|

市场调查报告书

商品编码

1686624

异丙醇 (IPA):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Isopropyl Alcohol (IPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

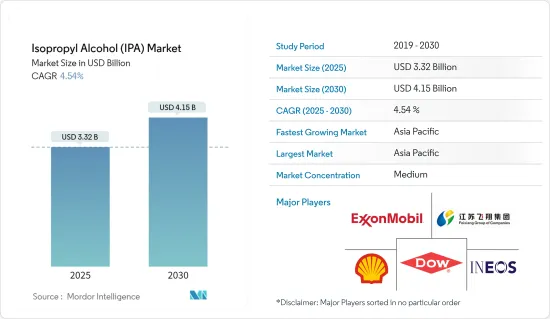

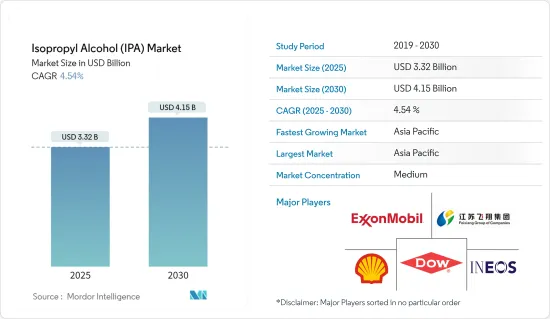

异丙醇 (IPA) 市场规模预计在 2025 年为 33.2 亿美元,预计到 2030 年将达到 41.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.54%。

COVID-19 疫情对全球异丙醇市场产生了显着影响。最初,需求下降是由于包装和农业行业的中断,这两个行业是异丙醇的主要消费者。不过,即使在 COVID-19 疫情期间,由于医疗产业的需求,市场仍录得小幅成长率。

主要亮点

- 从中期来看,製药业对异丙醇的需求不断增加以及个人护理和化妆品行业对异丙醇的使用不断增长预计将推动市场成长。

- 另一方面,异丙醇替代品的可用性仍然是市场关注的一大问题。

- 生物基异丙醇的技术创新可能在未来几年为市场创造机会。

- 预计亚太地区将主导市场。

异丙醇(IPA)市场趋势

医疗保健产业占据市场主导地位

- 异丙醇(IPA)已被证明在多个方面对医疗保健产业有用。由于其优异的物理化学性质和稳定性,它们在生产原料药和製剂方面具有重要应用,而这在製药製造中至关重要。它也是干洗手剂、防腐剂和消毒剂中的活性成分。

- 在医疗保健领域,IPA 被广泛用于对医疗设备和表面进行消毒、为注射准备皮肤,以及作为干洗手剂和消毒湿纸巾的成分。

- IPA 受到食品药物管理局(FDA) 的监管,作为非处方 (OTC) 消毒剂中的活性成分。其中包括干洗手剂和皮肤消毒剂。

- 近年来,医药市场快速成长。预计2023年全球医药市场规模将达1.6兆美元,较2022年的1.48兆美元略有成长。此外,Astra Zeneca预计2023年在美国的医药销售额将达6,780亿美元,而2022年为6,080亿美元。

- 世界上一些主要的製药公司包括 Sun Pharma、Divis Labs、Dr Reddy's Labs、Cipla、Cadila Health、Torrent Pharma、Alkem Labs 和 Abbott India。

- 根据Astra Zeneca预测,2024年医药销售额将达6,330亿美元,其中北美占最大份额,其次是欧盟(不包括英国),为2,870亿美元,东南亚和东亚为2,320亿美元。

- 由于对各种计划的持续投资,印度製药业预计到 2024年终将达到 650 亿美元,到 2030 年将达到 1,300 亿美元。

- 据印度食品药物管理局称,2022-2023财年,古吉拉突邦已核准超过139个製药生产计划,总投资额超过700亿印度卢比(8.4014亿美元)。大多数新製造工厂都是超现代化的并以出口为导向。

- 美国是世界上最大的製药产业之一。据Astra Zeneca称,美国占全球整体药品销售额的45%以上,占全球整体产量的22%。预计2024年美国医药销售额将达6,330亿美元。

- 欧洲是製药业的发源地。欧洲製药工业协会联合会 (EFPIA) 代表了欧洲相当一部分製药商。目前,该协会会员包括36家国内製药组织和39家主要企业。

- 上述因素可能会在预测期内对市场产生影响。

亚太地区占市场主导地位

- 亚太地区占据整个市场的主导地位。预计化学工业投资以及该地区对化妆品和药品的需求不断增加等因素将推动异丙醇市场的成长。

- 根据欧洲涂料协会的报告,作为世界工业中心的中国拥有多达 10,000 家涂料製造商。尤其是日本涂料、阿克苏诺贝尔、PPG工业等大公司都在中国设有製造地。

- 根据中国涂料工业协会统计,2023年中国涂料产量将达357.72亿吨,与前一年同期比较增4.5%。出口量飙升 19.6% 至 262,000 吨,而国内消费量增长 4.2% 至 35,663 万吨,证实了该行业的强劲增长。

- 随着中国消费者越来越重视外在美并将化妆品融入日常生活,中国化妆品市场正在强劲成长。这种快速增长的动力源于生活方式的改变和对美容日益增长的兴趣。其中,国家统计局预计,2023年中国化妆品零售额将达4,142亿元人民币,与前一年同期比较增5.1%。这种成长并没有被忽视,化妆品市场现在正吸引许多投资者的注意。

- 印度异丙醇市场的主要企业包括 Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL)、陶氏化学和埃克森美孚。国内需求不断增长刺激国内製造商提高生产能力。例如,GAIL(印度)有限公司于 2023 年 8 月宣布计划在马哈拉斯特拉邦建立其第一家特种化学品工厂,生产能力为 50,000 吨异丙醇 (IPA)。此举可能会使 GAIL 现有的石化/产品系列增加至每年 300 万吨。

- 日本是全球化妆品和个人护理的中心,拥有约 3,000 家美容相关企业,其中包括资生堂、花王、高丝和POLA Orbis 等行业巨头。

- 上述因素可能会在预测期内影响该地区所研究市场的需求。

异丙醇 (IPA) 产业概览

异丙醇(IPA)市场因其性质而部分整合。市场的主要企业包括(不分先后顺序)壳牌公司、英力士、埃克森美孚公司、陶氏化学和开灵化工(张家港)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 製药业对异丙醇的需求不断增加

- 异丙醇在个人护理和化妆品行业的应用不断扩大

- 限制因素

- 异丙醇替代品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 应用

- 製程和预处理溶剂

- 清洗和干燥剂

- 涂料/染料溶剂

- 中间体

- 其他用途

- 最终用户产业

- 化妆品和个人护理

- 卫生保健

- 电子产品

- 油漆和涂料

- 化学

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Cnpc Jinzhou Petrochemical Company

- Deepak Fertilisers and Petrochemicals Corporation Ltd(dfpcl)

- Dow

- ENEOS Corporation

- Ineos

- Kailing Chemical(Zhangjiagang)Co. Ltd

- LCY GROUP

- LG Chem

- Mitsui Chemicals Inc.

- Shell PLC

- Yancheng Super Chemical Technology Co. Ltd.

- Zhejiang Xinhua Chemical Co. Ltd.

第七章 市场机会与未来趋势

- 生物基异丙醇的创新

The Isopropyl Alcohol Market size is estimated at USD 3.32 billion in 2025, and is expected to reach USD 4.15 billion by 2030, at a CAGR of 4.54% during the forecast period (2025-2030).

The COVID-19 pandemic had a notable impact on the global isopropyl alcohol market. Initially, demand declined due to disruptions in the packaging and agriculture sectors, one of the key consumers of isopropyl alcohol. However, the market registered a slight growth rate due to demand from the medical industry even during the COVID-19 pandemic.

Key Highlights

- Over the medium term, rising demand for isopropyl alcohol from the pharmaceutical industry and growing utilization of isopropyl alcohol in the personal care and cosmetics industry are likely to drive the market's growth,

- On the flip side, the availability of substitute products for isopropyl alcohol remains one of the major concerns for the market.

- Innovation in bio-based isopropyl alcohol is likely to create opportunities for the market in the coming years.

- Asia-Pacific region is expected to dominate the market.

Isopropyl Alcohol (IPA) Market Trends

Healthcare Industry to Dominate the Market

- Isopropyl alcohol (IPA) has proven helpful for the healthcare industry in several ways. Due to its excellent physical and chemical properties and stability, it finds significant applications in producing bulk drugs and drug formulations, which are vital in pharmaceutical manufacturing. It is an active ingredient in hand sanitizers, antiseptics, and disinfectants.

- In the healthcare sector, IPA is extensively used to sanitize medical equipment and surfaces, prepare skin for injections, and as a component in hand sanitizers and disinfectant wipes.

- IPA is regulated by the Food and Drug Administration (FDA) as an active ingredient in over-the-counter (OTC) antiseptic products. These include hand sanitizers and skin disinfectants.

- In recent years, the pharmaceutical market has grown expeditiously. The global pharmaceuticals market was valued at USD 1.60 trillion in 2023, a marginal rise from the value of USD 1.48 trillion recorded in 2022. Further, as per AstraZeneca, the total pharmaceutical sales in the United States reached USD 678 billion in 2023, as compared to USD 608 billion in 2022.

- Some of the leading pharmaceutical companies in the world are Sun Pharma, Divis Labs, Dr. Reddy's Labs, Cipla, Cadila Health, Torrent Pharma, Alkem Lab, and Abbott India.

- According to AstraZeneca, the projected pharmaceutical sales in 2024 are expected to reach a value of USD 633 billion, with North America holding the major share, followed by the European Union (excluding the United Kingdom) accounting for USD 287 billion and Southeast and East Asia accounting for USD 232 billion.

- The pharmaceutical industry in India is expected to reach a value of USD 65 billion by the end of 2024 and USD 130 billion by 2030 due to continued investments in various projects.

- According to the Food and Drug Control Administration, in Gujarat, in FY 2022-2023, more than 139 drug manufacturing projects were approved, garnering a total investment of more than INR 70,000 million (USD 840.14 million). Most new manufacturing units are equipped with ultra-modern technology and are export-oriented.

- The United States has one of the world's largest pharmaceutical industries. According to AstraZeneca, the United States dominates pharmaceutical sales with a share of over 45% of global pharmaceutical sales and 22% of global production. The projected pharmaceutical sales for the United States in 2024 are expected to be USD 633 billion.

- Europe is the homeland of the pharmaceutical industry. The European Federation of Pharmaceutical Industries and Association (EFPIA) represents a sizable proportion of Europe's drug manufacturers. It currently includes 36 national pharmaceutical associations and 39 of Europe's leading pharmaceutical companies.

- The abovementioned factors will likely impact the market in the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominates the overall market. Factors such as investment in the chemical industry and increasing demand for cosmetic and pharmaceutical products in the region are expected to drive the growth of the isopropyl alcohol market.

- China, a global hub for industrialization, boasts a staggering 10,000 coatings manufacturers, as reported by European Coatings. Notably, major players like Nippon Paint, AkzoNobel, and PPG Industries have established manufacturing bases in the country.

- Figures from the China Coatings Industry Association reveal that in 2023, China's coatings production hit 35,772 million tons, marking a 4.5% increase from the previous year. Exports surged by 19.6% to 262,000 tons, while domestic consumption rose by 4.2% to 35,663 million tons, underlining the sector's robust growth.

- As Chinese consumers increasingly prioritize external beauty and embrace cosmetics in their daily routines, the nation's cosmetic market is witnessing a robust upswing. This surge is further fueled by shifting lifestyles and a heightened focus on beauty. Notably, in 2023, China's cosmetic retail sales, as reported by the National Bureau of Statistics, reached CNY 414.2 billion (~USD 58.42 billion), marking a 5.1% Y-o-Y increase. This growth has not gone unnoticed, with the cosmetics market now catching the eye of numerous investors.

- Key players driving the isopropyl alcohol market in India include Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL), Dow Chemical, ExxonMobil, and others. Rising local demand has spurred domestic manufacturers to ramp up their production capacities. For instance, in August 2023, GAIL (India) Limited announced plans to set up its inaugural specialty chemical plant in Usar, Maharashtra, with a capacity of 50,000 tonnes of isopropyl alcohol (IPA). This move is likely to bolster GAIL's existing petrochemicals/chemicals portfolio to 3 million tpa.

- Japan stands as a global hub for cosmetics and personal care, boasting around 3,000 beauty companies, including industry giants like Shiseido, Kao, Kose, and Pola Orbis.

- The above-mentioned factors are likely to impact the demand for the market studied in the region during the forecast period.

Isopropyl Alcohol (IPA) Industry Overview

The isopropyl alcohol (IPA) market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) Shell PLC, Ineos, ExxonMobil Corporation, Dow, and Kailing Chemical (Zhangjiagang) Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Isopropyl Alcohol from the Pharmaceutical Industry

- 4.1.2 Growing Utilization of Isopropyl Alcohol in the Personal Care and Cosmetics Industry

- 4.2 Restraints

- 4.2.1 Availability of Substitute Products for Isopropyl Alcohol

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Application

- 5.1.1 Process and Preparation Solvent

- 5.1.2 Cleaning and Drying Agent

- 5.1.3 Coating and Dye Solvent

- 5.1.4 Intermediate

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Healthcare

- 5.2.3 Electronics

- 5.2.4 Paints and Coatings

- 5.2.5 Chemicals

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Cnpc Jinzhou Petrochemical Company

- 6.4.2 Deepak Fertilisers and Petrochemicals Corporation Ltd (dfpcl)

- 6.4.3 Dow

- 6.4.4 ENEOS Corporation

- 6.4.5 Ineos

- 6.4.6 Kailing Chemical (Zhangjiagang) Co. Ltd

- 6.4.7 LCY GROUP

- 6.4.8 LG Chem

- 6.4.9 Mitsui Chemicals Inc.

- 6.4.10 Shell PLC

- 6.4.11 Yancheng Super Chemical Technology Co. Ltd.

- 6.4.12 Zhejiang Xinhua Chemical Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Bio-based Isopropyl Alcohol