发展正在推动对塑胶建筑产品的需求。

- 越南政府还计划在 350 多个工业区建造 100 万套经济适用住宅。这些基础设施建设计划和不断增加的工厂数量正在推动该国对建筑和技术塑胶的强劲需求。

- 2022 年 4 月,越南领先的 PET 包装营运商 Ngoc Nghia工业、服务和贸易股份公司 (NN) 被全球永续化学公司 Indorama Ventures Ltd (IVL) 收购。透过此次收购,IVL 将扩大其综合 PET 产品供应范围,向该国的主要跨国客户供应产品,并巩固其市场地位。

- 2022年9月,美国饮料公司可口可乐公司在越南推出完全回收的宝特瓶。该公司声称符合越南食品级 rPET 包装法规和国际标准。

- 考虑到以上所有因素,挤压技术可望占领市场主导地位。

包装领域占据市场主导地位

- 包装占越南塑胶市场的最大份额。重量轻、耐热、耐化学性和耐腐蚀性等因素使塑胶成为越南市场包装的热门选择。

- 在包装产业,塑胶用于医疗保健包装、食品和饮料包装、消费包装商品、消费者和个人护理包装、家居和花园等。

- 聚对苯二甲酸乙二醇酯(PET)是用于包装的主要塑胶之一,主要用于食品和饮料行业。便携性、设计灵活性、易于清洗、重量轻和防潮是 PET 适合用于包装用途的一些特性。

- 此外,低操作危险、低毒性以及不含双酚 A (BPA) 和重金属也有利于 PET 在食品包装行业的市场发展。

- 未来几年,包装产业的成长率将达到15%至20%,是越南成长最快的产业之一。目前,该行业有 900 多家工厂,其中约 70%位置南部,主要在胡志明市、平阳和同奈。

- 2022年3月,知名食品饮料公司利乐公司向平阳省一家价值1.412亿美元的包装材料工厂追加投资590万美元,展现了对越南的信心。为了满足越南和其他地区市场对无菌包装日益增长的需求,新增投资将使该工厂的年产能从目前的115亿包增加到165亿包。

- 因此,由于上述方面,预计包装领域将占据市场主导地位。

越南塑胶产业概况

越南塑胶市场是一个集中市场,从事塑胶树脂生产的参与者有限。市场的主要企业包括(不分先后顺序)远东新世纪、宜山炼油石化(NSRP)、晓星化学、亿利实业控股有限公司和SCG化工公众有限公司(TPC VINA)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑业需求不断成长

- 其他驱动因素

- 限制因素

- 过度依赖原料和塑胶成品的进口

- 对塑胶的环境担忧以及新替代品的出现

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

第五章 市场区隔

- 类型

- 传统塑料

- 聚乙烯

- 聚丙烯

- 聚苯乙烯

- 聚氯乙烯

- 工程塑料

- 聚氨酯

- 氟树脂

- 聚酰胺

- 聚碳酸酯

- 苯乙烯共聚物(ABS 和 SAN)

- 热塑性聚酯

- 其他工程塑料

- 生质塑胶

- 传统塑料

- 成型技术

- 吹塑成型

- 挤压

- 射出成型

- 其他技术

- 应用

- 包装

- 电气和电子

- 建筑和施工

- 汽车和运输

- 家居用品

- 家具和床上用品

- 其他用途

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Agc Inc.

- Billion Industrial Holdings Limited

- Far Eastern New Century Corporation

- Hyosung Chemical

- Lyondellbasell Industries Holdings Bv

- Nan Ya Plastics Corporation

- Nsrp Llc

- Scg Chemicals Public Company Limited

- Toray Industries Inc.

- 越南石油天然气集团

- Vietnam Polystyrene Co. Ltd

- Vinaplast

第七章 市场机会与未来趋势

- 增加外国投资

- 其他机会

The Vietnam Plastics Market size is estimated at 11.84 million tons in 2025, and is expected to reach 17.76 million tons by 2030, at a CAGR of 8.44% during the forecast period (2025-2030).

The COVID-19 pandemic affected the Vietnamese market negatively. However, with the resumption of work in major end-user industries, the market is estimated to have reached pre-pandemic levels.

Key Highlights

- In the short term, the increasing demand from the construction industry is expected to drive market growth.

- Over-reliance on imports of raw materials and finished plastics is expected to hinder the growth of the market.

- An increase in foreign investments is expected to offer various opportunities for the growth of the market.

Vietnam Plastic Market Trends

Extrusion Technology to Dominate the Market

- In Vietnam, extrusion molding technology is used to make products such as PVC, PE pipe, aluminum and plastic pipe, fiber, PVC doors, frames, roofings, and wall coverings. An extrusion molding process involves lower production costs and faster setup time. However, it provides mediocre precision and is mostly suitable for uniform cross-section parts and not complex parts.

- This technology is used mainly in construction activities, and the main products include PVC, HDPE, PPR pipes, profile bars, plastic doors and windows, panels, and furniture.

- According to the plastic industry development plan of 2020, the plastics industry will be restructured toward reducing the proportion of packaging and consumer plastics and increasing the percentage of the construction and technical plastics segment.

- Vietnam's construction plastics segment accounts for around one-fourth of the total plastics industry. Developing the construction and real estate sector is boosting the demand for plastic construction products.

- In addition, the country's government aims to build a million affordable houses in more than 350 industrial zones. These infrastructural development projects and the increasing number of factories being installed are robustly increasing the demand for construction and technical plastics in the country.

- In April 2022, one of the top PET packaging businesses in Vietnam, Ngoc Nghia Industry - Service - Trading Joint Stock Company (NN), was acquired by Indorama Ventures Public Company Limited (IVL), a global sustainable chemical company. The acquisition will strengthen IVL's market position as it broadens its integrated PET product offering to significant multinational customers throughout the country.

- In September 2022, the US-based beverage company The Coca-Cola Company introduced fully recycled plastic bottles in Vietnam. The company claims to meet both Vietnamese regulations and international standards for food-grade rPET packaging.

- Based on the aforementioned aspects, extrusion technology is expected to dominate the market.

Packaging Segment to Dominate the Market

- Packaging accounts for the largest share of the Vietnamese plastics market. Factors like light weight and thermal, chemical, and corrosion resistance make plastics a viable choice for packaging purposes in the Vietnamese market.

- In the packaging industry, plastics are used for healthcare packaging, food and beverage packaging, consumer packaged goods, consumer and personal care packaging, and in the home and garden.

- Polyethylene terephthalate (PET) is one of the majorly used plastics for packaging purposes, mostly in the food and beverage industry. Portability, design flexibility, ease of cleaning, light weight, and protection against moisture are a few properties of PET that make them suitable for packaging purposes.

- In addition, low handling hazards, low toxicity, absence of Bisphenol A (BPA), and heavy metals favor the PET market for the food packaging industry.

- With a growth rate of 15% to 20% in the upcoming years, the packaging industry is one of Vietnam's fastest-growing sectors. Over 900 factories are currently in operation in the sector, with approximately 70% of them located in the Southern region, primarily in Ho Chi Minh City, Binh Duong, and Dong Nai.

- In March 2022, Tetra Pak, a well-known F&B company, with an additional USD 5.9 million investment into its USD 141.2 million packaging material factory in the province of Binh Duong, proved its confidence in Vietnam. To meet the growing demand for aseptic packages in Vietnam and other regional markets, the additional investment will increase the factory's annual output from the current 11.5 billion to 16.5 billion packages.

- Thus, based on the aforementioned aspects, the packaging segment is expected to dominate the market.

Vietnam Plastic Industry Overview

The Vietnamese plastics market is a consolidated market with a limited number of players engaged in the production of plastic resins. Some of the key players in the market include Far Eastern New Century, Nghi Son Refinery and Petrochemical (NSRP), Hyosung Chemicals, Billion Industrial Holdings Limited, and SCG Chemicals Public Company Limited (TPC VINA), among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Over-reliance on Imports of Raw Materials and Finished Plastics

- 4.2.2 Environmental Concerns of Plastics and the Availability of New Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Traditional Plastics

- 5.1.1.1 Polyethylene

- 5.1.1.2 Polypropylene

- 5.1.1.3 Polystyrene

- 5.1.1.4 Polyvinyl Chloride

- 5.1.2 Engineering Plastics

- 5.1.2.1 Polyurethanes

- 5.1.2.2 Fluoropolymers

- 5.1.2.3 Polyamides

- 5.1.2.4 Polycarbonates

- 5.1.2.5 Styrene Copolymers (ABS and SAN)

- 5.1.2.6 Thermoplastic Polyesters

- 5.1.2.7 Other Engineering Plastics

- 5.1.3 Bioplastics

- 5.1.1 Traditional Plastics

- 5.2 Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Housewares

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Agc Inc.

- 6.4.2 Billion Industrial Holdings Limited

- 6.4.3 Far Eastern New Century Corporation

- 6.4.4 Hyosung Chemical

- 6.4.5 Lyondellbasell Industries Holdings Bv

- 6.4.6 Nan Ya Plastics Corporation

- 6.4.7 Nsrp Llc

- 6.4.8 Scg Chemicals Public Company Limited

- 6.4.9 Toray Industries Inc.

- 6.4.10 Vietnam Oil And Gas Group

- 6.4.11 Vietnam Polystyrene Co. Ltd

- 6.4.12 Vinaplast

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Foreign Investments

- 7.2 Other Opportunities