|

市场调查报告书

商品编码

1686220

奈米陶瓷粉末-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Nanoceramic Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

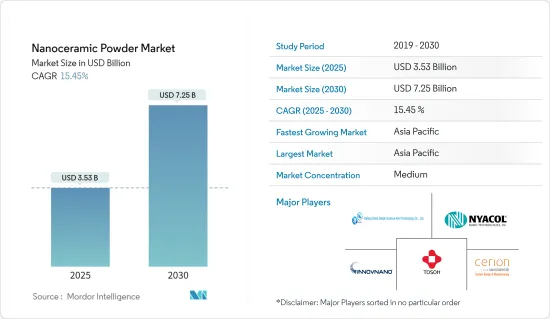

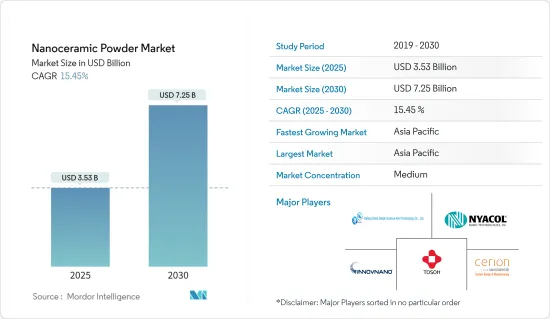

奈米陶瓷粉末市场规模预计在 2025 年为 35.3 亿美元,预计到 2030 年将达到 72.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.45%。

主要亮点

- 新冠疫情影响了各行各业,严重影响了对奈米陶瓷粉末的需求。需求波动是由于供应链中断、经济活动减少和消费行为改变所造成的。对奈米陶瓷粉末的需求受到运输、化学和工业领域衰退趋势的影响。然而,自从限制解除以来,该行业已经復苏。

- 推动市场研究的关键因素是其在电子产业的广泛应用。此外,对医疗保健领域和高性能陶瓷涂层的需求不断增长,推动了奈米陶瓷粉末市场的发展。

- 奈米陶瓷粉末的高加工成本以及健康安全问题预计将对2024-2029年期间奈米陶瓷粉末的成长产生负面影响。

- 碳化硅和氮化镓的应用日益增多以及太空探勘和太阳能电池等先进技术领域的机会预计将为市场提供新的成长机会。

- 预计亚太地区将在 2024 年至 2029 年期间占据市场主导地位。电气和电子产业受到不断增加的投资和出口机会的支持,从而推动成长。

奈米陶瓷粉体市场趋势

电气和电子产业需求增加

- 近二十年来,人们对奈米陶瓷进行了大量研究,为学术界和工业界带来了许多积极的成果。因此,这些先进材料在电子领域有广泛的应用。

- 奈米陶瓷粉末的介电、铁磁、压电、磁阻和超导性特性使其成为电力传输装置、工业电容器和高能能源储存装置等应用的理想选择。

- 奈米陶瓷粉末用于电子工业,传统上用于製造行动电话、可携式电脑、游戏系统和其他个人电子设备中的高速计算晶片。

- 奈米陶瓷氧化铝在电子产品中应用最为广泛,因为它可以承受更高的电压,并且其形状可以根据设备的尺寸量身定制。

- 由于对行动电话、可携式电脑、游戏系统和其他个人电子设备的需求不断增长,全球消费性电子产业多年来一直经历快速成长。根据日本电子情报技术产业协会统计,2023年1-8月电子产品总生产值为69,372.33亿日圆。

- 根据国家统计局资料,2023年4月中国积体电路产量达281亿块。中国智慧型手机用户数量快速成长。预计到2023年底,该国智慧型手机用户数将达到8.682亿。

- 东协是亚太地区消费性电子领域成长最快的地区。电气和电子製造业是东协最突出的产业之一。该行业约占该地区出口总额的30-35%。世界上大多数消费性电子产品,包括收音机、电脑和行动电话,都是在东南亚国协生产和组装的。

- 在北美,尤其是美国,电子产业预计将经历温和成长。预计未来对采用新技术的产品的需求不断增加将推动市场扩张。

- 由于最新科技产品的日益普及,全球消费性电子产品市场在过去几年中取得了显着成长。家庭自动化和个人辅助设备的整合正在推动市场显着成长。

- 根据电子情报技术产业协会的数据,2023 年 1 月至 9 月电子产品产值为 7,891,720 百万日圆(约 52,864,900,000 美元)。

- 所有上述因素都可能增加 2024 年至 2029 年的市场需求。

亚太地区可望主导市场

- 亚太地区占全球需求的50%以上,是奈米陶瓷粉体材料最具前景的市场,并有可能在不久的将来占据市场主导地位。这种主导地位归因于该地区电子和医疗行业日益增长的需求。

- 中国占该地区奈米陶瓷粉末需求的33%以上。中国也是全球奈米陶瓷粉末的主要市场之一。电子、航太和国防(A&D)产业蓬勃发展,对奈米陶瓷粉末的需求持续成长。

- 中国是全球最大的电子产品製造基地之一,对韩国、新加坡和台湾等现有的上游製造商构成了激烈的竞争。从需求来看,智慧型手机、OLED电视、平板电脑等电子产品在消费性电子市场中成长率最高。根据中国国家统计局的数据,2023 年 4 月中国家电及消费性电子产品零售额达到近 610 亿元人民币(85.2 亿美元)。

- 此外,根据印度品牌股权基金会(IBEF)的数据,预计到2025年,印度电子製造业的产值将达到5,200亿美元。此外,预计到2025年,印度将成为世界第五大家电和电子产业国。由于印度製造、国家电子政策、电子产品净零进口和零缺陷零效应等政府倡议,印度电气和电子设备产量预计将快速增长,这些倡议促进了国内製造业的增长,减少了进口依赖,促进了出口并致力于製造业。

- 该地区也是最大的汽车製造地,中国和印度为最大限度提高生产能力做出了贡献,东南亚国协也加入了市场扩张的行列。中国是全球最大的汽车市场,在全球汽车领域中发挥着至关重要的作用。 2022年,中国汽车产量预计将达到2,702万辆,比上年(2,609万辆)增加3%。中国产量高显示对汽车材料(包括奈米陶瓷粉末)的需求强劲,这支撑了这个蓬勃发展的产业。

- 此外,中国是最大的飞机製造商之一,也是最大的国内航空客运市场之一。此外,该国的飞机零件和组装製造业正在快速发展,拥有超过 200 家小型飞机零件製造商。

- 预计 2024 年至 2029 年期间该地区的奈米陶瓷粉末市场前景广阔,因为其在军用飞机、发动机和战斗机的高级设备和部件中的应用至关重要。

- 中国政府每年都会公布国防支出。中国宣布,2023 年 3 月的国防预算为 1.55 兆元(2,248 亿美元)。这比 2022 年的 1.45 兆元(2,296 亿美元)预算名义上增加了 7.2%。

- 总体而言,由于中国和印度的持续成长,预计未来几年全部区域对奈米陶瓷粉末的需求将以更快的速度成长。亚太地区的巨大成长为全球奈米陶瓷粉末市场的扩张做出了巨大贡献。

奈米陶瓷粉体产业概况

全球奈米陶瓷粉体市场呈现寡占和部分整合的格局,少数几家公司占据主导地位。主要企业包括东曹株式会社、北京大科奈米技术有限公司、NYACOL Nano Technologies Inc.、Innovnano-Materiais Avancados SA 和 Cerion LLC。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电子业普及

- 医疗保健产业需求增加

- 对高性能陶瓷涂层的需求不断增加

- 限制因素

- 加工成本高

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

- 原料分析

第五章市场区隔

- 类型

- 氧化物粉末

- 碳化物粉末

- 氮化物粉末

- 硼粉

- 其他类型

- 最终用户产业

- 电气和电子

- 工业的

- 运输

- 医疗保健

- 化学

- 防御

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 世界其他地区

- 亚太地区

第六章竞争格局

- 市场排名分析

- 主要企业策略

- 公司简介

- ABM Advance Ball Mill Inc.

- Beijing DK Nano Technology Co. Ltd

- Cerion LLC

- Inframat Advanced Materials LLC

- Innovnano-materiais Avancados SA

- Nanophase Technologies Corporation

- NYACOL Nano Technologies Inc.

- Tosoh Corporation

- Trunnano

第七章 市场机会与未来趋势

- 太空探勘和太阳能电池等尖端技术领域的商机

- 碳化硅和氮化镓的应用范围不断扩大

简介目录

Product Code: 50700

The Nanoceramic Powder Market size is estimated at USD 3.53 billion in 2025, and is expected to reach USD 7.25 billion by 2030, at a CAGR of 15.45% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic had a diverse effect on different industries, significantly impacting the demand for nanoceramics powder. The demand fluctuations were due to disruption in supply chains, reduced economic activity, and changed consumer behavior. The demand for nanoceramics powder was affected as the transportation, chemical, and industrial sectors witnessed a decreasing trend. However, since restrictions were removed, the industry has been recovering.

- A significant factor driving the market study is widespread use in the electronics industry. Additionally, increasing demand in the healthcare sector and high-performance ceramic coatings drive the nanoceramics powder market.

- The high processing costs of nanoceramic powder and health and safety issues are expected to negatively affect the growth of the nanoceramic powder between 2024 and 2029.

- Increasing applications of silicon carbide and gallium nitride and opportunities in advanced technologies, like space exploration and photovoltaic solar cells, are expected to provide new growth opportunities for the market.

- Asia-Pacific is expected to dominate the market from 2024 to 2029. The electrical and electronics sector is supported by increasing investments and export opportunities, which drive this growth.

Nanoceramic Powder Market Trends

Increasing Demand from the Electrical and Electronics Industry

- Over the last 20 years, there has been a huge amount of study into nanoceramics that has resulted in some positive outcomes for academia and industry. As a result, these advanced materials have a wide range of uses in electronics.

- Nanoceramic powders with properties like dielectricity, ferromagnetism, piezoelectricity, magnetoresistance, and superconductivity make them a perfect fit for applications in power transmission devices, industrial capacitors, high-energy storage devices, and others.

- Nanoceramic powders are used in the electronics industry, and they are traditionally used during the production of high-speed computing chips in cellular phones, portable computing devices, gaming systems, and other personal electronic devices.

- Nanoceramic alumina is most commonly used in electronics, as it can withstand a much higher voltage, so its shape can be customized based on the device size.

- The global consumer electronics industry has been growing rapidly across the world over the years due to the consistently increasing demand for cellular phones, portable computing devices, gaming systems, and other personal electronic devices. According to the Japan Electronics and Information Technology Industries Association, the total production of electronic products accounted for JPY 6,937,233 million in the first 8 months of 2023.

- According to data from the National Bureau of Statistics, China's integrated circuit production volume reached 28.1 billion units in April 2023. The number of smartphone users in China is growing rapidly. The number of smartphone users in the country is expected to reach 868.2 million by the end of 2023.

- ASEAN has the fastest-growing consumer electronics segment in Asia-Pacific. Electrical and electronics manufacturing is one of the most prominent sectors in ASEAN. The sector accounts for about 30-35% of the total exports from the region. Most global consumer electronic products, such as radio, computers, and cellular phones, are manufactured and assembled in ASEAN countries.

- In North America, especially in the United States, the electronics industry is expected to grow at a moderate rate. An increase in the demand for new technological products is expected to help the market expansion in the future.

- The global consumer electronics market has witnessed notable growth in the past few years as the latest technological gadgets are gaining popularity. Home automation and integrating devices with personal assistance have provided noteworthy growth to the market.

- According to the Japan Electronics and Information Technology Industries Association, the production of electronic products accounted for JPY 7,891,720 million (~USD 52,864.9 million) in the first nine months (i.e., January- September) of 2023.

- All the aforementioned factors are likely to increase the demand for the market between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- With over 50% of the global demand, Asia-Pacific is the most promising market for nanoceramic powder materials, which is likely to dominate the market in the near future. This domination can be attributed to the rising demand from the electronics and medical industries in the region.

- China accounts for over 33% of the demand for nanoceramic powder in this region. The country is also one of the major global markets for nanoceramic powder. Sustained demand for nanoceramic powder is witnessed here through its robust electronics, aerospace, and defense (A&D) sectors.

- China has one of the world's largest electronics production bases and offers tough competition to the existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, and tablets, have the highest growth rates in the consumer electronics segment of the market in terms of demand. According to the National Bureau of Statistics of China, retail sales of household appliances and consumer electronics in China amounted to almost CNY 61 billion (USD 8.52 billion) in April 2023.

- Moreover, according to the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025. Electrical and electronics production in India is expected to increase rapidly due to government initiatives with policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence, energizing exports, and manufacturing.

- The region is also the largest manufacturer of automobiles, with China and India contributing to maximum production capacity and ASEAN countries joining the expanding market. China is the largest automobile market globally and plays a pivotal role in the global automotive sector. In 2022, vehicle production in China reached a notable total of 27.02 million units, marking a 3% increase compared to the previous year (26.09 million units). The substantial production volume in China signifies a robust demand for automotive materials, including nanoceramic powder, to support this thriving industry.

- Moreover, China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers. Moreover, the country's aircraft parts and assembly manufacturing sector has been growing rapidly, with the presence of over 200 small aircraft parts manufacturers.

- Since the use of nanoceramic powder is important in high-grade military equipment and parts of military aircraft, engines, and fighter jets, the market for nanoceramic powder looks promising from 2024 to 2029 in the region.

- The Chinese government announces defense expenditure information annually. China announced a defense budget of CNY 1.55 trillion (USD 224.8 billion) in March 2023. This represents a nominal 7.2% increase from the CNY 1.45 trillion (USD 229.6 billion) budget in 2022.

- Overall, with the consistent growth in China and India, the demand for nanoceramics powder is expected to increase at a faster pace in the overall region in the coming years. The huge growth of Asia-Pacific is quite instrumental in the expansion of the global nanoceramics powder market.

Nanoceramic Powder Industry Overvview

The global nanoceramic powder market is oligopolistic and partially consolidated, with few players dominating the market. The major companies include Tosoh Corporation, Beijing DK Nano Technology Co. Ltd, NYACOL Nano Technologies Inc., Innovnano-Materiais Avancados SA, and Cerion LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Widespread Use in the Electronics Industry

- 4.1.2 Increasing Demand from the Healthcare Sector

- 4.1.3 Increasing Demand for High-performance Ceramic Coatings

- 4.2 Restraints

- 4.2.1 High Processing Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

- 4.6 Raw Material Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Oxide Powder

- 5.1.2 Carbide Powder

- 5.1.3 Nitride Powder

- 5.1.4 Boron Powder

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Industrial

- 5.2.3 Transportation

- 5.2.4 Medical

- 5.2.5 Chemical

- 5.2.6 Defense

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 North America

- 5.3.3.1 United States

- 5.3.3.2 Canada

- 5.3.3.3 Mexico

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABM Advance Ball Mill Inc.

- 6.3.2 Beijing DK Nano Technology Co. Ltd

- 6.3.3 Cerion LLC

- 6.3.4 Inframat Advanced Materials LLC

- 6.3.5 Innovnano-materiais Avancados SA

- 6.3.6 Nanophase Technologies Corporation

- 6.3.7 NYACOL Nano Technologies Inc.

- 6.3.8 Tosoh Corporation

- 6.3.9 Trunnano

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Opportunities in Advanced Technologies, Like Space Exploration and Photovoltaic Solar Cell

- 7.2 Increasing Applications of Silicon Carbide and Gallium Nitride

02-2729-4219

+886-2-2729-4219