|

市场调查报告书

商品编码

1686224

电动车充电站:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Electric Vehicle Charging Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

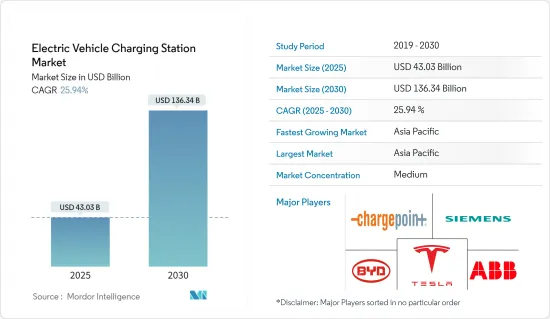

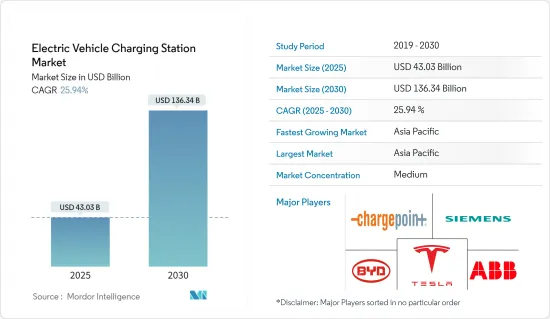

预计 2025 年电动车充电站市场规模将达到 430.3 亿美元,到 2030 年将达到 1,363.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 25.94%。

电动车充电站市场正在蓬勃发展,因为越来越多的人转向电动车,因为电动车具有成本效益、环境友好、严格的排放和燃油效率标准、政府激励措施以及经济实惠的车型可供选择,这些都刺激了对充电站的需求。

因此,电动车在汽车行业的普及和汽车销售的增加正在推动市场成长。此外,政府迅速实施严格的法规以减少汽车排放并提高电池效率,正在刺激汽车产业对电动车的需求,从而增加对充电基础设施的需求。

儘管最初遭遇挫折,但电动车充电站市场已证明具有韧性。自新冠疫情爆发以来,世界各国政府都优先考虑永续的交通解决方案,包括投资电动车充电基础设施以刺激经济成长和创造就业机会。

到目前为止,消费者对电动车充电站的态度一直很积极,对快速充电和便利使用的需求不断增长。然而,人们仍然担心充电基础设施的成本和可靠性,这为企业创新和改进服务提供了机会。

电动车充电站市场趋势

乘用车推动电动车充电站市场

乘用车市场是电动车充电站市场中最大的部分。这主要是因为乘用车的数量相对于商用车而言较大,而且全球电动乘用车的采用率日益提高。乘用车占电动车销售的很大一部分,因此对充电基础设施的需求不断增长,以满足其充电需求。

- 国际能源总署(IEA)预测,儘管2022年汽车销量整体疲软,但预计2023年全球电动车销量将成长约32.38%,首次突破1,300万辆。

随着越来越多的人意识到传统汽油动力汽车对环境的影响,人们对电动车的兴趣日益浓厚。燃料价格上涨也推动了汽车产业对电动车的采用,并在刺激充电站需求方面发挥了关键作用。

此外,叫车和汽车共享市场预计也将推动充电站的需求。与私家车相比,叫车和共乘汽车的使用时间通常更长,利用率也更高。这意味着他们需要更频繁地充电,从而增加对充电站的需求。

儘管这种增长显示了汽车电气化的趋势,但这还不足以减少全球二氧化碳排放。根据国际能源总署估计,到 2022 年,最普遍购买的车辆 SUV 的二氧化碳排放将达到近 10 亿吨。这些担忧促使主要汽车製造商推出电动 SUV 来吸引市场注意力。

- 例如,沃伦·巴菲特的比亚迪于 2023 年 1 月在印度推出了其首款乘用车——一款电动运动型多功能车 (SUV),标誌着其作为更广泛的全球扩张的一部分进入主流市场。比亚迪推出了电动 SUV Atto 3,搭载其成熟的 Blade 电池技术,目标是到 2030 年占领印度电动车市场 40% 的份额。此举是中国汽车製造商全球扩张计画的一部分,中国汽车製造商已开始在挪威、纽西兰、新加坡、巴西、哥斯大黎加和哥伦比亚等国家销售电动车和插电式混合动力汽车。

上述发展预计将促进电动车充电站市场乘用车领域的成长。

亚太地区将成为预测期内成长最快的地区

电动车 (EV) 充电站市场成长最快的地区是亚太地区 (APAC)。几项关键发展推动该地区走在电动车应用和充电基础设施发展的前沿。尤其是中国和印度,对亚太地区电动车充电市场的成长做出了重大贡献。

亚太地区市场成长的关键催化剂之一是政府的大力支持和鼓励电动车和充电基础设施部署的政策。中国、印度、日本和韩国等国家正在实施雄心勃勃的目标和奖励,以加速电动车的普及和充电基础设施网路的扩张。例如

- 中国的新能源汽车(NEV)信贷计画和补贴计画引发了对电动车充电基础设施的投资激增,导致全国充电站数量迅速增加。

- 同样,日本经济产业省的《促进电动车充电基础设施发展的指南》设定了2035年安装多达30万个电动车充电埠的目标。

此外,亚太地区国家快速的都市化和人口成长正在推动对永续交通解决方案的需求,包括电动车和充电站。人口稠密、污染严重的都市区尤其鼓励人们转向更清洁的交通方式,导致电动车的采用和充电基础设施的部署激增。

电动车充电技术的进步和创新正在促进亚太市场的成长。该地区的主要参与者正在开发先进的充电解决方案,包括快速充电系统、无线充电技术和智慧充电网络,以满足消费者和企业不断变化的需求。

- 例如,英国汽车製造商 Lotus 于 2023 年 11 月推出了一系列电动车 (EV) 充电解决方案,包括超高速 450kW 直流充电器、电源柜和可同时为多达四辆汽车充电的模组化装置。这些新的充电解决方案是专为印度市场设计的。液冷一体成型直流充电器是一款尖端充电器,可提供高达 450kW 的超快速充电速度。

总体而言,由于政府支持、都市化趋势和技术创新,预计亚太地区市场在未来几年将实现显着的复合年增长率。

电动车充电站产业概况

电动车充电站市场适度整合。该市场由 ABB、西门子、比亚迪、西门子股份公司和特斯拉等主要企业主导。主要企业致力于透过研发投资、先进技术的整合、产品合作以及现有产品线的创新来不断改进产品。

- 2023 年 1 月:ABB E-Mobility 签署全球框架协议,为斯堪尼亚提供全球电动车充电解决方案支援。 ABB 的电动车产品组合将使斯堪尼亚能够为客户提供完整的电动车解决方案,为他们的车辆提供电气化,并在全球范围内供应车辆、充电器、服务和软体。

- 2023 年 2 月,FLO 推出了 FLO Ultra,这是一款超快速充电器,旨在最大限度地提高能量输送,同时提供面向未来的性能和时尚的设计,以提供终极电动车充电体验。

- 2023年3月,冈谷电力集团旗下的冈谷电机与电动车(4W车辆)车队营运商Prakriti E-Mobility建立策略伙伴关係,为该公司的车队业务提供充电站。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 电动车销量成长和电动车价格下降正在推动市场

- 市场限制

- 安装和维护标准电动车充电站的初始成本高是一个问题

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按车辆类型

- 搭乘用车

- 商用车

- 按充电器类型

- 交流充电站

- 直流充电站

- 按充电所有者类型

- 公共

- 私人的

- 按充电服务类型

- 电动车充电服务

- 电池更换服务

- 按充电基础设施类型

- CHAdeMO

- CCS

- 国标快速充电器

- 特斯拉超级充电站

- 其他充电基础设施类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东和非洲

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- ABB Ltd

- ChargePoint Inc.

- Schneider Electric SE

- Siemens AG

- Tesla Motors Inc.

- Evbox(ENGIE)

- BYD Company

- Leviton Manufacturing Co. Inc.

- SemaConnect Inc.

- The Newmotion BV(Acquired by Shell)

- EFACEC Power Solutions SGPS

- EV Solutions(Webasto)

- Chargemaster Limited(BP Pulse)

- Qingdao Tgood Electric Co. Ltd

- Wanbang Digital Energy Pte. Ltd(Star Charge)

第七章 市场机会与未来趋势

- 未来 V2G 和物联网充电基础设施的采用将会增加

第八章 市场规模和基于数量的预测

第九章 各地区/国家电动车充电相关法规结构分析

The Electric Vehicle Charging Station Market size is estimated at USD 43.03 billion in 2025, and is expected to reach USD 136.34 billion by 2030, at a CAGR of 25.94% during the forecast period (2025-2030).

The electric vehicle charging station market is gaining momentum as more people are turning toward electric vehicles due to their cost-effectiveness and eco-friendliness, enactment of stringent emission and fuel economy norms, government incentives, and availability of budget-friendly models, which is generating demand for charging stations.

Thus, the increasing penetration of electric vehicles in the automotive industry and rising vehicle sales have augmented the market's growth. Moreover, the rapid implementation of stringent government regulations to curb automobile emissions and increase battery efficiency has catalyzed the demand for electric vehicles in the automobile industry, increasing the demand for charging infrastructure.

Despite the initial setbacks, the electric vehicle charging station market has shown resilience. Governments worldwide started prioritizing sustainable transportation solutions after COVID-19, which include investments in electric vehicle charging infrastructure to stimulate economic growth and create jobs.

Consumers' stance toward EV charging stations has been positive so far, with a growing demand for fast charging and easy accessibility. However, there are still concerns about the cost and reliability of charging infrastructure, which presents an opportunity for companies to innovate and improve their offerings.

Electric Vehicle Charging Station Market Trends

Passenger Cars are Leading the Electric Vehicle Charging Station Market

The passenger car segment is the largest in the electric vehicle charging stations market. This is primarily due to the higher volume of passenger cars compared to commercial vehicles and the increasing adoption of electric passenger vehicles globally. Passenger cars account for a significantly higher portion of EV sales, driving the demand for charging infrastructure to support their charging needs.

- According to the International Energy Agency (IEA), global sales of electric vehicles increased by around 32.38% in 2023, surpassing 13 million for the first time, even though car sales broadly were soft in 2022.

As more people become aware of the environmental impacts of traditional gasoline-powered cars, there is a growing interest in electric cars. Rising fuel prices have also driven the penetration of electric vehicles in the automobile industry, which plays a significant role in stimulating the demand for charging stations.

Moreover, the ride-hailing and car-sharing markets are expected to increase the demand for charging stations. Ride-hailing and car-sharing vehicles are typically used for longer periods and experience higher utilization rates than privately owned vehicles. This means that they need to be charged more frequently, which increases the demand for charging stations.

Even though the rise does point to a trend in the drive toward electrifying vehicles, it is insufficient to reduce global CO2 emissions. According to the IEA, CO2 emissions from SUVs, the most common type of vehicle purchased, were estimated to reach almost a billion tons by 2022. Owing to this concern, key automakers are offering electric SUVs to gain market traction.

- For instance, in January 2023, BYD, by Warren Buffet, launched its first passenger car in India, an electric sport-utility vehicle (SUV), marking its entry into the mainstream market as part of a broader global expansion. BYD introduced the Atto 3 electric SUV, which is equipped with its renowned Blade battery technology, with the goal of capturing 40% of the country's electric car market by 2030. The move is part of a larger global push by the Chinese automaker, which has begun selling EVs and plug-in hybrids in countries such as Norway, New Zealand, Singapore, Brazil, Costa Rica, and Colombia.

The above-mentioned developments and factors are expected to contribute to the growth of the passenger cars segment of the EV charging station market.

Asia-Pacific to be the Fastest Growing Region During the Forecast Period

The fastest-growing region in the electric vehicle (EV) charging stations market is Asia-Pacific (APAC). Several key factors have propelled the region to the forefront of EV adoption and charging infrastructure development. China and India, in particular, stand out as major contributors to the growth of the EV charging market in APAC.

One of the primary catalysts of the market's growth in the APAC region is the strong government support and policies promoting electric mobility and charging infrastructure deployment. Countries like China, India, Japan, and South Korea have implemented ambitious targets and incentives to accelerate the adoption of electric vehicles and the expansion of charging infrastructure networks. For example,

- China's New Energy Vehicle (NEV) credit system and subsidy programs have led to a surge in investments in EV charging infrastructure, leading to a rapid increase in the number of charging stations across the country.

- Similarly, Japan's METI's "Guidelines for Promoting the Development of EV Charging Infrastructure" have set targets for the installation of up to 300,000 EV charging ports by 2035.

Furthermore, the rapid urbanization and population growth in APAC countries have increased the demand for sustainable transportation solutions, including electric vehicles and charging stations. Urban areas with dense populations and high levels of pollution are particularly incentivized to transition to cleaner transportation alternatives, leading to a surge in EV adoption and charging infrastructure deployment.

Technological advancements and innovation in EV charging technology have contributed to the growth of the market in APAC. Key players operating in the region are developing advanced charging solutions, including fast-charging systems, wireless charging technology, and smart charging networks, to address the evolving needs of consumers and businesses.

- For instance, in November 2023, Lotus, the UK-based automaker, introduced its suite of electric vehicle (EV) charging solutions, including an ultra-fast 450 kW DC charger, a power cabinet, and a modular unit capable of charging up to four vehicles simultaneously. These new charging solutions are specifically designed for the Indian market. The Liquid-Cooled All-in-One DC Charger is a cutting-edge charger that provides ultra-fast charging at rates of up to 450 kW.

Overall, the market studied in Asia-Pacific is expected to record a significant CAGR in the coming years, owing to government support, urbanization trends, and technological innovations.

Electric Vehicle Charging Station Industry Overview

The electric vehicle charging station market is moderately consolidated. The market is led by a few companies, such as ABB, Siemens, BYD Company, Siemens AG, and Tesla Inc. The key players are engaged in continuously improving their product offerings through R&D investments, integration of advanced technology, product collaboration, and innovation of existing product lines.

- January 2023: ABB E-mobility signed a global framework agreement to support Scania globally with EV charging solutions. ABB's E-mobility portfolio will enable Scania to provide complete EV solutions for customers, electrifying its fleet and supplying vehicles, chargers, services, and software globally.

- February 2023: FLO announced the FLO Ultra, an ultra-fast charger designed to maximize energy delivery while providing future-proof performance and a smart design for the ultimate EV charging experience.

- March 2023: Okaya, a subsidiary of Okaya Power Group, established a strategic alliance with Prakriti E-Mobility, a fleet operator of electric 4 W cars, to provide charging stations for its fleet operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising EV Sales and Decreasing EV Prices are Driving the Market

- 4.2 Market Restraints

- 4.2.1 High Initial Cost of Installing and Maintaining a Standard EV Charging Station is a Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD billion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Charger Type

- 5.2.1 AC Charging Station

- 5.2.2 DC Charging Station

- 5.3 By Charging Ownership Type

- 5.3.1 Public

- 5.3.2 Private

- 5.4 By Charging Service Type

- 5.4.1 EV Charging Services

- 5.4.2 Battery Swapping Services

- 5.5 By Charging Infrastructure Type

- 5.5.1 Chademo

- 5.5.2 CCS

- 5.5.3 GB/T Fast Charge

- 5.5.4 Tesla Superchargers

- 5.5.5 Other Charging Infrastructure Types

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.4.1 South America

- 5.6.4.2 Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ABB Ltd

- 6.2.2 ChargePoint Inc.

- 6.2.3 Schneider Electric SE

- 6.2.4 Siemens AG

- 6.2.5 Tesla Motors Inc.

- 6.2.6 Evbox (ENGIE)

- 6.2.7 BYD Company

- 6.2.8 Leviton Manufacturing Co. Inc.

- 6.2.9 SemaConnect Inc.

- 6.2.10 The Newmotion BV (Acquired by Shell)

- 6.2.11 EFACEC Power Solutions SGPS

- 6.2.12 EV Solutions (Webasto)

- 6.2.13 Chargemaster Limited (BP Pulse)

- 6.2.14 Qingdao Tgood Electric Co. Ltd

- 6.2.15 Wanbang Digital Energy Pte. Ltd (Star Charge)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 There will be an Increased Adoption of V2G and IoT-enabled Charging Infrastructure in Coming Years