|

市场调查报告书

商品编码

1939147

汽车冷却液:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Automotive Coolant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

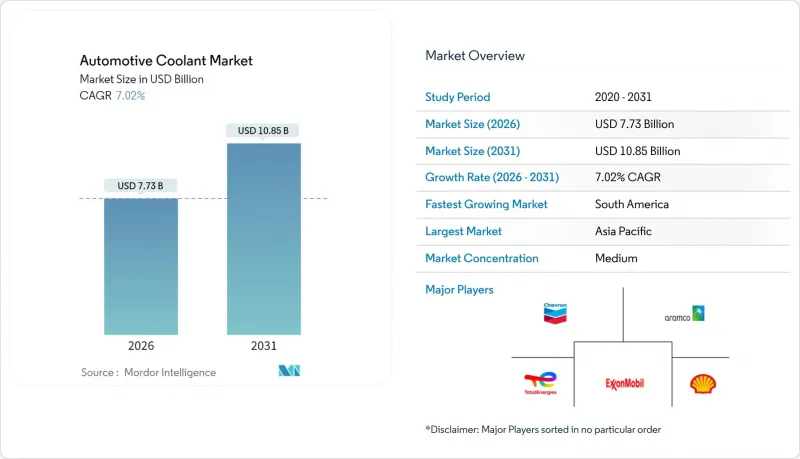

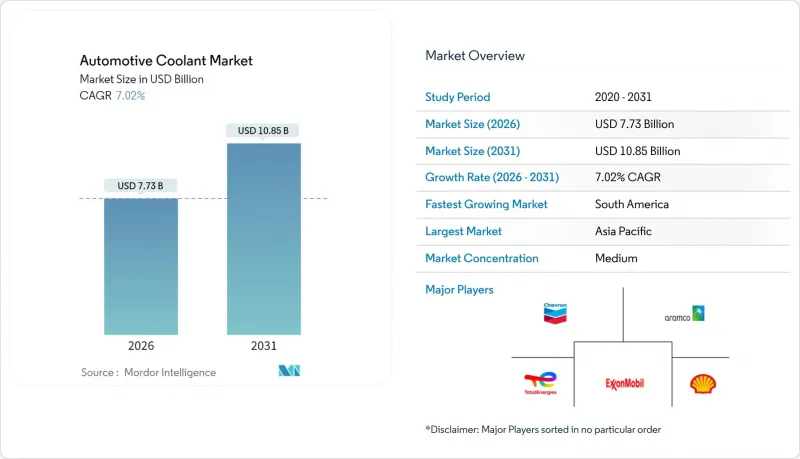

汽车冷却液市场预计将从 2025 年的 72.2 亿美元成长到 2026 年的 77.3 亿美元,预计到 2031 年将达到 108.5 亿美元,2026 年至 2031 年的复合年增长率为 7.02%。

电动车产量不断增长、老旧内燃机车队需要频繁更换冷却液,以及日益严格的温度控管法规,共同推动了汽车冷却液市场的稳定扩张。供应商受益于能够延长换液週期的增值化学配方,而车队营运商则可以透过更高品质的配方降低停机成本。电气化正在重塑产品需求,推动低导电性和介电性冷却液的大规模生产,从而在传统的乙二醇基产品线之外创造新的收入来源。

全球汽车冷却液市场趋势与洞察

全球汽车保有量不断成长,车队却日益老旧。

老化的车队催生了持续的售后市场需求,因为与现代长效冷却液相比,老旧车辆所需的冷却液更换週期更短。全球汽车保有量的扩张,尤其是在新兴市场,正在创造超过新车销售成长的替换需求。在政府政策(例如生产关联激励计划 (PLI) 和永久性机动车排放控制计划 (PM E-DRIVE))的支持下,印度汽车售后市场预计将达到大规模的规模,足以支撑庞大的内燃机 (ICE) 车队的运作。随着北美和欧洲老化的车队在关键保养週期中从传统冷却系统过渡到长效冷却系统,这一趋势将尤其有利于售后冷却液供应商。重型商用车最能反映这一趋势,车队营运商越来越多地采用长效冷却液,以在管理更多车辆的同时降低维护成本。

原始设备製造商推广长效 OAT/HOAT 冷却液

为了实现超过15万英里的保养週期,汽车製造商正在将有机酸技术(OAT)和混合配方作为标准,这从根本上改变了冷却液的需求模式,使其从基于用量转向基于价值。通用汽车(GM)率先采用DexCool冷却液,将使用寿命延长至15万英里,而传统冷却液的使用寿命仅为3万英里。这种转变降低了车辆整个生命週期内的冷却液总消耗量,同时提高了每单位冷却液的价值和复杂性。欧洲汽车製造商,例如梅赛德斯-奔驰,正在为某些应用指定15年的保养週期,这催生了对具有更高稳定性和更强防腐蚀性能的优质冷却液的需求。这种转变给市场供应商带来了挑战:既需要储备多种不同化学成分的冷却液,又需要对维修技师进行相容性培训,因为混合使用不相容的冷却液会加速零件故障。

原料(乙二醇)价格波动

乙二醇价格波动直接影响冷却液的生产成本,供应链中断可能会挤压冷却液製造商的利润空间,并限制价格敏感型细分市场的成长。全球乙二醇价格波动影响冷却液製造商维持价格稳定的能力,对其拓展成本敏感型新兴市场造成负面影响。环保生物基甘油替代品的高昂价格加剧了这项挑战,限制了其在註重成本的售后市场的普及。为了降低进口依赖和外汇波动带来的风险,供应链韧性变得日益重要,例如像Alteco这样的製造商已在中国建立本地生产基地。原料短缺可能会加速产业整合,尤其是对于那些没有垂直整合或长期供应协议的小型冷却液製造商。

细分市场分析

凭藉其卓越的性能和成熟的供应链,乙二醇将继续保持市场领导地位,预计到2025年将占据汽车冷却液市场51.92%的份额。同时,甘油预计将成为成长最快的细分市场,到2031年复合年增长率将达到9.01%,这反映了环境永续性的迫切需求以及生物基化学技术的应用。乙二醇市场受益于成熟的生产基础设施和成本优势,尤其是在亚太地区的生产基地,规模经济效应使其价格更具竞争力。

该领域的趋势反映了整个行业的转型,传统化工行业的领导地位正受到永续性驱动的创新挑战,这为拥有生物基技术的供应商创造了机会,而现有的乙二醇生产商除非致力于开发可再生替代品,否则将面临市场份额被侵蚀的风险。

到2025年,乘用车仍将占据汽车冷却液市场45.52%的份额,这主要得益于电子商务的扩张和最后一公里配送电气化带来的特殊温度控管需求。轻型商用车将成为成长最快的细分市场,到2031年复合年增长率将达到7.12%。虽然乘用车市场受益于大规模生产和标准化的冷却液规格,但随着长效冷却液的推出,更换需求减少,其成长速度将会放缓。商用车应用需要高性能冷却液,以应对更长的保养週期和严苛的驾驶条件。重型商用车市场正越来越多地采用OAT(氧亚甲基基)配方,以实现100万英里(约160万公里)的使用寿命。中型和重型商用车受益于车队采购优势和专业的维护保养方式,这些因素使得高端冷却液配方优于传统产品。

该领域的转型反映了交通运输电气化的整体趋势。由于电动车的整体拥有成本优势,商用车队正在主导电动车的普及,这也催生了对专用电池温度控管冷却剂的需求。美国环保署(EPA)要求在2032年大幅提高插电式电动车(PEV)的普及率,这将对中型货车产生特别显着的影响。亚马逊和联邦快递等车队采购商正在推动电动动力传动系统的早期应用,而这些系统需要专门的温度控管解决方案。

区域分析

到2025年,亚太地区将继续保持其在汽车冷却液市场的最大份额,占全球市场份额的34.53%。这主要得益于中国严格的电动车温度控管法规以及印度在政府製造业激励政策支持下汽车生产的快速成长。中国的GB标准对电动车冷却液的电导率有明确的限制,从而催生了对兼顾热性能和电气安全要求的专用配方的需求。在印度,在生产关联激励计划(PLI)和PM E-DRIVE政策的支持下,汽车售后市场的成长推动了对传统冷却液和电动车专用冷却液的持续需求,因为印度本土汽车製造商正在建立温度控管供应链。日本和韩国正在为先进电动车技术的发展做出贡献,这需要用于电池和电力电子设备冷却的专用介电冷却液。

南美洲正崛起为成长最快的地区,预计到2031年复合年增长率将达到6.67%。阿根廷和巴西的汽车一体化政策简化了车辆认证和零件核准流程,同时扩大了商用车生产以满足不断增长的电子商务需求。该地区加速成长的原因在于,两国签署了相互核准协议,降低了冷却液製造商向这两个主要市场供货的监管门槛,为区域营运创造了规模经济效益。

北美和欧洲市场已趋于成熟,成长速度较为温和,这主要得益于长效冷却剂的普及降低了更换频率,同时监管要求也推动了高端配方产品的升级。尤其值得一提的是,欧洲市场正面临来自REACH和PFAS法规的转型压力,生物基冷媒替代品更受青睐。这为拥有永续化学技术的供应商创造了机会。北美车队营运商正在加速采用长效冷却剂以降低维护成本,虽然对售后市场销售成长构成结构性阻力,但却有利于OEM厂商的冷媒填充应用。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球汽车保有量不断成长,车辆老化问题日益严重。

- 原始设备製造商推广长效 OAT/HOAT 冷却液

- 新兴市场汽车产量成长

- 高性能内燃机设计

- 电动车对介温度控管液的需求

- 向生物基甘油冷却剂的环境转变

- 市场限制

- 原料(乙二醇)价格波动

- 延长换油週期会降低售后市场需求。

- 下一代电动车平台中的闭式冷却迴路

- 基于毒性的乙二醇监管

- 价值/价值链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元))

- 依产品类型

- 乙二醇

- 丙二醇

- 甘油

- 其他的

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和重型商用车辆

- 公车和长途客车

- 透过技术

- 无机添加剂技术(IAT)

- 有机添加剂技术(OAT)

- 混合有机酸技术(HOAT)

- 最终用户

- OEM

- 售后市场

- 按地区

- 北美洲

- 我们

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 土耳其

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BASF SE

- Dow Inc.

- Chevron Corporation

- ExxonMobil Corp.

- Shell plc

- TotalEnergies SE

- China Petroleum and Chemical Corp.(Sinopec)

- BP plc(Castrol)

- Saudi Aramco Group

- PETRONAS(Petroliam Nasional Berhad)

- Cummins Inc.

- Fuchs Petrolub SE

- Motul SA

- Old World Industries, LLC(PEAK)

- Recochem Corporation

- CCI Corporation

- Prestone Products Corporation

- Evans Cooling Systems Inc.

- AMSOIL Inc.

第七章 市场机会与未来展望

The automotive coolant market is expected to grow from USD 7.22 billion in 2025 to USD 7.73 billion in 2026 and is forecast to reach USD 10.85 billion by 2031 at 7.02% CAGR over 2026-2031.

Rising electric-vehicle production, aging internal-combustion fleets that require frequent fluid changes, and stricter thermal-management regulations all contribute to the steady expansion of the automotive coolant market. Suppliers gain from value-added chemistry that lengthens drain intervals, while fleet operators reduce downtime costs through premium formulations. Electrification reshapes product needs by pushing low-conductivity, dielectric coolants into volume production, creating a fresh revenue layer atop traditional ethylene-glycol lines.

Global Automotive Coolant Market Trends and Insights

Rising Global Vehicle Parc and Aging Fleet

Fleet aging dynamics create sustained aftermarket demand as older vehicles require more frequent coolant service intervals compared to modern extended-life formulations. The global vehicle parc expansion, particularly in emerging markets, generates replacement demand that outpaces the growth of new vehicle sales. India's automotive aftermarket is projected to reach a significant scale, driven by government policies such as PLI and PM E-DRIVE that incentivize domestic vehicle production while maintaining substantial ICE fleet operations. This trend particularly benefits aftermarket coolant suppliers as aging fleets in North America and Europe transition from conventional to long-life coolant systems during major service intervals. Heavy-duty commercial vehicles demonstrate this pattern most clearly, where fleet operators increasingly adopt extended-life coolants to reduce maintenance costs while managing larger vehicle populations.

OEM Push for Long-Life OAT/HOAT Coolants

Original equipment manufacturers are standardizing on organic acid technology and hybrid formulations to achieve service intervals exceeding 150,000 miles, fundamentally altering coolant demand patterns from volume-based to value-based consumption. General Motors' DexCool adoption established the template, with service life extending to 150,000 miles compared to conventional coolants' 30,000-mile intervals. This shift reduces total coolant volume consumption per vehicle over its lifetime while increasing per-unit coolant value and complexity. European OEMs, such as Mercedes-Benz, specify 15-year service intervals for certain applications, creating demand for premium coolant chemistries with enhanced stability and corrosion protection. The transition challenges aftermarket suppliers to stock multiple chemistry types while educating service technicians on compatibility requirements, as mixing incompatible coolant types accelerates component failures.

Raw-Material (Glycol) Price Volatility

Ethylene glycol price fluctuations directly impact coolant manufacturing costs, with supply chain disruptions creating margin pressure for coolant producers while potentially limiting market growth in price-sensitive segments. Global ethylene glycol pricing volatility affects coolant manufacturers' ability to maintain stable pricing, particularly impacting the penetration of emerging markets, where cost sensitivity remains high. The challenge intensifies as bio-based glycerin alternatives, while environmentally preferred, command premium pricing that limits adoption in cost-conscious aftermarket segments. Supply chain resilience becomes critical as manufacturers like Arteco establish local production facilities in China to mitigate risks associated with import dependency and currency fluctuations. Raw material constraints, particularly for smaller coolant manufacturers lacking vertical integration or long-term supply contracts, can accelerate industry consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Emerging-Market Vehicle Production

- Demand for Dielectric Thermal-Management Fluids in EVs

- Extended Drain Intervals Cutting Aftermarket Volume

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ethylene glycol maintains its market leadership with a 51.92% of the automotive coolant market share in 2025, driven by its proven performance characteristics and established supply chains. Meanwhile, glycerin emerges as the fastest-growing segment, with a 9.01% CAGR through 2031, reflecting environmental sustainability mandates and the adoption of bio-based chemistry. The ethylene glycol segment benefits from mature manufacturing infrastructure and cost advantages, particularly in Asia-Pacific production hubs where scale economies support competitive pricing.

The segment dynamics reflect a broader industry transformation, where traditional chemistry leadership faces disruption from sustainability-driven innovation, creating opportunities for suppliers with bio-based capabilities while challenging established ethylene glycol producers to develop renewable alternatives or risk erosion of their market share.

Passenger cars maintain a 45.52% of the automotive coolant market share in 2025, as e-commerce expansion and last-mile delivery electrification create specialized thermal management requirements. Light commercial vehicles represent the fastest-growing segment, with a 7.12% CAGR through 2031. The passenger car segment benefits from volume production and standardized coolant specifications; however, growth moderates as extended-life coolants reduce the need for replacement. Commercial vehicle applications require higher-performance coolants that can support extended service intervals and severe-duty operation. The heavy-duty segments are increasingly adopting OAT formulations to achieve a 1,000,000-mile service life. Medium- and heavy-duty commercial vehicles benefit from the purchasing power of fleets and professional maintenance practices that favor premium coolant formulations over conventional alternatives.

The segment transformation reflects broader transportation electrification trends, where commercial fleets lead EV adoption due to total cost of ownership benefits, creating demand for specialized battery thermal management coolants. EPA regulations mandating substantial PEV penetration through 2032 particularly impact medium-duty delivery vehicles, where fleet purchasers like Amazon and FedEx drive early adoption of electric powertrains requiring dedicated thermal management solutions.

The Automotive Coolant Market Report is Segmented by Product Type (Ethylene Glycol, Propylene Glycol, Glycerin, Others), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Technology (IAT, OAT, HOAT), End User (OEM, and Aftermarket), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region maintains the largest regional market share, accounting for 34.53% of the automotive coolant market in 2025. This is driven by China's stringent EV thermal management regulations and India's rapid expansion of automotive production, which is supported by government manufacturing incentives. China's GB standards mandate specific electrical conductivity limits for EV coolants, creating demand for specialized formulations that balance thermal performance with electrical safety requirements. India's automotive aftermarket growth, supported by PLI and PM E-DRIVE policies, generates sustained demand for both conventional and EV-specific coolant formulations as domestic OEMs establish thermal management supply chains. Japan and South Korea contribute to advanced EV technology development, which requires specialized dielectric coolants for battery and power electronics cooling applications.

South America emerges as the fastest-growing region, with a 6.67% CAGR through 2031, benefiting from Argentina-Brazil automotive integration policies that streamline vehicle homologation and component approval processes, while expanding commercial vehicle production to meet growing e-commerce demand. The region's growth acceleration stems from mutual recognition agreements that reduce regulatory barriers for coolant suppliers serving both major markets, creating economies of scale for regional operations.

North America and Europe represent mature markets with moderate growth rates, as the adoption of extended-life coolants reduces replacement frequency, while regulatory requirements drive specification upgrades toward premium formulations. European markets are facing particular transformation pressure from REACH regulations and PFAS restrictions, which favor bio-based coolant alternatives, creating opportunities for suppliers with sustainable chemistry capabilities. North American fleet operators increasingly adopt extended-life coolants to reduce maintenance costs, creating structural headwinds for aftermarket volume growth while benefiting OEM fill applications.

- BASF SE

- Dow Inc.

- Chevron Corporation

- ExxonMobil Corp.

- Shell plc

- TotalEnergies SE

- China Petroleum and Chemical Corp. (Sinopec)

- BP plc (Castrol)

- Saudi Aramco Group

- PETRONAS (Petroliam Nasional Berhad)

- Cummins Inc.

- Fuchs Petrolub SE

- Motul S.A.

- Old World Industries, LLC (PEAK)

- Recochem Corporation

- CCI Corporation

- Prestone Products Corporation

- Evans Cooling Systems Inc.

- AMSOIL Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Vehicle Parc And Aging Fleet

- 4.2.2 OEM Push For Long-Life OAT/HOAT Coolants

- 4.2.3 Growth Of Emerging-Market Vehicle Production

- 4.2.4 Adoption Of High-Performance ICE Designs

- 4.2.5 Demand For Dielectric Thermal-Management Fluids In EVs

- 4.2.6 Environmental Shift Toward Bio-Based Glycerin Coolants

- 4.3 Market Restraints

- 4.3.1 Raw Material (Glycol) Price Volatility

- 4.3.2 Extended Drain Intervals Cutting Aftermarket Volume

- 4.3.3 Sealed Cooling Loops in Next-Gen EV Platforms

- 4.3.4 Toxicity-Driven Ethylene-Glycol Restrictions

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Product Type

- 5.1.1 Ethylene Glycol

- 5.1.2 Propylene Glycol

- 5.1.3 Glycerin

- 5.1.4 Others

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Bus and Coaches

- 5.3 By Technology

- 5.3.1 Inorganic Additive Technology (IAT)

- 5.3.2 Organic Additive Technology (OAT)

- 5.3.3 Hybrid Organic Acid Technology (HOAT)

- 5.4 By End User

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Dow Inc.

- 6.4.3 Chevron Corporation

- 6.4.4 ExxonMobil Corp.

- 6.4.5 Shell plc

- 6.4.6 TotalEnergies SE

- 6.4.7 China Petroleum and Chemical Corp. (Sinopec)

- 6.4.8 BP plc (Castrol)

- 6.4.9 Saudi Aramco Group

- 6.4.10 PETRONAS (Petroliam Nasional Berhad)

- 6.4.11 Cummins Inc.

- 6.4.12 Fuchs Petrolub SE

- 6.4.13 Motul S.A.

- 6.4.14 Old World Industries, LLC (PEAK)

- 6.4.15 Recochem Corporation

- 6.4.16 CCI Corporation

- 6.4.17 Prestone Products Corporation

- 6.4.18 Evans Cooling Systems Inc.

- 6.4.19 AMSOIL Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment