|

市场调查报告书

商品编码

1686573

包装涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Packaging Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

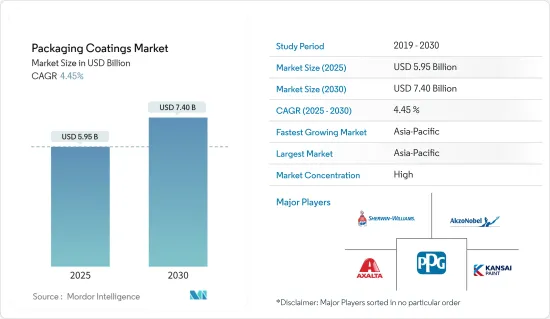

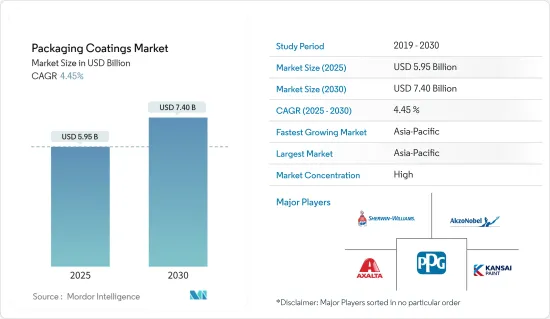

预计 2025 年包装涂料市场规模为 59.5 亿美元,到 2030 年将达到 74 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.45%。

COVID-19疫情对包装涂料市场产生了不利影响。全球封锁和严格的社交距离措施导致包装设施关闭,进而影响了包装涂料市场。然而,新冠疫情爆发后,限制措施被取消,市场恢復良好。由于各种包装应用中包装涂料的消费量增加,市场出现强劲復苏。

主要亮点

- 预计在预测期内,食品和饮料包装需求的不断增长以及个人护理行业气雾罐包装涂料的使用不断增加将推动市场需求。

- 然而,有关包装涂料排放的严格规定和环境问题预计将阻碍市场成长。

- 在预测期内,环保包装涂料的日益增长的趋势可能会为市场带来机会。

- 亚太地区贡献了最高的市场占有率,预计在预测期内将占据市场主导地位。

包装涂料的市场趋势

食品和饮料包装占据市场主导地位

- 在食品和饮料行业,包装涂层可增强包装的阻隔性、保质期和整体美观度,同时提供对可能影响包装产品品质的防潮、防光和其他外部因素的保护。

- 环氧树脂基底包装涂料由于其干燥速度快、韧性、附着力、耐水性和优异的固化性能,非常适合保护金属表面。这些独特的性能使丙烯酸成为涂层材料的绝佳选择。

- 环氧涂料包括环氧酚醛、环氧酐、环氧胺基等多种共混物,其中以环氧酚醛应用最为广泛。

- 2023 年 1 月,欧洲復兴开发银行 (EBRD) 宣布向土耳其 Akkim Kimya Sanayi ve Ticaret AS (Akkim) 提供 1,500 万欧元贷款,资助该公司在亚洛瓦工厂建立第一家本地环氧树脂製造厂。该贷款将使 Akkim 能够生产液体环氧树脂 (LER)、固态环氧树脂 (SER) 和环氧氯丙烷 (ECH),每年生产能力为 68,000 吨。

- 随着时代的发展,人们对罐头食品和饮料的需求也日益增加。近年来,人们对罐装果汁和啤酒的偏好日益增长,推动了对罐头和其他金属盖的需求,这可能会在未来几年进一步推动环氧基包装涂料的应用。

- 根据PAC Global报告的资料,受製造业和快速消费品产业包装需求不断增长的推动,美国包装市场规模预计到2025年将达到约310亿美元。

- 根据饮料行销公司预测,2022 年美国软性饮料销售量将达到 363 亿加仑,较 2021 年的 360.4 亿加仑有所成长。

- 据加拿大政府称,受製造业和快速消费品行业对软包装需求不断增长的推动,加拿大包装行业规模预计到 2025 年将达到约 312 亿美元。

- 因此,随着食品和饮料包装行业需求的不断增加,预计预测期内全球对包装涂料的需求将会增加。

中国主导亚太地区

- 中国拥有世界上最大的製造业和最大的消费群。中国是世界第一人口大国,也是各类商品最大的消费国。由于多种原因,包装涂料市场是中国经济中成长最快的领域之一。

- 近年来,涂层在各种产品上的应用显着扩大。对装饰性和吸引力包装的需求不断增加,导致对包装涂料的需求增加。

- 中国占据电子商务市场的最大份额。中国的销售额占电子商务总销售额的30%以上。中国是全球成长最快的电子商务市场之一,也是电子商务巨头阿里巴巴的所在地。

- 电子商务市场的成长导致包装产业的需求大幅增加,进而带动了包装涂料产业的需求大幅增加。食品和饮料包装是一个成长特别快速的行业。

- 在中国,人们对环境和污染的认识不断增强,导致了有关挥发性有机化合物(VOC)等危险化学品的法规的製定。这些因素可能会对包装涂料市场产生负面影响。这些因素被证明是因祸得福,因为公司很快就适应了各种环保替代品。

- 此外,佛山市池田空气清新剂等公司专门生产罐装汽车空气清新剂。公司在中国拥有四家工厂,总面积超过10万平方公尺,拥有30多条不同的生产线。该公司的愿景是到 2026 年将产值提高到 10 亿美元。预计此类发展将对研究市场产生影响。

- 上述因素将导致预测期内该国对包装涂料的消费需求增加。

包装涂料产业概况

包装涂料市场正在整合。市场的主要企业(不分先后顺序)包括阿克苏诺贝尔公司、PPG工业公司、宣伟公司、艾仕得涂料系统公司和关西涂料公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 食品和饮料包装需求不断成长

- 扩大个人护理品气雾罐包装涂料的应用

- 限制因素

- VOC排放的严格法规与环境问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按树脂

- 环氧树脂

- 丙烯酸纤维

- 聚氨酯

- 聚烯

- 聚酯纤维

- 其他树脂

- 按应用

- 食品罐

- 饮料罐

- 气雾管

- 盖子与封口装置

- 工业和特殊包装

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Akzo Nobel NV

- ALTANA

- Axalta Coating Systems, LLC

- BASF SE

- FGN Fujikura Kasei Global Network

- Hempel A/S

- Henkel Corporation.

- Jamestown Coating Technologies

- Kangnam Jevisco Co. Ltd

- Kansai Paint Co.,Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Weilburger

第七章 市场机会与未来趋势

- 环保包装涂料的趋势日益增长

The Packaging Coatings Market size is estimated at USD 5.95 billion in 2025, and is expected to reach USD 7.40 billion by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market for packaging coatings. Nationwide lockdowns and strict social distancing measures led to the closure of packaging facilities, consequently affecting the packaging coatings market. However, after the COVID-19 pandemic, the market recovered well following the lifting of restrictions. It rebounded significantly due to the increased consumption of packaging coatings in various packaging applications.

Key Highlights

- Increasing demand for food and beverage packaging and the growing utilization of packaging coatings in aerosol cans for the personal care industry are expected to drive market demand during the forecast period.

- On the flip side, stringent regulations and environmental concerns regarding VOC emission from packaging coatings are expected to hinder the growth of the market studied.

- The growing inclination for eco-friendly packaging coatings is likely to act as an opportunity for the market studied over the forecast period.

- The Asia Pacific region accounts for the highest market share and is expected to dominate the market during the forecast period.

Packaging Coatings Market Trends

Food and Beverage Packaging to Dominate the Market

- In the food and beverage industry, packaging coatings enhance the barrier properties, shelf-life, and overall aesthetics of the packaging, while also protecting against moisture, light, and other external factors that can potentially impact the quality of the packaged products.

- Epoxies resin-based packaging coatings, due to their features, such as fast-drying properties, toughness, adhesion properties, resistance to water, and good curing, are suitable for protecting metal surfaces. These unique characteristics make acrylic resins a noble choice as a coating material.

- Different blends of epoxy-based coatings are available, which include epoxy-phenolic, epoxy-anhydride, and epoxy-amino coatings, among which epoxy-phenolic is mainly used.

- In January 2023, the European Bank for Reconstruction and Development (EBRD) announced to provide a EUR 15 million loan to Akkim Kimya Sanayi ve Ticaret A.S. (Akkim) in Turkey to finance the establishment of the first local epoxy resin manufacturing plant at its premises in Yalova. The loan will enable Akkim to produce liquid epoxy resin (LER), solid epoxy resin (SER), and epichlorohydrin (ECH), with an annual production capacity of 68,000 tonnes.

- The demand for canned food and beverages has been increasing over time. The growing preference for canned fruit juice and beer among people in recent times has been boosting the demand for cans and other metal caps, which may further drive the applications of epoxy-based packaging coatings in the coming years.

- According to the data reported by PAC Global, the United States packaging market is expected to reach about USD 31 billion by 2025, owing to the increasing demand for packaging from the manufacturing and FMCG sectors.

- According to the Beverage Marketing Corporation, in the United States, the sales volume of liquid refreshment beverages reached 36,300 million gallons in 2022 and registered growth when compared to 36,040 million gallons in 2021.

- According to the government, the packaging industry in Canada is expected to reach about USD 31.2 billion by 2025, owing to the increasing demand for flexible packaging from the country's manufacturing and FMCG sectors.

- Hence, with the increasing demand from the food and beverage packaging industry, the demand for packaging coatings is projected to increase worldwide, during the forecast period.

China to Dominate the Asia-Pacific Region

- China has the biggest manufacturing sector in the world and the largest consumer base. Being the most populated country, China makes it the largest consumer of various goods. Owing to various reasons, the packaging coatings market is one of the fastest-growing markets in the Chinese economy.

- The applications of coatings on various products have grown significantly in recent times. The increasing need for decorative and attractive packaging has led to an increase in the demand for coatings for packaging.

- China has the largest share of the e-commerce market. Sales in China account for more than 30% of the total e-commerce sales. China is one of the fastest-growing e-commerce markets in the world, and it is home to the e-commerce giant Alibaba.

- The growth in the e-commerce market led to a huge increase in demand for the packaging industry and, consequently, the packaging coatings industry. Food and beverage packaging is the fastest-growing sector among them.

- In China, the awareness concerning the environment and pollution led to the formation of regulations related to harmful chemicals (such as volatile organic compounds (VOCs)). Such factors can adversely affect the market for packaging coatings. These factors have also been a blessing in disguise, as companies have quickly adapted to various eco-friendly alternatives.

- Moreover, companies such as Foshan Ikeda Air Freshener Co., Ltd. are focusing on specializing in the production of canned car fresheners. The company has 4 factories in China with a total area of more than 100,000 square meters, with over 30 different production lines. The company's vision is to increase the output value will reach 1 billion by 2026. Such developments are expected to affect the studied market.

- The factors above contribute to the increasing demand for packaging coatings consumption in the country during the forecast period.

Packaging Coatings Industry Overview

The packaging coatings market is consolidated. Some of the major players (not in any particular order) in the market include Akzo Nobel NV, PPG Industries Inc., The Sherwin-Williams Company, Axalta Coating Systems, and Kansai Paint Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Food and Beverage Packaging

- 4.1.2 Growing Utilization of Packaging Coatings in Aerosol Cans for Personal Care Industry

- 4.2 Restraints

- 4.2.1 Stringent Regulation and Environmental Concern Regarding VOC Emission

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Resin

- 5.1.1 Epoxies

- 5.1.2 Acrylics

- 5.1.3 Polyurethane

- 5.1.4 Polyolefins

- 5.1.5 Polyester

- 5.1.6 Other Resins

- 5.2 By Application

- 5.2.1 Food Cans

- 5.2.2 Beverage Cans

- 5.2.3 Aerosol and Tubes

- 5.2.4 Caps and Closures

- 5.2.5 Industrial and Specialty Packaging

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Qatar

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 South Africa

- 5.3.5.6 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 ALTANA

- 6.4.3 Axalta Coating Systems, LLC

- 6.4.4 BASF SE

- 6.4.5 FGN Fujikura Kasei Global Network

- 6.4.6 Hempel A/S

- 6.4.7 Henkel Corporation.

- 6.4.8 Jamestown Coating Technologies

- 6.4.9 Kangnam Jevisco Co. Ltd

- 6.4.10 Kansai Paint Co.,Ltd.

- 6.4.11 PPG Industries, Inc.

- 6.4.12 RPM International Inc.

- 6.4.13 The Sherwin-Williams Company

- 6.4.14 Weilburger

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Inclination for Eco-Friendly Packaging Coatings