|

市场调查报告书

商品编码

1686273

北美气雾罐:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

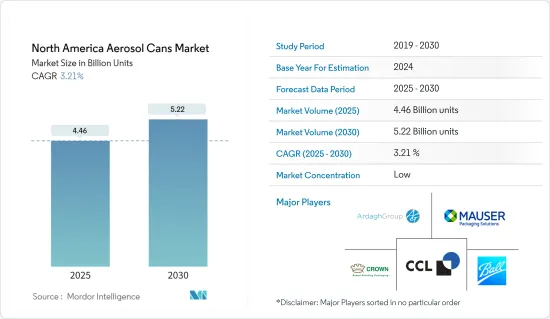

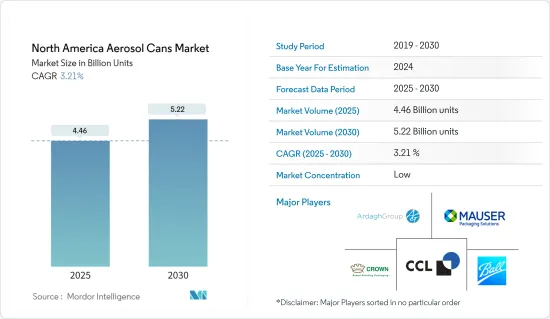

北美气雾罐市场规模预计在2025年为44.6亿个,预计到2030年将达到52.2亿个,预测期内(2025-2030年)的复合年增长率为3.21%。

主要亮点

- 化妆品、个人护理、食品饮料和医疗保健等终端行业正在推动对气雾罐的需求。化妆品和个人护理领域是市场成长的主要驱动力,受可支配收入增加、消费者生活方式改变以及对除臭剂和髮胶喷雾等产品的需求不断增长等因素的推动。

- 在美国,美容产品供应商正在转向标准化包装解决方案。 2023 年 1 月,Aptar Beauty 的倡议标誌着该行业正在大力推动创新。该公司透过推出两款气雾剂致动器和一款含有高达 46% 消费后再生树脂 (PCR) 的细雾喷雾器,扩展了其永续分配器解决方案。 Aptar Beauty 的 EuroMist 技术被誉为北美领先的细雾喷雾,可与多种配方完美搭配。

- 消费者在洗衣和清洁产品上的支出显着增加,显示需求不断增长。金属家用喷雾罐对于清洗和消毒空气清新剂和家具上光剂等物品尤其重要。宝洁公司(P&G)预计2023年美国净销售额将强劲成长,从2018年的273亿美元跃升至3,87亿美元,成长率约12.1%。这一成长凸显了宝洁家居和个人保健产品需求的重大转变,尤其是自新冠疫情爆发以来,这些产品包括清洗产品、空气清新剂和宝洁自己的卫生产品,其中许多产品都罐装。

- 儘管行业在成长,但由于竞争加剧和许多可互换产品,化妆品和个人保健产品的消费者俱有很大的议价能力。这常常迫使生产商降低降价,对气雾罐产业构成挑战。此外,能源成本上升加剧了供应链中断,减缓了铝业的成长。

- 铝製气雾罐因其灵活性而受到重视,随着对可回收材料的关注度不断提高,其需求也不断增长。根据铝业协会报告,该行业每年回收超过 400 亿个铝罐,体现了其对永续性的承诺。在美国,回收目前进入掩埋的铝每年可节省 8 亿美元。

- 行业协会的积极策略进一步支持了市场的成长。美国罐头製造商协会(CMI)制定了雄心勃勃的目标,到2030年将美国铝饮料罐的回收率提高到70%,到2040年提高到80%,到2050年提高到90%以上。这些倡议彰显了业界对铝永续性利用的承诺。

北美气雾罐市场趋势

汽车/工业领域引领市场

- 包装产业增强了气雾罐的储存、运输和消费者便利功能。根据美国能源资讯署(EIA)8月发布的月度报告,预计2023年美国原油产量将创历史新高,增加85万桶/日,达到1276万桶/日。气雾罐提供了一种方便且精确的涂抹润滑剂的方法。

- 随着润滑剂供应的日益增加,使用者可能更喜欢使用气雾罐,因为它们易于使用且应用精确,特别是在难以触及的地方和复杂的机器部件中。根据 Extroplate 的研究,到 2023 年,北美流体和润滑剂市场价值预计将达到 267 亿美元。由于汽车销售的快速成长,预计未来几年汽车售后市场将蓬勃发展,从而增加汽车领域对气雾罐的需求。

- 这些罐子也用于汽车的各种喷漆和维护目的。除了蓬勃发展的汽车产业外,快速扩张的生产也影响市场对气雾罐的需求。气雾剂在世界各地被广泛用于清洗和除油工具以及维护工厂机械。这使得工厂和製造设施能够维持最佳的生产产量。

- 根据美国汽车协会 2023 年 10 月发布的报告,普通车主每行驶一英里,平均要花费 9.83% 的钱用于车辆维护和维修(2022 年增长了 1.6%)。消费者在车辆维护和修理上花费的钱越多,他们就越有可能让车辆在更长时间内保持较好的状况。这反过来又会导致汽车拥有量的增加以及汽车气雾剂产品潜在客户的增加。

- 铝罐的回收率很高,并且比其他类型的包装含有更多的可回收材料。据铝业协会称,铝是市场上回收率最高的材料之一,可节省生产新金属所需的 90% 以上的能源,并降低生产成本。鲍尔公司已与 Recycle Aerosol LLC 合作,以提高美国铝製气雾罐的回收率。这项合作关係促进了气雾罐的回收利用,并建立了一个将旧罐回收成新气雾罐的闭合迴路系统。

预计美国将占据最大市场占有率

- 包装行业越来越多地采用气雾罐,因为它们在储存、运输和使用方面效用,使得这些包装解决方案高效且适合大多数要求。由于美国个人护理行业的扩张,预计气雾罐的需求将会增加,这与消费者可支配收入的增加和购买奢侈品的能力有关。气雾剂通常用于个人保健产品,预计市场将受益于这些产品销售的成长。

- 气雾剂也用于全身药物输送。患者需要安全、可靠、便携且易于使用的设备。医疗领域的成长是由国内对干粉呼吸吸入器和定量喷雾吸入器日益增长的需求所推动的。污染加剧导致气喘病例增加,预计未来将推动对气雾剂容器的需求。

- 根据PKN包装新闻2023年2月发表的报导,国际铝气雾剂容器製造商协会(Aerobal)报告称,全球气雾剂出货量增长了6.8%,交付南美和北美的量也增长了6%。这两个地区约占Aerobal会员公司总出货量的71%。随着药剂师数量的增加,处方笺需求可能会增加。这可能会导致对药品的需求增加,包括透过吸入器和外用喷雾剂等气雾罐输送的药品。

- 根据美国人口普查局的资料,美国医疗保健和个人护理专卖店的零售额从2022年1月的322.24亿美元增长至2023年1月的342.46亿美元。许多消费者正在寻找不含化学成分的美容产品替代品。对于不需要使用特定化学物质来配製的产品来说,气雾剂金属罐具有优势。金属气雾罐可以控制分配,最大限度地减少暴露在空气中,并减少对防腐剂的需求。

- 气雾罐是分配油漆和清漆的简单而方便的方法。它受到许多消费者的青睐,包括住宅和 DIY 爱好者,因为它不需要刷子或滚筒等额外的工具。根据美国人口普查局的数据,截至 2023 年 8 月,全国建筑支出为 1.2847 兆美元,比 2022 年同期的 1.2334 兆美元增加 4.2%。随着建设活动的扩大,对用于完成和保护新建建筑物和结构的油漆和被覆剂的需求也在不断增长。

北美气雾罐产业概况

北美气雾罐市场分散,主要参与者包括:Crown Holdings Inc.、Ball Corporation、CCL Container Inc.(CCL Industries Inc.)、Mauser Packaging Solutions(Bway Holding Company)和 Ardagh Group SA。这些参与者正在采用合作、创新和收购等策略来增强其产品供应并获得可持续的竞争优势。

2023年9月,永续铝解决方案供应商Novelis宣布与北美Ball Corporation签署了一份主力客户协议。该协议规定,Novelis 将向北美的球罐製造厂提供铝板。

2023 年 5 月,铝製饮料罐製造商 Ardagh Metal Packaging Co. 和 Crown Holdings Ltd. 投资了一项新的津贴计划,作为其持续支持在专门对单流回收进行分类的资源回收设施内安装铝罐捕获设备的努力的一部分。初步估计,这笔津贴将支援的设备一旦安装完成,每年可收集 7,100 万个铝罐,并为美国回收系统创造略高于 100 万美元的年收入。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 化妆品产业需求增加

- 扩大汽车润滑油的使用

- 市场挑战

- 替代包装的竞争加剧

- 市场机会(气雾罐的可回收性)

第五章市场区隔

- 按材质

- 铝

- 马口铁钢

- 按最终用户产业

- 化妆品及个人护理品(除臭剂、止汗剂、髮胶喷雾、造型慕丝等)

- 家用

- 药品/动物用药品

- 油漆和清漆

- 汽车/工业

- 按国家

- 美国

- 加拿大

第六章 竞争格局

- 公司简介

- Crown Holdings Inc.

- Ball Corporation

- CCL Container Inc.(CCL Industries Inc.)

- Mauser Packaging Solutions(Bway Holding Company)

- Ardagh Group SA

- DS Containers Inc.

- ITW Sexton(Illinois Tool Works Inc.)

- Sonoco Products Company

- Graham Packaging Company Inc.

- Trivium Packaging BV

第七章投资分析

第八章:市场的未来

The North America Aerosol Cans Market size is estimated at 4.46 billion units in 2025, and is expected to reach 5.22 billion units by 2030, at a CAGR of 3.21% during the forecast period (2025-2030).

Key Highlights

- End-use industries, such as cosmetics, personal care, food and beverage, and healthcare, are driving the demand for aerosol cans. The cosmetics and personal care sectors, driven by factors like increasing disposable incomes, changing consumer lifestyles, and a growing demand for items like deodorants and hairsprays, are key drivers of this market's growth.

- In the United States, beauty product vendors are increasingly moving toward standardized packaging solutions. The industry's push for innovation was shown by Aptar Beauty's move in January 2023. The company expanded its sustainable dispensing solutions by introducing two aerosol actuators and a fine mist spray containing up to 46% post-consumer recycled resin (PCR). Aptar Beauty's EuroMist technology, known as North America's leading fine mist spray, works well with many formulas.

- There is a noticeable increase in consumer spending on laundry and cleaning products, showing a higher demand. Metal cans, especially in household sprays, are important for cleaning and disinfecting items like air fresheners and furniture polishes. Procter & Gamble (P&G) witnessed a significant increase in net sales in the United States in 2023, jumping from USD 27.3 billion in 2018 to USD 38.7 billion, marking a strong growth rate of about 12.1%. This rise highlights a significant shift in demand, especially after COVID-19, for P&G's household and personal care products, many of which, including cleaning agents, air fresheners, and unique hygiene products, come in aerosol cans.

- Despite the industry's growth, consumers of cosmetics and personal care products have significant bargaining power, driven by increased competition and many interchangeable products. This often forces producers to lower prices, presenting a challenge for the aerosol can segment. In addition, supply chain disruptions, worsened by rising energy costs, have slowed the growth of the aluminum sector.

- Aluminum aerosol cans are praised for their flexibility, and with a growing focus on recyclable materials, their demand is increasing. The Aluminum Association reports recycling over 40 billion cans annually, showing the industry's commitment to sustainability. The United States could save a significant USD 800 million each year by recycling the aluminum that is currently going to landfills.

- The market's growth is further supported by the proactive strategies of industry associations. The Can Manufacturers Institute (CMI) has set ambitious goals to increase the aluminum beverage can recycling rate in the United States to 70% by 2030, with further goals of 80% by 2040 and over 90% by 2050. These initiatives show the industry's commitment to using aluminum's sustainability.

North America Aerosol Cans Market Trends

The Automotive/Industrial Segment to Drive the Market

- The packaging industry has enhanced aerosol cans' functionality for storage, transportation, and consumer convenience. According to the Energy Information Administration's (EIA) monthly report published in August 2023, crude oil production in the United States was projected to reach an all-time high of 12.76 million barrels per day (bpd) in 2023, rising by 850,000 bpd. Aerosol cans provide a convenient and precise method for applying lubricants.

- With the growing availability of lubricants, users may prefer aerosol cans for their ease of use and accurate application, especially in hard-to-reach or complex machinery parts. According to an Extroplate survey, North America's fluids and lubricants market was worth USD 26.7 billion in 2023. The burgeoning sales of vehicles are predicted to cause a surge in the automotive aftermarket in the future years, which will, in turn, push up the requirement for aerosol cans in the automotive segment.

- These cans are also used in automobiles for various painting and maintenance purposes. Apart from the thriving automotive industry, rapidly expanding production also impacts the demand for aerosol cans in the market. Aerosols are used heavily for tool cleaning and degreasing and the maintenance of factory machinery worldwide. This, in turn, allows factories and manufacturing facilities to maintain their optimum production volumes.

- According to a report by the American Automobile Association, published in October 2023, for every mile driven, the average vehicle owner spent an average of 9.83% on vehicle maintenance and repairs (up by 1.6% in 2022). As consumers spend more on maintaining and repairing their vehicles, they are likely to keep them in better condition for longer. This can result in higher vehicle ownership rates and a larger pool of potential customers for automotive aerosol products.

- Aluminum cans have a higher recycling rate and contain more recycled content than competing packaging types. According to The Aluminum Association, aluminum is one of the most recycled materials on the market, saving more than 90% of the energy required to produce new metal and reducing production costs. Ball Corporation partnered with Recycle Aerosol LLC to boost the recycling rates of aluminum aerosol cans in the United States. The collaboration increases aerosol can recycling and establishes a closed-loop system in which used cans are recycled into new aerosol cans.

The United States is Expected to Account for the Largest Market Share

- The packaging industry has increased the utility of aerosol cans for storage, transportation, and convenience of use, making these packaging solutions efficient and fulfilling most requirements. The demand for aerosol cans is expected to increase due to the expansion of the personal care sector in the United States, which is related to consumers' increased disposable income and ability to purchase luxury goods. Aerosols are commonly used in personal care products, and the market is projected to profit from their increased sales.

- Aerosols are also being used for systemic drug delivery. Patients need safe, reliable, portable, and easy-to-use devices. The growth of the medical segment can be credited to the increasing demand for dry powder respiratory inhalers and metered dose inhalers in the country. Growing pollution has led to a rise in asthma patients, which is anticipated to propel the demand for aerosol containers in the upcoming period.

- According to an article published by PKN Packaging News in February 2023, the International Organisation of Aluminium Aerosol Container Manufacturers (Aerobal) reported that global shipments of aerosols increased by 6.8%, and the deliveries to South and North America also increased by 6%. These two regions accounted for about 71% of the total deliveries of the Aerobal members. With more pharmacists available, there may be an increase in the overall volume of prescriptions filled. This could result in a higher demand for pharmaceutical products, including those delivered through aerosol cans, such as inhalers or topical sprays.

- Notably, according to data from the US Census Bureau, the retail sales of health and personal care stores in the United States increased from USD 32,224 million in January 2022 to USD 34,246 million in January 2023. Many consumers are looking for chemical-free alternatives in their beauty products. Aerosol metal cans can be advantageous for products that need to be formulated without certain chemicals, as they allow for controlled dispensing and minimal exposure to air, reducing the need for preservatives.

- Aerosol cans are an easy, user-friendly way to dispense paints and varnishes. They eliminate the need for additional equipment like brushes or rollers, making them a preferred choice for many consumers, including homeowners and DIY enthusiasts. According to the US Census Bureau, till August 2023, construction spending across the country amounted to USD 1,284.7 billion, 4.2% higher than USD 1,233.4 billion for the same period in 2022. As construction activity expands, there is a greater demand for paints and coatings to finish and protect newly constructed buildings and structures.

North America Aerosol Cans Industry Overview

The North American aerosol cans market is fragmented with the presence of major players such as Crown Holdings Inc., Ball Corporation, CCL Container Inc. (CCL Industries Inc.), Mauser Packaging Solutions (Bway Holding Company), and Ardagh Group SA. These players are adopting strategies such as partnerships, innovation, and acquisitions to enhance their product offerings and gain sustainable competitive advantages.

In September 2023, Novelis, a sustainable aluminum solutions provider, declared that it had entered into an anchor customer agreement with Ball Corporation in North America. The agreement stipulates that Novelis will provide aluminum sheets to the Ball can manufacturing facilities in North America.

In May 2023, Ardagh Metal Packaging and Crown Holdings, producers of aluminum beverage cans, invested in a new grant initiative as part of their ongoing support for initiatives to encourage the installation of aluminum can capture equipment within material recovery facilities, which specialize in sorting single-stream recyclables. According to the initial estimates, these grants would fund equipment that, upon installation, would collect 71 million cans of aluminum per year, amounting to a little over USD 1 million in annual revenue for the US recycling system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Rising Demand from Cosmetics Sector

- 4.4.2 Growth in Use of Automotive Lubricants

- 4.5 Market Challenges

- 4.5.1 Increasing Competition from Substitute Packaging

- 4.6 Market Opportunities (Recyclability of Aerosol Cans)

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Aluminium

- 5.1.2 Steel-Tinplate

- 5.2 By End-user Industry

- 5.2.1 Cosmetic and Personal Care (Deodorants/Antiperspirants, Hairsprays, Hair Mousse, and Others)

- 5.2.2 Household

- 5.2.3 Pharmaceutical/Veterinary

- 5.2.4 Paints and Varnishes

- 5.2.5 Automotive/Industrial

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Crown Holdings Inc.

- 6.1.2 Ball Corporation

- 6.1.3 CCL Container Inc. (CCL Industries Inc.)

- 6.1.4 Mauser Packaging Solutions (Bway Holding Company)

- 6.1.5 Ardagh Group SA

- 6.1.6 DS Containers Inc.

- 6.1.7 ITW Sexton (Illinois Tool Works Inc.)

- 6.1.8 Sonoco Products Company

- 6.1.9 Graham Packaging Company Inc.

- 6.1.10 Trivium Packaging BV