|

市场调查报告书

商品编码

1686625

亚太电池:市场占有率分析、行业趋势和成长预测(2025-2030 年)Asia-Pacific Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

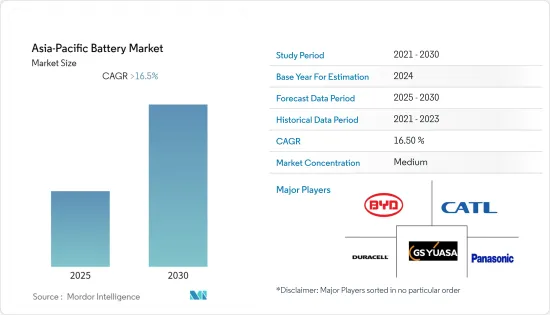

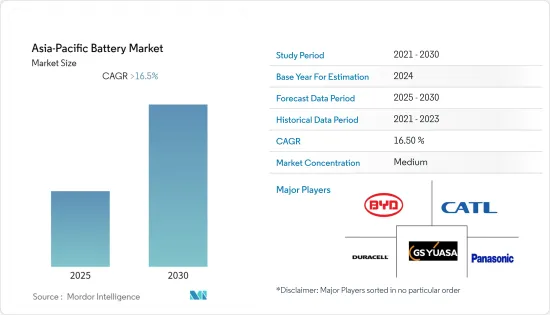

预计预测期内亚太电池市场的复合年增长率将超过 16.5%。

2020年市场受到新冠疫情的不利影响,目前市场已恢復至疫情前的水准。

主要亮点

- 从中期来看,锂离子电池价格下降、电动车快速普及、可再生能源领域的成长以及家用电器销售成长等因素预计将推动市场发展。

- 另一方面,原材料供需不匹配可能会在未来几年抑制市场成长。

- 然而,随着该地区对新车的需求不断增加,汽车电池领域预计将成为电池市场成长最快的领域。预计未来几年该领域将成为锂离子电池的主要终端用户。将可再生能源纳入国家电网的计画预计将为未来锂离子电池製造商和供应商创造重大商机。

- 在政府鼓励製造业发展的政策层面的支持下,印度很可能在亚太电池市场中见证显着成长。

亚太电池市场趋势

汽车电池产业将经历显着成长

- 预计未来汽车产业将成为锂离子电池的主要终端用户领域之一。电动车的广泛应用预计将为锂离子电池行业的成长提供巨大推动力。

- 目前,世界各地销售的车辆类型多样,混合动力和电气化程度不断提高,包括混合动力电动车 (HEV)、插电式混合动力电动车和电动车 (EV)。

- 电动车在已开发经济体和新兴经济体中越来越受欢迎。中国的电动车销量居世界首位,印度等新兴经济体正在改造其公共交通基础设施以适应电动车。

- 在当前的市场情势下,政策支持对于加速电动车的普及发挥关键作用。政策支持将为消费者提供有吸引力的汽车,降低投资者的风险,并鼓励製造商大规模开发电动车,从而促进市场发展。

- 电池价格下降和技术进步预计将为市场带来具有价格竞争力的电动车,从而创造对电池技术的需求。

- 全球电动车电池生产集中在亚太地区,中国、日本和韩国公司在该领域占据主导地位,并在欧洲建厂以捍卫其主导地位。截至2021年,中国是最大的电动车市场,销量约330万辆。该国也正在努力降低空气污染水平,预计将进一步促进汽车电池产业的发展。

- 印度政府已采取多项倡议来推广电动车。 「印度快速采用和製造(混合动力和)电动车(FAME)」计画第二阶段于 2019 年 4 月启动,为期三年。该计划的主要目标是鼓励更快地采用电动和混合动力汽车汽车,并透过奖励购买电动车和创建电动车必要的充电基础设施来促进汽车电池产业的发展。

- FAME印度计画(于2019年4月启动)原定于2022年结束。然而,经主管机关核准,联邦政府于2021年6月决定将FAME印度第二阶段计画延长两年,至2024年3月。 2021年第一季,联邦政府增加了电动两轮车和三轮车的激励措施,以鼓励更广泛的采用。据一些行业专家称,由于过去两年电动车销售一直低迷,政府希望利用专门用于 FAME 计划的资金。

- 因此,随着电动车的普及,汽车电池产业可能会经历强劲成长。

印度经济快速成长

- 亚太地区拥有多个发展中经济体,自然资源和人力资源丰富。基于政府对製造业的政策支持,印度预计将在未来几年成为电池企业的主要投资热点。

- 印度市场受到人口成长、都市化、电子设备价格下降、新智慧技术的采用和可负担的网路存取的推动。此外,新款智慧型手机更换旧款智慧型手机也有望成为市场成长的推动力。

- 通讯服务渗透率的不断提高将为印度通讯市场的成长提供机会。因此,随着用户的增加,预计该国对通讯塔的需求将会增加,从而进一步增加对备用所需电池的需求。

- 印度是世界上二氧化碳排放排名前五的国家之一。为了缓解空气污染问题,政府一直带头实施有利于电动车普及的政策。

- 政府已明确表示,计划设立电动车充电站的企业可能不需要获得交通部颁发的授权或执照。印度政府也设定了一个雄心勃勃的目标,从 2030 年起销售的所有新车都将实现纯电动化。预计这些努力将提振该国对电池的需求。

- 在印度,超过50%的通讯塔位于每天停电超过8小时的地方。通讯业者必须维持 99.5% 的运转率,否则将面临处罚。因此,该塔严重依赖柴油发电机。电讯业正在转向可再生能源,特别是太阳能,以及电池储存系统,以减少温室气体排放。

- 因此,2020年2月,印度通讯部指示通讯服务供应商使用可再生能源解决方案和节能技术,从而推动印度电池市场的发展。

- 因此,由于这些因素,预计印度在预测期内将在亚太电池市场中呈现显着成长。

亚太电池产业概况

亚太电池市场需要更加紧密地团结起来。主要公司包括(排名不分先后)宁德时代、比亚迪、金霸王、GS汤浅、Panasonic Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 2027年电池/原料价格趋势及各主要技术类型预测

- 2020年前主要电池技术及主要国家进出口分析

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 类型

- 一次电池

- 二次电池

- 科技

- 铅酸电池

- 锂离子电池

- 其他技术

- 应用

- 汽车电池(HEV、PHEV、EV)

- 工业电池(原动机、固定式(电信、UPS、能源储存系统(ESS)))

- 可携式电池(消费性电子产品)

- 其他用途

- 地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc.

- EnerSys

- GS Yuasa Corporation

- Clarios International Inc.

- LG Chem Ltd

- Panasonic Corporation

- Saft Groupe SA

- Samsung SDI Co. Ltd

- Tesla Inc.

- TianJin Lishen Battery Joint-Stock Co. Ltd

第七章 市场机会与未来趋势

简介目录

Product Code: 53366

The Asia-Pacific Battery Market is expected to register a CAGR of greater than 16.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors including lithium-ion battery prices decline, rapid adoption of electric vehicles, growing renewable sector, and increased sale of consumer electronics are expected to drive the market.

- On the other hand, the demand-supply mismatch of raw materials is likely to restrain the market's growth in the coming years.

- Nevertheless, The automotive batteries segment is expected to be the fastest-growing segment in the battery market due to the increasing demand for new vehicles produced in the region. The segment is expected to be the leading end-user for lithium-ion batteries in the coming years. Plans to integrate renewable energy with the national grids in respective countries are expected to create a significant opportunity for lithium-ion battery manufacturers and suppliers in the future.

- India is likely to experience significant growth in the Asia-Pacific battery market based on policy-level support from the government encouraging the manufacturing sector.

Asia Pacific Battery Market Trends

Automotive Battery Segment to Witness Significant Growth

- The automotive sector is anticipated to be one of the major end-user segments for lithium-ion batteries in the future. The penetration of electric vehicles will likely provide a massive impetus for the lithium-ion battery industry's growth.

- Different vehicle types are now available globally, featuring increasing degrees of hybridization and electrification, such as Hybrid Electric Vehicles (HEVs), plug-in hybrid electric vehicles, and Electric Vehicles (EVs).

- In developed and developing economies, the adoption of electric vehicles is increasing at a high rate. China is leading in global EV sales, and other developing economies like India are transforming their public transportation infrastructure for EVs.

- In the current market scenario, policy support plays a crucial role in driving the adoption of electric vehicles. Policy support enables market growth by making vehicles appealing to consumers, reducing risks for investors, and encouraging manufacturers to develop electric vehicles on a large scale.

- Falling battery prices and improving technology are expected to bring price-competitive electric vehicles to the market, creating demand for battery technologies.

- The global production of batteries for electric vehicles is concentrated in Asia-Pacific, with Chinese, Japanese, and South Korean companies dominating the sector and building factories in Europe to conserve their supremacy. As of 2021, China was the largest market for electric vehicles, as the country accounted for approximately 3300000 vehicles sold. The country is also making efforts to reduce air pollution levels, which is further expected to push the automotive battery segment.

- The Indian government has taken several initiatives to promote electric vehicles. In April 2019, Phase II of the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) India scheme was implemented for three years. The scheme's main objective is to promote faster adoption of electric and hybrid vehicles by providing an incentive for the purchase of electric vehicles and creating necessary charging infrastructure for electric vehicles, thereby boosting the automotive battery segment.

- The FAME India Scheme (which started in April 2019) was supposed to end by 2022. However, with the approval of competent authorities, the union government, in June 2021, decided that the FAME India Phase II Scheme will be extended for two years, i.e., up to March 2024. In Q1 of 2021, the union government increased incentives on electric two- and three-wheelers to help boost broad-based adoption. According to some industry experts, the government wanted to utilize the funds earmarked for the FAME scheme, with the sale of EVs remaining muted for the past two years.

- Thus, the automotive battery sector will likely witness significant growth with the increasing adoption of electric vehicles.

India to Witness Significant Growth

- Asia-Pacific has multiple growing economies with substantial natural and human resources. India is expected to become a major investment hotspot for battery companies in the coming years, based on the policy-level support from the governments encouraging the manufacturing sector.

- The Indian market is driven by increasing population, urbanization, declining cost of electronic items, the introduction of new smart technologies, and availability of the internet at a cheaper cost. Replacement of older smartphones with newer ones is also expected to drive the market's growth.

- The increasing penetration of telecommunication services provides an opportunity for the growth of the telecommunication market in India. Therefore, with the increase in subscribers, the requirement for telecommunication towers in the country is expected to increase, further fostering the demand for batteries required for backup purposes.

- India is among the top five emitters of CO2 in the world. To mitigate the problem of air pollution, the government has taken the initiative to implement policies favorable to increase the EV fleet count on the road.

- The government has clarified that entities planning to set up EV charging stations may not require licensing from the ministry. The Indian government also set an ambitious target of new vehicles sold after 2030 to be fully electric. Such initiatives are expected to drive the demand for batteries in the country.

- India has more than 50% of telecom towers located in sites that face outages for 8 hours a day or more. The telecom industry players must maintain an uptime of 99.5% or face penalties. As a result, the towers are heavily dependent on diesel generators. The telecom industry is moving toward renewable sources, particularly solar, in tandem with battery energy storage systems to reduce greenhouse emissions.

- To this effect, in February 2020, the Indian Department of Telecommunications issued directions to the telecom service providers to use renewable energy solutions and energy-efficient technologies, thereby boosting the Indian battery market.

- Hence, due to such factors, India is expected to witness significant growth in the Asia-Pacific battery market during the forecast period.

Asia Pacific Battery Industry Overview

The Asia-Pacific Battery Market could be more cohesive. Some major players include (not in particular order) Contemporary Amperex Technology Co. Limited, BYD Co. Ltd, Duracell Inc., GS Yuasa Corporation, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Battery/Raw Material Price Trends and Forecast, by Major Technology Type, till 2027

- 4.4 Import and Export Analysis, by Major Battery Technology and Major Country, in USD million, till 2020

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lead-acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Automotive Batteries (HEV, PHEV, and EV)

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, and Energy Storage Systems (ESS))

- 5.3.3 Portable Batteries (Consumer Electronics)

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 India

- 5.4.2 China

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc.

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Clarios International Inc.

- 6.3.7 LG Chem Ltd

- 6.3.8 Panasonic Corporation

- 6.3.9 Saft Groupe SA

- 6.3.10 Samsung SDI Co. Ltd

- 6.3.11 Tesla Inc.

- 6.3.12 TianJin Lishen Battery Joint-Stock Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219