|

市场调查报告书

商品编码

1686581

北美建筑化学品:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)North America Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

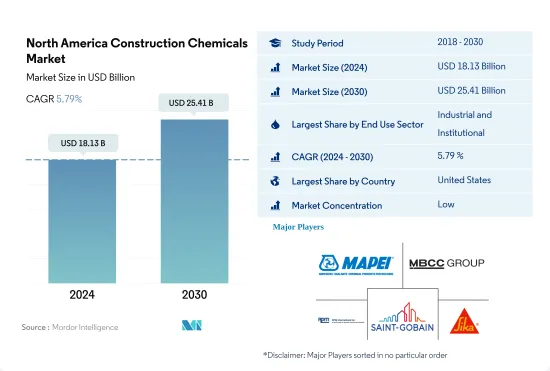

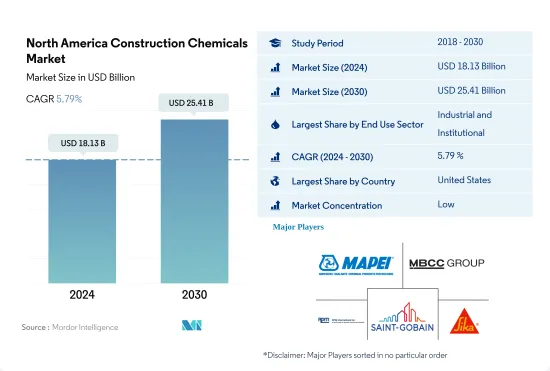

北美建筑化学品市场规模预计在 2024 年为 181.3 亿美元,预计到 2030 年将达到 254.1 亿美元,预测期内(2024-2030 年)的复合年增长率为 5.79%。

工业建设投资不断增加,预计到 2026 年美国将花费约 475.9 亿美元,这将推动市场发展。

- 2022年,北美建筑化学品市场与前一年同期比较增6.24%,这得益于商业、工业和机构建筑业需求的不断增长。到 2023 年,该地区的建筑化学品预计将占全球建筑化学品市场总量的约 20.06%。

- 工业和机构建筑业是该地区最大的建设化学品消费产业,以金额为准计算,2022 年约占 36.50%。预计工业和医疗保健领域的建设投资增加将推动工业和设施建设领域的需求。例如,预计到2026年,美国新工业建筑的建设支出将达到475.9亿美元。都市化和工业化的不断推进将进一步推动该国市场的成长。因此,该地区该行业的建设化学品预计将从 2023 年的 62.8 亿美元增长到 2030 年的 93.6 亿美元。

- 该地区的住宅建筑业预计将成为建设化学品成长最快的消费产业,由于住宅占地面积的增加,预测期内(2023-3030 年)的以金额为准最高,为 6.27%。例如,预计该地区2023年新住宅占地面积将达到39.6亿平方英尺,2030年将达到50.9亿平方英尺。因此,预计2030年该地区该产业的建筑化学品需求将比2023年增加18.5亿美元。

随着墨西哥政府实施USMCA,墨西哥预计将成为成长最快的国家。

- 混凝土外加剂、防水溶液、黏合剂和密封剂、锚栓和水泥浆、地板材料树脂等建筑化学品在提高建筑物和结构的性能方面发挥着至关重要的作用。 2022年,北美建筑化学品市场以金额为准将成长6.24%,其中墨西哥将以15.94%的成长率领先,加拿大将以7.83%的成长率领先。预计 2023 年北美建筑化学品市场将成长 6.31%。

- 2022 年,美国占据市场主导地位,占有 79% 的份额。 2022年该国建筑业吸引投资17,929亿美元,与前一年同期比较增10.2%。投资激增主要集中在住宅、土木工程和非住宅计划。随着建设活动的激增,对建筑化学品的需求也随之增加。 2022 年,美国建筑化学品市场以金额为准预计将成长 5.15%,预计 2023 年这一成长轨迹将持续,成长率为 6.54%。

- 预计墨西哥在预测期内的复合年增长率最高,为 6.04%。这一成长归功于墨西哥商业建筑业的扩张。 《美国-墨西哥-加拿大协议》(USMCA)的实施以及与中国的紧张关係加剧等因素,导致供应链活动转向有利于墨西哥的方向。因此,墨西哥的仓库和仓储设施建设正在蓬勃发展。此外,预计到 2030 年,墨西哥新商业占地面积将比 2022 年增加 5,600 万平方英尺,这将进一步推动墨西哥对建筑化学品的消费。

北美建筑化学品市场趋势

美国等主要经济体即将进行的商业建筑可能会推动商业建筑的成长。

- 在北美,2022 年新增商业占地面积较 2021 年增加了 4%,这主要是由于加拿大和墨西哥同期的成长率分别约为 7% 和 24%。由于在家工作趋势的下降以及随着企业在全部区域扩张而对商业空间的需求增加,预计 2023 年该行业的新占地面积将比 2022 年增长约 6%。

- 由于新冠疫情及其影响(包括供应链中断和经济不确定性),该行业在 2020-2021 年遭受了显着损失。因此,2020年和2021年新占地面积分别与前一年同期比较下降12.96%和8.39%。加拿大是该产业受影响最严重的国家,2020 年该国新建占地面积较去年与前一年同期比较下降 25.05%。

- 就数量而言,商业领域新的商业占地面积预计在预测期内(2023-2030 年)将实现 4% 的复合年增长率,这主要归因于美国等主要国家即将开展的商业建设活动。例如,103 街和安提阿克路的混合用途重建项目、埃利奥特和索萨曼路的资料中心、门罗街区混合用途设施以及伍德赛德广场的重建项目都是预计将于 2023 年在全国范围内启动的一些大型商业计划。据估计,该产业在墨西哥的成长最快,预计 2030 年新增占地面积将达到 1.92 亿平方英尺,而 2022 年为 1.36 亿平方英尺。

受收入成长、低利率和新居住者涌入的推动,加拿大预计将引领北美住宅产业的成长。

- 2022年,儘管住宅飙升,但北美住宅新占地面积仍成长5.03%。值得注意的是,到 2022 年初,美国房屋抵押贷款利率已从 3.2% 飙升至 7.5% 左右。预计这一飙升趋势将持续到 2023 年,新建占地面积将成长 3.45%。据估计,到 2023 年 5 月,美国将建造 163 万套住宅,较 2022 年 4 月以来建造的 180 万套大幅增长。

- 2020 年,该地区的住宅产业遭遇挫折,新建占地面积减少了 9,000 万平方英尺,这主要是由于新冠疫情的不利影响。这些干扰包括封锁、流动性限制和新建筑需求减弱。例如,2020 年加拿大新建住宅中多用户住宅数量急剧下降了 51.9%。但随着 2021 年经济从疫情的影响中復苏,该产业也开始復苏,新增占地面积增加了 2.89 亿平方英尺。其中,美国和加拿大新建住宅占地面积分别成长14.5%和19.7%。

- 就建筑面积而言,该地区新建占地面积预计在 2023 年至 2030 年期间的复合年增长率为 3.67%。由于收入增加、利率较低以及新居民的涌入,尤其是千禧世代和 Z 世代,他们正在组建家庭并寻求拥有住房,预计加拿大将引领这一成长。

北美建筑化学品产业概况

北美建筑化学品市场分散,前五大公司占39.73%的市占率。该市场的主要企业包括 MAPEI SpA、MBCC Group、RPM International Inc.、Saint-Gobain 和 Sika AG。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告发布

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用途趋势

- 商业

- 工业/设施

- 基础设施

- 住宅

- 重大基础设施计划(目前和已宣布)

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 按最终用途

- 商业

- 工业/设施

- 基础设施

- 住宅

- 按产品

- 胶水

- 按子产品

- 热熔胶

- 反应性

- 溶剂型

- 水

- 锚固水泥浆

- 按子产品

- 水泥基固定材料

- 树脂固定

- 其他的

- 混凝土外加剂

- 按子产品

- 加速器

- 引气剂

- 高效减水剂(塑化剂)

- 阻燃剂

- 减缩剂

- 黏度调节剂

- 减水剂(塑化剂)

- 其他的

- 混凝土保护漆

- 按子产品

- 丙烯酸纤维

- 醇酸

- 环氧树脂

- 聚氨酯

- 其他树脂

- 地板树脂

- 按子产品

- 丙烯酸纤维

- 环氧树脂

- 聚天冬酰胺

- 聚氨酯

- 其他树脂类型

- 修復和再生化学品

- 按子产品

- 光纤缠绕系统

- 水泥浆料

- 微混凝土砂浆

- 改质砂浆

- 钢筋保护材料

- 密封材料

- 按子产品

- 丙烯酸纤维

- 环氧树脂

- 聚氨酯

- 硅胶

- 其他树脂

- 表面处理化学品

- 按子产品

- 固化剂

- 脱模剂

- 其他的

- 防水解决方案

- 按子产品

- 化学品

- 膜

- 胶水

- 按国家

- 加拿大

- 墨西哥

- 美国

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Ardex Group

- Arkema

- CEMEX, SAB de CV

- Dow

- Five Star Products, Inc.

- HB Fuller Company

- Henkel AG & Co. KGaA

- LATICRETE International, Inc.

- MAPEI SpA

- MBCC Group

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Standard Industries Inc.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 52872

The North America Construction Chemicals Market size is estimated at 18.13 billion USD in 2024, and is expected to reach 25.41 billion USD by 2030, growing at a CAGR of 5.79% during the forecast period (2024-2030).

Rising investment in industrial construction, such as the United States spending around USD 47.59 billion by 2026, is expected to boost the market

- The construction chemicals market in North America witnessed a growth of 6.24% by value in 2022 compared to the previous year due to increasing demand from the commercial & industrial and institutional construction sectors. In 2023, the region's construction chemicals are estimated to account for around 20.06% of the overall global construction chemicals market.

- The industrial and institutional construction sector is the region's largest consumer of construction chemicals, accounting for around 36.50% by value in 2022. The increase in investment for the construction of the industrial and healthcare sectors is projected to drive the demand for the industrial and institutional sectors. For instance, construction spending in new industrial buildings in the United States is projected to reach USD 47.59 billion by 2026. Growing urbanization and industrialization further aid the market growth in the country. As a result, the construction chemicals for the sector in the region are projected to reach USD 9.36 billion in 2030 from USD 6.28 billion in 2023.

- The region's residential construction sector is expected to be the fastest-growing consumer of construction chemicals, with the highest CAGR of 6.27% in terms of value during the forecast period (2023-3030), owing to an increase in residential new construction floor area. For instance, the residential new floor area in the region was expected to reach 3.96 billion square feet in 2023 and is projected to reach 5.09 billion square feet in 2030. As a result, the construction chemicals for the sector in the region are projected to increase by USD 1.85 billion in 2030 compared to 2023.

Mexico is expected to witness the fastest growth due to the government's implementation of USMCA

- Construction chemicals, including concrete admixtures, waterproofing solutions, adhesives & sealants, anchors & grouts, and flooring resins, play a pivotal role in enhancing the performance of buildings and structures. In 2022, the construction chemicals market in North America witnessed a 6.24% growth in value, with Mexico and Canada leading with 15.94% and 7.83%, respectively. The North American construction chemicals market was projected to grow by 6.31% in 2023.

- The United States dominated the market with a commanding share of 79% in 2022. The nation's construction sector attracted investments totaling USD 1792.9 billion in 2022, marking a 10.2% increase from the previous year. This surge in investments was primarily directed toward residential, civil engineering, and non-residential projects. As construction activities surged, so did the demand for construction chemicals. In 2022, the US construction chemicals market witnessed a 5.15% growth in value, and this growth trajectory was expected to continue with a projected 6.54% increase in 2023.

- Mexico is poised to witness the highest CAGR of 6.04% in the construction chemicals market during the forecast period. This growth can be attributed to Mexico's expanding commercial construction sector. Factors such as the implementation of the United States-Mexico-Canada Agreement (USMCA) and escalating tensions with China have led to a shift in supply chain activities, favoring Mexico. Consequently, the country is witnessing a surge in warehouse and storage facility construction. Moreover, the projected increase of 56 million square feet in new floor area for commercial construction by 2030, compared to 2022, is expected to further boost the consumption of construction chemicals in Mexico.

North America Construction Chemicals Market Trends

Upcoming commercial construction in leading economies, such as the United States, may propel the growth of commercial construction

- In North America, the new floor area construction in the commercial sector was 4% higher in 2022 compared to 2021, primarily due to Canada and Mexico, which recorded growth rates of about 7% and 24%, respectively, during the same period. The new floor area construction of the sector was estimated to increase by around 6% in 2023 compared to 2022 due to the growth in demand for commercial spaces as the work-from-home trend declined and businesses expanded across the region.

- The sector witnessed noticeable losses during 2020 and 2021 because of the COVID-19 pandemic and its impact, such as disruptions in supply chains and economic uncertainty. As a result, the new floor area constructions in 2020 and 2021 declined by 12.96% and 8.39% compared to their respective previous years. The sector was most affected in Canada in 2020, such that the new floor area construction declined by 25.05% over the previous year.

- The commercial sector's new floor area construction is expected to register a CAGR of 4% in terms of volume during the forecast period (2023-2030) due to upcoming commercial construction activities, primarily in leading economies such as the United States. For instance, 103rd Street and Antioch Road mixed-use redevelopment, Elliot and Sossaman Road data center, Monroe Block mixed-use complex, and Woodside Square redevelopment were some large commercial projects that were expected to commence in the country in 2023. The sector is estimated to witness the most growth in Mexico, with the new floor area construction estimated to reach 192 million sq. ft by 2030 compared to 136 million sq. ft in 2022.

Canada is expected to lead the residential sector's growth in North America, driven by rising incomes, low interest rates, and an influx of new residents

- In 2022, the residential sector in North America saw a 5.03% growth in new floor area construction despite soaring housing prices. Notably, mortgage rates in the United States surged from 3.2% to approximately 7.5% by early 2022. This surge was expected to persist in 2023, with new floor area construction rising by 3.45%. By May 2023, the United States was estimated to hit 1.63 million new home constructions, marking a significant surge from 1.8 million units since April 2022.

- In 2020, the region's residential sector faced a setback, witnessing a 90-million sq. ft drop in new floor area construction, primarily due to the negative impact of the COVID-19 pandemic. These disruptions included lockdowns, liquidity constraints, and a dampened demand for new buildings. For instance, in 2020, new residential construction in Canada saw a steep 51.9% decline in multi-family homebuilding. However, in 2021, with the economies recovering from the impact of the pandemic, the sector also rebounded, with a notable 289 million sq. ft increase in new floor area construction. Specifically, the United States and Canada saw volume growths of 14.5% and 19.7%, respectively, in new residential construction.

- The region's new floor area construction is projected to witness a CAGR of 3.67% in terms of volume from 2023 to 2030. Canada is expected to lead this growth, driven by rising incomes, low interest rates, and an influx of new residents, particularly millennials and Gen Z, who are forming their own households and seeking homeownership.

North America Construction Chemicals Industry Overview

The North America Construction Chemicals Market is fragmented, with the top five companies occupying 39.73%. The major players in this market are MAPEI S.p.A., MBCC Group, RPM International Inc., Saint-Gobain and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Product

- 5.2.1 Adhesives

- 5.2.1.1 By Sub Product

- 5.2.1.1.1 Hot Melt

- 5.2.1.1.2 Reactive

- 5.2.1.1.3 Solvent-borne

- 5.2.1.1.4 Water-borne

- 5.2.2 Anchors and Grouts

- 5.2.2.1 By Sub Product

- 5.2.2.1.1 Cementitious Fixing

- 5.2.2.1.2 Resin Fixing

- 5.2.2.1.3 Other Types

- 5.2.3 Concrete Admixtures

- 5.2.3.1 By Sub Product

- 5.2.3.1.1 Accelerator

- 5.2.3.1.2 Air Entraining Admixture

- 5.2.3.1.3 High Range Water Reducer (Super Plasticizer)

- 5.2.3.1.4 Retarder

- 5.2.3.1.5 Shrinkage Reducing Admixture

- 5.2.3.1.6 Viscosity Modifier

- 5.2.3.1.7 Water Reducer (Plasticizer)

- 5.2.3.1.8 Other Types

- 5.2.4 Concrete Protective Coatings

- 5.2.4.1 By Sub Product

- 5.2.4.1.1 Acrylic

- 5.2.4.1.2 Alkyd

- 5.2.4.1.3 Epoxy

- 5.2.4.1.4 Polyurethane

- 5.2.4.1.5 Other Resin Types

- 5.2.5 Flooring Resins

- 5.2.5.1 By Sub Product

- 5.2.5.1.1 Acrylic

- 5.2.5.1.2 Epoxy

- 5.2.5.1.3 Polyaspartic

- 5.2.5.1.4 Polyurethane

- 5.2.5.1.5 Other Resin Types

- 5.2.6 Repair and Rehabilitation Chemicals

- 5.2.6.1 By Sub Product

- 5.2.6.1.1 Fiber Wrapping Systems

- 5.2.6.1.2 Injection Grouting Materials

- 5.2.6.1.3 Micro-concrete Mortars

- 5.2.6.1.4 Modified Mortars

- 5.2.6.1.5 Rebar Protectors

- 5.2.7 Sealants

- 5.2.7.1 By Sub Product

- 5.2.7.1.1 Acrylic

- 5.2.7.1.2 Epoxy

- 5.2.7.1.3 Polyurethane

- 5.2.7.1.4 Silicone

- 5.2.7.1.5 Other Resin Types

- 5.2.8 Surface Treatment Chemicals

- 5.2.8.1 By Sub Product

- 5.2.8.1.1 Curing Compounds

- 5.2.8.1.2 Mold Release Agents

- 5.2.8.1.3 Other Product Types

- 5.2.9 Waterproofing Solutions

- 5.2.9.1 By Sub Product

- 5.2.9.1.1 Chemicals

- 5.2.9.1.2 Membranes

- 5.2.1 Adhesives

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ardex Group

- 6.4.3 Arkema

- 6.4.4 CEMEX, S.A.B. de C.V.

- 6.4.5 Dow

- 6.4.6 Five Star Products, Inc.

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 LATICRETE International, Inc.

- 6.4.10 MAPEI S.p.A.

- 6.4.11 MBCC Group

- 6.4.12 RPM International Inc.

- 6.4.13 Saint-Gobain

- 6.4.14 Sika AG

- 6.4.15 Standard Industries Inc.

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219