|

市场调查报告书

商品编码

1686566

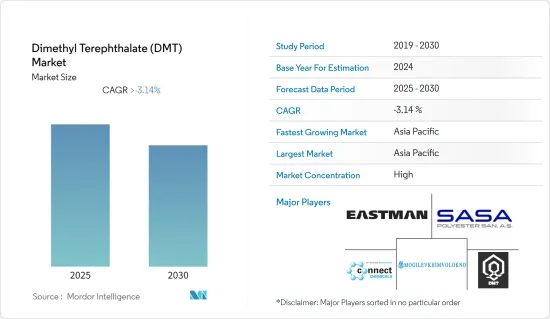

对苯二甲酸二甲酯(DMT):市场占有率分析、产业趋势和成长预测(2025-2030年)Dimethyl Terephthalate (DMT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内对苯二甲酸二甲酯市场将会下滑。

COVID-19疫情对市场产生了负面影响。许多国家实施封锁措施以遏制病毒传播。许多公司和工厂关闭,扰乱了全球供应链,影响了全球的生产、交货时间和产品销售。

主要亮点

- 短期内,聚对苯二甲酸乙二醇酯(PET)、聚丁烯对苯二甲酸酯(PBT)的需求上升,以及纺织业对聚酯纤维的需求上升是推动市场成长的主要因素。

- 另一方面,PTA(精对苯二甲酸)等经济替代品的可用性可能会抑制市场成长。

- 亚太地区占据了最高的市场占有率,并可能在预测期内占据市场主导地位。

对苯二甲酸二甲酯(DMT)市场趋势

聚酯纤维占据市场主导地位

- 聚酯纤维是以对苯二甲酸二甲酯为原料製成的合成纤维。聚酯纤维具有优异的机械抗性,可以收缩和拉伸而不会损失强度。

- 这些纤维通常用于製造纱线、绳索、输送机织物、安全带、塑胶增强材料和其他工业应用。它也用于纺织工业,製造服饰、地毯、家居用品以及作为机械增强的辅助材料。此外,这种材料以其卓越的强度和耐用性而闻名。这就是为什么它也用于运动服和製服的原因。

- 聚酯纤维采用合成材料製成,比天然纤维便宜,但吸水性低,不适合製造需要吸收水分的产品,如运动服、毛巾和床上用品。

- 根据 ITC Trademap 的数据,2022 年全球整体聚酯短纤维(未经梳理、精梳或纺纱加工)出口国包括中国(包括台北)(1,221,267 吨)、韩国(624,362 吨)、泰国(318,081 吨)、印度(254,531 吨)、泰国(31.85 万吨)吨)。

- 2022年全球整体聚酯短纤维主要进口国包括斯里兰卡(2,593,370吨)、美国(455,384吨)、越南(326,289吨)、土耳其(210,140吨)和德国(175,604吨)。

- 虽然聚酯纤维薄膜的成长呈现出正面的趋势,但由于新工厂通常更倾向于使用TPA製程(DMT的替代品),因此该领域对DMT的需求正在下降。

- 因此,未来聚酯纤维对DMT的需求可能会下降。

亚太地区占市场主导地位

- 亚太地区占据全球市场占有率。由于聚酯和PET树脂的持续生产,亚太地区是市场研究中最大的地区。

- PET、聚酯薄膜及纤维、PBT是中国对苯二甲酸二甲酯的主要消费者。然而,由于聚酯树脂生产中 PTA 的使用量不断增加,预计 DMT 的需求将会下降。

- 华彩、东亚纺织技术有限公司、中国石化和常熟阿祖尔是中国主要的聚酯纤维製造商/供应商。

- 2022年中国新增聚酯产能507.5万吨/年。运力成长率为 8.7%,但由于一些老旧机组退役,成长率下调至 7.3%。聚酯产能仍在上升,预计2022年底将达到7,000万吨/年以上。

- 在印度,由于纺织和包装行业的蓬勃发展,过去几年一直推动着市场的成长,对聚酯树脂、薄膜、纤维和 PET 的需求正在迅速增长。然而,随着印度精对苯二甲酸(PTA)生产能力的扩大,PTA的使用量正在取代DMT而上升。

- 纺织业对聚酯的需求正在蓬勃发展。据印度纺织部称,2022财年印度纺织品和服装出口(包括手工艺品)达444亿美元,比上年度增长41%。印度占全球纺织品和服装贸易的份额为4.0%。

- 因此,由于上述因素,亚太地区很可能会占据市场主导地位。

对苯二甲酸二甲酯(DMT)产业概况

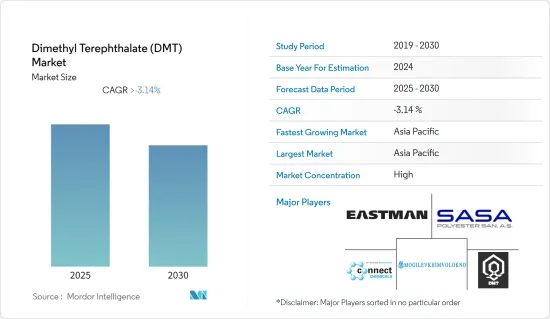

全球对苯二甲酸二甲酯 (DMT) 市场本质上是整合的。市场的主要企业包括伊士曼化学公司、Connect Chemicals、SASA Polyester Sanayi AS、OAO Mogilevkhimvolokno 和 Fiber Intermediate Products Company。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 聚对苯二甲酸乙二醇酯(PET)和聚丁烯对苯二甲酸酯(PBT)的需求不断增加

- 纺织业对聚酯纤维的需求不断增加

- 限制因素

- 有经济的替代品,例如 PTA(精对苯二甲酸)

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 片状(固体)DMT

- 液体 DMT

- 按应用

- 聚酯薄膜

- 聚酯纤维

- PET树脂

- 其他用途(包括PBT)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Connect Chemicals

- Eastman Chemical Company

- Fiber Intermediate Products Company

- OAO Mogilevkhimvolokno

- Sarna Chemicals

- SASA Polyester Sanayi AS

- SK chemicals

- Yangzhou Juhechang Technology Co. Ltd

第七章 市场机会与未来趋势

The Dimethyl Terephthalate Market is expected to decline during the forecast period.

The COVID-19 pandemic negatively impacted the market. Several countries worldwide applied lockdowns to curb the spread of the virus. The shutdown of numerous companies and factories disrupted worldwide supply networks and harmed global production, delivery schedules, and product sales.

Key Highlights

- In the short term, major factors driving the market's growth are the rising demand for polyethylene terephthalate (PET), polybutylene terephthalate (PBT), and the rising demand for polyester fiber in the textile industry.

- On the flip side, the availability of economical substitutes like PTA (Purified Terephthalic Acid) may likely restrain the market's growth.

- Asia-Pacific accounted for the highest market share, and the region may likely dominate the market during the forecast period.

Dimethyl Terephthalate (DMT) Market Trends

Polyester Fiber to Dominate the Market

- Polyester fibers are synthetic fibers which are produced from dimethyl terephthalate. Polyester fibers exhibit superior mechanical resistance and can shrink and stretch without losing strength.

- These fibers are increasingly used in manufacturing yarns, ropes, conveyor belt fabrics, seatbelts, plastic reinforcements, and others for industrial purposes. It is also used in the textile industry to manufacture clothing, carpets, and home furnishing, and as a mechanical reinforcement aid. In addition, the material is known for its superior strength and durability. Hence, it is used in sportswear and uniforms.

- Polyester fibers are manufactured using synthetic materials and are less expensive than natural fibers. They have low absorbency and are not ideal for manufacturing products that need to soak moisture, including activewear, towels, or bedding.

- According to ITC Trademap, the exporters of polyester staple fiber (not carded, combed, or otherwise processed for spinning) across the globe in 2022 are China (including Taipei, China) (12,21,267 tons), South Korea (624,362 tons), Thailand (318,081 tons), India (254,531 tons), Indonesia (212,413 tons), and Turkey (157,542), among others.

- The key importers of polyester staple fiber across the globe in 2022 are Sri Lanka (2,593,370 tons), the United States (455,384 tons), Vietnam (326,289 tons), Turkey (210,014 tons), and Germany (175,604 tons), among others.

- Although the growth of polyester fiber film is following a positive trend, the demand for DMT in this segment is declining since the newer plants generally tend to use the TPA process (an alternative for DMT).

- Hence, the demand for DMT in polyester fiber may decline in the future.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounts for the highest global Dimethyl Terephthalate (DMT) market share. Continuous polyester and PET resin production make the Asia-Pacific region the largest in the market studied.

- PET, polyester film and fiber, and PBT are China's major consumers of dimethyl terephthalate. However, the demand for DMT is projected to decline due to the rising applications of PTA for polyester resin production.

- HUACAI, EAST ASIA TEXTILE TECHNOLOGY LTD, Sinopec Inc., and Changshu Azue Co. Ltd are the major manufacturers/suppliers of polyesters in China.

- In 2022, China's new polyester capacity was 5,075 kilotons per year. The capacity growth rate was 8.7%, but it was revised to 7.3% after some old units were eliminated. Polyester capacity still edged and was above 70 million tons/year by the end of 2022.

- In India, the demand for polyester resins, film, fiber, and PET is increasing rapidly due to the surging textile and packaging sectors, which have driven the market's growth in past years. However, the expanding production facility for purified terephthalic acid (PTA) in India is increasing the usage of PTA rather than DMT.

- The demand for polyester is increasing rapidly in the textile industry. According to the Ministry of Textiles, India's textile and apparel exports (including handicrafts) stood at USD 44.4 billion in FY22, a 41% increase YoY. India has a 4.0% share of the global trade in textiles and apparel.

- Therefore, due to the above factors, Asia-Pacific may dominate the market studied.

Dimethyl Terephthalate (DMT) Industry Overview

The global Dimethyl Terephthalate (DMT) market is consolidated in nature. Some major companies in the market include Eastman Chemical Company, Connect Chemicals, SASA Polyester Sanayi AS, OAO Mogilevkhimvolokno, and Fiber Intermediate Products Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Polyethylene Terephthalate (PET) and Polybutylene Terephthalate (PBT)

- 4.1.2 Rising Demand for Polyester Fiber in the Textile Industry

- 4.2 Restraints

- 4.2.1 Availability of Economical Substitutes Like PTA (Purified Terephthalic Acid)

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Form

- 5.1.1 Flake (Solid) DMT

- 5.1.2 Liquid DMT

- 5.2 By Application

- 5.2.1 Polyester Film

- 5.2.2 Polyester Fiber

- 5.2.3 PET Resin

- 5.2.4 Other Applications (Including PBT)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Connect Chemicals

- 6.4.2 Eastman Chemical Company

- 6.4.3 Fiber Intermediate Products Company

- 6.4.4 OAO Mogilevkhimvolokno

- 6.4.5 Sarna Chemicals

- 6.4.6 SASA Polyester Sanayi AS

- 6.4.7 SK chemicals

- 6.4.8 Yangzhou Juhechang Technology Co. Ltd