|

市场调查报告书

商品编码

1686208

生物聚乳酸(PLA) -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Bio-polylactic Acid (PLA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

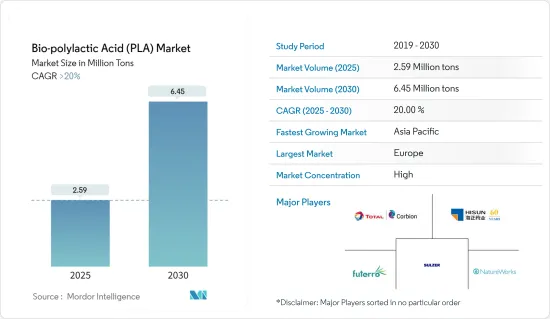

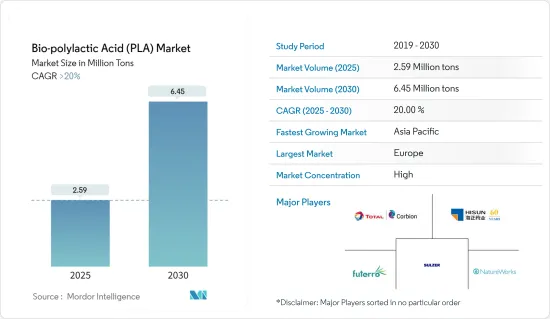

预计2025年生物聚乳酸市场规模为259万吨,2030年将达到645万吨,预测期间(2025-2030年)的复合年增长率将超过20%。

新冠疫情导致全球范围内的停工,扰乱了製造活动和供应链,生产暂停,劳动力短缺,对市场产生了不利影响。然而,情况在 2021 年开始復苏,因此预测期内所研究的市场的成长轨迹有所回升。

主要亮点

- 推动市场成长的主要因素是政府对生质塑胶的优惠政策。

- 另一方面,PLA的高成本预计会阻碍市场发展。

- 基因改造玉米产量的不断增加以及生物PLA在3D列印中的应用日益增加可能会在未来带来机会。

- 亚太地区占据全球市场主导地位,其中最大的消费国是中国和日本等国家。

聚乳酸(PLA)市场趋势

包装领域预计将主导市场

- 包装产业是生物PLA的最大消费者之一。 2021 年,包装占生物 PLA 市场的 68% 以上(以以收益为准计算)。此外,在疫情背景下,卫生和食品安全问题已成为全球优先事项。

- 根据印度包装研究所的数据,印度的包装消费量在过去十年中增加了 200%,从人均每年 4.3 公斤增加到 8.6 公斤。然而,中国在该领域占据主导地位,是世界上最大的包装材料和产品製造商和出口国。

- 预计对维生素等营养补充剂和过敏药物等必需产品的需求将会增加。此外,对环境和气候变迁的担忧正在促使世界各国选择生物分解性的包装材料。

- Bio-PLA主要用于超级市场的水果和蔬菜包装、麵包袋和麵包盒、瓶子、信封、展示纸箱窗口、购物袋和手提袋。

- 连锁餐厅和食品加工行业越来越多地采用生物分解性的材料进行食品包装。此外,由于某些塑胶已知具有致癌性,人们对食品安全的意识也越来越强。

- 封锁结束后的数据表明,消费者的购买偏好已从线下转向线上。随着全球消费者逐渐习惯网路购物,预计未来几年对 PLA 的需求将会增加。

中国可望主导亚太市场

- 中国是亚太地区最大的经济体,拥有世界上最大的製造业和生产基地之一。

- 由于塑胶禁令和向永续和生物分解性包装的转变,该国的包装行业取得了显着增长。因此,预计它将在此期间推动市场。

- 而且,中国食品加工产业正在成熟并经历缓慢成长。加工和包装的冷冻食品越来越受欢迎,尤其是乳製品、婴儿食品和糖果零食,并推动了食品加工产业的发展。

- 根据中国国家统计局的数据,2021年中国食品工业利润总额约6,180亿元人民币(885亿美元)。食品製造业贡献了约1,791亿元人民币(266亿美元)的利润总额。

- 中国是世界上最大的纺织品生产国和出口国。据工业和资讯化部称,2021年中国纺织业稳步增长,利润总额达2,677亿元人民币(382亿美元),与前一年同期比较去年同期成长25.4%。

- 2021年医疗费用约7.2兆元,占国内生产总值)的7.1%。由于医院数量的增加和医疗支持需求的上升,中国的医疗保健和治疗市场正在经历强劲增长。因此,预计医疗应用的进步将在预测期内推动市场发展。

- 此外,根据ZVEI Dia Elektroindustrie预测,2021年中国电子产业规模约为2.5兆欧元(2.635兆美元),占全球产出的50%以上,预计2022年和2023年将分别年与前一年同期比较14%和8%。

因此,未来几年亚太地区的生物聚乳酸市场很可能由中国主导。

聚乳酸(PLA)产业概况

生物基聚乳酸市场高度整合,四大公司以产能计算占约86%的市场占有率。受调查的市场主要企业(排名不分先后)包括 NatureWorks LLC、浙江海正生物材料、Sulzer Ltd、Total Corbion PLA、Futerro 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 政府推出优惠政策促进生质塑胶发展

- 其他驱动因素

- 限制因素

- 价格高和其他缺点

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 原料

- 玉米

- 木薯

- 甘蔗和甜菜

- 其他成分(糖蜜、马铃薯、小麦)

- 形式

- 纤维

- 薄膜和片材

- 涂层

- 其他形式

- 最终用户产业

- 包装

- 医疗保健

- 电子产品

- 农业

- 纤维

- 其他终端使用者产业(建筑、消费品)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 独联体地区

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- BASF SE

- BEWiSynbra Group

- Cofco

- Danimer Scientific

- Esun

- Futerro

- Jiangxi Keyuan Bio-Material Co. Ltd

- Musashino Chemical Laboratory Ltd

- NatureWorks LLC

- Polysciences Inc.

- Shanghai Tong Jie Liang Biomaterials Co. Ltd

- Sulzer Ltd

- Weforyou

- Total Corbion PLA

- Zhejiang Hisun Biomaterials Co. Ltd

第七章 市场机会与未来趋势

- 食品包装的新应用

- 扩充 3D 列印 PLA 的应用

The Bio-polylactic Acid Market size is estimated at 2.59 million tons in 2025, and is expected to reach 6.45 million tons by 2030, at a CAGR of greater than 20% during the forecast period (2025-2030).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, production halts and labor unavailability negatively impacted the market. However, the conditions started recovering in 2021, thereby restoring the growth trajectory of the market studied during the forecast period.

Key Highlights

- The primary factor driving the market's growth is favorable government policies toward bio-plastics.

- On the flip side, the high cost of PLA is expected to hinder the development of the market studied.

- The growing production of genetically modified corn and the increasing usage of bio-PLA in 3D printing are likely to act as opportunities in the future.

- Asia-Pacific dominated the market worldwide, with the most significant consumption from countries like China and Japan.

Polylactic Acid (PLA) Market Trends

The Packaging Segment is Expected to Dominate the Market

- The packaging industry is one of the largest consumers of bio-PLA. Packaging accounted for a little over 68% of the bio-PLA market in 2021 in terms of revenue. Moreover, concerns about hygiene and food safety in the context of the pandemic have become a higher priority globally.

- As per the Indian Institute of Packaging, the packaging consumption in India has increased by 200% in the past decade, rising from 4.3 to 8.6 kg per person per year. Nonetheless, China dominates the sector and is the largest manufacturer and exporter of packaging materials and products globally.

- The demand is expected to increase for dietary supplements, such as vitamins, and essential supplies, such as allergy medication. Moreover, environmental and climate change concerns are driving countries worldwide to choose biodegradable packaging materials.

- Bio-PLA is primarily used in fruit and vegetable packaging in supermarkets and for bread bags and bakery boxes, bottles, envelopes, display carton windows, and shopping or carrier bags.

- The restaurant chains and food processing industries are increasingly adopting biodegradable materials for food packaging. People are also becoming more aware of how safe food is, since some plastics are known to cause cancer.

- The post-lockdown numbers indicate a systemic shift in consumer purchasing preferences from offline to online. Customers around the world are getting more and more used to shopping online, which is expected to increase demand in the PLA market over the next few years.

China is Expected to Dominate the Market in Asia-Pacific

- China is the largest economy in the Asia-Pacific region and has one of the largest manufacturing and production bases in the world.

- In the country, the packaging industry is witnessing tremendous growth due to the plastic ban and shift toward sustainable and biodegradable packaging. Thus, it is expected to drive the market during the period.

- Furthermore, the Chinese food processing industry is moving toward maturity and experiencing moderate growth. Processed and packaged frozen food products are increasingly popular, especially dairy, baby food, and confectionery products, which is a driver for the food processing industry.

- According to the National Bureau of Statistics of China, in 2021, the food industry in China generated a total profit of about 618 billion yuan (USD 88.5 billion). The food manufacturing industry contributed approximately 179.1 billion yuan (USD 26.6 billion) to the total profits.

- China is the largest textile-producing and exporting country in the world. The textile industry of China grew steadily in 2021, with collective profits of 267.7 billion yuan (USD 38.20 billion), a 25.4 percent increase year-on-year (YoY), according to the Ministry of Industry and Information Technology (MIIT).

- In 2021, the health expenditure was approximately CNY 7.2 trillion, accounting for 7.1% of the country's GDP. The medical and therapeutical market in China has witnessed strong growth due to a growing number of hospitals and the increasing demand for medical assistance. Thus, advancements in medical applications are expected to drive the market during the forecast period.

- Furthermore, according to ZVEI Dia Elektroindustrie, China's electronics industry will be worth approximately EUR 2,500 billion (USD 2635 billion) in 2021, accounting for more than 50% of global production, and is expected to grow at 14% and 8% Y-o-Y in 2022 and 2023, respectively.

So, the bio-polylactic acid market in Asia-Pacific is likely to be led by China over the next few years.

Polylactic Acid (PLA) Industry Overview

The bio-polylactic acid market is highly consolidated, and the four major players have a share of around 86% market in terms of production capacity. The major players of the market studied (not in any particular order) include NatureWorks LLC, Zhejiang Hisun Biomaterials Co. Ltd, Sulzer Ltd, Total Corbion PLA and Futerro, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Favorable Government Policies Promoting Bio-plastics

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Price and Other Disadvantages

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 Corn

- 5.1.2 Cassava

- 5.1.3 Sugarcane and Sugar Beet

- 5.1.4 Other Raw Materials(molasses, potato, wheat)

- 5.2 Form

- 5.2.1 Fiber

- 5.2.2 Films and Sheets

- 5.2.3 Coatings

- 5.2.4 Other Forms

- 5.3 End-user Industry

- 5.3.1 Packaging

- 5.3.2 Medical

- 5.3.3 Electronics

- 5.3.4 Agriculture

- 5.3.5 Textiles

- 5.3.6 Other End-user Industries(construction, consumer goods)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 CIS region

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BEWiSynbra Group

- 6.4.3 Cofco

- 6.4.4 Danimer Scientific

- 6.4.5 Esun

- 6.4.6 Futerro

- 6.4.7 Jiangxi Keyuan Bio-Material Co. Ltd

- 6.4.8 Musashino Chemical Laboratory Ltd

- 6.4.9 NatureWorks LLC

- 6.4.10 Polysciences Inc.

- 6.4.11 Shanghai Tong Jie Liang Biomaterials Co. Ltd

- 6.4.12 Sulzer Ltd

- 6.4.13 Weforyou

- 6.4.14 Total Corbion PLA

- 6.4.15 Zhejiang Hisun Biomaterials Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications in Food Packaging

- 7.2 Growing Applications for 3D-printed PLA