|

市场调查报告书

商品编码

1686639

合成钻石:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Synthetic Diamond - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

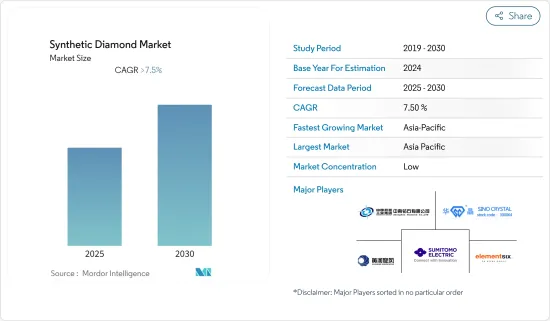

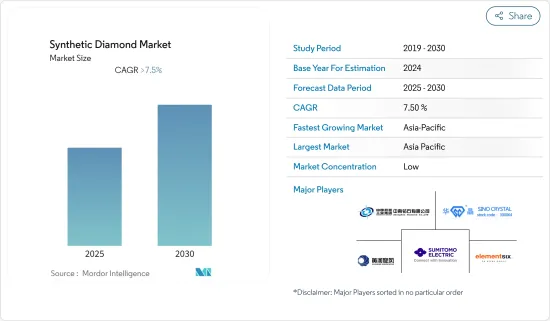

预测期内,合成钻石市场预计将以超过 7.5% 的复合年增长率成长。

预计年终合成钻石市场规模将达202.779亿美元。

由于供应链和市场中断,COVID-19 疫情对合成钻石市场造成了影响。在政府封锁期间,各种终端用户活动暂时停止。不过,市场在 2021 年已经復苏。

主要亮点

- 短期内,电子和半导体应用需求的上升以及超磨粒需求的上升正在推动市场需求。

- 合成钻石的复杂製造过程阻碍了市场的成长。

- 增材製造、在整形外科医疗设备中的应用以及薄而宽的 CVD 金刚石板的引入可能会在未来几年为市场创造机会。

- 预计亚太地区将主导市场,并在预测期内以最高的复合年增长率成长。

合成钻石市场趋势

建筑业主导毛坯房市场

- 合成钻石广泛应用于石材和建设产业。合成钻石可用于所有磨料表面的切割刀片解决方案。合成钻石在建设产业的其他用途包括锯切、切割、研磨、舱壁切割和隧道钻孔。

- 合成钻石极为坚硬,特别适合切割花岗岩和大理石等立体石材。合成钻石也可以用于钻孔应用,以快速钻孔。

- 亚太地区建筑业约占全球建筑支出的45%,预计将成为全球最大、成长最快的产业。

- 例如,中国政府启动了一项大规模建设计画,包括未来十年将2.5亿人口迁移到新的特大城市,大大扩展未来建筑材料的范围并改善建筑物的性能。

- 随着日本举办的活动,日本的建设产业预计将蓬勃发展。世博会将于2025年在大阪举办,建设将主要由重建和自然灾害后的復原所推动。东京车站的两栋高层建筑,一栋37层楼、230公尺高的办公大楼计划于2021年竣工,一栋61层、390公尺高的办公大楼计划于2027年竣工。

- 除亚太地区外,美国是世界上最大的建筑业地区之一。根据美国人口普查局的数据,2021年美国每年的新建筑金额将达到16264.44亿美元,2020年为14995.70亿美元。

- 预计这些因素将在预测期内推动全球合成钻石市场的成长。

亚太地区占市场主导地位

- 亚太地区占据全球市场占有率的主导地位。由于中国许多终端用户产业的製造活动活跃,合成钻石在中国拥有庞大的市场。

- 根据中国今年1月发布的五年规划,预计2022年中国建设产业的成长率将达到6%左右。中国计划增加装配式建筑的建设,以减少建筑工地的污染和废弃物。

- 该国不仅满足了国内对电子产品的需求,还将其电子产品出口到其他国家。随着中产阶级可支配收入的增加,对电子产品的需求预计会增加。预计这将推动所研究市场的发展。中国是半导体晶片的净进口国,生产的半导体不到全球所需半导体的20%。作为国家雄心勃勃的「中国製造2025」计画的一部分,中国政府宣布决心在2030年实现产值3050亿美元,满足80%的国内需求。

- 电子产业的兴起正在推动散热器用合成钻石的需求。此外,预计2025年印度将成为全球第五大家电和电子产业国。

- 此外,预计2021年日本电子业国内产值将达到10,9322亿日圆(约997.6亿美元),年增与前一年同期比较%。预计2022年国内工业产值将达到11,1614亿日圆(约902.2亿美元),比与前一年同期比较增长2%,可能会推动国内电子业对合成钻石的需求。

- 由于这些因素,预计预测期内亚太地区合成钻石市场将稳定成长。

合成钻石产业概况

合成钻石市场比较分散。市场的主要参与者包括(不分先后顺序)中南钻石、河南黄河旋风、郑州华晶钻石、Element Six UK Ltd、住友电气工业株式会社。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电子和半导体应用的需求不断增长

- 超磨粒的需求不断增加

- 限制因素

- 复杂的製造工艺

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 抛光

- 珠宝饰品

- 电子产品

- 卫生保健

- 其他抛光类型

- 粗糙的

- 建造

- 矿业

- 石油和天然气

- 其他毛坯类型

- 抛光

- 製造过程

- 高压高温 (HPHT)

- 化学气相沉积 (CVD)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 其他北美国家

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 南美洲其他地区

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 合併、收购、合资、合作和协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Adamas One Corp.

- Applied Diamond Inc

- Element Six UK Ltd

- Henan Huanghe Whirlwind Co., Ltd.

- ILJIN DIAMOND CO., LTD.

- New Diamond Technology

- Pure Grown Diamonds(PGD)

- Sumitomo Electric Industries, Ltd.

- Swarovski

- Zhengzhou Sino-Crystal Diamond Co., Ltd.

- Zhongnan Diamond Co., Ltd.

第七章 市场机会与未来趋势

- 增材製造上的应用

- 整形外科医疗设备应用

- 推出薄型和宽型 CVD 金刚石板

The Synthetic Diamond Market is expected to register a CAGR of greater than 7.5% during the forecast period.

The synthetic diamond market is expected to reach USD 20,277.90 million by the end of this year.

The COVID-19 pandemic affected the synthetic diamond market because of supply chain and market disruption. Various end-user activities were temporarily stopped during the government-imposed lockdowns. However, the market rebounded back in 2021.

Key Highlights

- Over the short term, increasing demand from electronics and semiconductors applications and growing demand for super abrasives are some driving factors stimulating the market demand.

- The complex manufacturing process of synthetic diamonds is hindering the market's growth.

- Applications in additive manufacturing and orthopedic medical devices and the introduction of thin and wide CVD diamond plates are likely to create opportunities for the market in the future.

- The Asian-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Synthetic Diamond Market Trends

Construction Segment to Dominate the Rough Type

- Synthetic diamonds are widely used in the stone and construction industry. They are used in cutting blade solutions for all abrasive surfaces. Other applications of synthetic diamonds in the construction industry include sawing, cutting, grinding, diaphragm wall cutting, tunneling, etc.

- The extreme hardness of synthetic diamond makes it particularly apt for cutting dimension stones, such as granite and marble. Synthetic diamonds can also be used for boring applications, which help rapidly drill holes.

- The construction industry in Asia-Pacific is expected to become the largest and fastest-growing industry in the world, with approximately 45% share of global construction spending ion.

- For instance, the Chinese government rolled out massive construction plans, including making provisions for the movement of 250 million people to new megacities over the next ten years, creating a major scope for construction materials in the future to enhance the building properties.

- The Japanese construction industry is expected to bloom due to events that will be hosted in the country. Osaka will host the World Expo in 2025. Construction is mostly driven by redevelopment and recovery from natural disasters. Two high-rise towers for Tokyo Stations, a 37-story, 230m tall office tower, were expected to be completed in 2021, and a 61-story, 390m tall office tower is due for completion in 2027.

- Apart from Asia-Pacific, the United States has one of the world's largest construction industries. According to the United States Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,626,444 million in 2021, compared to USD 1,499,570 million in 2020.

- Owing to all these factors, the market for synthetic diamonds is likely to grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asian-Pacific region dominated the global market share. Owing to the high manufacturing activities by numerous end-user industries in the country, synthetic diamonds have a huge market in China.

- According to China's five-year plan unveiled in January 2022, the construction industry in the country is estimated to register a growth rate of approximately 6% in 2022. China plans to increase the construction of prefabricated buildings to reduce pollution and waste from construction sites.

- The country serves the domestic demand for electronics and exports electronic output to other countries. With an increase in disposable incomes of the middle-class population, the demand for electronic products is projected to increase. This factor is expected to drive the market studied. China is a net importer of semiconductor chips, manufacturing less than 20% of the semiconductors used. As part of the country's ambitious 'Made in China 2025' plan, the Chinese government has announced its decision to reach an output of USD 305 billion by 2030 and meet 80% of its domestic demand.

- The rising electronics sector is driving the demand for synthetic diamonds for heat sinks. India is also expected to become the fifth-largest consumer electronics and appliances industry globally by 2025.

- Moreover, the domestic production by the Japanese electronics industry was estimated to witness a growth rate of 11% Y-o-Y in 2021 to reach JPY 10,932.2 billion (~USD 99.76 billion). Domestic industry production is estimated to reach JPY 11,161.4 billion (~USD 90.22 billion) in 2022, with a growth rate of 2% Y-o-Y, which may enhance the demand for synthetic diamonds from the country's electronics sector.

- Due to all such factors, the market for synthetic diamonds in the Asian-Pacific region is expected to have steady growth during the forecast period.

Synthetic Diamond Industry Overview

The synthetic diamond market is fragmented in nature. Some of the major players in the market include Zhongnan Diamond Co. Ltd, Henan Huanghe Whirlwind Co. Ltd, Zhengzhou Sino-Crystal Diamond Co. Ltd, Element Six UK Ltd, and Sumitomo Electric Industries, Ltd, amongst others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Electronics and Semiconductors Applications

- 4.1.2 Growing Demand for Super Abrasives

- 4.2 Restraints

- 4.2.1 Complex Manufacturing Process

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polished

- 5.1.1.1 Jewelry

- 5.1.1.2 Electronics

- 5.1.1.3 Healthcare

- 5.1.1.4 Other Polished Types

- 5.1.2 Rough

- 5.1.2.1 Construction

- 5.1.2.2 Mining

- 5.1.2.3 Oil and Gas

- 5.1.2.4 Other Rough Types

- 5.1.1 Polished

- 5.2 Manufacturing Process

- 5.2.1 High Pressure, High Temperature (HPHT)

- 5.2.2 Chemical Vapor Deposition (CVD)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 ASEAN Countries

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 GCC Countries

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adamas One Corp.

- 6.4.2 Applied Diamond Inc

- 6.4.3 Element Six UK Ltd

- 6.4.4 Henan Huanghe Whirlwind Co., Ltd.

- 6.4.5 ILJIN DIAMOND CO., LTD.

- 6.4.6 New Diamond Technology

- 6.4.7 Pure Grown Diamonds (PGD)

- 6.4.8 Sumitomo Electric Industries, Ltd.

- 6.4.9 Swarovski

- 6.4.10 Zhengzhou Sino-Crystal Diamond Co., Ltd.

- 6.4.11 Zhongnan Diamond Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Applications in Additive Manufacturing

- 7.2 Applications in Orthopedic Medical Devices

- 7.3 Introduction of Thin and Wide CVD Diamond Plates