|

市场调查报告书

商品编码

1686579

印度电力:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)India Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

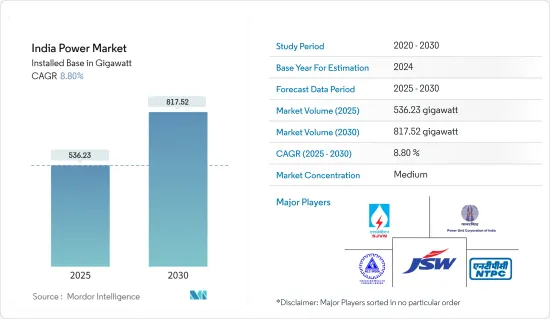

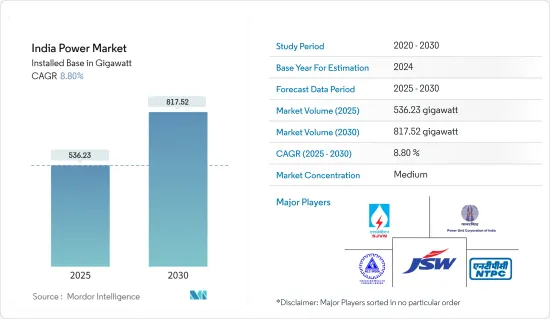

印度电力市场规模预计将从 2025 年的 536.23 吉瓦扩大到 2030 年的 817.52 吉瓦,预测期内(2025-2030 年)的复合年增长率为 8.8%。

主要亮点

- 从中期来看,政府支持政策、基础设施建设导致的电力需求增加以及人口成长等因素将在预测期内推动市场发展。

- 同时,建立和现代化发电、输电和配电网路需要大量投资,而私营部门投资疲软预计将阻碍印度电力市场的成长。

- 然而,印度太阳照度充足,全年都能接收太阳能。这为利用太阳能创造了绝佳的机会,尤其是来自拉贾斯坦邦、古吉拉突邦和安得拉邦等阳光最充足的地区。上述因素加上外国投资和大型电力计划为印度电力市场的成长提供了机会。

印度电力市场趋势

火力发电占市场主导地位

- 印度拥有丰富的煤炭蕴藏量,使其成为一种易于取得且相对廉价的发电燃料。印度煤炭蕴藏量丰富,既是煤炭生产大国,也是煤炭消费大国,因此火力发电厂成为满足日益增长的电力需求的一个有吸引力的选择。

- 此外,印度已建立起燃煤发电基础设施。众多煤矿、交通网和燃煤发电厂已投入运作。现有的基础设施是支撑我们在火力发电市场占据主导地位的基础。

- 此外,2022年9月,印度能源部宣布,准备在2030年增加高达56吉瓦的燃煤发电能力,以满足不断增长的电力需求。燃煤发电能力的增加将比目前燃煤发电厂高出约 25%。

- 截至2023年11月,印度严重依赖火力发电,总设备容量为23,907兆瓦,占全国总发电量的56%以上。

- 此外,火力发电厂(尤其是使用煤炭的火力发电厂)与可再生等替代能源相比具有成本竞争力。建立火力发电厂的初始资本投资通常较低,而且与波动的石油和天然气价格相比,包括燃料成本在内的营业成本相对稳定。

- 火力发电厂非常适合满足基本负载需求(满足消费者日常需求所需的最低电量),因为它们可以提供稳定可靠的电力供应。能够提供稳定的电力供应使得火力发电在市场上占优势。

- 因此,如上所述,火力发电部门很可能在预测期内占据市场主导地位。

政府政策和支持可望推动市场

- 政府政策和支援是印度电力市场的主要驱动力,因为它们提供了电力产业发展所需的清晰蓝图、财政奖励、法律规范和基础设施发展。透过推广可再生能源、能源效率、电网整合和数数位化,政府正在创造有利环境来吸引投资、促进永续并促进印度向永续和可靠的电力市场转型。

- 印度政府制定了雄心勃勃的再生能源目标,以增加再生能源在其整体能源结构中的份额。国家太阳能计划、国家风能计划以及各州可再生能源政策等奖励和支持可再生能源发电计划的发展。这些倡议旨在吸引投资、简化监管流程、提供财务奖励并确保为可再生能源的发展提供有利的环境。

- 为了推动国家的永续转型,政府设定了一个雄心勃勃的目标,在 2030 年实现可再生能源装置容量达到 500 吉瓦 (GW)。该目标包括安装 280GW 的太阳能和 140GW 的风能,旨在推动全国范围内的重大绿色革命。

- 截至 2022 年,印度的可再生能源装置容量超过 162 吉瓦,而 2021 年为 147 吉瓦,这表明可再生能源的采用有所增加,从而推动了印度电力市场的发展。

- 2023年3月,印度製定了扩大可再生能源领域的明确路线图,为再生能源领域的发展绘製了清晰的蓝图。作为这个愿景的一部分,印度正致力于在2024年3月之前建立总合发电量达到40吉瓦的超大型大规模太阳能发电厂园区。这项雄心勃勃的倡议表明了印度对扩大可再生能源基础设施和促进永续未来的坚定承诺。

- 此外,政府也提供一系列财政奖励和补贴,鼓励采用可再生能源和能源效率措施。这些措施包括资本补贴、以发电为基础的奖励、税收优惠、优惠融资和可行性缺口融资。这些奖励使可再生能源计划具有财务吸引力,并鼓励私营部门参与电力市场。

- 因此,如上所述,预计政府支持政策将在预测期内推动市场发展。

印度电力业概况

印度电力市场是半固定的。该市场的主要企业(不分先后顺序)包括 NTPC Ltd、NLC India Ltd、SJVN Ltd、JSW Group、Power Grid Corporation India Ltd 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 印度2028年发电产能预测

- 各州装置容量占比(%)(2022年)

- 印度2028年发电量及消费量预测(单位:兆瓦时)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 能源需求不断成长

- 政府对电力业的支持

- 限制因素

- 财务能力

- 驱动程式

- 供应链分析

- PESTLE分析

第五章市场区隔

- 按电源

- 火力

- 水力发电

- 可再生能源

- 其他的

- 输配电

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Adani Group

- JSW Group

- NHPC Ltd

- NLC India Ltd.

- NTPC Ltd.

- Power Grid Corporation India Ltd.

- Reliance Power Limited

- SJVN Ltd.

- Tata Power Company Limited

- Torrent Power Ltd.

第七章 市场机会与未来趋势

- 可再生能源的成长

简介目录

Product Code: 52852

The India Power Market size in terms of installed base is expected to grow from 536.23 gigawatt in 2025 to 817.52 gigawatt by 2030, at a CAGR of 8.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, factors such as supportive government policies, rising electricity demand due to infrastructural activities, and rising population are expected to drive the market during the forecasted period.

- On the other hand, huge investment is required to set up and modernize power generation, transmission & distribution networks, and weak private sector investments are expected to hinder the growth of the Indian power market.

- Nevertheless, India has abundant availability of solar irradiance and receives solar energy throughout the year. This has created enormous opportunities to exploit solar energy from the sunniest sites in the country, especially Rajasthan, Gujarat, and Andhra Pradesh. The factor above, clubbed with foreign investment and extensive power projects, provides an opportunity to grow the power market in India.

India Power Market Trends

Thermal Source for Power Generation to Dominate the Market

- India has significant coal reserves, a readily available and relatively affordable fuel source for power generation. The country's large coal reserves have made it a major producer and consumer, making thermal power plants an attractive option for meeting the growing electricity demand.

- Moreover, India has a well-established infrastructure for coal-based thermal power generation. Numerous coal mines, transportation networks, and coal-fired power plants are already operating. This existing infrastructure provides a foundation for the market's dominance of thermal power generation.

- Furthermore, in September 2022, the Ministry of Energy India announced that the country is preparing to add as much as 56 GW of coal-fired generation capacity by 2030 to meet the growing electricity demand. The increase in coal-fired capacity would represent about a 25% jump above the country's current 204 GW of coal-fueled generation from 285 coal thermal power plants.

- As of November 2023, India heavily relies on thermal power sources for generating electricity, with a total installed capacity of 239.07 GW, accounting for more than 56% of the country's electricity generation capacity.

- Additionally, thermal power plants, especially those using coal, have been cost-competitive compared to alternative sources such as renewable energy. The initial capital investment for setting up thermal power plants is often lower, and the operating costs, including fuel costs, have been relatively stable compared to volatile oil and gas prices.

- Thermal power plants can provide a consistent and reliable supply of electricity, making them suitable for meeting the base load demand, which is the minimum level of power required to meet the everyday needs of consumers. The ability to provide a stable power supply has contributed to the dominance of thermal sources in the market.

- Therefore, as mentioned above, the thermal power sector will likely dominate the market during the forecasted period.

Government Policies and Support are Expected to Drive the Market

- Government policies and support are crucial drivers of the Indian power market as they provide a clear roadmap, financial incentives, regulatory frameworks, and infrastructure development necessary for the sector's growth. By promoting renewable energy, energy efficiency, grid integration, and digitalization, the government creates an enabling environment that attracts investments, fosters innovation, and facilitates the transition toward a sustainable and reliable power market in India.

- The Indian government has set ambitious renewable energy targets to increase the share of renewables in the overall energy mix. Policies such as the National Solar Mission, National Wind Energy Mission, and various state-level renewable energy policies provide incentives and support for developing renewable power projects. These initiatives aim to attract investments, streamline regulatory processes, provide financial incentives, and ensure a favorable environment for renewable energy growth.

- To catalyze a sustainable transformation in the nation, the government has established a formidable objective of achieving 500 gigawatts (GW) of installed renewable energy capacity by 2030. This target encompasses the installation of 280 GW from solar power and 140 GW from wind power sources, aiming to drive a significant green revolution across the country.

- As of 2022, the country has more than 162 GW of installed renewable energy capacity compared to 147 GW in 2021, signifying the increasing adaption of renewable energy in the country, consequently driving the power market in India.

- In March 2023, India charted a definitive path for expanding its renewable energy sector, outlining a clear roadmap for its growth. As part of this vision, the country is committed to establishing Ultra Mega Solar Parks with a combined generation capacity of 40 gigawatts by March 2024. This ambitious initiative demonstrates India's steadfast dedication to scaling up its renewable energy infrastructure and fostering a sustainable future.

- Additionally, the government offers various financial incentives and subsidies to promote renewable energy deployment and energy efficiency measures. These include capital subsidies, generation-based incentives, tax benefits, concessional financing, and viability gap funding. Such incentives make renewable projects financially attractive and encourage private sector participation in the power market.

- Therefore as per the above mentioned point, supportive government policies are expected to drive the market during the forecasted period.

India Power Industry Overview

The Indian power market is semi-consolidated. Some key players in this market (not in a particular order) include NTPC Ltd, NLC India Ltd, SJVN Ltd, JSW Group, and Power Grid Corporation India Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 India Installed Power Generating Capacity Forecast, till 2028

- 4.3 Share of Installed Power Generation Capacity (%), by State, India, 2022

- 4.4 Electricity Generation and Consumption Forecast, in Terawatt Hours, India, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Increasing Energy Demand

- 4.7.1.2 Government Support for Power Sector

- 4.7.2 Restraints

- 4.7.2.1 Financial Viability

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Generation

- 5.1.1 Thermal

- 5.1.2 Hydro

- 5.1.3 Renewable

- 5.1.4 Others

- 5.2 Transmission and Distribution

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Adani Group

- 6.3.2 JSW Group

- 6.3.3 NHPC Ltd

- 6.3.4 NLC India Ltd.

- 6.3.5 NTPC Ltd.

- 6.3.6 Power Grid Corporation India Ltd.

- 6.3.7 Reliance Power Limited

- 6.3.8 SJVN Ltd.

- 6.3.9 Tata Power Company Limited

- 6.3.10 Torrent Power Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Renewable Energy Growth

02-2729-4219

+886-2-2729-4219