|

市场调查报告书

商品编码

1687047

北美聚氯乙烯(PVC)-市场占有率分析、产业趋势与成长预测(2025-2030年)North America Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

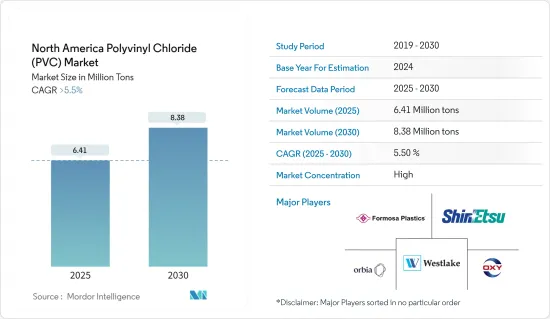

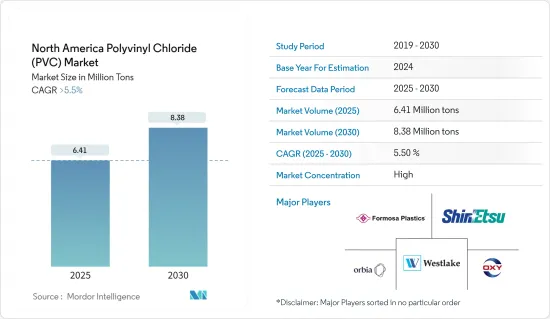

预计 2025 年北美聚氯乙烯市场规模将达到 641 万吨,预计 2030 年将达到 838 万吨,预测期内(2025-2030 年)的复合年增长率将超过 5.5%。

由于各国政府实施禁令和限制,COVID-19 疫情对北美建筑业产生了重大影响,限制了该地区聚氯乙烯市场的成长。然而,自 2021 年这些限制解除以来,该产业一直蓬勃发展。这很可能使市场在预测期内恢復到其研究的成长轨迹。

主要亮点

- 从中期来看,建设产业塑胶使用量的增加以及医疗保健行业的应用不断增长预计将推动北美聚氯乙烯市场的发展。

- 另一方面,聚氯乙烯对人类和环境有害,预计将减缓未来几年研究市场的成长。

- 此外,增加聚氯乙烯的回收利用及其在电动车中的使用可能会创造未来的机会。

- 在北美,美国是最大的聚氯乙烯生产国,由于使用聚氯乙烯的产业可能会进一步成长,未来美国很可能仍将是最大的生产国。

北美聚氯乙烯(PVC)市场趋势

建设产业需求不断增长

- PVC 管道已在建筑施工中使用了 60 多年,因为它们在製造过程中可以节省大量能源,运输成本低,并且使用寿命安全、免维护。这些管道广泛用于水、废弃物和废水管道系统,因为它们没有积聚、结垢、腐蚀和点蚀,并且表面光滑,从而减少了泵送所需的能量。

- PVC地板材料具有多种优点,包括耐用性、美观效果的灵活性、易于安装、易于清洁和可回收性。这就是地板材料能使用这么多年的原因。 PVC 在建设产业的另一个用途是作为屋顶材料。人们之所以使用它们,主要是因为它们的使用寿命超过 30 年,几乎不需要维护。

- 在独栋道路、桥樑和设施建设的推动下,北美建设产业预计将在未来几年经历温和成长。在美国,南部和西部是主要的成长地区,尤其是内华达州、德克萨斯州和新墨西哥州。在加拿大,在非建筑建筑復苏的支撑下,预计整体建设产业将在预测期内恢復成长。

- 美国在北美建设产业中占有很大的份额。除美国外,加拿大和墨西哥也是建筑业投资的重要贡献者。根据美国人口普查局的数据,2022 年 11 月美国建筑支出经季节性已调整的后预计年率为 1.8075 兆美元,比 10 月修订后的 10 亿美元高出 0.2%。

- 在加拿大,经济适用房倡议(AHI)、新建筑加拿大计划(NBCP)和加拿大製造等各种政府计划极大地促进了该行业的扩张。此外,作为「投资加拿大计画」的一部分,加拿大政府宣布计画在2028年在加拿大的基础建设上投资约1,400亿美元。

- 建筑业是墨西哥经济的支柱。过去50年来,墨西哥的都市化速度比大多数经济合作暨发展组织国家都要快。此外,墨西哥社会住宅计画(Programa De 住宅 Social)预算预计将在 2021 年增加 179%,达到 2 亿美元,以支持建筑支出。此外,宽鬆的贷款条件和优惠的房屋抵押贷款制度预计将有利于该国的住宅建设。

- 由于上述所有原因,未来几年建筑业很可能需要更多的聚氯乙烯。

美国主导市场成长

美国拥有北美最大的建筑业之一。根据美国人口普查局的数据,2021 年美国新建设年价值将达到 16,264.44 亿美元,而 2020 年为 14,995.7 亿美元。

- 此外,根据美国人口普查局的统计,2022年11月美国非住宅建筑金额达9,301.35亿美元,较2021年11月增加11.79%。

- 聚氯乙烯(PVC)因其重量轻而被广泛应用于汽车工业。 PVC具有优良的柔韧性、热稳定性、阻燃性和高光泽度。聚氯乙烯具有优良的柔韧性、热稳定性、耐火性和光泽度,可以透过挤出、射出成型、压塑和吹塑成型等成型方法製成各种软质和硬质製品。美国是仅次于中国的第二大汽车生产国。 2021年产量为916万辆,较2020年的880万辆成长3.8%。

- 不过,美国是第二大电动车市场。根据 EV Revenues 的数据,2021 年美国插电式汽车註册量为 6,566,900 辆,比 2020 年增加了 100%。 2022 年 7 月美国混合动力汽车(HEV) 销量为 63,366 辆,较 2021 年 7 月销量下降 14.7%。

- 预计所有上述因素都将在预测期内对市场产生重大影响。

北美聚氯乙烯(PVC)产业概况

北美聚氯乙烯市场集中在前五大公司手中。顶尖公司专注于为各个终端用户产业提供更好的材料。北美聚氯乙烯的主要生产商(排名不分先后)是台塑公司、工业、西方石油公司、奥比亚公司(Mexichem SAB de CV)和Westlake公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 扩大医疗保健和医疗设备产业的应用

- 建设产业需求增加

- 限制因素

- 对人类和环境的有害影响

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 进出口趋势

第五章市场区隔

- 产品类型

- 硬质PVC

- 透明硬质PVC

- 不透明硬质PVC

- 软质PVC

- 透明柔性PVC

- 不透明软质PVC

- 低烟聚氯乙烯

- 氯化聚氯乙烯

- 硬质PVC

- 应用

- 管道和配件

- 薄膜和片材

- 电线电缆

- 瓶子

- 型材、软管、管材

- 其他用途

- 最终用户产业

- 卫生保健

- 车

- 电气和电子

- 包装

- 鞋类

- 建筑与施工

- 其他最终用户产业

- 地区

- 美国

- 加拿大

- 墨西哥

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- Amco Polymers

- Aurora Plastics LLC(Nautic Partners, LLC.)

- Formosa Plastics Corporation

- Ineos

- LG Chem

- Occidental Petroleum Corporation

- Orbia(Mexichem SAB de CV)

- SABIC

- Shin-Etsu Chemical Co. Ltd.

- Westlake Corporation

第七章 市场机会与未来趋势

- 回收PVC

- 加速电动车的使用

The North America Polyvinyl Chloride Market size is estimated at 6.41 million tons in 2025, and is expected to reach 8.38 million tons by 2030, at a CAGR of greater than 5.5% during the forecast period (2025-2030).

The outbreak of COVID-19 significantly affected the North American construction sector due to government-imposed bans and restrictions, thereby limiting the growth of the polyvinyl chloride market in the region. But since these restrictions were lifted in 2021, the sector has been doing well. This is likely to bring the market back to the growth path that was studied during the forecast period.

Key Highlights

- Over the medium term, the increasing use of plastics in the construction industry and increasing applications in the healthcare industry are likely to drive the polyvinyl chloride market in North America.

- On the other hand, polyvinyl's harmful effects on people and the environment will slow the growth of the studied market over the next few years.

- Also, recycling polyvinyl chloride and using it more and more in electric cars could lead to a chance in the future.

- In North America, the United States is the biggest producer of polyvinyl chloride, and it is likely to stay the biggest producer in the coming years as well, since the industries that use it are likely to grow even more.

North America Polyvinyl Chloride (PVC) Market Trends

Growing Demand from the Construction Industry

- PVC pipes have been used in building and construction for over 60 years, as they offer valuable energy savings during production, low-cost distribution, and a safe, maintenance-free lifetime of service. These pipes are widely used for pipeline systems for water, waste, and drainage as they suffer no buildup, scaling, corrosion, or pitting, and they provide smooth surfaces, reducing the energy requirements for pumping.

- PVC flooring has several benefits, such as durability, freedom of aesthetic effects, ease of installation, ease of cleaning, recyclability, etc. Thus, its flooring has been used over the years. Another area in the building and construction industry where PVC is used is in roofing. It is used mainly due to its low maintenance requirements, as it lasts for more than 30 years.

- In the North American region, the construction industry is expected to witness moderate growth, supported by single-family roads and bridges and institutional construction in the coming years. In the United States, the southern and western regions are the key regions for growth, with Nevada, Texas, and New Mexico leading the growth prospects. In Canada, the overall construction industry is expected to resume its growth during the forecast period, supported by a rebound in non-building construction.

- The United States has a major share in the construction industry in North America. Apart from the United States, Canada and Mexico are also contributing significantly to the construction sector's investments. According to the US Census Bureau, during November 2022, construction spending in the United States was estimated at a seasonally adjusted annual rate of USD 1,807.5 billion, 0.2% more than the revised October estimate of USD billion.

- In Canada, various government projects, including the Affordable Housing Initiative (AHI), the New Building Canada Plan (NBCP), and Made in Canada, are set to support the expansion of the sector hugely. Additionally, as part of the "Investing in Canada Plan," the government has announced plans to invest nearly USD 140 billion in infrastructure developments in the country by 2028.

- The building and construction sector is the backbone of the Mexican economy. Over the last five decades, Mexico has urbanized faster than the majority of OECD (Organization for Economic Co-operation and Development) countries. Further, in Mexico, the Programa De Vivienda Social, or social housing program, had a budget increase of 179% to USD 200 million in 2021, thus supporting the construction spending. Moreover, the easy loan facilities and favorable mortgage schemes are expected to benefit residential construction in the country.

- Over the next few years, the construction and building industry is likely to need more polyvinyl chloride because of all of the above reasons.

The United States to Dominate the Market Growth

The United States has one of North America's largest construction industries. According to the United States Census Bureau, the annual value of new construction put in place in the United States accounted for USD 1,626,444 million in 2021, compared to USD 1,499,570 million in 2020.

- Furthermore, non-residential construction in the United States reached USD 930,135 million in November 2022, which is an increase of 11.79 percent over November 2021, according to U.S. Census Bureau statistics.

- Because of its lightweight, polyvinyl chloride (PVC) is widely used in the automotive industry.PVC has good flexibility, thermal stability, fire resistance, and high gloss. PVC can be molded into various flexible and rigid products and supports extrusion, injection molding, compression molding, and blow molding. The United States is the second-largest automotive manufacturer after China. In 2021, the country produced 9.16 million units, an increase of 3.8% compared to 8.8 million units in 2020.

- However, the United States is the second-largest market for electric vehicles. In the United States, according to the EV Revenues, in 2021, the country's total plug-in vehicle registrations accounted for around 6,56,900 units, registering a growth rate of 100% compared to 2020. In July 2022, 63,366 hybrid electric vehicles (HEVs) were sold in the United States, registering a decline rate of 14.7% from sales in July 2021.

- During the forecast period, all of the above factors are expected to have a big effect on the market that was looked at.

North America Polyvinyl Chloride (PVC) Industry Overview

The North American polyvinyl chloride market is consolidated among the top five players. The top companies have been focusing on providing better materials for various end-user industries. Major manufacturers (not in any particular order) of North American PVCs are Formosa Plastics Corporation, Shin-Etsu Chemical Co. Ltd., Occidental Petroleum Corporation, Orbia (Mexichem SAB de CV), and Westlake Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in the Healthcare and Medical Devices Industries

- 4.1.2 Rising Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Hazardous Impact on Humans and the Environment

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import-Export Trends

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Product Type

- 5.1.1 Rigid PVC

- 5.1.1.1 Clear Rigid PVC

- 5.1.1.2 Non-clear Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.2.1 Clear Flexible PVC

- 5.1.2.2 Non-clear Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.1.1 Rigid PVC

- 5.2 Application

- 5.2.1 Pipes and Fittings

- 5.2.2 Films and Sheets

- 5.2.3 Wires and Cables

- 5.2.4 Bottles

- 5.2.5 Profiles, Hoses, and Tubings

- 5.2.6 Other Applications

- 5.3 End-user Industry

- 5.3.1 Healthcare

- 5.3.2 Automotive

- 5.3.3 Electrical and Electronics

- 5.3.4 Packaging

- 5.3.5 Footwear

- 5.3.6 Building and Construction

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Amco Polymers

- 6.4.2 Aurora Plastics LLC (Nautic Partners, LLC.)

- 6.4.3 Formosa Plastics Corporation

- 6.4.4 Ineos

- 6.4.5 LG Chem

- 6.4.6 Occidental Petroleum Corporation

- 6.4.7 Orbia (Mexichem SAB de CV )

- 6.4.8 SABIC

- 6.4.9 Shin-Etsu Chemical Co. Ltd.

- 6.4.10 Westlake Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recycling of PVC

- 7.2 Accelerating Usage in Electric Vehicles