|

市场调查报告书

商品编码

1687085

全球生物种子处理市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Biological Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

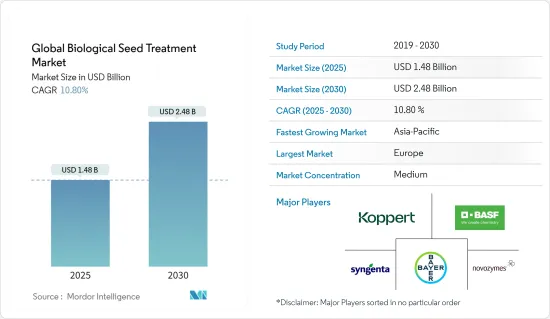

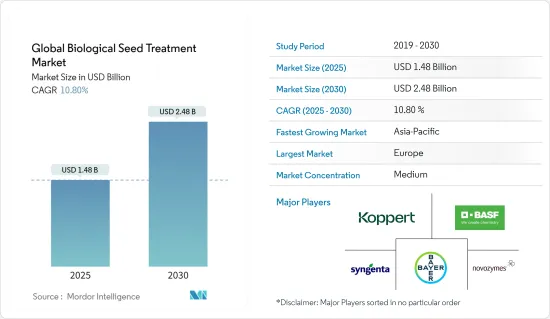

预计 2025 年全球生物种子处理市场规模为 14.8 亿美元,到 2030 年将达到 24.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.8%。

近年来,生物种子处理市场经历了显着成长。自然处理方法越来越被视为一种环保的种子处理方法。随着人们对化学肥料和杀虫剂对环境的影响的担忧日益加剧,生物种子处理提供了更永续、更环保的替代方案。消费者和政府越来越关注减少食品生产中的化学残留,并鼓励使用生物种子处理方法。 2024 年,美国农业部 (USDA) 开始透过新计画、伙伴关係、津贴奖励和额外的 1,000 万美元资金增加对有机农民的支持。这些项目旨在开发国内有机农产品市场,为转向有机生产的生产者提供在职培训,并减轻获得有机认证的财务负担。向有机农业的转变将进一步鼓励采用生物种子处理方法。

生物种子处理旨在保护种子,针对并控制幼苗早期的特定害虫和真菌疾病。此外,这些处理方法也用于多种作物,包括谷物、谷类、油籽和蔬菜,以控制多种害虫。生物引发技术的使用日益广泛,以提高生产力并降低投入成本,推动了生物种子处理技术的广泛应用。例如,印度农业技术大学研究人员在 2022 年进行的一项研究表明,永续农业中的生物引发更具成本效益且更环保。因此,预计在预测期内,越来越多地采用环保选择、有机农业趋势、有利的法规环境和支持性措施将推动市场成长。

生物种子处理市场趋势

谷物和谷类食品领域引领市场

谷物和谷类中生物种子处理的采用正在增加,为化学方法提供了可持续的替代方案。这一趋势是由全球推广生态友善农业方法和对有机农产品日益增长的需求所推动的。随着对植物蛋白的需求不断增加,特别是对小麦、大豆和玉米等谷类的需求,人们正在使用生物处理来最大限度地提高产量并改善作物品质。此外,小麦、大麦和玉米等作物易受多种土壤传播疾病的侵害,如镰刀菌赤霉病、幼苗猝倒病和根腐病。含有木霉菌、芽孢桿菌和假单胞菌的生物种子处理剂可以保护作物免受这些病原体的侵害,从而使作物更健康,减少对化学杀菌剂的需求。

在研究期间,有机谷物种植面积显着增加。根据有机农业实验室 (FiBL) 的数据,全球有机谷物种植面积从 2021 年的 540 万公顷增加到 2022 年的 560 万公顷。有机作物种植和综合虫害管理 (IPM) 的日益普及使得生物种子处理成为减少化学品使用的关键手段,并支持其在这一领域的使用。

正在进行的研究和开发重点是提高生物处理剂的有效性、保质期和成本效益。新的微生物菌株和创新的递送方法正在提高生物种子处理的性能。 2024 年,Indigo Ag 推出了突破性的 CLIPS 仪器。这种自动化免持系统节省了时间并减少了种子处理过程的麻烦,并有可能彻底改变标准生物种子处理应用。 CLIPS 是与 3BarBio 合作设计的,3BarBio 是第一个致力于农业产业的生物合约开发和製造组织。因此,有机农产品日益增长的重要性、农作物种植面积的增加以及技术的进步正在推动预测期内的市场成长。

欧洲主导市场

由于人们对永续性、环境保护和减少农业化学投入的浓厚兴趣,欧洲是生物种子处理的重要市场。欧盟正在主导生态友善农业实践,大大增加了对生物种子处理的需求。欧盟对农药使用实施了严格的规定,以减少食品中的化学残留,最大限度地减少对环境的影响。欧盟绿色交易和「从农场到餐桌」战略旨在到2050年使欧盟实现气候中和。这些策略强调永续粮食生产,减少对化学农药和化学肥料的依赖,鼓励采用生物和有机农业方法,并增加对生物种子处理的需求。

欧洲消费者越来越要求使用更少化学品和环保耕作方法生产的食品。根据有机农业实验室 (FiBL) 的数据,欧洲有机零售额从 2019 年的 503 亿美元成长到 2022 年的 558 亿美元。对有机农产品的需求鼓励农民采用永续的农业技术,包括生物种子处理。向有机食品的转变,尤其是在德国、法国和英国,正在推动大型和小型农业经营采用生物解决方案。

此外,市场上的新产品开发策略也支持了这一成长。 2023 年,先正达生物製品公司和 Unium Bioscience 联手为西北欧各地的农民提供突破性的生物种子处理解决方案 NUELLO iN。该产品自然增强了植物转化和利用大气中现有氮的能力,有可能减少 10% 或更多的氮使用量。这项创新将提高作物产量,促进植物和土壤健康,并为氮管理策略提供更大的灵活性,同时减少农业对环境的影响。因此,政府对永续性的支持不断增加,加上对有机农产品的需求和支持策略将有助于预测期内的市场成长。

生物种子处理行业概况

生物种子处理市场适度整合,主要企业包括先正达、拜耳作物科学、BASF、诺维信和 Koppert BV。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 有机农业的日益流行

- 使用生物引发技术提高效率

- 增加对研发活动的投资

- 市场限制

- 高成本、可得性低

- 政府监管障碍

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 功能

- 种子保护

- 种子增强

- 其他的

- 作物类型

- 粮食

- 油籽

- 蔬菜

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 泰国

- 越南

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 北美洲

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- BASF SE

- Bayer Cropscience AG

- Verdesian Life Sciences LLC

- Syngenta AG

- Floridienne Group

- Germains Seed Technology

- Koppert Biological Systems

- Novozymes

- Bioceres Crop Solutions Corp

- Locus AG

第七章 市场机会与未来趋势

The Global Biological Seed Treatment Market size is estimated at USD 1.48 billion in 2025, and is expected to reach USD 2.48 billion by 2030, at a CAGR of 10.8% during the forecast period (2025-2030).

The biological seed treatment market has experienced notable growth in recent years. Natural treatment methods are increasingly viewed as environmentally friendly options for seed treatment. With rising concerns about the environmental impact of chemical fertilizers and pesticides, biological seed treatments provide a more sustainable, eco-friendly alternative. Consumers and governments are focusing more on reducing chemical residues in food production, aiding the usage of biological seed treatments. In 2024, the United States Department of Agriculture (USDA) started increasing its support for organic farmers through new programs, partnerships, grant awards, and an additional USD10 million in funding. These programs aim to develop better markets for domestic organic products, offer hands-on training for producers transitioning to organic production, and ease the financial burden of obtaining organic certification. This shift towards organic farming further encourages the adoption of biological seed treatments.

Biological seed treatments, which are designed to protect seeds, offer targeted control of specific pests and fungal diseases during the early seedling stage. Additionally, these treatments are used on various crops, such as grains, cereals, oilseeds, and vegetables, to manage a range of pests. The increasing use of bio-priming techniques to improve productivity and reduce input costs is supporting the widespread adoption of biological seed treatments. For instance, a 2022 study by researchers from the University of Agriculture and Technology, India indicated that bio-priming in sustainable agriculture is more cost-effective and environmentally benign. Therefore, the growing adoption of eco-friendly options, the trend towards organic farming, a favourable regulatory environment, and supportive initiatives are expected to drive the growth of the market during the forecast period.

Biological Seed Treatment Market Trends

Grains and Cereal segment leads the market

The adoption of biological seed treatments in cereals and grains is increasing, offering a sustainable alternative to chemical methods. This trend is driven by the global push for environmentally friendly farming practices and the rising demand for organic produce. As the demand for plant-based proteins grows, particularly in cereals and grains like wheat, soy, and corn, biological treatments are being utilized to maximize yields and improve crop quality. Additionally, crops such as wheat, barley, and corn are prone to various soil-borne diseases, including Fusarium head blight, seedling blight, and root rot. Biological seed treatments, which include Trichoderma, Bacillus species, and Pseudomonas species, protect against these pathogens, resulting in healthier crops and reducing the need for chemical fungicides.

During the study period, there has been a notable increase in the area under organic cereal farming. According to the Research Institute of Organic Agriculture (FiBL), the global organic area under cereal cultivation was 5.4 million hectares in 2021, which increased to 5.6 million hectares in 2022. The growing popularity of organic farming for cereal crops and integrated pest management (IPM) has made biological seed treatments a key component in reducing chemical use, thereby supporting their usage in the segment.

Ongoing research and development efforts are focused on improving the efficacy, shelf life, and cost-effectiveness of biological treatments. New microbial strains and innovative delivery methods are enhancing the performance of biological seed treatments. In 2024, Indigo Ag launched its ground-breaking CLIPS device. This automatic hands-free system saves time, eliminates the hassle in the seed treatment process, and has the potential to revolutionize standard biological seed treatment applications. CLIPS was designed in collaboration with 3BarBio, the first biological Contract Development and Manufacturing Organization focused on the agriculture industry. Therefore, the rising importance of organic produce, coupled with the expanding area of cereal farming and technological advancements, is driving market growth during the forecast period.

Europe Dominates the Market

Europe is a crucial market for biological seed treatments, driven by a strong focus on sustainability, environmental protection, and reducing chemical inputs in agriculture. The European Union (EU) leads in promoting eco-friendly farming practices, significantly increasing the demand for biological seed treatments. The EU has implemented stringent regulations on pesticide use to reduce chemical residues in food and minimize environmental impact. The EU Green Deal and the Farm to Fork Strategy aim to make the EU climate-neutral by 2050. These strategies emphasize sustainable food production and reducing reliance on chemical pesticides and fertilizers, encouraging the adoption of biological and organic farming practices and boosting the demand for biological seed treatments.

European consumers increasingly demand food produced with fewer chemicals and more environmentally friendly practices. According to the Research Institute of Organic Agriculture (FiBL), organic retail sales in Europe grew from USD 50.3 billion in 2019 to USD 55.8 billion in 2022. This demand for organic produce pushes farmers to adopt sustainable farming techniques, including biological seed treatments. The shift toward organic food, particularly in Germany, France, and the UK, has driven the adoption of biological solutions in both large-scale and small-scale farming operations.

Furthermore, strategies for developing new products in the market support growth. In 2023, Syngenta Biologicals and Unium Bioscience collaborated to bring breakthrough biological seed treatment solutions based on NUELLO iN to farmers across northwest Europe. The product naturally improves a plant's ability to convert and use nitrogen readily available in the atmosphere, potentially reducing nitrogen use by more than 10 percent. This innovation lowers the environmental impact of farming while increasing crop yield, promoting plant and soil health, and offering farmers greater flexibility in their nitrogen management strategies. Therefore, growing government support for sustainability, coupled with the demand for organic produce and supportive strategies, aids market growth during the forecast period.

Biological Seed Treatment Industry Overview

The Biological Seed Treatment Market is moderately consolidated, with major players such as, Syngenta, Bayer Crop Science, BASF, Novozymes, and Koppert B.V. in the market studied. The players are investing in the improvisation of products, partnerships, expansions, and acquisitions for business expansions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Trend of Organic Farming

- 4.2.2 Use of Bio-Priming Techniques for Improved Efficiency

- 4.2.3 Players Investing More in R&D Activities

- 4.3 Market Restraints

- 4.3.1 High Costs and Low Availability

- 4.3.2 Government Regulatory Barriers

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Seed Protection

- 5.1.2 Seed Enhancement

- 5.1.3 Other Functions

- 5.2 Crop Type

- 5.2.1 Grains and Cereal

- 5.2.2 Oil Seeds

- 5.2.3 Vegetables

- 5.2.4 Other Crop Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Thailand

- 5.3.3.5 Vietnam

- 5.3.3.6 Australia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer Cropscience AG

- 6.3.3 Verdesian Life Sciences LLC

- 6.3.4 Syngenta AG

- 6.3.5 Floridienne Group

- 6.3.6 Germains Seed Technology

- 6.3.7 Koppert Biological Systems

- 6.3.8 Novozymes

- 6.3.9 Bioceres Crop Solutions Corp

- 6.3.10 Locus AG