|

市场调查报告书

商品编码

1686592

三聚氰胺:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Melamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

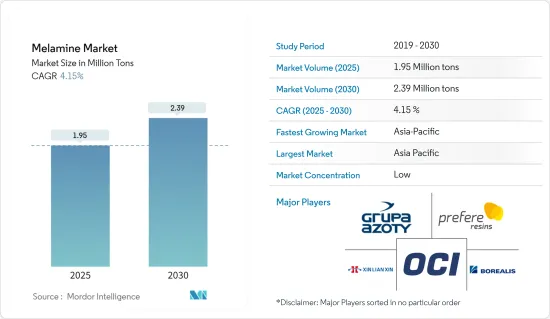

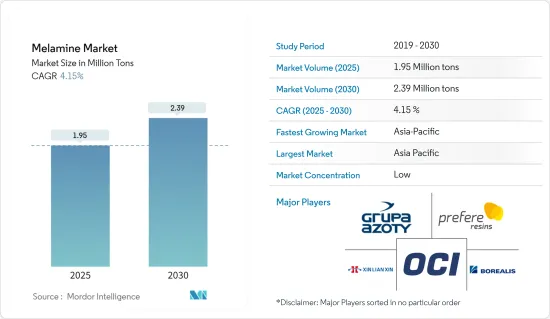

预计2025年三聚氰胺市场规模为195万吨,预计2030年将达到239万吨,预测期(2025-2030年)的复合年增长率为4.15%。

2020年,三聚氰胺市场在新冠疫情期间受到负面影响。 2021年,市场有所改善。建筑和汽车製造活动从封锁中恢復,对层压板、油漆、被覆剂和木材黏合剂等建筑材料的需求增加了。建设产业正在迅速復苏,预计未来几年将进一步成长,这可能会增加对三聚氰胺的需求。

主要亮点

- 短期内,建设产业对层压板、涂料和木材黏合剂的需求不断增长,预计将推动市场成长。

- 液化木材、大豆和粉末涂料等替代品的出现,以及消费者对三聚氰胺基成型化合物甲醛排放的日益担忧,预计会阻碍市场的成长。

- 然而,三聚氰胺基发泡体的成长趋势很可能在未来成为一个机会。

- 亚太地区占全球市场主导地位,其中中国和印度的消费量最大。

三聚氰胺黏合剂的市场趋势

层压板占据市场主导地位

- 三聚氰胺树脂是用于製造层压板、檯面和桌面、厨柜、地板、家具等的外层和装饰层的首选聚合物。

- 三聚氰胺树脂具有硬度、透明度、抗污性、不变色性和整体耐用性。在本应用中,用于浸润覆盖层和装饰板的树脂是透过每摩尔三聚氰胺与约两摩尔甲醛发生反应而製备的。

- 这些板材通常应用于墙壁、柱子、桌面、家具、悬吊天花板等表面装饰计划。

- 据加拿大建筑协会称,建筑业是加拿大最大的就业行业之一,为该国的经济成功做出了重大贡献。它是加拿大经济的支柱。据加拿大建筑协会称,建筑业僱用了超过 140 万人,每年为加拿大经济贡献约 1,410 亿美元。它也占国内生产总值(GDP)的7.5%。

- 根据美国人口普查资料,2022 年 2 月的总建筑支出约为 17,044 亿美元,而 2022 年 1 月为 1,6955 亿美元。

- 根据美国人口普查局的数据,2022 年 7 月美国住宅建筑业成长 14%,达到 9,297 亿美元,而 2021 年 7 月为 8,155 亿美元。破旧的住宅通常需要增加新功能并修理或更换旧零件,这表明改造市场正在成长。全国各地住宅的上涨也鼓励住宅在住宅维修上花费更多。

亚太地区占市场主导地位

- 亚太地区占据整体市场份额的主导地位。中国、印度和日本的建设活动不断增加,推动了对层压板、木材胶粘剂以及油漆和被覆剂的需求,从而导致该地区三聚氰胺的使用量增加。

- 中国占全球涂料市场的四分之一以上。根据中国涂料工业协会统计,近年来,该产业成长率达7%。

- 中国政府已启动一项大规模建设计画,其中包括在未来十年内将 2.5 亿人迁移到新的特大城市。这些计划可能会增加对油漆的需求,而油漆的配方中会用到三聚氰胺。

- 预计2023年至2026年中国整体建设产业将实际成长4.6%。根据中国国家统计局发布的报告,2022年上半年交通运输投资成长了6.7%。

- 印度政府与日本政府合作启动了德里-孟买工业走廊计画。该计画旨在向德里-孟买工业走廊地区投资 2,000 亿美元,开发一座新的工业城市。班加罗尔-清奈走廊等地区也可能推出类似的计画。

- 根据中国民航局介绍,目前,政府已復工80%以上的机场计划,全国共有65个机场计划復工。其中国家重大机场计划27个。预计这些计划将增加三聚氰胺的需求。

三聚氰胺黏合剂产业概况

三聚氰胺市场较为分散,五大主要企业占总产能的约40%。这些公司包括(不分先后顺序):OCI NV、Borealis AG、河南心连心化工集团、Prefere Resins Holding GmbH 和 Grupa Azoty。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建设产业需求强劲

- 其他驱动因素

- 限制因素

- 消费者越来越担心三聚氰胺基模塑胶的甲醛释放量

- 液化木材、大豆和粉末涂料等替代品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析和趋势

- 生产流程

- 进出口趋势

- 价格趋势

- 专利分析

- 监理政策分析

第五章 市场区隔

- 应用

- 层压板

- 木材胶黏剂

- 模塑胶

- 油漆和涂料

- 其他用途(阻燃剂、纤维树脂)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- BASF SE

- Borealis AG

- Cornerstone Chemical Company

- Grupa Azoty

- Gujarat State Fertilizers & Chemicals Limited(GSFC)

- Prefere Resins Holding GmbH

- Methanol Holdings(Trinidad)Limited(MHTL)

- Mitsui Chemicals Inc.

- Hexion

- Nissan Chemical Corporation

- OCI NV

- Qatar Melamine Company

- Sichuan Chemical Works Group Ltd

- Henan Xinlianxin Chemicals Group Co. Ltd

- Eurochem Group

第七章 市场机会与未来趋势

- 三聚氰胺泡沫的成长趋势

The Melamine Market size is estimated at 1.95 million tons in 2025, and is expected to reach 2.39 million tons by 2030, at a CAGR of 4.15% during the forecast period (2025-2030).

The melamine market was negatively impacted during the COVID-19 pandemic in 2020. The market improved in 2021. With construction and automotive manufacturing activities recovering from the lockdown, the demand for construction materials such as laminates, paints, and coatings, and wood adhesives increased. The construction industry is recovering rapidly and is estimated to grow further in the coming years, which may boost the demand for melamine.

Key Highlights

- Over the short term, the rising demand for laminates, coatings, and wood adhesives from the construction industry is expected to drive the market's growth.

- The availability of substitutes like liquefied wood, soy, and powder coatings and increasing consumer concerns about formaldehyde emissions from melamine-based molding compounds are expected to hinder the market's growth.

- However, the increasing trend of melamine-based foams is likely to act as an opportunity in the future.

- Asia-Pacific dominates the market across the world, with the largest consumption from China and India.

Melamine-based Adhesives Market Trends

Laminates Segment to Dominate the Market

- Melamine resins are the polymers of choice used in the outer or decorative layer of laminates and in manufacturing counters and tabletops, kitchen cabinets, flooring, furniture, etc.

- Melamine resins impart a hardness, transparency, stain resistance, freedom from discoloration, and overall durability. For this application, the resin used to saturate the overlay or decorative sheet is prepared by reacting approximately two moles of formaldehyde per mole of melamine.

- These sheets are commonly applied to the surface decoration projects, such as walls, columns, tabletops, furniture, and suspended ceilings.

- According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a major contributor to the country's economic success. It is the backbone of the country's economy. As per the Canadian Construction Association, the construction sector employs more than 1.4 million people and generates about USD 141 billion for the Canadian economy annually. Also, the industry accounts for 7.5% of the country's Gross Domestic Product (GDP).

- According to the US Census data, the total construction spending in February 2022 was around USD 1,704.4 billion compared to USD 1,695.5 billion in January 2022.

- As per the United States Census Bureau, the residential construction industry in the United States was valued at USD 929.7 billion in July 2022, as compared to USD 815.5 billion in July 2021, registering a growth of 14%. The aging houses signal a growing remodeling market, as old structures normally need to add new amenities or repair/replace old components. Rising home prices in the country have also encouraged homeowners to spend more on home improvements.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominates the overall market share. With growing construction activities and the increasing demand for laminates, wood adhesives, and paints and coatings in China, India, and Japan, the usage of melamine is increasing in the region.

- China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry registered a 7% growth in recent years.

- The Chinese government rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next 10 years. Such plans will increase the demand for paints where melamine is used to prepare paints.

- The overall Chinese construction industry is expected to increase by 4.6% in real terms in 2023-2026. According to the report published by the National Bureau of Statistics of China, transportation investment increased by 6.7% in the first half of 2022.

- The Indian government launched the Delhi-Mumbai Industrial Corridor program in collaboration with the Japanese government, which aims at developing new industrial cities with an investment of 200 billion USD in the Delhi-Mumbai Industrial Corridor region. Similar programs may be launched in regions such as the Bangalore Chennai Corridor etc.

- According to the Civil Aviation Administration of China, the government has resumed construction work on more than 80% of total airport projects, representing 65 airport projects across the country. Out of these, 27 airports are national major airport projects. Such projects are expected to increase the demand for melamine.

Melamine-based Adhesives Industry Overview

The melamine market is fragmented, and the top five players account for around 40% of the total production capacity. These companies include (not in any particular order) OCI NV, Borealis AG, Henan Xinlianxin Chemicals Group Co. Ltd, Prefere Resins Holding GmbH, and Grupa Azoty.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand from the Construction Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Consumer Concerns About Formaldehyde Emission from Melamine-based Molding Compounds

- 4.2.2 Availability of Substitutes, like Liquefied Wood, Soy, and Powder Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis and Trends

- 4.6 Production Process

- 4.7 Import-export Trends

- 4.8 Price Trends

- 4.9 Patent Analysis

- 4.10 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Laminates

- 5.1.2 Wood Adhesives

- 5.1.3 Molding Compounds

- 5.1.4 Paints and Coatings

- 5.1.5 Other Applications (Flame Retardants and Textile Resins)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Russia

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Borealis AG

- 6.4.3 Cornerstone Chemical Company

- 6.4.4 Grupa Azoty

- 6.4.5 Gujarat State Fertilizers & Chemicals Limited (GSFC)

- 6.4.6 Prefere Resins Holding GmbH

- 6.4.7 Methanol Holdings (Trinidad) Limited (MHTL)

- 6.4.8 Mitsui Chemicals Inc.

- 6.4.9 Hexion

- 6.4.10 Nissan Chemical Corporation

- 6.4.11 OCI NV

- 6.4.12 Qatar Melamine Company

- 6.4.13 Sichuan Chemical Works Group Ltd

- 6.4.14 Henan Xinlianxin Chemicals Group Co. Ltd

- 6.4.15 Eurochem Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Trend of Melamine-based Foams