|

市场调查报告书

商品编码

1686555

数位签章:市场占有率分析、产业趋势与统计资料、成长预测(2025-2030 年)Digital Signatures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

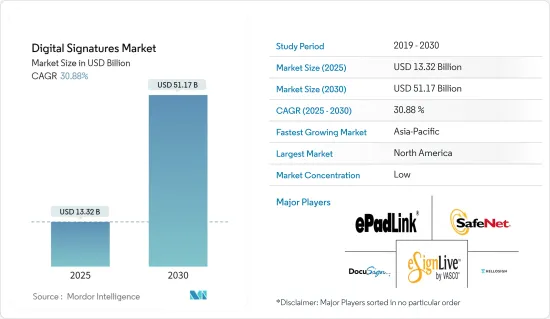

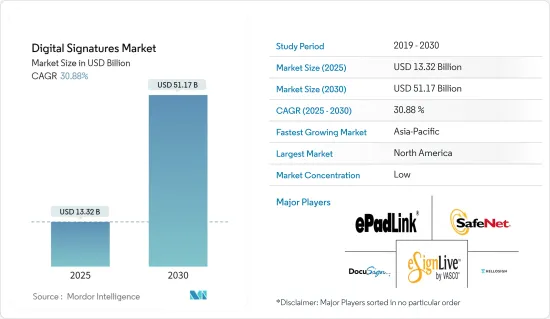

预计 2025 年数位签章市场规模为 133.2 亿美元,到 2030 年将达到 511.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 30.88%。

企业正在从传统签名转向数位签章,因为它降低了法律纠纷的风险并提供更有力的证据。

主要亮点

- 传输敏感资讯时,资料安全始终是必需的。随着电子商务和网路银行的兴起,企业需要确保其网路安全以赢得客户信任。这导致数位签章的采用和普及程度不断提高,数位签章可作为任何电子文件发送者的真实性印章。

- 随着技术的发展,文件执行过程也在不断发展。近年来,随着人们对以现代、便捷的方式进行具有约束力的交易的需求不断增长,电子合约和电子签章得到了极大的发展。这些发展极大地改变了交易的进入方式和执行过程。

- 年轻的消费者也推动了金融服务业数位签章的兴起。全球各地的Z世代和千禧世代都在签署银行帐户开户、贷款协议、投资、财富管理、房屋抵押贷款合约等金融文件,导致数位签章的需求激增。此外,陆上交通部、移民局等政府机构也加大对重要文件电子签章的支持。

- 由于新冠疫情爆发后远距办公的增加,人们不再依赖纸本文件,而是转向交易流程的数位化,预计数位签章市场将呈现正成长率。公司希望能够以无缝、高效的方式在任何地方开展业务。也有人讨论将文檔处理流程转移到网路上。

数位签章市场趋势

政府部门预计将实现显着成长

- 采用数数位签章解决方案可以帮助联邦、州和地方政府实现广泛的文件处理和自动化功能,改善对关键资料的访问,同时降低获取数据的相关成本。签署和检验解决方案受益的一些关键政府应用包括请愿自动化、邮寄投票、表单资料提取和邮件处理。

- 市政、州和地方政府实体正在经历越来越多的诈骗签名。州和地方政府在数千个不同的实体上花费了大量的资金,并且追踪这些交易需要耗费大量的劳动力。

- 政府致力于发展数位基础设施,因此需要基于软体的解决方案来处理其不断累积的资料。美国政府已经实施了 IT倡议,包括数位体验、身分、凭证和存取管理 (ICAM) 和数位策略。

- 该法的重要内容包括电子签章认证设施的标准、资料保护方法、防止伪造、篡改电子签章和电子文件的措施、註册和使用电子签章认证服务的程序、以及验证用户的方法等。

北美占据最高市场占有率

- 北美是收益最高的市场之一,这主要是因为越来越多的企业转向采用云端基础的解决方案、行动装置的快速普及以及知名企业占据了相当大的市场占有率。

- 例如,据思科称,预计到去年年底该地区将成为云端运算应用最广泛的地区之一。这是因为企业对云端基础的服务的偏好日益增加,预计这将推动安全云中数位解决方案的成长。

- 与电子签章电子签章相关的政府倡议,例如《统一电子交易法》(UETA)和《全球和国家商务电子签名法》(E-SIGN),允许在所有交易中使用电子签章,并在推动市场发展方面发挥重要作用。 《美国-墨西哥-加拿大协定》(USMCA)等贸易协定也鼓励使用电子签章。

- 领先的供应商正在推出创新产品以保持市场竞争力。该公司正致力于技术进步,例如 Mitek 于 2021 年 6 月宣布推出美国签章检验平台 Check Intelligence。随着技术的快速进步,加上《2020 年数位身分改进法案》等政府法规的收紧,预计该国将为受调查市场的成长创造更安全的环境。

- 该地区的软体解决方案采用率异常高,新冠疫情限制了数百万选民的行动,迫使政府鼓励选民采用数位投票。这对数位签章软体的使用产生了直接影响,并促使政府和签名检验开发公司之间的合作。

数位签章产业概况

数位签章市场高度分散,受企业对具有成本效益的解决方案的需求和政府措施的推动。然而,由于其创新和前瞻性的解决方案,许多公司透过赢得新合约和探索新市场来扩大其市场占有率。该市场的主要企业包括 DocuSign、HelloSign、SunGard Signix Inc.、SafeNet Inc. 和 ePadLink。

- 2022 年 9 月:欧洲领先的身份验证平台提供商 IDnow 宣布与全球领先的 PDF 和电子签章工具解决方案 Adobe Document Cloud 进行全球合作,以简化有效签名的身份验证并使其更加安全。透过与 Workday、Salesforce、Microsoft 和 Google 等平台的原生集成,使用 Acrobat Sign 的客户也可以使用新的身份验证功能。

- 2022 年 2 月:Smart Communications 和 OneSpan 合作,透过电子签章整合扩展客户对话的价值,提高业务效率,透过简化数位协议流程改善客户体验,提高客户满意度,提高申请完成率,从而加快收益实现时间,并证明合规性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章市场动态

- 市场驱动因素

- 电子签章的增加和云端基础的服务的采用

- 远距工作文化和海外合约的增加

- 市场限制

- 更容易受到网路攻击和诈骗

第六章市场区隔

- 按部署

- 本地

- 云

- 透过提供

- 软体

- 硬体

- 服务

- 按最终用户产业

- BFSI

- 政府

- 卫生保健

- 石油和天然气

- 军事和国防

- 物流与运输

- 研究与教育

- 其他终端用户产业(房地产、製造业、法律、IT、通讯)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- SunGard Signix Inc.

- DocuSign

- Silanis-eSignLive

- SafeNet Inc.

- ePadLink

- Topaz systems

- Ascertia

- DigiStamp Inc.

- GMO GlobalSign Inc.

- RightSignature

- HelloSign

- Wacom

- Adobe Sign

- airSlate Inc.

- PandaDoc Inc.

- SignEasy

第八章投资分析

第九章:市场的未来

The Digital Signatures Market size is estimated at USD 13.32 billion in 2025, and is expected to reach USD 51.17 billion by 2030, at a CAGR of 30.88% during the forecast period (2025-2030).

Enterprises are shifting from traditional to digital signatures because they reduce the risk of legal disputes and provide stronger evidence.

Key Highlights

- There has been a constant need for data security while transmitting sensitive information. Due to the e-commerce and online banking boom, companies needed to secure their networks to gain customer confidence. This has led to a greater and faster rate of adoption rates of digital signatures, which act as the sender's seal of authenticity over any electronic document.

- With the evolution of technology, the way of executing documents has also evolved. Electronic agreements and digital signatures have gained much momentum in recent years with the increasing demand for modern, convenient methods for entering binding transactions. Such developments have significantly changed how these transactions are entered and the execution processes.

- Younger consumers have also been a driving force behind the rise in digital signatures in the financial services industry. Various Gen Z and Millennials worldwide signed financial documents, such as opening a bank account, loan agreement, investment, wealth management, and mortgage agreements during the pandemic, resulting in a burgeoning digital signature demand. Also, government agencies, like the DMV and immigration, have provided more e-signature support for critical documents.

- With the outbreak of COVID-19, the digital signature market is anticipated to exhibit a positive growth rate due to the rise in remote working that shifted the focus from relying on paper-based documentation and increasing the digitalization of the transaction process. Enterprises are seeking business methods that are seamless and efficient and can be done from anywhere. Enterprises are also considering taking document processes online.

Digital Signatures Market Trends

Government Sector Expected to Witness Significant Growth

- Adopting digital signature solutions helps in a wide range of document processing and automation capabilities for federal, state, and local governments, improving access to critical data while reducing costs associated with obtaining it. Some of the essential applications of government where signature and verification solutions are helpful include petition automation, vote-by-mail, form data extraction, and mail processing.

- There have been increasing fraud cases of forged signatures in municipalities, states, and local governments. State and local governments spend significant money with thousands of different entities, and keeping track of the transactions takes effort.

- Various efforts by the government have been put into developing a digital infrastructure that triggers the need for software-based solutions for the data accumulated. The US government already has IT initiatives, such as digital experience, identity, credentials, access management (ICAM), and digital strategy.

- Some of the important contents of the act include standards for facilities involved with digital signature certification and data protection methods, countermeasures against counterfeiting and falsification of electronic signatures and electronic documents, procedures for signing up for and using the digital signature authentication service, and methods of verifying subscribers.

North America to Hold the Highest Market Share

- The North American region has been one of the highest revenue-generating markets primarily due to the increased shift of organizations toward cloud-based solution adoption, rapid mobile adoption, and the presence of prominent players occupying a significant market share.

- For instance, as per Cisco, the region was anticipated to be one of the most cloud-ready regions by the end of last year. This was due to the increased preference of companies towards cloud-based services, which is expected to propel the growth of digital solutions in the secure cloud.

- Government initiatives related to e-signatures, such as the Uniform Electronic Transactions Act (UETA) and the Electronic Signatures in Global and National Commerce Act (E-SIGN), permitted the usage of e-sign for every transaction, thereby playing a crucial role in driving the market. Trade deals, like the United States-Mexico-Canada Agreement (USMCA), also encourage the usage of e-signatures.

- Major vendors are rolling out innovative offerings to remain competitive in the market. Companies have been involved in technological advancements, like the launch of Check Intelligence by Mitek, a US-based signature verification platform, in June 2021. With such rapid technological advancements, alongside increased regulation by the government, such as the Improving Digital Identity Act of 2020, the country is expected to witness a more secure environment for the growth of the studied market.

- The region witnessed exceptionally higher usage of software solutions, and the COVID-19 pandemic restricted the movement of millions of voters, which compelled the government to encourage voters to adopt digital voting. This directly impacted the usage of digital signature software, prompting government collaboration with signature verification developer companies.

Digital Signatures Industry Overview

The digital signatures market is highly fragmented due to the demand from companies seeking cost-effective solutions and government initiatives. However, with innovative and advanced solutions, many companies are increasing their market presence by securing new contracts and tapping new markets. Some major players in the market are DocuSign, HelloSign, SunGard Signix Inc., SafeNet Inc., and ePadLink.

- September 2022: IDnow, a leading identity-proofing platform provider in Europe, announced a global collaboration with Adobe Document Cloud, the world's leading PDF and e-signature tools solution, to simplify identity verification for validated signatures and more secure. The new authentication capabilities will also be available to customers using Acrobat Sign through native integrations on platforms such as Workday, Salesforce, Microsoft, or Google.

- February 2022: Smart Communications and OneSpan partner to expand the value of customer conversations with Electronic Signature Integration, create operational efficiencies as well as improves the customer experience by streamlining digital agreement processes; joint customers achieve higher customer satisfaction and increase application completions that shorten time to revenue, all while demonstrating compliance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in E-signatures and Adoption of Cloud-based Services

- 5.1.2 Increse in Remote Work Culture and Overseas Contracts

- 5.2 Market Restraints

- 5.2.1 Increasing Vulnerability Related to Cyber Attacks and Frauds

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Offering

- 6.2.1 Software

- 6.2.2 Hardware

- 6.2.3 Service

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Government

- 6.3.3 Healthcare

- 6.3.4 Oil and Gas

- 6.3.5 Military and Defense

- 6.3.6 Logistics and Transportation

- 6.3.7 Research and Education

- 6.3.8 Other End-user Industries (Real Estate, Manufacturing, Legal, IT, and Telecom)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SunGard Signix Inc.

- 7.1.2 DocuSign

- 7.1.3 Silanis-eSignLive

- 7.1.4 SafeNet Inc.

- 7.1.5 ePadLink

- 7.1.6 Topaz systems

- 7.1.7 Ascertia

- 7.1.8 DigiStamp Inc.

- 7.1.9 GMO GlobalSign Inc.

- 7.1.10 RightSignature

- 7.1.11 HelloSign

- 7.1.12 Wacom

- 7.1.13 Adobe Sign

- 7.1.14 airSlate Inc.

- 7.1.15 PandaDoc Inc.

- 7.1.16 SignEasy