|

市场调查报告书

商品编码

1686254

汽车 HVAC:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Automotive HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

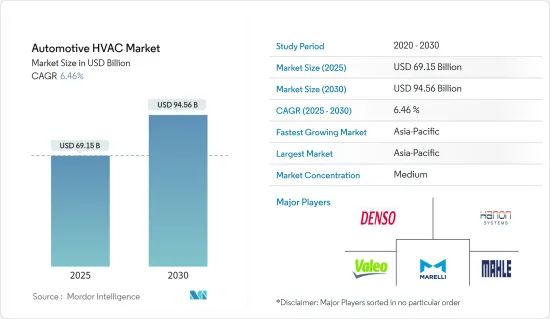

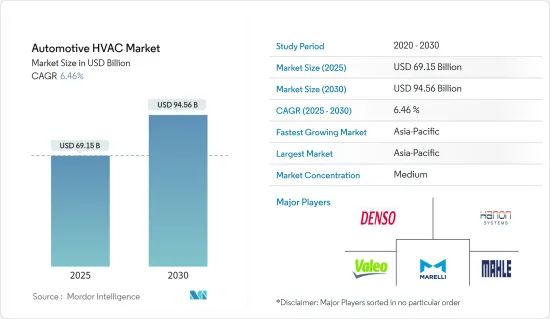

预计 2025 年汽车 HVAC 市场规模为 691.5 亿美元,到 2030 年将达到 945.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.46%。

汽车用品和供应链市场受到了COVID-19的严重影响。汽车暖通空调系统市场因疫情爆发而受到影响。 2020年乘用车和商用车销量的下降以及车辆和零件生产设施的暂时关闭,主要是由于地方政府实施的严格封锁措施。

区域市场在供应链和原材料来源方面面临一些挑战,这些挑战在同一时期成为焦点。 2021年被誉为汽车产业生产部门改组转型之年,但随着案例的减少、生产设施恢復营运以及全部区域暖通空调零件的製造和销售带来了光明的前景。

从长远来看,由于采用 HVAC 系统而对热舒适性和安全性提高的需求不断增加,预计将推动汽车 HVAC 市场的成长。更小的系统和更轻的重量可能会在未来几年支持市场成长。以较低的成本整合电子设备、感测器和自动气候控制功能,正在推动 HVAC 装置在乘用车中的广泛应用。汽车电气化的不断提高有望进一步促进先进舒适性和安全性功能的整合。

对创新和研发措施的大量投资有望增强参与者的产品和技术力。此外,采用环保冷媒和生产廉价的 HVAC 系统为汽车 HVAC 市场参与者提供了丰厚的成长机会。主要企业正在将先进的 HVAC 系统引入汽车,以帮助对抗车厢内的颗粒物。

由于中国、印度和日本等国家的汽车产量高,亚太地区预计将成为汽车 HVAC 市场最大的细分市场。预计未来几年北美将为製造商创造新的成长前景。欧洲市场正呈现缓慢但稳定的成长,预计未来五年将达到危机前的水平。

汽车暖通空调市场趋势

乘用车将成为长期驱动力

乘用车销售一直深度推动各类车型的 HVAC 市场的发展。 2021 年全球汽车销量约 6,670 万辆,而 2020 年约为 6,380 万辆。全球疫情影响了全球的经济活动,包括全球汽车销售,多个国家实施了严格的封锁措施以遏制病毒传播。因此,2020年的汽车销量与2019年相比下降了14.8%。然而,随着生活恢復正常,预计全球汽车销量将增加,这将在预测期内推动汽车转向感测器市场的成长。为了适应这些汽车的销售, OEM目前正在将先进的 HVAC 和气候控制系统纳入其产品中。例如:

- 2022年10月,Polestar将向全球市场推出三款电动SUV车型。这款 SUV 配备了先进的气候控制系统,即使在长途旅行中也能为乘客提供舒适的感觉。

全球汽车领域研发活动的活性化将增强市场参与者的技术力。这些市场参与者正在引入汽车暖通空调领域的先进技术来开发新产品,为其带来市场竞争优势。市场上的竞争对手正在开发环保产品,以遵守政府有关排放的严格规定。能源效率是推动 HVAC 系统成长的另一个参数。製造商越来越多地采用绿色技术来开发环保、节能的汽车 HVAC 系统。例如

- 2021年11月,马瑞利公司开发了一种室内空气品质(IAQ)净化系统,可杀死车辆和室内环境中的细菌和病毒。该系统结合使用 UV-A 和 UV-C 光以及二氧化钛 (TiO2) 过滤器来消灭空气中的细菌和病毒,包括 COVID-19,15 分钟内的有效性超过 99%。

市场参与者正在进行併购,以扩大其市场影响力。例如,Denso与丰田合作开发普锐斯混合动力技术,以提高汽车安全性、燃油效率和绿色技术。此外,人们对全球暖化的日益担忧对汽车暖通空调市场产生了一定影响。因此,世界许多国家已开始采取措施减少二氧化碳排放,这可能会导致该领域对暖通空调的需求下降。

亚太地区可望实现高成长

由于主要汽车製造商的接近性、汽车产量巨大以及印度、韩国和中国等生产国对汽车的需求激增,亚太市场可能会出现显着的发展。政府振兴汽车业的努力预计将在下一个财政年度推动汽车市场的发展。例如,印度政府正在透过汽车产业的专案和课程鼓励外国投资,为市场带来新的创新。

2022年4月,中国乘用车产销分别完成99.6万辆和96.5万辆。与前一年同期比较,产量下降了41.9%,销量下降了43.4%。 2022年1-4月乘用车产量也较去年同期下降2.6%至64.94亿辆。

中国是最大的市场之一,对这些汽车 HVAC 系统的需求做出了巨大贡献。印度、中国和亚太地区其他地区对乘用车的需求不断增加,这是人们对舒适性和安全性的偏好不断增加的结果。预计这些因素将促进该地区的市场成长。消费者正在寻找能够提供同等舒适功能的高规格车辆。此外,泰国、马来西亚等国的外资汽车生产也蓬勃发展。

根据中国汽车流通协会(CADA)统计,2021年8月中国豪华车经销商销售量为27.8万辆,较去年同期下降9.4%。还有狮子塔。 2021年,BMW销量达815,691辆,支撑了中国豪华汽车市场的销售量。这使得宝马成为中国最畅销的豪华汽车製造商。梅赛德斯·奔驰和奥迪的高端汽车销量下滑。

考虑到这些因素和持续的需求,预计预测期内市场将以高速成长。

汽车暖通空调产业概况

汽车暖通空调市场正在整合,主要企业占大部分市场占有率。空调市场的主要企业包括 Mahle GmbH、 Denso Corporation、三菱重工有限公司和 Hanon Systems。併购、与区域空调设备製造商的合作、以及与汽车製造商建立和巩固联盟是塑造市场竞争格局的一些动态。例如

- 2021 年 11 月,Hanon Systems 在匈牙利启用了两家新工厂:位于佩奇的新工厂和位于莱萨格的扩建大楼。该工厂拥有 22,464平方公尺的製造空间,包括用于汽车空调(A/C) 管路的成型、硬焊、焊接、折弯、组装和测试的设备。

- 2021 年 8 月,法雷奥推出了一款新型法雷奥热泵,采用天然冷媒,可从外部空气中满足三分之二的能源需求,从而减少了从车载电池中获取能源的需要。与配备传统加热系统的电动车相比,配备此热泵的电动车在低至 -15°C 的温度下可行驶距离增加 30%。

- 2021年2月,海立国际(香港)有限公司与Marelli Corporation KK的合资公司Highly Marelli Holdings成立。 Highly Marelli 将专注于为客户和供应商提供压缩机电气化、热泵系统、暖气、通风和空调(「HVAC」)以及电动压缩机(「EDC」)系统领域的世界一流解决方案。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 依技术类型

- 手排/半自动 HVAC

- 自动暖通空调系统

- 按车型

- 搭乘用车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Valeo Group

- Denso Corporation

- Mahle GmbH

- Marelli Corporation

- Sanden Corporation

- Keihin Corporation

- Japan Climate Systems Corporation

- Mitsubishi Heavy Industries Ltd

- Hanon Systems Corp.

- Samvardhana Motherson Group

- Hella GmbH & KGaA

第七章 市场机会与未来趋势

The Automotive HVAC Market size is estimated at USD 69.15 billion in 2025, and is expected to reach USD 94.56 billion by 2030, at a CAGR of 6.46% during the forecast period (2025-2030).

The automotive goods and supply chain market were drastically impacted by COVID-19. The automotive HVAC system market was affected due to the outbreak of the pandemic. The decline in passenger car and commercial vehicle sales in 2020 and the temporary shutdown of vehicle and component production facilities were primarily attributed to the stringent lockdown measures prevailed by regional governments.

The regional markets were exposed to several challenges in terms of supply chain and raw material sources which got highlighted during the same period. Although 2021 has marked itself as the year of transition where the auto sector revamped its production units, and with the decline in the cases, production facilities are back in operation, and vehicle sales have increased across major geographies creating a positive outlook for the HVAC component manufacturing and sales.

Over the long term, a rise in demand for thermal comfort and an increase in safety due to the adoption of HVAC systems are expected to boost the growth of the automotive HVAC market. A reduction in system size and weight of the system may support the growth of the market over the coming years. The integration of electronics, sensors, and automated climate control features at a lesser cost is translating into greater adoption of HVAC units in passenger vehicles. Rising vehicle electrification is likely to increase the integration of advanced comfort and safety features in vehicles.

Technological innovations and substantial investments in R&D initiatives are poised to enhance players' offerings and technological capabilities. Furthermore, the adoption of eco-friendly refrigerants and the production of cheaper HVAC systems provide lucrative growth opportunities for the players operating in the automotive HVAC market. Major players are introducing advanced HVAC system in vehicle which help to fight against fine particulates in vehicle cabin.

The Asia-Pacific region is expected to be the largest segment in the automotive HVAC market owing to the large vehicle production levels in countries such as China, India, and Japan. North America is forecasted to create new growth prospects for the manufacturers in the coming years. The European market is showing slow but steady growth and is expected to reach pre-meltdown levels over the period of the next five years.

Automotive HVAC Market Trends

Passenger Car to Provide Longer Term Momentum

Passenger car sales have deeply driven the market of HVAC across all car models. In 2021, global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales across the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower when compared to 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive steering sensor market growth in the forecast period. Owing to these vehicle sales, the present offering by OEM carries advanced HVAC and climate control systems integrated into their offered models. For instance:

- In October 2022, Polestar introduced its 3 electric SUV models in the global market. The SUV is equipped with an advanced climate control system to provide passenger comfort during long-duration journeys.

The augmenting research and developments in the automotive sector across the world are set to enhance the technological capabilities of the market players. These market players are introducing advanced technologies in automotive HVAC to develop new products that impart a competitive edge in the market. The competitors in the market are developing eco-friendly products to fall in line with the stringent government regulations regarding emissions. Energy efficacy is the other parameter driving growth in HVAC systems. Manufacturers are increasingly using green technologies to develop eco-friendly and energy-efficient automotive HVAC systems. For Instance,

- In November 2021, Marelli Corporation has developed an Indoor Air Quality (IAQ) Purification System, which kills bacteria and viruses in vehicles and indoor environments. The system utilizes UV-A and UV-C light combined with a titanium dioxide (TiO2) filter to destroy airborne bacteria and viruses, including COVID-19, with greater than 99% effectiveness within 15 minutes.

Market players are involved in mergers and acquisitions to expand their market presence. For instance, Denso collaborated with Toyota to develop Prius, a hybrid technology promoting safety, fuel efficiency, and green technology in vehicles. Furthermore, growing concerns about global warming have slightly impacted the automotive HVAC market. Consequently, many nations worldwide have started taking measures to reduce their carbon footprints which might reduce the HVAC deman in the segment.

High Growth Anticipated in the Asia-Pacific Region

The Asia-Pacific market is probably going to observe huge development attributable to the nearness of key automotive makers, vast scale generation of vehicles, and spiraling vehicle requests in the manufacturing countries, like India, South Korea, and China. Government activities to restore the automotive business are required to drive the market during the forthcoming year. For example, the Government of India is encouraging foreign investments through programmed courses in the automotive area to bring new innovations to market.

In April 2022, Chinese passenger car production reached 996,000 units with sales registering 965,000 units. This accounts the downfall of 41.9% and 43.4% respectively in production and sales compared to previous year. In 2022, January to April, passenger car production also decreased with 2.6% year-on-year registering 6,494 million units.

China is one of the largest markets and contributes significantly to the demand for these automotive HVAC systems. The increasing demand for passenger vehicles from India, China, and their other counterparts in the Asia-Pacific region is a result of the growing preferences of people for comfort and safety. These factors are expected to contribute to the market growth in the region. Consumers are aligning toward high-specification vehicles that offer par comfort features. In addition, there is an upsurge in vehicle production by foreign companies in countries, including Thailand and Malaysia.

According to the China Automobile Dealers Association (CADA), the luxury car dealers in the country sold 278,000 vehicles in August 2021, an 9.4% decrease year-on-year. In addition, llion units. In 2021, BMW backed up China's premium segment car sales registering 815, 691 units. This made BMW to become China's top selling luxury car maker. On similar lines Mercedes Benz and Audi witnessed decline in their premium car sales.

Considering these factors and ongoing demand, market is anticpated to witness high growth rate during the forecast period.

Automotive HVAC Industry Overview

The automotive HVAC market is consolidated, with the top global players accounting for most of the market share. The major companies in the air-conditioning market include MAHLE GmbH, DENSO Corporation, Mitsubishi Heavy Industries Ltd, and Hanon Systems. Mergers and acquisitions, partnerships with regional HVAC equipment manufacturers, and establishing and ensuring tie-ups with car manufacturers are some of the dynamics shaping the market's competitive landscape. For instance:

- In November 2021, Hanon System inaugurated its two new establishments in Hungary - a new greenfield production facility in Pecs and a building expansion in Retsag. The facility provides 22,464 square meters of manufacturing space and accommodates equipment including forming, brazing, welding and bending, assembly lines and testing for automotive air conditioning (A/C) lines.

- In August 2021, Valeo announced New Valeo heat pump that procures two-thirds of its energy demand from the ambient air, thereby limiting the need to draw energy from the onboard batteries, and uses a natural refrigerant. EVs equipped with the device can travel up to 30% further at -15°C than those fitted with more conventional heating systems.

- In February 2021, Highly Marelli Holdings Co., Ltd., a previously announced joint venture between Highly International (Hong Kong) Limited and Marelli Corporation K.K., has been formed. Highly Marelli will concentrate on providing world-class solutions for clients and suppliers in the areas of compressor electrification, heat pump systems, heating, ventilation, and air conditioning ("HVAC") and electric driven compressor ("EDC") systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Technology Type

- 5.1.1 Manual/Semi-automatic HVAC

- 5.1.2 Automatic HVAC

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Valeo Group

- 6.2.2 Denso Corporation

- 6.2.3 Mahle GmbH

- 6.2.4 Marelli Corporation

- 6.2.5 Sanden Corporation

- 6.2.6 Keihin Corporation

- 6.2.7 Japan Climate Systems Corporation

- 6.2.8 Mitsubishi Heavy Industries Ltd

- 6.2.9 Hanon Systems Corp.

- 6.2.10 Samvardhana Motherson Group

- 6.2.11 Hella GmbH & KGaA