|

市场调查报告书

商品编码

1686215

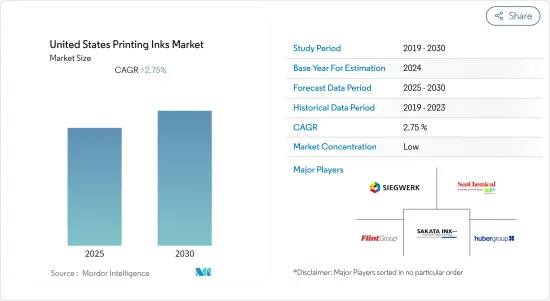

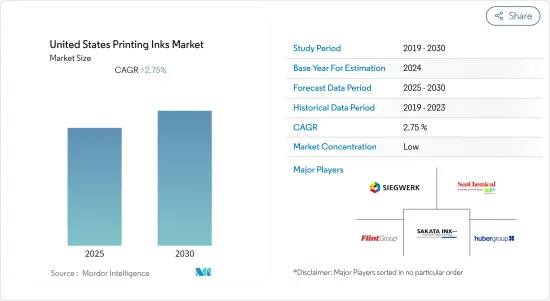

美国印刷油墨:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)United States Printing Inks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内美国印刷油墨市场将以超过 2.75% 的复合年增长率成长。

COVID-19 对市场的影响很小,预计预测期内将稳定成长。

主要亮点

- 推动市场成长的主要因素包括数位印刷行业需求的扩大以及包装和标籤领域需求的增加。

- 另一方面,对数位广告和电子书的需求不断增长以及有关处置的严格规定预计将阻碍所调查市场的成长。

美国印刷油墨市场趋势

水性油墨将实现最高成长

- 水性油墨含有以胶体悬浮形式存在于溶剂(即水)中的颜料或染料。儘管可能存在其他助溶剂,但水性油墨中的主要溶剂是水。

- 这些印刷油墨主要用于柔版印刷和凹版印刷工艺,应用于饮料和清洁剂纸盒、礼品包装等。水性油墨需要更高的温度和更长的干燥时间来去除水和较低的蒸气压成分。

- 使用水性油墨的主要目的不仅是减少VOC,而且要彻底去除油墨中的有害化学物质。

- 随着新印刷製程和添加剂的发展,水性油墨现已广泛应用于几乎所有印刷製程和大多数材料中。

- 水性油墨适用于纸张、纸板和纺织品等印刷应用,也可用于箔、塑胶和食品包装上的印刷。

- 因此,随着适用于多种用途的水性油墨研究的不断增加,水性油墨很可能在美国印刷油墨市场中显示出最高的增长。

软包装领域占据市场主导地位

- 软包装是整个包装市场中最大的包装应用领域,因为它具有多种优势,例如与硬包装相比,所需材料减少 91%,占用空间减少约 96%。

- 此外,随着对永续性的关注度不断提高,传统的硬质包装解决方案正被创新的软包装解决方案所取代。

- 在食品工业中,软包装因其能够保持吸湿性、产品新鲜度、温度控制和产品保质期而受到青睐。瓶装水、香烟及相关烟草製品等其他产品是软包装产业的主要产品。

- 食品业对轻量化和创新包装解决方案的需求是市场的主要驱动力。

- 与消费者进行线上互动的趋势日益增长,这是企业推广品牌的一种新方式,企业希望透过将其与社交媒体结合,与消费者建立更持久的双向关係。

- 软包装油墨也为品牌所有者、零售商和消费者带来了许多好处,包括增强的图形外观。它还透过在产品製造、包装、运输和最终使用过程中保持影像品质来提高包装性能。

- 因此,基于上述方面,预计软包装将占据市场主导地位。

美国印刷油墨产业概况。

美国印刷油墨市场较为分散,没有一家公司能够占据较大的市场份额。市场上排名前几名的製造商(不分先后顺序)是 Sun Chemical、Flint Group、Sakata Inx Corporation 和 Siegwerk Druckfarben AG &Co.KGaA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 数位印刷产业的需求不断增长

- 包装产业需求旺盛

- 限制因素

- 对数位广告和电子书的需求不断增加

- 严格的处置规定

- 产业价值链

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 溶剂型

- 水性

- 油性

- 紫外线

- UV-LED型

- 其他类型

- 流程

- 平版印刷

- 柔版印刷

- 凹版印刷

- 数位印刷

- 其他流程

- 应用

- 包装

- 硬包装

- 纸板容器

- 瓦楞纸箱

- 硬质塑胶容器

- 金属罐

- 其他硬质包装

- 软包装

- 标籤

- 其他包装

- 商业/出版

- 纺织品

- 其他用途

- 包装

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Altana

- Dainichiseika Color & Chemicals Mfg Co. Ltd

- Dow

- DuPont

- Electronics For Imaging Inc.

- Flint Group

- FUJIFILM Corporation

- Hubergroup Deutschland GmbH

- Sakata Inx Corporation

- Sicpa Holding SA

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical

- T&K TOKA Corporation

- Tokyo Printing Ink Mfg Co. Ltd

- Toyo Ink SC Holdings Co. Ltd

- Wikoff Color Corporation

- Zeller+Gmelin

第七章 市场机会与未来趋势

- 生物基和紫外线固化油墨的出现

The United States Printing Inks Market is expected to register a CAGR of greater than 2.75% during the forecast period.

The impact of COVID-19 was negligible on the market, and the market is expected to grow at a steady rate during the forecast period.

Key Highlights

- The major factors driving the growth of the market studied include the growing demand from the digital printing industry and rising demand from the packaging and labels sector.

- On the flip side, rising demand for digital advertisements and e-books and stringent regulations regarding disposal are expected to hinder the growth of the market studied.

United States Printing Ink Market Trends

Water-based Inks to Observe the Highest Growth

- Water-based inks have pigments or dyes in a colloidal suspension of solvent, with the solvent being water. Although there can be other co-solvents, the main solvent in water-based inks is water.

- These printing inks are used majorly in flexographic printing processes and gravure for applications, such as beverage and detergent cartons and gift wrap. Water-based inks require higher temperature and longer dry exposure time to drive off water and constituents with lower vapor pressure.

- The main driving force for the usage of water-based inks is that they not only reduce the VOCs but also completely remove hazardous chemicals from the ink.

- With the development of new printing processes and additives, water-based inks are now majorly used in almost all printing processes and on most materials for many different applications.

- Water-based inks work well in printing applications involving paper, cardboard, and textiles, and they are used to print on foils, plastics, and food packaging.

- Hence, water-based inks are likely to exhibit the highest growth in the US printing ink market with the growing research on water-based inks, making them suitable for diverse purposes.

Flexible Packaging Segment to Dominate the Market

- Flexible packaging is the largest packaging application segment of the overall packaging market, owing to its various advantages, such as requiring 91% lesser material than rigid packaging and about 96% of space-saving.

- Moreover, with an increasing focus on sustainability, traditional rigid packaging solutions are being replaced by innovative and flexible packaging solutions.

- In the food industry, flexible packaging is preferred due to its moisture absorption properties, product freshness, and temperature control while being able to maintain the shelf life of the product. Cigarettes and associated tobacco products are major products for the flexible packaging industry, among other products, such as bottled water.

- The demand for lightweight and innovative packaging solutions from the food industry is majorly driving the market.

- The growing trend of online interaction with consumers is the new branding technique for companies, as they are eager to forge a longer-lasting two-way relationship with consumers by integrating with social media.

- Flexible packaging inks also offer many advantages to brand owners, retailers, and consumers, such as high graphic appearance. They also contribute to the performance of the package by preserving the quality of the images during manufacturing, packaging, transportation, and end use of products.

- Thus, based on the aforementioned aspects, Flexible packaging is expected to dominate the market.

United States Printing Ink Industry Overview

The US printing inks market is fragmented in nature, with no company holding a major share in the market. The top manufacturers of the market (in no particular order) include Sun Chemical, Flint Group, Sakata Inx Corporation, and Siegwerk Druckfarben AG & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Digital Printing Industry

- 4.1.2 High Demand from the Packaging Sector

- 4.2 Restraints

- 4.2.1 Rising Demand for Digital Advertisements and E-books

- 4.2.2 Stringent Regulations Regarding Disposal

- 4.3 Industry Value Chain

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solvent-based

- 5.1.2 Water-based

- 5.1.3 Oil-based

- 5.1.4 UV

- 5.1.5 UV-LED

- 5.1.6 Other Types

- 5.2 Process

- 5.2.1 Lithographic Printing

- 5.2.2 Flexographic Printing

- 5.2.3 Gravure Printing

- 5.2.4 Digital Printing

- 5.2.5 Other Processes

- 5.3 Application

- 5.3.1 Packaging

- 5.3.1.1 Rigid Packaging

- 5.3.1.1.1 Paperboard Containers

- 5.3.1.1.2 Corrugated Boxes

- 5.3.1.1.3 Rigid Plastic Containers

- 5.3.1.1.4 Metal Cans

- 5.3.1.1.5 Other Rigid Packaging

- 5.3.1.2 Flexible Packaging

- 5.3.1.3 Labels

- 5.3.1.4 Other Packaging

- 5.3.2 Commercial and Publication

- 5.3.3 Textiles

- 5.3.4 Other Applications

- 5.3.1 Packaging

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Altana

- 6.4.2 Dainichiseika Color & Chemicals Mfg Co. Ltd

- 6.4.3 Dow

- 6.4.4 DuPont

- 6.4.5 Electronics For Imaging Inc.

- 6.4.6 Flint Group

- 6.4.7 FUJIFILM Corporation

- 6.4.8 Hubergroup Deutschland GmbH

- 6.4.9 Sakata Inx Corporation

- 6.4.10 Sicpa Holding SA

- 6.4.11 Siegwerk Druckfarben AG & Co. KGaA

- 6.4.12 Sun Chemical

- 6.4.13 T&K TOKA Corporation

- 6.4.14 Tokyo Printing Ink Mfg Co. Ltd

- 6.4.15 Toyo Ink SC Holdings Co. Ltd

- 6.4.16 Wikoff Color Corporation

- 6.4.17 Zeller+Gmelin

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of Bio-based and UV-curable Inks