|

市场调查报告书

商品编码

1686221

农业检查:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Agricultural Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

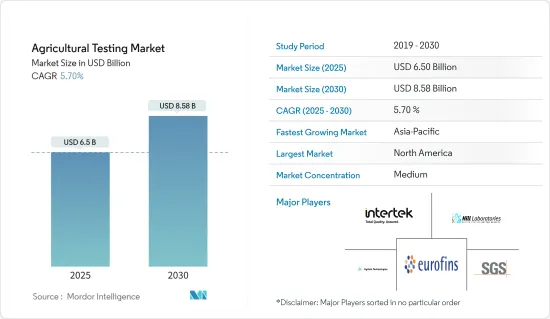

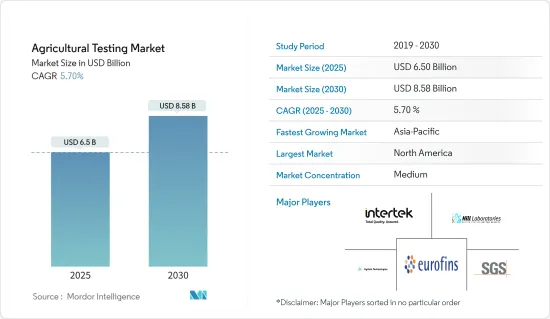

2025 年农业测试市场规模预估为 65 亿美元,预计到 2030 年将达到 85.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.7%。

主要亮点

- 农业测试包括测试水、土壤、种子等样本,以评估其品质和污染物水平。该行业经历了显着的成长,尤其是在世界各地发达和商业化的地区。为了确保环境安全并提高农业生产力,法规和法律是市场扩张的主要驱动力。

- 受农产品需求上升、产量增加和定期土壤检测需求的推动,农业检测市场预计将在未来几年强劲復苏。此外,消费者对食品安全和品质的偏好越来越高,特别是在化学残留方面。这导致了对维持土壤特性以实现高品质生产的需求增加,从而推动了市场成长。

- 全球化需要标准化的估价技术来促进谷物和油籽的贸易。因此,出口商和进口商越来越多地要求提供分析证书来证明符合全球品质和安全标准。这导致对农业检验服务的需求增加,特别是在农业出口较大的地区。例如,中国糙米出口额从 2020 年的 168,867,000 美元大幅成长至 2022 年的 211,847,000 美元。然而,由于谷物中水分含量高导致霉菌滋生,出口商面临挑战。由于对可接受毒性水平的规定非常严格,霉菌生长产生的高毒性已导致糙米被全球市场拒绝。

- 目前,农业检测市场主要由北美主导。这是因为该地区对食品安全、环境、农业、营养成分、化学品和标籤有严格的规定。该地区有大量的农业检测服务供应商,促进了市场的成长。

农业检测市场趋势

农业检验及环境安全法规及立法

有关农业检查和环境安全的法规和立法是市场成长的主要驱动力。政府针对农业和食品安全的措施正在推动市场扩张。例如,食品药物管理局(FDA)最近提案更新FDA食品安全现代化法案(FSMA),制定安全规则,透过防止灌溉水中的有害污染物引起食源性疾病来提高食品安全。根据提案的指导方针,涵盖的农场必须至少每年进行一次收穫前农业用水评估,并在变化时进行评估,以降低污染风险。这些监管变化旨在为农民提供更大的灵活性,同时确保消费者的产品安全。

抽样检测在商业化农业国家已成为一种流行做法,以维持农产品出口的成长。国际种子检测协会 (ISTA) 在标准化程序和现代化种子贸易方面发挥关键作用。

2022 年 4 月,加拿大政府启动了加拿大谷物采样计画 (CGSP),使企业能够收集并提供种子、谷物和谷物产品批次的样品,以协助加拿大出口的植物检疫认证。该政策为加拿大食品检验局(CFIA)核准公司参与CGSP制定了指导方针。此外,该政策详细说明了样本收集和提交给加拿大食品检验局所需的程序。

此外,2024 年,英国政府更新了《谷物标准作业程序》(GSOP),用于为从英格兰和威尔斯向需要认证的非欧盟目的地出口散装谷物签发植物检疫证书,包括由认可的贸易检查员(ATI)对谷物进行抽样和检查的程序。由于政府强制执行检验通讯协定以确保全球供应链的安全和质量,农产品检验市场正在经历重大变化。这些准则要求每个阶段都采取细緻的程序以防止污染,从而推动了全球对农业检测的需求。

北美可望主导市场

北美是世界上最大的农业测试市场,对种子测试的持续需求使美国成为一个有吸引力的市场。这种需求是由美国种子认证的需求所驱动。种子监管和测试部门(SRTD)在测试农业种子、确保种子高效有序销售以及支持市场成长方面发挥着至关重要的作用。此外,食品安全也是一个主要考虑因素。例如,美国疾病管制与预防中心 (CDC) 估计每年有 4,800 万人因食源性疾病而患病。为了解决这个问题,作为「更聪明的食品安全蓝图」计画的一部分,联邦谷物检验局正在标准化检验方法、评估检验和测试实验室服务,并开发新的测试和分析方法以改善最终用途的品质属性。

在加拿大,由于技术进步、政策变化和消费者偏好的改变,农业部门正在发生重大变化,导致对农业行销的投资增加,以满足对高品质、安全和营养农产品日益增长的需求。需求的增加使得严格的测试通讯协定成为必要,从而进一步推动了该国的测试市场的发展。此外,英国沃伯顿 (Warburtons) 等公司与加拿大小麦种植者签订合同,也体现了农业领域对特定要求的趋势,凸显了对定制规格的日益增长的需求。 2023 年,收穫样品计画收到 379 个油籽型大豆样品,而 2022 年为 256 个样品,凸显了对检测的更加重视。

这些改进的检验标准正在提高北美农业部门的声誉,为增加出口铺平道路,从而导致对符合国际品质和安全标准的检验服务的需求增加。

农业检测产业概况

全球农业检测市场较为分散,有许多政府下属的检测实验室为世界各地的农民提供一系列农业检测服务。主要公司包括 Eurofins Scientific、RJ Hill Laboratories Ltd、Agilent Technologies Inc.、SGS SA 和 Intertek。在农业检测市场上,各企业以设备品质、推广等为主要竞争手段,纷纷采取策略性倡议,以抢占更大的市占率。新服务、伙伴关係和收购是市场主要企业采用的关键策略。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 样本

- 水质检测

- 土壤测试

- 种子检验

- 生物固形物检测

- 粪便和尿液检测

- 其他范例

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 澳洲

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Eurofins Scientific

- Intertek

- SGS SA

- Bureau Veritas SA

- Merieux NutriSciences Corporation

- Temasek Holdings(Element Materials Technology)

- TUV Nord Group

- Agilent Technologies Inc.

- EMD Millipore Corporation

- BioMerieux SA

- RJ Hill Laboratories Limited

第七章 市场机会与未来趋势

The Agricultural Testing Market size is estimated at USD 6.50 billion in 2025, and is expected to reach USD 8.58 billion by 2030, at a CAGR of 5.7% during the forecast period (2025-2030).

Key Highlights

- Agricultural testing involves the examination of samples such as water, soil, and seeds to assess their quality and levels of contaminants. This industry is experiencing significant growth, particularly in developed areas and commercialized regions across the world. Regulations and laws largely drive the market's expansion to ensure environmental safety and improve agricultural productivity.

- Over the next few years, the agricultural testing market is anticipated to rebound strongly, driven by increased demand for farm products, leading to higher production and the need for regular soil testing. Additionally, there is a shift in consumer preferences toward higher standards of food safety and quality, particularly about chemical residues. This is creating a greater need to maintain soil properties for quality production, thus bolstering the market's growth.

- Globalization has necessitated standardized assessment techniques to facilitate the trade of grains and oilseeds. Consequently, exporters and importers are requesting analysis certificates to demonstrate compliance with global quality and safety standards. This has led to an increased demand for testing services related to agricultural outputs, particularly in regions with high agricultural exports. For instance, China saw a significant increase in the value of its brown rice exports from USD 168,867 thousand in 2020 to USD 211,847 thousand in 2022. However, exporters are facing challenges due to mold growth caused by high moisture levels in the grains. The high toxicity of the fungal growth has led to the rejection of brown rice in global markets due to stringent regulations on permissible toxicity levels.

- The agricultural testing market is currently dominated by North America. This is attributed to the region's stringent regulations related to food safety, environment, agriculture, nutritional content, chemicals, and labeling. The presence of numerous agricultural testing service providers in the region is contributing to the market's growth.

Agricultural Testing Market Trends

Regulations and Legislations Pertaining to Agriculture Testing and Environmental Safety

Regulations and legislation concerning agricultural testing and environmental safety have been key drivers for the market's growth. Government initiatives to address agricultural and food safety have propelled market expansion. For instance, the Food and Drug Administration (FDA) recently proposed revisions to the FDA Food Safety Modernization Act (FSMA) Produce Safety Rule to enhance food safety by preventing harmful contaminants in irrigation water from causing foodborne illnesses. Under the proposed guidelines, covered farms would be mandated to conduct pre-harvest agricultural water assessments at least once annually and whenever changes occur, thereby reducing the risk of contamination. These regulatory changes aim to provide farmers with greater flexibility while ensuring product safety for consumers.

Sample testing has gained popularity in commercialized agriculture countries to sustain the export growth of agricultural commodities. Seed and soil testing have also seen increased adoption, with the International Seed Testing Association (ISTA) playing a crucial role in standardizing procedures and modernizing the seed trade.

In April 2022, the Canadian government initiated the Canadian Grain Sampling Program (CGSP), allowing companies to gather and deliver samples from batches of seed, grain, and grain products to assist with phytosanitary certification for exports from Canada. This policy sets out the guidelines that the Canadian Food Inspection Agency (CFIA) uses to approve companies participating in the CGSP. Furthermore, this policy details the steps that need to be taken for the collection and submission of samples to the CFIA.

Moreover, in 2024, the UK government updated the grain standard operating protocol (GSOP) for the issue of phytosanitary certificates for the export of bulk grain from England and Wales to non-EU requiring certification, including the procedures for sampling and inspection of grain by authorized trade inspectors (ATI). The agricultural testing market is experiencing a major shift as government mandates enforce testing protocols to ensure safety and quality throughout the global supply chain. These guidelines necessitate meticulous procedures at every stage to prevent contamination, thereby driving the demand for agricultural testing across the world.

North America is Expected to Dominate the Market

North America is the largest market for agricultural testing globally, with the United States being an attractive market due to the ongoing demand for seed testing. This demand is driven by the need for certifications for seeds in the United States. The Seed Regulatory and Testing Division (SRTD) plays a crucial role in testing agricultural seeds, ensuring the efficient and orderly marketing of seeds, and supporting the growth of the market. Furthermore, there is a significant emphasis on food safety initiatives. For instance, the United States Centers for Disease Control and Prevention (CDC) estimated that 48 million people get sick every year from a foodborne illness. To address this, the Federal Grain Inspection Service is standardizing testing methodologies, evaluating testing and laboratory services, and developing new testing and analytical methods to enhance end-use quality attributes as part of the Smarter Food Safety Blueprint plan.

In Canada, the agriculture sector has been undergoing significant changes due to technological advancements, policy changes, and evolving consumer preferences, with increased investments in the marketing of agriculture products to meet the increasing demand for high-quality, safe, and nutritionally consistent output. This increased demand has necessitated rigorous testing protocols, further driving the market for testing in the country. Additionally, the trend toward specific requirements in the agriculture sector is exemplified by companies such as Warburtons in the United Kingdom establishing contracts with Canadian wheat producers, emphasizing the growing need for tailored specifications. In 2023, the Harvest Sample Program received 379 samples of oilseed-type soybean, compared to 256 samples in 2022, highlighting the growing emphasis on testing.

These improved testing standards enhance the reputation of the North American agriculture sector and pave the way for increased exports, leading to a greater need for testing services to meet international quality and safety standards.

Agriculture Testing Industry Overview

The global agricultural testing market is fragmented, with numerous government-operated laboratories providing various agricultural testing services to farmers worldwide. Eurofins Scientific, R J Hill Laboratories Ltd, Agilent Technologies Inc., SGS SA, and Intertek are some of the major players. Companies compete in the agricultural testing market based on equipment quality and promotion and focus on strategic moves to hold larger shares in the market. New services, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sample

- 5.1.1 Water Testing

- 5.1.2 Soil Testing

- 5.1.3 Seed Testing

- 5.1.4 Bio-solids Testing

- 5.1.5 Manure Testing

- 5.1.6 Other Samples

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Eurofins Scientific

- 6.3.2 Intertek

- 6.3.3 SGS SA

- 6.3.4 Bureau Veritas SA

- 6.3.5 Merieux NutriSciences Corporation

- 6.3.6 Temasek Holdings (Element Materials Technology)

- 6.3.7 TUV Nord Group

- 6.3.8 Agilent Technologies Inc.

- 6.3.9 EMD Millipore Corporation

- 6.3.10 BioMerieux SA

- 6.3.11 R J Hill Laboratories Limited