|

市场调查报告书

商品编码

1686608

託管网路服务-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Managed Network Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

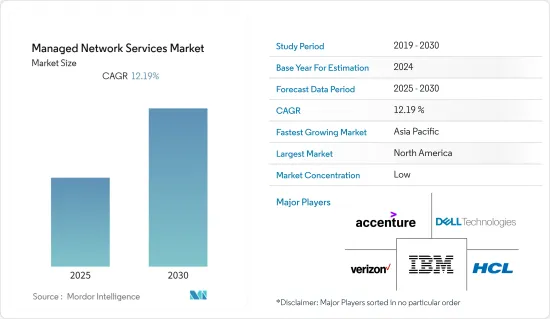

预计託管网路服务市场在预测期内的复合年增长率将达到 12.19%。

主要亮点

- 託管网路服务为中小型企业提供了更大的发展空间并实现其目标。中小企业的 IT 支出预计将增加,这表明中小企业正不断专注于透过采用新的和扩展的 IT 服务来扩展业务。随着中小企业越来越多地采用云端处理、自动化服务和尝试先进的数位技术,对託管网路服务的需求也日益增长。

- 日益增长的数位转型正在推动对託管网路服务的需求,因为它们在管理支撑现代企业的复杂和关键网路方面提供了专业知识、扩充性、安全性和营运效率。根据 NTT 集团的全球网路调查,约 93% 的组织认识到网路作为数位转型支柱的重要性。

- 在当今高度分散的劳动力中,随着越来越多的员工从不同地点和设备进行连接,客户的网路和安全要求也在不断发展。为了适应新的、高度分散的劳动力,组织正在寻求解决这些挑战的解决方案和服务,为託管网路服务提供者创造机会。

- 网路犯罪的惊人成长使组织担心外包网路管理带来的潜在风险,包括将机密资讯洩露给第三方。涉及託管服务提供者的备受瞩目的资料外洩和安全事件可能会加剧这些担忧,并使一些企业不愿接受託管网路服务市场。

- COVID-19 危机为全球 MSP 带来了前所未有的困境。随着企业适应快速变化的职场环境,协作和沟通的品质对生产力和员工生产力产生了重大影响。这导致对企业管理网路服务的需求增加,以确保员工能够在任何装置(无论是个人设备还是公司设备)上无缝存取职场应用程式。

託管网路服务市场趋势

IT和通讯产业是最大的最终用户

- 在 IT 和通讯领域实现 IT 服务管理现代化是一种相当成熟的方法。它弥合了内部部署和云端基础的IT 解决方案之间的差距。这将提高业务的有效性和效率。透过统一整个企业的资料记录、处理和共用方式,可以为内部 IT负责人和外部相关人员带来更好的体验。

- 随着科技的快速发展,电信业者不断注重创新。因此,我们加强了基础设施建设,同时提供先进的解决方案,为客户的创新、客户服务、基础设施配置和人才提供支援。

- 当前的市场趋势是5G网路的采用日益广泛。行动网路营运商正在应对 5G 部署日益复杂的问题以及对可靠、安全和稳健连接的要求。这种复杂性是由不断增长的设备数量、各种新技术以及广泛的服务需求所驱动的。随着 5G 用案例变得越来越复杂、要求越来越高、关键性越来越强,安全的使用者体验已成为最终用户的主要期望。

- 随着5G网路的规划、开发、建置和实施,重点将转向支援安全性和最终用户的整体品质体验。这反过来又要求对部署网路的管理和最佳化方式进行根本性的转变。

- 为了安全地运作高效能服务主导的网络,并摆脱以技术相关的容量、可用性和效能为关键的传统网路资源管理模式,5G 网路营运和最佳化需要从以技术为中心转变为以最终用户服务为中心的方法。因此,对电信管理服务的需求不断增加,以协助实现这一转变,从而推动市场收益的成长。根据爱立信2023年6月的行动报告,预计5G用户数在可预见的未来仍将持续成长,今年底全球用户数将达到15亿人。

- 全球各地的不同公司正在采取不同的措施来采用託管服务。大型企业部门正在成为市场中不断成长的一部分。公司正在努力提供更好的管理服务。

亚太地区主导託管网路服务市场

- 亚太地区 (APAC) 的託管网路服务市场由于几个关键因素而不断增长。快速的数位转型、不断增长的行动和互联网普及率、电子商务的成长以及对可靠、高速连接的需求推动了对託管网路服务的需求。一些公司正尝试将新的数位技术融入数位革命运动中。随着企业不断投资数位转型,他们正在向託管网路服务供应商寻求协助。

- 亚太地区的企业正在意识到网路管理的好处,以确保高效的营运和强大的网路安全,从而推动市场成长。

- 许多市场参与者正在采取多种策略来获得竞争优势,进一步推动託管网路服务的需求。 2023年6月,在2023世界行动大会-上海(MWCSH 2023)上,华为启动了产品与解决方案创新与实务共用活动。在此次活动中,该公司共用了资料通讯通讯业者从互联网服务提供商转型为管理服务提供商,抓住数位转型的新机会,从而推动市场成长。

- 从最终用户来看,製造业预计会出现成长。近年来,该地区的製造业经历了令人难以置信的数位革命。中国政府积极支持传统製造流程中的数位化技术,以提高生产效率并促进创新。

- 随着数位转型的推进,对可靠的高速连接、安全的数位化营运以及遵守监管标准的需求预计将推动该地区市场的成长,同时也将推动市场参与者的成长。

託管网路服务产业概况

託管网路服务市场由规模较小的参与者分散,并由拥有强大基本客群的大型参与者主导,包括 IBM Corporation、HCL Technologies Limited、戴尔、Verizon 和埃森哲公司。这些公司不断透过新的扩张、合作和收购来扩大其服务范围,使其市场渗透力在市场上具有强大的竞争优势。

- 2023 年 8 月,Verizon Business 建立策略性全球伙伴关係关係,使 HCL Tech 成为其为全球企业客户进行所有网路部署的主要託管网路服务 (MNS) 合作伙伴。 HCL Tech 和 Verizon 将把 Verizon 的网路实力、解决方案交付和规模与 HCL Tech 市场领先的託管服务相结合,为企业客户开创大规模有线电视服务交付的新时代。

- 2022年10月:Accenture与Google云端宣布延长全球伙伴关係关係,扩大双方联合能力,以加强人才队伍建设、创造创新资料和人工智慧解决方案,并重申致力于提供强有力的支持,帮助在云端建立强大的数位基础并实现业务转型。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19对市场宏观经济趋势的影响

第五章市场动态

- 市场驱动因素

- 缺乏内部专业知识

- 专注于核心业务的好处

- 利用託管服务实现成本效益和投资报酬率

- 市场挑战

- 组织不愿外包关键业务

- 生态系分析

- 定价模式分析

- 託管网路服务定价模式

- 定价案例研究

- 网路设备提供者提供的硬体定价详细信息

- 网路即即服务(NaaS)定价及定价模式分析

- 关键使用案例

- 网路设备趋势

- 各类网路设备(路由器、交换器、伺服器、网路安全设备等)的整体市场预测

- 市场趋势和发展

- 主要网路设备供应商列表

第六章市场区隔

- 按类型

- 託管区域网路

- 託管广域网

- 託管 Wi-Fi

- 託管网路安全

- 其他服务

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户

- BFSI

- 资讯科技/通讯

- 医疗保健和製药

- 零售

- 製造业

- 教育

- 其他(公共产业、媒体等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第七章竞争格局

- 市场占有率分析

- 公司简介

- IBM

- HCL Technologies Limited

- Dell

- Verizon

- Accenture PLC

- TCS

- Wipro

- Lumen Technologies

- Cato Networks

- NTT Group

The Managed Network Services Market is expected to register a CAGR of 12.19% during the forecast period.

Key Highlights

- Managed network services give SMEs much space to grow and achieve their goals. IT spending among SMEs is anticipated to rise, demonstrating that SMEs constantly focus on expanding through implementing new and extended IT services. The demand for managed network services is increasing as SMEs increasingly adopt cloud computing, automate services, and experiment with advanced digital technologies.

- The growing digital transformation propels the demand for managed network services as they provide expertise, scalability, security, and operational efficiency in managing complex and critical networks that underpin modern businesses. According to a Global Network survey by NTT Group, about 93% of organizations recognize the significance of the network as the backbone of digital transformation.

- With a modern hyper-distributed workforce, customers' networking and security requirements are evolving as more employees use the network from various places and devices. Organizations are searching for solutions and services to handle these difficulties to serve the new and highly scattered workforce, providing opportunities for the managed network service providers.

- The alarming growth in cybercrimes has worried organizations about the potential risks associated with outsourcing network management, including exposing confidential information to third parties. High-profile data breaches or security incidents involving managed service providers can exacerbate these concerns and lead some businesses to hesitate in adopting the managed network service market.

- The COVID-19 crisis created an unprecedented situation for MSPs on a global level. As businesses adjusted to rapidly changing work environments, the quality of collaboration and communication profoundly impacted both productivity and employee output. This resulted in increased demand for managed network services from businesses so that employees had seamless access to their workplace apps on the device they used, whether personal or company-owned.

Network Managed Services Market Trends

IT and Telecom Sector to be the Largest End User

- Modernizing IT service management for the IT and telecommunications sectors is quite a mature methodology. This bridges the gap between on-premise and cloud-based IT solutions. It improves operational effectiveness and efficiency. As a result, integrating how data is recorded, processed, and shared across companies enhances the experience for internal IT personnel and external constituents.

- With the rapid growth of technology, telecommunication companies are constantly concentrating on innovation. As a result, they are enhancing their infrastructure while providing advanced solutions to support their clients, such as innovation, customer service, infrastructure configuration, and human resources.

- The increased adoption of 5G networks is the current market trend. Mobile network operators handle the increasing complexity caused by implementing 5G and the requirement for dependable, secure, and robust connections. The increased number of devices, a diversity of new technologies, and a broader spectrum of service requirements drive this complexity. As the 5G usage cases become more sophisticated, demanding, and vital, secure user experience has become the primary end-user expectation.

- When 5G networks are planned, developed, built, and implemented, the emphasis shifts to supporting end users' whole security and quality experience. This further necessitates a fundamental shift in how deployed networks are managed and optimized.

- To successfully operate high-performance service-driven networks securely and depart from the traditional network resource management model, where technology-related capacity, availability, and performance are critical, the 5G network operations and optimization require a shift from technology-centric to end-user service-centric. As a result, there is an increase in the demand for telecom-managed services to help with this transition, thereby driving the market revenue growth. According to Ericsson Mobility Report, June 2023, the growth in 5G subscriptions is expected to continue into the foreseeable future, reaching 1.5 billion subscriptions globally by the end of the year, which includes an increase of 500 million subscriptions in the past one year.

- Various players across the world are undertaking various initiatives as a move toward the adoption of managed services. Large enterprises segment has emerged to be a growing segment in the market. Companies are making significant efforts to offer enhanced managed services.

Asia Pacific Holds a Dominant Position in Managed Network Services Market

- The managed network services market in the Asia-Pacific (APAC) region is expanding due to several key factors. The demand for managed network services is driven by rapid digital transformation, rising penetration of mobile devices and the Internet, growing e-commerce, and a need for reliable high-speed connectivity. Some companies seek to integrate new digital technologies into the digital revolution movement. As firms continue to invest in digital transformation, every company has enlisted the help of a managed network services provider.

- APAC businesses recognize the benefits of network management to ensure efficient operations and robust cybersecurity, fueling the growth of the market.

- Several market players are involved in numerous strategies to gain a competitive edge, further fueling the demand for Managed Network Services. In June 2023, at Mobile World Congress Shanghai 2023 (MWCSH 2023), Huawei launched a product and solution innovation and practice sharing event. During this event, the company shared the latest innovations and practices with its digitally managed network solution in the data communication field, aiming to help carriers transform from Internet service providers to managed service providers and capture new opportunities in digital transformation, thereby driving the growth of the market.

- By end user, the manufacturing segment is expected to grow. The manufacturing sector in the region has recorded a tremendous digital revolution in recent years. The Chinese government has actively supported digital technologies in traditional manufacturing processes to increase production efficiency and encourage innovation.

- With growing digital transformation, the need for reliable and high-speed connectivity, safeguarding digital operations, and complying with regulatory standards, along with the developments by the market players, are expected to drive the growth of the market in the region.

Network Managed Services Industry Overview

The managed network services market is fragmented with small players and dominated by major players, such as IBM Corporation, HCL Technologies Limited, Dell, Verizon, Accenture PLC, and others, with a strong client base. These players are constantly providing increased and enhanced offerings, along with newer expansions, partnerships, and acquisitions; the level of market penetration is favorable to the market, and it is providing major competitiveness.

- August 2023: Verizon Business formed a strategic global partnership, making HCLTech its primary Managed Network Services (MNS) collaborator in all networking deployments for global enterprise customers. HCLTech and Verizon bring together Verizon's networking strength, solution offering, and scale, and HCLTech's market-leading Managed Service offerings to create a new era for large-scale, wireline service provision for enterprise customers.

- October 2022: Accenture and Google Cloud announced an extended global partnership, reaffirming its commitment to growing its talent-enhancing joint capabilities, creating innovative data and AI solutions, and providing robust support to assist clients in establishing a solid digital foundation and transforming their businesses in the cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Macroeconomic Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Lack of in-house Expertise

- 5.1.2 Benefit of Extensive Focus on Core Operations

- 5.1.3 Cost Benefits and ROI Achieved through Managed Services

- 5.2 Market Challenges

- 5.2.1 Organizations Remain Reluctant to Outsource Key Operations

- 5.3 Ecosystem Analysis

- 5.4 Analysis of Pricing Model

- 5.4.1 Managed Network Services Pricing Model

- 5.4.2 Case Studies for Pricing Determination

- 5.4.3 Pricing Details of Hardware by Network Equipment Providers

- 5.4.4 Analysis of Pricing and Pricing Model of Network as a Service (NaaS)

- 5.5 Key Use Cases

- 5.6 Networking Equipment Trends

- 5.6.1 Overall Market Estimates for Different Network Equipment (Routers, Switches, Servers, Network Security Equipment, Etc.)

- 5.6.2 Market Trends and Developments

- 5.6.3 List of Major Vendors Providing Network Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Managed LAN

- 6.1.2 Managed WAN

- 6.1.3 Managed Wi-Fi

- 6.1.4 Managed Network Security

- 6.1.5 Other Services

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare and Pharmaceutical

- 6.3.4 Retail

- 6.3.5 Manufacturing

- 6.3.6 Education

- 6.3.7 Others (Utilities, Media, Etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Middle East and Africa

- 6.4.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Profiles

- 7.2.1 IBM

- 7.2.2 HCL Technologies Limited

- 7.2.3 Dell

- 7.2.4 Verizon

- 7.2.5 Accenture PLC

- 7.2.6 TCS

- 7.2.7 Wipro

- 7.2.8 Lumen Technologies

- 7.2.9 Cato Networks

- 7.2.10 NTT Group