|

市场调查报告书

商品编码

1686632

农业界面活性剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Agricultural Surfactant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

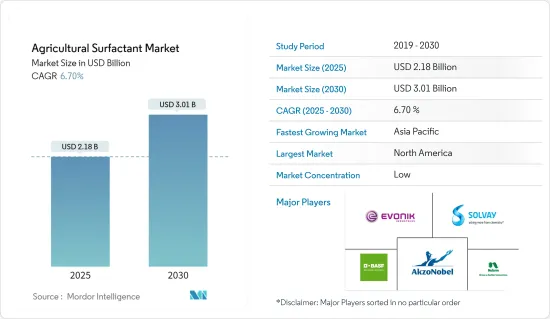

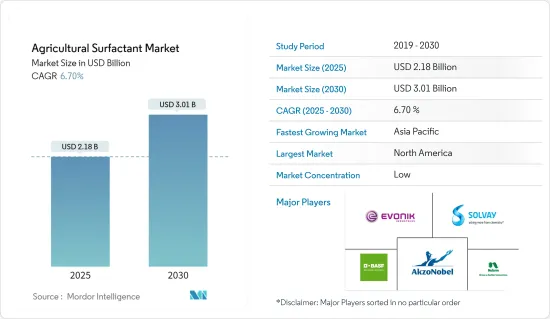

预计 2025 年农业界面活性剂市场规模为 21.8 亿美元,到 2030 年将达到 30.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.7%。

农业界面活性剂主要用于水性除草剂喷雾溶液,以增强乳化、分散、铺展、润湿和其他表面改质性能。这些添加剂在除草剂处理中非常重要,可以提高喷雾液滴的保留率并提高活性成分向植物叶子的渗透率。为了满足不断增长的世界人口,对粮食生产的需求不断增加,因此农业界面活性剂的使用量显着增长。根据《哈佛商业评论》预测,到2050年世界人口预计将达到97亿,同期粮食需求预计将增加70%。因此,农民越来越多地采用农业表面活性剂来提高作物产量并满足日益增长的需求。

传统界面活性剂通常来自石化产品,并且面临日益严重的环境问题和监管挑战。 2023年,欧盟委员会提案更新欧盟界面活性剂框架,以确保食品安全和环境永续性。这推动了对生物基、生物分解性和环境友善的表面活性剂作为更永续的替代品的需求。这些界面活性剂来自可再生资源,包括植物来源和农产品,并且易于生物分解,从而最大限度地减少对环境的影响。随着製造商开发出满足农业性能要求并符合环境管理目标的产品,向永续表面活性剂解决方案的转变正在刺激产业内部的创新。

农用表面活性剂的市场趋势

谷物和谷类占据市场主导地位

小麦、大米、玉米和大麦等谷类是世界上种植最广泛的作物之一。这些是世界相当一部分人口的主食,需要大规模生产。如此大规模的种植导致对农业表面活性剂的需求庞大,以提高作物产量,改善土壤健康,并促进农作物保护产品的有效应用。根据联合国粮食及农业组织统计,2023年全球整体小麦种植面积超过2.191亿公顷,玉米种植面积约2.034亿公顷,水稻种植面积约1.651亿公顷。这些惊人的数字凸显了谷物和谷类生产的巨大规模,需要广泛使用农业界面活性剂。

此外,世界人口正在呈指数级增长,每天全世界的粮食需求将增加近20万人。根据联合国统计,过去100年来世界人口增加了近四倍。向不断增长的人口供应谷物和谷类对全球构成了威胁。此外,各种作物害虫每年造成全球10-16%的作物损失,使情况更加恶化。因此,农民采用作物保护作为满足全球日益增长的谷物需求的关键策略。

用于种植谷物和谷类的可耕地面积的减少也增加了对保护性耕作和犁地农业等永续农业实践的需求。农业界面活性剂在这些实践中发挥关键作用,它使农药能够有效地施用和吸收,而不会过度扰动土壤。

北美占据市场主导地位

北美占据农业表面活性剂市场的最大份额。预计该地区在估计和预测期内将稳步增长,特别是由于政府采取各种措施来提高产量并保持食品、饲料和生质燃料行业原材料的持续供应。推动成长的关键因素是生物表面活性剂的使用量不断增加以及原料的丰富可得性。

由于大规模商业性农业经营的存在,美国在全部区域的市场中占据主导地位,这对高效农药製剂产生了巨大的需求,从而推动了对兼容表面活性剂的需求。此外,美国农民的购买力增强,更愿意投资先进的农业投入,导致界面活性剂的使用量更高。例如,根据美国农业部的数据,到2023年,美国农场的平均收入将超过178,692美元,因此可以为农作物保护产品进行大量投资。此外,由于担心环境影响、土壤健康和长期农业生产力,该国越来越重视永续农业实践。因此,对生物表面活性剂的需求十分强烈,以最大限度地减少对环境的影响并促进土壤健康。

农用表面活性剂产业概况

农用界面活性剂市场较为分散。市场的主要企业正在采取策略,透过收购、新产品发布、业务扩展和投资、协议、伙伴关係、合资企业和合资企业等方式拓展到新的地区。投资研发也是市场领导所采取的策略之一。市场的主要企业包括 Evonik Industries AG、 BASF SE、Solvay SA、Akzo Nobel NV 和 Kao Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 提高农作物产量对农药的需求不断增加

- 农业技术进步

- 更重视永续农业和环保解决方案

- 市场限制

- 生物基界面活性剂生产成本高

- 有关化学品使用的严格环境法规

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 阴离子

- 非离子

- 阳离子

- 男女皆宜

- 油性界面活性剂

- 应用

- 杀虫剂

- 除草剂

- 杀菌剂

- 其他用途

- 基材

- 合成

- 生物基

- 作物用途

- 以作物为基础

- 粮食

- 油籽

- 水果和蔬菜

- 非作物

- 草坪和观赏草

- 其他作物

- 以作物为基础

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Akzo Nobel NV

- Evonik Industries

- BASF SE

- Nouryon

- Solvay SA

- Wilbur-Ellis Company

- Croda International PLC

- Canopus International

- Nufarm Limited

- Marubeni Corporation

- Air Products and Chemicals

- Kao Corporation

- Clariant

- Lamberti SPA

- Brandt Consolidated Inc.

- Bionema Limited

- Zhejiang Transfar(Tanatex Chemicals)

- Garrco Products Inc.

第七章 市场机会与未来趋势

The Agricultural Surfactant Market size is estimated at USD 2.18 billion in 2025, and is expected to reach USD 3.01 billion by 2030, at a CAGR of 6.7% during the forecast period (2025-2030).

Agricultural surfactants are primarily used in water-based herbicide spray solutions to enhance their emulsifying, dispersing, spreading, wetting, or other surface-modifying properties. These additives are crucial in herbicide treatments, improving spray droplet retention and the penetration of active ingredients into plant foliage. The use of agricultural surfactants has grown significantly due to the increasing demand for food production to support the growing global population. According to Harvard Business Review projections, the world population is expected to reach 9.7 billion by 2050, with food demand estimated to increase by 70% during the same period. As a result, farmers are increasingly adopting agricultural surfactants to improve crop yield and meet this rising demand.

Traditional surfactants, typically derived from petrochemical sources, have raised environmental concerns and faced regulatory challenges. In 2023, the European Commission proposed an update to the EU framework on surfactants for food safety and environmental sustainability. This has led to a growing demand for bio-based, biodegradable, and eco-friendly surfactants as more sustainable alternatives. These surfactants are derived from renewable sources, such as plant-based materials or agricultural byproducts, and are designed to be readily biodegradable, minimizing their environmental impact. The shift towards sustainable surfactant solutions has spurred innovation within the industry, with manufacturers developing products that meet agricultural performance requirements while aligning with environmental stewardship goals.

Agricultural Surfactants Market Trends

Grains and Cereals Dominates the Market

Grains and cereals, such as wheat, rice, maize, and barley, are among the most widely cultivated crops worldwide. They serve as staple foods for a significant portion of the global population and necessitate large-scale production. This large cultivation translates into a significant need for agricultural surfactants to enhance crop yields, improve soil health, and facilitate the efficient application of crop protection products. According to the Food and Agriculture Organization, in 2023, wheat was cultivated on over 219.1 million hectares of land globally, while maize occupied around 203.4 million hectares, and rice covered approximately 165.1 million hectares. These staggering figures highlight the immense scale of grain and cereal production, necessitating the extensive use of agricultural surfactants.

Moreover, the global population is increasing exponentially, and every day, nearly 200,000 people are being added to the world's food demand. According to the United Nations, the world's human population increased nearly fourfold in the past 100 years. Supplying grains and cereals to this growing population has become a global threat. Moreover, various crop pests are causing 10-16% of global crop losses annually, worsening the scenario. Therefore, farmers are adopting crop protection as the key strategy to meet the growing demand for grains and cereals globally.

The shrinking of arable land for grains and cereals has also driven the need for sustainable agricultural practices, such as conservation tillage and no-till farming. Agricultural surfactants play a crucial role in these practices by enabling the effective application and absorption of agrochemicals without the need for excessive soil disturbance.

North America Dominates the Market

North America holds one the largest part of the agricultural surfactant market. The region is estimated to grow steadily during the forecast period, especially with the various government initiatives to increase yield and maintain a continuous supply of raw materials for the food, feed, and biofuel industries. Major factors driving the growth are the increasing usage of bio-surfactants and the abundant availability of raw materials.

The United States dominated the market across the region due to the presence of large-scale commercial agricultural operations has created a significant demand for efficient and effective agrochemical formulations, which in turn has driven the need for compatible surfactants. Additionally, the United States farmers have high purchasing power and willingness to invest in advanced agricultural inputs contributing to the high usage of surfactants. For instance, the United States farm median income was more than USD 178,692 in 2023, according to the United States Department of Agriculture, allowing for significant investment in crop protection products. Moreover, there is a growing emphasis on sustainable farming practices in the country, driven by concerns over environmental impact, soil health, and long-term agricultural productivity. As a result, the demand for bio surfactants is growing significantly to minimize the environmental impact and promote soil health.

Agricultural Surfactants Industry Overview

The market for agricultural surfactants is fragmented. The key players in the market have been following strategies to explore new regions through acquisitions, new product launches, expansions and investments, agreements, partnerships, collaborations, and joint ventures. Investment in R&D is another strategy adopted by market leaders. Some of the major players in the market are Evonik Industries AG, BASF SE, Solvay SA, Akzo Nobel N.V., and Kao Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Agrochemicals to Boost Crop Yield

- 4.2.2 Technological Advancements in Agricultural Practices

- 4.2.3 Rising Focus on Sustainable Agriculture and Eco-Friendly Solutions

- 4.3 Market Restraints

- 4.3.1 High Production Costs of Bio-based Surfactants

- 4.3.2 Stringent Environmental Regulations on Chemical Use

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Anionic

- 5.1.2 Nonionic

- 5.1.3 Cationic

- 5.1.4 Amphoteric

- 5.1.5 Oil- Based Surfactants

- 5.2 Application

- 5.2.1 Insecticide

- 5.2.2 Herbicide

- 5.2.3 Fungicide

- 5.2.4 Other Applications

- 5.3 Substrate

- 5.3.1 Synthetic

- 5.3.2 Bio-based

- 5.4 Crop Application

- 5.4.1 Crop-based

- 5.4.1.1 Grains and Cereals

- 5.4.1.2 Oilseeds

- 5.4.1.3 Fruits and Vegetables

- 5.4.2 Non-crop-based

- 5.4.2.1 Turf and Ornamental Grass

- 5.4.2.2 Other Crop Applications

- 5.4.1 Crop-based

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Akzo Nobel N.V.

- 6.3.2 Evonik Industries

- 6.3.3 BASF SE

- 6.3.4 Nouryon

- 6.3.5 Solvay SA

- 6.3.6 Wilbur-Ellis Company

- 6.3.7 Croda International PLC

- 6.3.8 Canopus International

- 6.3.9 Nufarm Limited

- 6.3.10 Marubeni Corporation

- 6.3.11 Air Products and Chemicals

- 6.3.12 Kao Corporation

- 6.3.13 Clariant

- 6.3.14 Lamberti SPA

- 6.3.15 Brandt Consolidated Inc.

- 6.3.16 Bionema Limited

- 6.3.17 Zhejiang Transfar (Tanatex Chemicals)

- 6.3.18 Garrco Products Inc.