|

市场调查报告书

商品编码

1687083

纸板包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

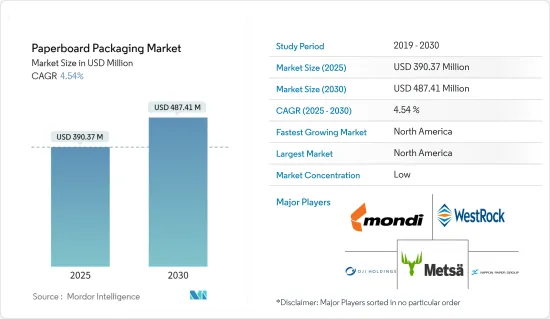

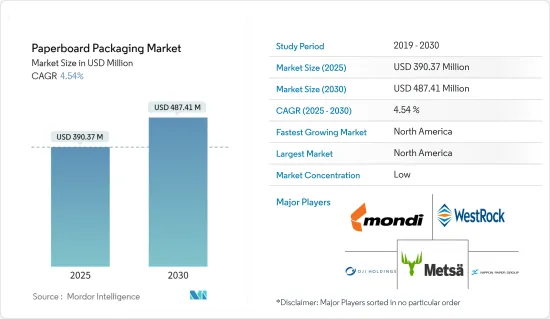

纸板包装市场规模预计在 2025 年为 3.9037 亿美元,预计到 2030 年将达到 4.8741 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.54%。

主要亮点

- 纸板包装是包装食品市场的首选。它用于各种食品,包括汤、调味品和乳製品。纸板通常覆盖有聚合物或塑胶以保持其清洁和防污。与玻璃或金属相比,它可以减轻最终产品的总重量,同时保持食物的新鲜度。纸板是一种完美的包装材料,因为它没有气味和味道。

- 越来越明显的是,当谈到包装时,消费者更重视可回收性和生物分解性,而不是再生性。这显示消费者越来越担心包装废弃物对环境的未来影响。美国超过 60% 的社区收集和回收纸板包装。公司也正在朝着推出回收纸板产品的方向发展。例如,Cascades推出了由可回收纤维製成的瓦楞纸托盘,SIG开发了利用消费后废弃物製成的再生聚合物纸箱。

- 此外,根据联合国粮食及农业组织(FAO)2023年11月发布的报告,中国国内纸和纸板领域的生产线将对全球贸易动态产生重大影响。中国加强製造能力(特别是纸浆采购能力)的战略倡议对国际供应链构成了挑战。因此,预计纸板市场将在中国快速成长的生产能力和出口潜力推动下需求上升的带动下实现成长。

- 不过,联合国欧洲经济委员会的报告表示,由于需求减弱和价格下跌,欧洲纸张和纸板产量将在2023年上半年下降,迫使部分机器关闭。预计 2023 年纸和纸板产量将下降 2.7% 至 9,010 万吨。停产可能会影响纸板市场,因为它可能会收紧供应并影响价格动态。

- 有几个方面正在推动纸板包装行业的发展,包括对永续和环保包装材料的需求不断增加、电子商务和网路购物的兴起、以及食品和饮料行业的增长。此外,先进的包装和製造流程使该行业能够生产出高品质、客製化的包装解决方案,满足不同行业和客户的特定需求。

纸板包装市场趋势

食品和饮料领域的需求增加

- 食品和饮料产业是纸板包装的主要终端用户,占全球市场占有率的一半以上。涂布未漂白纸板广泛应用于饮料包装,显示其多功能性和耐用性。此外,冷冻食品消费的成长趋势预计将推动对纸板包装的需求,为纸板包装市场创造新的机会,以满足食品和饮料行业不断变化的消费者需求。

- 折迭纸盒在食品和饮料行业中广泛应用,为多种产品提供多功能、经济高效的包装解决方案。折迭纸盒可以保持谷物、零食和糖果零食等干货的新鲜度,同时为品牌和产品资讯提供充足的空间。轻质而坚固的结构可实现高效的储存和运输,有助于简化物流业务。此外,折迭式纸盒易于打开和关闭,为消费者提供了更大的便利,并延长了产品的商店寿命。

- 根据美国人口普查局的资料,美国食品和饮料企业的每月销售额正在创造可观的收益,证实该行业的庞大消费正在推动对纸板包装的需求。随着製造商寻求永续且经济高效的解决方案来满足其食品和饮料包装需求,该国纸板包装市场的成长预计将上升。

- 生活方式的改变和年轻消费者数量的增加导致对品牌和包装产品的需求激增。根据Appmysite在2024年2月发布的消息,美国三分之一的顾客每週至少使用两次线上食品订购服务。因此,食品宅配和零售业对便利性、环保包装选择的需求日益增长,预计将推动对纸板包装等永续、多功能包装解决方案的需求。

- 例如,2023 年 11 月,主要企业Ariake 宣布将把食品无菌填充到 SIG 纸盒包装中。 Ariake 打算透过推出一系列采用 SIG Slimline 纸盒包装的优质液体汤来扩大其汤品组合。

- 由于人口成长、可支配收入增加和对永续性的重视程度不断提高等因素,印度、中国和日本等国家对纸板包装的需求正在增加。在印度,不断壮大的中产阶级和环保包装的监管要求正在推动食品和饮料包装对纸板解决方案的需求。中国作为全球製造地的地位及其不断增长的城市人口正在推动食品和饮料行业对纸板包装的强劲需求。

- 同样,在永续性和品质至关重要的日本,食品和饮料行业依靠纸板包装来满足消费者对环保、高品质包装解决方案的偏好。总的来说,这些国家为纸板包装製造商提供了绝佳的机会,使他们能够满足食品和饮料行业日益增长的需求,同时实现永续性目标。

北美地区成长率稳定

- 北美仍然是纸板包装产品的主要市场之一。北美食品和饮料行业严重依赖纸板包装,包括折迭纸盒和瓦楞纸板。这些包装解决方案耐用、多功能且环保,是运输和储存各种食品和饮料的理想选择。无论是谷物盒包装、果汁容器或冷冻食品包装,纸板材料对于确保产品完整性同时保持永续性目标至关重要。

- 此外,折迭纸盒的可自订特性使品牌能够在商店以有吸引力的方式来展示他们的产品,从而增加消费者的吸引力并在竞争激烈的市场中推动销售。此外,瓦楞纸箱是北美食品和饮料行业必不可少的二级或三级包装,为产品在供应链中移动时提供额外的保护并提供品牌机会。

- 北美电子商务市场严重依赖纸板包装市场来实现安全且有效率的产品运输。瓦楞纸箱对于在运输过程中保护产品、减少破损以及最大限度地减少因包装篡改而造成的退货至关重要。随着网路购物的迅猛增长,确保产品完好无损地送达客户已成为首要任务。瓦楞纸箱能够提供坚固的保护,避免衝击和搬运事故,从而确保货物从仓库到门的完整性。可自订的设计可对各种尺寸和形状的产品进行安全包装,从而提高物流链的效率。

- 根据联合国粮食及农业组织的资料,2023年美国纸和纸板产能为54,183公吨。儘管市场动态不断变化,但美国稳定的纸板生产能力凸显了该行业的弹性和稳定性。这种稳定的生产能力代表了各个领域对纸板产品的持续需求,也反映了美国强大的製造业基础设施和持续满足国内和国际市场需求的努力。

- 人们对塑胶使用的环境问题的日益关注,加上组织和政府推广永续包装材料的倡议,预计将在未来几年推动纸板市场的扩张。

- 此外,市场先驱者正透过参与併购和研发策略,越来越多地投资于创新和客製化的包装解决方案。例如,2023 年 8 月,百事可乐宣布将在北美采用纸板作为其饮料多件包装。该公司的目标是实现 2025 年的可回收性目标。

纸板包装产业概况

纸板包装是一种坚固、轻巧、用途广泛的解决方案,同时也具有成本效益。可回收的特性使纸板成为永续包装的可行选择,尤其是与塑胶等替代品相比。这种适应性进一步凸显了其对众多终端用户产业的适用性。

全球纸板包装市场高度分散。市场领导者正专注于新产品创新,并着手进行策略性收购以扩大其市场占有率。市场的主要企业包括日本製纸工业公司、Mondi、Metsa Board、Westrock、Oji Holdings 和 ITC Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争威胁

第五章 市场动态

- 市场驱动因素

- 电子商务产业需求强劲

- 扩大轻质材料的使用

- 市场限制

- 森林砍伐对纸包装的影响

- 营运成本增加

- 纸板进出口场景

- 纸板出口:金额和数量

- 纸板进口:金额和数量

第六章 市场细分

- 按年级

- 纸板

- 瓦楞纸板原纸

- 其他等级

- 依产品类型

- 折迭式纸盒

- 瓦楞纸箱

- 其他类型

- 按最终用户产业

- 食物

- 饮料

- 卫生保健

- 个人护理

- 家居用品

- 电器

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 亚洲

- 中国

- 日本

- 印度

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- International Paper Company

- Mondi Plc

- Smurfit Kappa Group

- DS Smith Plc

- WestRock Company

- Packaging Corporation of America

- Cascades Inc.

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Rengo Co. Ltd

- Graphic Packaging International

- Metsa Board Oyj

- Sonoco Products Company

- Visy Industries

- Seaboard Folding Box Company Inc.

第八章投资分析

第九章:未来市场展望

The Paperboard Packaging Market size is estimated at USD 390.37 million in 2025, and is expected to reach USD 487.41 million by 2030, at a CAGR of 4.54% during the forecast period (2025-2030).

Key Highlights

- Paperboard packaging is the preferred option in the packaged food market. It can be found in various foods, including soups, seasonings, and dairy products. Paperboard is usually covered with polymers or plastics to keep it clean and unspoiled. Compared to glass and metal, it helps reduce the final product's total weight while maintaining the freshness of the food product. Paperboard is the perfect packing material because of its odor and taste neutrality.

- It is becoming increasingly clear that consumers value recyclability and biodegradability over reusability regarding packaging. This indicates a growing concern among consumers about the future environmental impact of packaging waste. More than 60% of communities in the United States collect and recycle paperboard packaging. Companies are also taking steps to introduce recyclable paperboard products. For instance, Cascades has launched a cardboard tray made from recyclable fibers, while SIG has developed cartons made from recycled polymers that use post-consumer waste.

- Furthermore, according to the FAO's (Food and Agriculture Organization of United Nations) report published in November 2023, China's domestic production line in the paper and paperboard sectors is poised to impact global trade dynamics significantly. With a focus on bolstering its manufacturing capabilities, especially in pulp sourcing, China's strategic initiatives pose challenges to international supply chains. Consequently, the paperboard market is anticipated to witness growth, driven by increased demand fueled by China's burgeoning production capabilities and potential exports.

- However, in the first half of 2023, according to the UNECE report, reduced demand and declining prices led to decreased paper and paperboard production in Europe, prompting the closure of several machines. The outlook for producing paper and paperboard in 2023 indicates a 2.7% decline to 90.1 million tonnes. This downtime is likely to impact the paperboard market by tightening supply and potentially affecting pricing dynamics.

- Several aspects, including the increasing demand for sustainable and eco-friendly packaging materials, the rise in e-commerce and online shopping, and the growth of the food and beverage industry, drive the development of the paperboard packaging industry. Additionally, technological advancements and manufacturing processes have enabled the industry to produce high-quality and customized packaging solutions that serve the specific needs of different industries and customers.

Paperboard Packaging Market Trends

Increasing Demand from Food and Beverage Segment

- The food and beverage industry is the primary end-user of paperboard packaging, commanding over half of the global market share. The coated, unbleached paperboard has extensive use in packaging beverages, showcasing its versatility and durability. Furthermore, the growing trend towards frozen food consumption is expected to fuel demand for folding carton packaging, presenting additional opportunities for the paperboard packaging market to cater to evolving consumer needs in the food and beverage industry.

- Folding cartons find extensive application within the food and beverage industry, offering a versatile and cost-effective packaging solution for a wide range of products. Folding cartons preserve product freshness for dry goods such as cereals, snacks, and confectionaries while providing ample space for branding and product information. Their lightweight yet sturdy construction ensures efficient storage and transportation, contributing to streamlined logistics operations. Additionally, folding cartons offer consumer convenience through easy opening and reclosing features, enhancing user experience and product longevity on store shelves.

- According to data from the United States Census Bureau, the monthly sales of the US food and beverages store, which generate substantial revenue, underscores the vast consumption within the industry, driving the demand for paperboard packaging. As manufacturers seek sustainable and cost-effective solutions to meet the packaging needs of food and beverage products, the growth of the paperboard packaging market in the country is set to rise.

- Shifts in lifestyle and the increasing number of young consumers are driving a surge in demand for branded and packaged products. According to a news published by Appmysite in February 2024, one in three customers in the United States use online food ordering services at least twice a week. Consequently, the demand for sustainable and versatile packaging solutions, such as paperboard packaging, is expected to rise with the escalating need for convenient and eco-friendly packaging options in the food delivery and retail sectors.

- For instance, in November 2023, Ariake, Japan's leading company of livestock-derived natural seasonings, announced that it would fill food products aseptically in SIG carton packs. Ariake intends to grow its broth portfolio with a new range of premium liquid broths packaged in SIG Slimline carton packs.

- Across countries like India, China, and Japan, the demand for paperboard packaging is propelled by factors including population growth, rising disposable incomes, and an increased focus on sustainability. In India, the burgeoning middle class and regulatory mandates for eco-friendly packaging are boosting demand for paperboard solutions in food and beverage packaging. China's status as a global manufacturing hub and its expanding urban population drive robust demand for paperboard packaging in the food and beverage sector.

- Similarly, in Japan, where sustainability and quality are paramount, the food and beverage industry relies on paperboard packaging to meet consumer preferences for eco-friendly and high-quality packaging solutions. Overall, these countries present significant opportunities for paperboard packaging manufacturers as they cater to the growing needs of the food and beverage industry while aligning with sustainability goals.

North America to Witness Steady Growth Rate

- North America continues to be one of the leading markets for paperboard packaging products, owing to the presence of many players operating in the country. North America's food and beverage industry heavily relies on paperboard packaging, including folding cartons and corrugated boxes, for its products. These packaging solutions offer durability, versatility, and eco-friendliness, making them ideal for transporting and storing a wide range of food and beverage items. Whether it's cereal box packaging, juice containers, or frozen food packaging, paperboard materials are crucial in ensuring product integrity while maintaining sustainability goals.

- Additionally, the customizable nature of folding cartons allows brands to showcase their products attractively on store shelves, enhancing consumer appeal and driving sales in the competitive market. Furthermore, corrugated boxes serve as essential secondary or tertiary packaging in the North American food and beverage industry, providing additional layers of protection and branding opportunities for products as they move through the supply chain.

- The e-commerce market in North America relies heavily on the paperboard packaging market for safe and efficient product transportation. Corrugated boxes are crucial in safeguarding products during transit, reducing damage, and minimizing returns due to tampered packaging. With the exponential growth of online shopping, ensuring that products reach customers intact is paramount. Corrugated boxes provide sturdy protection against impacts and handle mishaps, maintaining the integrity of goods from warehouse to doorstep. Their customizable design allows for secure packaging tailored to various product sizes and shapes, enhancing efficiency in the logistics chain.

- According to data from the Food and Agriculture Organization of the United Nations, the production capacity of paper and paperboard in 2023 in the United States was 54,183 MT. The consistent production capacity of paperboard in the United States underscores the industry's resilience and stability despite evolving market dynamics. This steady capacity signifies the enduring demand for paperboard products across various sectors, reflecting the nation's robust manufacturing infrastructure and ongoing commitment to meeting domestic and international market needs.

- Growing environmental concerns surrounding plastic usage, coupled with the efforts of organizations and governments to promote sustainable packaging materials, are anticipated to drive the expansion of the paperboard market in the coming years.

- Furthermore, market players increasingly invest in innovative and customized packaging solutions by engaging in mergers and acquisitions or research and development strategies. For instance, in August 2023, PepsiCo announced the adoption of paperboard for beverage multipacks in North America. The company is aiming to make progress on a 2025 recyclability target.

Paperboard Packaging Industry Overview

Paperboard packaging stands out as a robust, lightweight, and versatile solution, all while being cost-effective. Its recyclable nature makes paperboard a prime choice for sustainable packaging, especially when juxtaposed with alternatives like plastic. This adaptability further underscores its suitability across a myriad of end-user industries.

The global paperboard packaging market is highly fragmented. The major players operating in the market are focusing on innovating new products and entering into strategic acquisitions to strengthen their market presence. Some major players operating in the market include Nippon Paper Industries Co. Ltd, Mondi, Metsa Board, WestRock Company, Oji Holdings Corporation, and ITC Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Threat of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong demand from the e-commerce sector

- 5.1.2 Growing adoption of light weighting materials

- 5.2 Market Restraints

- 5.2.1 Effects of Deforestation on Paper Packaging

- 5.2.2 Increasing Operational Costs

- 5.3 Cartonboard EXIM Scenario

- 5.3.1 Cartonboard Exports By Value and Volume

- 5.3.2 Cartonboard Import By Value and Volume

6 MARKET SEGMENTATION

- 6.1 By Grade

- 6.1.1 Cartonboard

- 6.1.2 Containerboard

- 6.1.3 Other Grades

- 6.2 By Product Type

- 6.2.1 Folding Cartons

- 6.2.2 Corrugated Boxes

- 6.2.3 Other Types

- 6.3 By End-User Industry

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Personal Care

- 6.3.5 Household Care

- 6.3.6 Electrical Products

- 6.3.7 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Mondi Plc

- 7.1.3 Smurfit Kappa Group

- 7.1.4 DS Smith Plc

- 7.1.5 WestRock Company

- 7.1.6 Packaging Corporation of America

- 7.1.7 Cascades Inc.

- 7.1.8 Oji Holdings Corporation

- 7.1.9 Nippon Paper Industries Co., Ltd.

- 7.1.10 Rengo Co. Ltd

- 7.1.11 Graphic Packaging International

- 7.1.12 Metsa Board Oyj

- 7.1.13 Sonoco Products Company

- 7.1.14 Visy Industries

- 7.1.15 Seaboard Folding Box Company Inc.