|

市场调查报告书

商品编码

1686214

汽车胶带:市场占有率分析、产业趋势与成长预测(2025-2030)Automotive Adhesive Tape - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

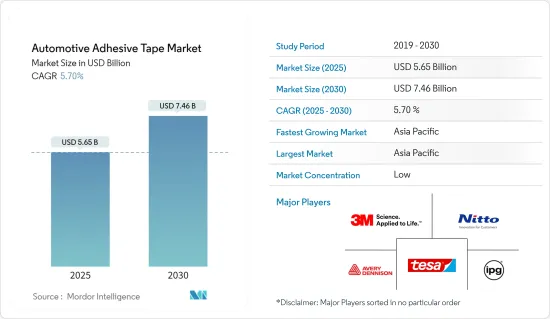

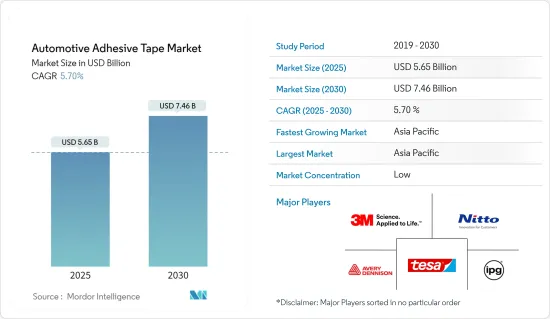

预计2025年汽车胶带市场规模为56.5亿美元,到2030年将达到74.6亿美元,预测期间(2025-2030年)的复合年增长率为5.7%。

COVID-19 疫情严重影响了汽车胶带市场,扰乱了供应链,导致生产放缓和停顿,并引发景气衰退。儘管 COVID-19 最初的影响是负面的,但市场预计将在预测期内復苏。

主要亮点

- 由于电动车对轻量化密封解决方案的需求不断增加,预计预测期内胶带需求将会成长。此外,胶带是传统机械紧固方法的一种有吸引力的替代方案,在电动车製造领域发挥重要作用。

- 电气化和自动化的不断发展给汽车製造商带来了越来越大的挑战。电动车的高成本是一个可能限制需求成长的挑战。

- 对耐热和低VOC汽车胶带的需求为提高温度控管效率创造了有利可图的机会。这与内燃机汽车和电动车相关,也将增加内装设计的自由度。

- 随着电动和传统汽车产量和销量的不断增长,亚太地区占据全球市场占有率。

汽车胶带市场趋势

电动和混合动力汽车中胶带的使用日益增多

- 胶带在电动车电池中的应用越来越多,以提高安全性并减轻车辆整体重量。预计在预测期内,用胶带代替紧固件以改善汽车美观度的趋势将推动市场发展。

- 在汽车工业中,胶带用于将零件固定到车身外部,防止清漆时磨损,并在组装中提供支撑。胶带也用于汽车内饰的各种特殊应用。

- 电动车因其运行成本低、驾驶平稳等优势,在世界各地越来越受欢迎。汽车製造商正在投资透过使用轻量材料(包括复合材料和轻质粘合、连接和紧固解决方案)来提高功率重量比。

- 电动车(EV)是实现全球零碳排放的关键一步。许多政府正在支持电动车的生产并帮助投资者建立必要的基础设施。此外,政府也透过各种补贴支持消费者购买电动车。

- 全球各地多家汽车製造商正在投资电动车。日产汽车、丰田汽车、宾士、特斯拉、现代等纷纷开始生产电动车,为汽车胶带市场带来利多。

- 欧盟计划在 2030 年之前在道路上引入 3000 万辆电动车,以减少该地区交通运输部门的排放。各国均根据欧盟计画采取了各种措施。例如,英国已宣布2030年禁止内燃机汽车。

- 根据开姆尼茨汽车研究所的数据,预计德国 2022 年将生产近 57 万辆电动车,2023 年将生产近 100 万辆。德国已获得多项电动车投资,电动车产量可能增加。例如,领先的电动车製造商特斯拉计划将其在德国的生产能力提高一倍。

- 法国新註册的电动车数量正在增加。预计到2023年9月,法国电动车销量将增加至34.1万辆,比2022年同期成长25%。根据媒体报道,特斯拉是法国最大的电动车品牌。

- 根据国际能源总署(IEA)的数据,美国是世界第三大市场。预计2023年第三季电动车销量将超过30万辆,较2022年第三季成长近49.8%。此外,美国企业平均燃油经济性(CAFE)法规旨在2025年将新型和改进型汽车的平均燃油经济性提高到每加仑54.5英里,从而减少对石油的依赖。

- 根据巴西电动车协会(ABVE)统计,2023年第一季轻型电动车销量总计1,4787辆,较2022年同期(9,844辆)成长50%,创下该系列车型历史最高销量。

- 沙乌地阿拉伯正在大力发展电动车。政府正在推广电动车以减少碳排放。政府的目标是到 2030 年生产 50 万辆。

- 此外,电动车在南非越来越受欢迎。根据媒体报道,2022年南非註册了502辆新的纯电动车。

- 预计未来几年,世界各国的新能源汽车强制规定、各种补贴和燃油经济法规等政策将推动轻型电动车的需求。这可能会推动汽车生产对胶带的需求。

亚太地区占市场主导地位

- 亚太地区是全球最大的电动车生产地区。其次是欧洲和北美洲。中国、印度和日本是亚太地区领先的电动车生产国。

- 预计未来胶带将成为汽车行业不可或缺的一部分,而且这不仅仅是出于数量的原因。电动汽车电池会产生热和电压,需要加以保护以确保使用者的安全。因此,製造商开发了自己的双面胶带和薄膜来防止突波。电池可能包裹在耐高温的不易燃产品中。这反过来又推动了汽车产业对胶带的需求。

- 根据国际贸易管理局(ITA)的数据,中国仍然是全球最大的汽车市场(按年销售量和製造产量计算)。预计2025年国内产量将达3,500万辆。为因应疫情,中国政府推出了促进汽车消费的措施。这些措施包括允许无限制销售符合中国5.5排放气体标准的汽车、推广使用电动车、降低汽车销售税、加强平行输入政策等。预计这项变更将使每年的支出增加约 300 亿美元。

- 为了因应汽车产业成长放缓并促进电动车市场的发展,中国政府在 2023 年上半年部分重新运作了这些支持措施。 2021 年 6 月,中华人民共和国政府宣布了针对汽车产业的巨额税收优惠政策。该计划将在四年内实施,预计价值 723 亿元人民币(5,200 亿美元)。

- 该激励措施专门用于促进电动和其他环保汽车的销售。这项税收减免是中国政府迄今针对汽车业提供的最大规模的减免政策,反映了政府在汽车销售低迷时期刺激成长的努力。

- 根据国际汽车工业协会(OICA)预测,2022年中国汽车产量将成长3%,从2021年的26,121,712辆增加至2022年的27,026,155辆。

- 印度是一个不断成长的电动车市场。在印度,电动车和零件製造业蓬勃发展,受到政府32亿美元奖励计画的支持,共吸引了83亿美元的投资。 2023年第三季电动车销量达371,214辆,较2022年第三季成长40%。

- 日本汽车製造商协会发布的新车註册资料显示,2023年9月日本新车市场销量较上月的395,163辆成长近11%,达到437,493辆。继八月市场表现积极之后,九月也迎来了强劲成长。日本市场在连续三个月放缓之后,8月开始加速。 8月汽车年销量达到5.36亿辆,较7月的低迷成长了28%。

- 此外,根据日本汽车经销商协会 (JADA) 的数据,2022 年电动车销量将会增加,日本将拥有 58,813 辆电池式电动车(BEV),是 2021 年的 2.7 倍。为了刺激对电动车的需求,日本政府继续为购买新电动车提供补贴,2022 财年的补充预算中将提供 700 亿日圆(5.01 亿美元)的补贴。

- 韩国的电动车市场正在迅速扩张。根据韩国电力交易所预测,2022年电动车销量预计将达到16万辆,较2021年成长60%。韩国也正在进行各种与电动车相关的投资。例如,现代汽车于2023年11月开始建造电动车工厂,投资额为15.2亿美元。

- 推动市场发展的主要因素是该地区大量的汽车製造厂、低成本劳动力、低廉的原材料价格以及不断增长的城市人口。

- 所有上述因素将在预测期内推动亚太地区对汽车胶带的需求。

汽车胶带产业概况

汽车胶带市场部分整合。主要公司(排名不分先后)包括 3M、Nitto Denko、Tesa SE、IPG 和 AVERY DENNISON CORPORATION。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电动和混合动力汽车中胶带的使用日益增多

- 汽车轻量材料的采用

- 其他驱动因素

- 限制因素

- 电动车和充电站高成本

- 热熔胶取代胶带

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 背衬材料

- 聚对苯二甲酸乙二醇酯(PET)

- 聚氯乙烯(PVC)

- 聚丙烯(PP)

- 纸

- 聚酰胺

- 其他基材(发泡聚苯乙烯、布料等)

- 黏合剂类型

- 环氧树脂

- 丙烯酸纤维

- 聚氨酯

- 硅胶

- 其他黏合剂类型(橡胶黏合剂、聚酯等)

- 应用

- 外部的

- 内部的

- 动力传动系统

- 电子产品

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- American Biltrite Inc.

- Avery Dennison Corporation

- Berry Global Inc.

- Certoplast Technische Klebebander Gmbh

- Coroplast Fritz Muller Gmbh & Co. Kg

- Godson Tapes Private Limited

- IPG

- L&L Products

- Lintec Corporation

- Lohmann Gmbh & Co. Kg

- Nitto Denko Corporation

- Saint-Gobain

- Scapa Group Ltd

- Shurtape Technologies, LLC

- Sika AG

- Tesa SE

- VIBAC Group SPA

第七章 市场机会与未来趋势

- 汽车胶带的优势

- 汽车对耐热、低VOC胶带的需求

The Automotive Adhesive Tape Market size is estimated at USD 5.65 billion in 2025, and is expected to reach USD 7.46 billion by 2030, at a CAGR of 5.7% during the forecast period (2025-2030).

The COVID-19 pandemic significantly impacted the automotive adhesive tape market by disrupting the supply chain, causing production to slow and shut down and an economic downturn. While the initial impact of COVID-19 was negative, the market is on a recovery path during the forecast period.

Key Highlights

- The adhesive tapes are anticipated to witness growth due to the rising demand for a lightweight sealing solution in electric vehicles over the forecast period. In addition, adhesive tapes offer an attractive alternative to traditional mechanical fastening methods and play a vital role in the EV manufacturing sector.

- Growing trends of electrification and automation are resulting in rising challenges for automotive manufacturers. The high cost of electric vehicles is a challenge that is likely to restrict the growing demand.

- Demand for heat-resistant and low VOC automotive adhesive tapes creates lucrative opportunities to improve heat management efficiency. It is associated with IC engine cars and electric vehicles, as well as increasing the degree of freedom in vehicle interior design.

- The Asia-Pacific region accounted for the most significant global automotive adhesive tape market share, considering the increasing production and sales of electric vehicles and conventional automobiles.

Automotive Adhesive Tape Market Trends

Rising Use of Adhesive Tapes in Electric and Hybrid Vehicles

- The adhesive tapes are increasingly used in electric vehicle batteries to increase safety and reduce the vehicle's overall weight. The growing replacement of fasteners with adhesive tapes to improve the vehicle's aesthetics is anticipated to drive the market over the forecast period.

- Adhesive tapes are used in the automotive industry to attach parts onto the outer surfaces of a car's body, offering protection against abrasion during varnishing and providing support during assembly. Adhesive tapes also serve a variety of purposes specific to automotive interiors.

- Electric vehicles are gaining popularity across the globe owing to their benefits, such as being cheap to run and smooth to drive. Automotive manufacturers are investing in improving the power-to-weight ratio using lightweight materials, including composites and weight-saving bonding, joining, and fixing solutions.

- Electric vehicles (EVs) are one of the important steps towards zero carbon emission initiatives globally. Many governments are supporting electric production and helping investors set up the necessary infrastructure. Moreover, the governments are also helping consumers through various subsidies to promote the use of electric vehicles.

- Several automotive manufacturers across the globe are investing in electric vehicles. Nissan Motors, Toyota Motor Corporation, Mercedes-Benz, Tesla, Hyundai Motors, etc., started electric vehicle production, benefitting the automotive adhesive tapes market.

- The European Union aimed to introduce 30 million electric vehicles on the road by 2030 to reduce emissions from the transportation sector in the region. Countries implemented different measures in line with the EU plan. For instance, the United Kingdom announced a ban on internal combustion engine vehicles by 2030.

- According to the Chemnitz Automotive Institute, Germany produced nearly 570,000 units in 2022 and is expected to produce nearly 1 million electric vehicles by 2023. Germany received some investments in electric vehicles, which is likely to increase EV production. For instance, Tesla, a leading manufacturer of EVs, is planning to double its production capacity in Germany.

- New electric vehicle registrations are rising in France. Until September 2023, the country's EV sales increased to 341,000 units, indicating 25% growth compared to the same period in 2022. According to media reports, Tesla is the leading EV brand in France.

- According to the International Energy Agency (IEA), the United States is the third largest market in the world. In Q3 2023, the sales of EVs surpassed 300,000 units, which is a nearly 49.8% increase compared to Q3 2022. Furthermore, the Corporate Average Fuel Economy (CAFE) regulations in the United States aim to raise the average fuel efficiency of new cars and vehicles to 54.5 miles per gallon by 2025 to reduce the nation's dependence on oil.

- According to the Brazilian Association of Electric Vehicles (ABVE), the first quarter of 2023 recorded the highest sales in the historical series, with 14,787 light electric vehicles sold, 50% more than the same period in 2022 (9,844).

- Saudi Arabia is focusing on electric vehicles. The government is promoting EVs to reduce carbon emissions. The government aims to manufacture 500,000 units by 2030.

- Furthermore, the electric vehicles are becoming popular in South Africa. In 2022, new 502 battery electric vehicles were registered in South Africa, according to the media reports.

- Policies like new energy vehicle mandates, various subsidies, and fuel economy regulations in countries across the globe are anticipated to drive the demand for lightweight electric vehicles over the coming years. It is likely to propel the demand for adhesive tapes for automotive production.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the largest producer of electric vehicles in the globe. Europe and North America follow it. China, India, and Japan are some of Asia-Pacific's leading electric vehicle-producing countries.

- Adhesive tape is expected to be an essential part of the automotive industry in the future, and not just for volume reasons. The battery of an electric car produces heat and voltage that must be protected to keep the user safe. As a result, manufacturers are developing double-sided adhesive tape and a unique film that prevents power surges. Batteries can be wrapped in nonflammable products that can withstand high temperatures. It, in turn, is significantly promoting the demand for adhesive tapes from the automotive industry.

- As per the International Trade Administration (ITA), China remains the world's largest vehicle market in terms of annual sales volume and manufacturing output. Domestic production is expected to hit 35 million vehicles in 2025. In response to the pandemic, China's government implemented measures to boost automobile consumption. The measures include allowing China 5 5-emission standard vehicles to be sold without restrictions, promoting the use of electric vehicles, reducing car sales tax, and enhancing parallel import policies. The changes are expected to boost consumption by about USD 30 billion annually.

- To address the slow growth of the automotive industry and to promote the EV market, the government of China partially reinvigorated these support measures in the first six months of 2023. In June 2021, the government of the People's Republic of China announced a huge tax incentive package for the automotive industry. The package, which will be implemented over four years, is estimated to amount to CNY 72.3 billion (USD 520 billion).

- The incentives are specifically designed to promote the sale of electric vehicles and other eco-friendly vehicles. It is the most significant tax incentive package ever offered by the Chinese government for the automotive industry and reflects the government's efforts to promote growth amid slow auto sales.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), automotive production in China registered an increase of 3% in 2022, increasing from 26,121,712 units in 2021 to 27,020,615 units in 2022.

- India is a growing market for EVs. In India, EV and component manufacturing is ramping up, supported by the government's USD 3.2 billion incentive program, attracting investments totaling USD 8.3 billion. In the third quarter of 2023, the electric vehicle sales reached 371,214 units, registering a growth of 40% compared to Q3 in 2022.

- In September 2023, Japan's new vehicle market grew by nearly 11% to reach 437.493 units from 395.163 units in the previous month, according to new vehicle registration data published by JAMA. The strong September growth follows a positive market development in August. After slowing for three consecutive months, the Japanese market picked up speed in August. The August sales rate reached an impressive 5,36 million units per year, a 28% increase from the weak July.

- Furthermore, as per the Japan Automobile Dealers Association (JADA), EV sales increased in 2022 to reach 58,813 battery electric vehicles (BEVs) in Japan, 2.7 times more than in 2021. To encourage demand for EVs, the Japanese government continues to offer subsidies for purchases of new EVs with a revised budget of JPY 70 billion ( USD 501 million) for the fiscal year 2022.

- The South Korean EV market is increasing at a fast pace. According to the Korea Power Exchange, EV sales reached 160 thousand units in 2022, an increase of 60% compared to 2021. The country is also receiving various investments related to electric vehicles. For instance, Hyundai Motors initiated an EV plant construction with an investment of USD 1.52 billion in November 2023.

- The market is majorly driven by the availability of low labor at low cost, low raw material prices, and the growing urban population in the region, in addition to many automotive manufacturing plants.

- All the factors above, in turn, boost the demand for automotive adhesive tapes in the Asia-Pacific region during the forecast period.

Automotive Adhesive Tape Industry Overview

The automotive adhesive tape market is partially consolidated in nature. The major players (not in any particular order) include 3M, Nitto Denko Corporation, Tesa SE, IPG, and AVERY DENNISON CORPORATION, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Use of Adhesive Tapes In Electric and Hybrid Vehicles

- 4.1.2 Adoption of Lightweight Materials in Automotive

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Electric Vehicles and Charging Stations

- 4.2.2 Hot-melt Adhesives are Replacing Adhesive Tapes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Backing Material

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Polyvinyl Chloride (PVC)

- 5.1.3 Polypropylene (PP)

- 5.1.4 Paper

- 5.1.5 Polyamide

- 5.1.6 Other Backing Material (Foam, Cloth, etc.)

- 5.2 Adhesive Type

- 5.2.1 Epoxy

- 5.2.2 Acrylic

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Adhesive Types (Rubber-Based Adhesives, Polyesters, etc.)

- 5.3 Application

- 5.3.1 Exterior

- 5.3.2 Interior

- 5.3.3 Powertrain

- 5.3.4 Electronics

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Mexico

- 5.4.2.3 Canada

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 American Biltrite Inc.

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Berry Global Inc.

- 6.4.5 Certoplast Technische Klebebander Gmbh

- 6.4.6 Coroplast Fritz Muller Gmbh & Co. Kg

- 6.4.7 Godson Tapes Private Limited

- 6.4.8 IPG

- 6.4.9 L&L Products

- 6.4.10 Lintec Corporation

- 6.4.11 Lohmann Gmbh & Co. Kg

- 6.4.12 Nitto Denko Corporation

- 6.4.13 Saint-Gobain

- 6.4.14 Scapa Group Ltd

- 6.4.15 Shurtape Technologies, LLC

- 6.4.16 Sika AG

- 6.4.17 Tesa SE

- 6.4.18 VIBAC Group S.P.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Benefits of Automotive Adhesive Tapes

- 7.2 Demand For Heat-resistant and Low VOC Automotive Adhesive Tapes