|

市场调查报告书

商品编码

1687094

工业包装:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Industrial Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

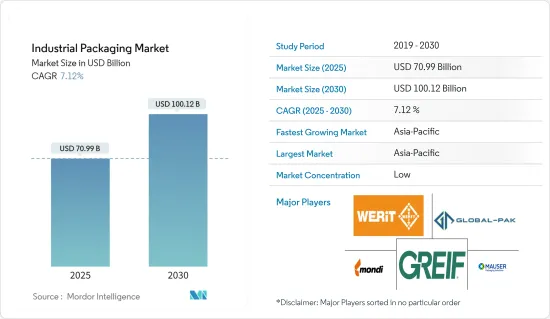

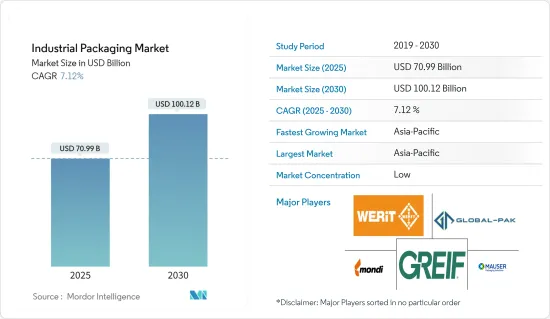

预计 2025 年工业包装市场规模为 709.9 亿美元,到 2030 年将达到 1,001.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.12%。

关键亮点

- 工业包装是一个总称,用于描述重型、专业化和客製化的包装解决方案,为客户的产品从 A 点到 B 点的运输或储存提供增值保护。这种包装通常用于危险或易碎产品,或彼此敏感的部件。

- 各地区之间资源和产品运输量的增加是导致散装工业包装成长的主要因素之一。工业包装市场高度依赖全球进出口活动。重工业对桶和桶等产品的需求量很大,而物料输送容器和中型散货箱(IBC)等其他产品则用于物流和短途货物运输。

- 硬质塑胶IBC用于各种行业,包括食品和饮料、製药、化学品、油漆、油墨和润滑剂。北美硬质中型散货容器协会 (RIBCA) 致力于促进参与硬质中型散货容器製造和组装的个人、企业和公司的利益。

- 过去几十年来,与消费性包装相比,工业包装很少受到关注。近年来,世界各国政府和组织开始认识到安全和永续工业包装的重要性。市场也越来越关注小型化/材料减少。其中一个例子就是推出多层壁纸袋。这使得袋子比传统袋子更轻,但强度和性能却没有受到影响。

- 随着对永续和可回收工业包装的需求变化,该公司正在推出创新产品。 2023 年 5 月,FlexSack 推出了 FlexSack-eco,这是一款含有 30% 消费后树脂 (PCR) 的大型散装袋。该公司表示,此项创新在北美尚属首创。

- 预计在预测期内,降低物流和材料成本以及提高整个供应链效率的需求日益增长,将推动工业包装製造商的投资和创新。这些因素是由致力于倡导减少包装浪费必要措施的企业和政府所推动的。预计这些趋势将在预测期内推动工业包装市场的发展。

工业包装市场趋势

食品和饮料可望引领市场

- 食品和饮料行业最常用的工业包装是桶、IBC、瓦楞纸箱、托盘和袋子。但是,包装需要经过食品级认证。例如,IBC 手提箱(采用不銹钢罐或聚乙烯笼手提箱设计)经过 DOT/UN 认证,确保包装不会污染食物。

- 鼓在酒精产业中被广泛使用。啤酒是全球运输量最大的酒精饮料。桶的材质有钢、塑胶和纺织。然而,美国运输部认为钢桶是最安全的。因此,预计使用钢桶储存和运输饮料将变得更加普遍。

- 编织袋通常用于包装干粮、谷物和其他产品。它的主要设计是抗衝击,可容纳 5 公斤至 75 公斤的食物。因此,由于生活方式和消费者需求的变化,预计预测期内研究市场对工业包装的需求将会成长。

- 预计全球葡萄酒贸易的成长将推动中型散货箱产业的未来成长。葡萄酒的需求和贸易正在上升,特别是随着许多国家在庆祝活动期间葡萄酒消费量的增加。中型散货箱是一种经济有效的解决方案,可以安全地用于散装运输葡萄酒。

- 根据欧盟委员会预测,2023年欧盟葡萄酒产量将达1.59亿百公升,高于2020年的1.44亿百公升。预计这一成长趋势将在预测期内持续,从而推动散装货柜的需求。

- 由于消费者对健康饮料的偏好日益增加,对食品级工业桶的需求也不断增加。此外,宣传「即饮」和「方便携带」等标语的公司可能会进一步增加对益生菌饮料(包括康普茶)的需求。与果汁和碳酸饮料相比,消费者越来越喜欢机能饮料。

亚太地区预计将占据主要市场占有率

- 亚太地区的工业和製造业正在快速发展,随着越来越多的製造商将製造地扩展到中国、印度和印尼等新兴经济体,预计工业桶的使用量将会增加。中国纸板桶生产呈现乐观成长态势。以金额为准,日本远远超过马来西亚、新加坡等其他国家。

- 中国是世界最大经济体之一,也是进出口总合最大的贸易国之一。该国的製成品出口贸易(也被称为世界工厂)在经历一段严重停滞后正在復苏。随着出口贸易的持续成长,预计市场对散装和重型工业包装产品的需求将强劲。

- 过去几十年来,中国作为亚太地区主要市场股东之一,其工业领域取得了惊人的成长。该行业的成长使该国成为一系列商品的主要製造商和出口国之一。根据中国国家统计局的数据,2023年,工业部门对中国GDP的贡献率为31.7%。

- 考虑到不断增长的需求,市场上的几家供应商正专注于提供广泛的工业包装产品。例如,印度的 Plastene 公司提供一系列用于干货和液体(散装)货物的运输和储存容器(巨型袋/FIBC)。巨型袋越来越受到工业客户的欢迎,取代了塑胶、纸和纸板包装解决方案。

- 化学品包装市场专注于製造和销售专为储存和运输大量化学品而设计的包装解决方案。这些包装解决方案的开发是为了满足最高的安全和监管要求,确保化学品在整个生命週期内的完整性和稳定性。据印度储备银行称,印度化学品出口额自 2017 年以来预计将增长近两倍,到 2023 年将达到 2,4353.6 亿印度卢比(约 291.1 亿美元)。随着这一增长,预计市场对中型散装容器、化学品桶和桶的需求将激增,从而推动化学品包装的成长。这些容器被视为化学工业的最佳化、节省成本的解决方案,可满足特定市场的需求。

工业包装产业概况

工业包装市场高度分散,有许多国际、地区和本地供应商。本地工业包装产品製造商能够以低于国际供应商的价格提供独特、创新的解决方案,从而带来激烈的价格竞争。

- 2024年1月,工业包装产品和服务的全球领导者Greif Inc.与专门从事等离子涂层的阻隔技术公司IonCraft宣布建立新的先导计画伙伴关係。此次合作的重点是彻底改变塑胶油桶包装的可回收性和永续性挑战,这需要额外的阻隔解决方案。

- 2023年7月,包装和造纸产业领导者Mondi宣布将投资1,600万欧元用于新技术,生产名为「终极功能阻隔纸」的新包装系列。该解决方案旨在满足客户对有助于循环经济的可持续包装日益增长的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 地缘政治情势如何影响市场

第五章市场动态

- 市场驱动因素

- 永续和可回收包装材料的出现

- 扩大货柜的使用

- 市场限制

- 由于环境问题日益严重,监管标准也发生动态变化

第六章市场区隔

- 按产品

- 中型散货箱(IBC)

- 解僱

- 鼓

- 桶罐

- 其他的

- 按最终用户产业

- 车

- 饮食

- 化学品和製药

- 石油、天然气和石化产品

- 建筑与施工

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- WERIT Kunststoffwerke W. Schneider GmbH & Co.

- Mondi PLC

- Greif Inc.

- Mauser Packaging Solutions

- Global-Pak Inc.

- Berry Global Inc.

- Smurfit Kappa Group PLC

- Tank Holding Corp.

- International Paper Company

- Veritiv Corporation

- Nefab Group

- Schutz GmbH & Co. KGaA

- DS Smith PLC

- Amcor PLC

- Packaging Corporation of America

- Pact Group Holdings Ltd

- Visy

- Brambles Ltd(CHEP)

- Snyder Industries LLC

- Myers Containers

第八章投资分析

第九章 市场机会与未来趋势

简介目录

Product Code: 54939

The Industrial Packaging Market size is estimated at USD 70.99 billion in 2025, and is expected to reach USD 100.12 billion by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

Key Highlights

- Industrial packaging is the umbrella term used to describe heavy-duty, specialized, and customized packaging solutions to provide added value protection for the customer's products to get from point A to point B or sit in storage. This type of packaging is usually used on hazardous or sensitive products or components sensitive to each other.

- The increasing volume of resources and products being transported across various regions is one of the primary factors that led to the growth of bulk industrial packaging. The industrial packaging market highly depends on global import and export activities. While products such as drums and pails experience huge demand from heavy manufacturing industries, other products, such as material handling containers and intermediate bulk containers (IBCs), include applications in logistics and the short-distance transportation of goods.

- Rigid plastic IBCs are used in various industries, such as food and beverage, pharmaceuticals, chemicals, and paints, inks, and lubricants. The Rigid Intermediate Bulk Container Association (RIBCA) of North America fosters the interests of people, firms, and corporations engaged in manufacturing or assembling rigid intermediate bulk containers.

- Industrial packaging has received scant attention over the past few decades compared to consumer packaging. Governments and organizations worldwide have recently realized the importance of safe and sustainable industrial packaging. The market also observed an increased focus on downgauging/material reduction. An instance of this is the introduction of multi-walled paper sacks. This helped reduce the weight of traditional sacks without sacrificing strength and performance.

- Companies are launching innovative products in line with the changing demand for sustainable and recyclable industrial packaging. In May 2023, FlexSack launched FlexSack-eco, large-sized bulk sacks with 30% post-consumer resin (PCR) content. According to the firm, this kind of innovation is the first of its kind in North America.

- Factors like the greater need to cut down on logistics costs and bills of materials and enhance overall efficiency across supply chains are expected to drive investments and innovation among industrial packaging manufacturers during the forecast period. These factors are buoyed by companies and governments focusing on claiming necessary measures to reduce packaging wastage. These trends are anticipated to drive the industrial packaging market during the forecast period.

Industrial Packaging Market Trends

Food and Beverages Expected to Drive the Market

- The most used industrial packaging for food and beverage industries are drums, IBCs, corrugated boxes, pallets, and sacks. However, the packaging needs to be certified as food-grade. For instance, IBC totes (designed with stainless steel tanks or poly-caged totes) are certified by the DOT/UN and guarantee that the packaging does not contaminate the food products.

- Drums are widely used in the alcohol industry. Beer is the most transported alcohol globally. Drums are made of steel, plastics, or fiber. However, steel drums are regarded as the safest by the US Department of Transportation. It is expected to drive further storage and transport of beverages in steel drums.

- Woven sacks are highly used in packaging dry food grains and other products. They are mainly designed to showcase high-impact resistance and hold food items of the capacity of 5 kg to 75 kg. Therefore, with changing lifestyles and consumer demands, the demand for industrial packaging in the market studied is expected to grow during the forecast period.

- The rising wine trade across the world is expected to boost the growth of the intermediate bulk container industry in the future. The increasing consumption of wine, especially during celebrations in many countries, increases the demand for wine and its trade. Intermediate bulk containers are one of the cost-effective solutions and can be utilized safely in bulk transporting wines.

- According to the European Commission, the European Union had 159 million hectoliters of wine production in 2023, a significant rebound from 144 million hectoliters in 2020. This growth trend is expected to be witnessed in the forecast period, consequently bolstering the demand for bulk containers.

- The progressive inclination of consumers toward health-oriented beverages has improved the demand for food-grade industrial drums. In addition, the companies promoting tag lines, such as "ready-to-drink," "on-the-go," and other convenience factors, may further augment the demand for probiotic drinks, including kombucha. Consumers have started to prefer functional drinks over fruit juices and carbonated beverages.

Asia-Pacific Expected to Hold a Significant Market Share

- The rapidly evolving industrial and manufacturing sector in the Asia-Pacific is expected to increase the usage of industrial drums as manufacturers are expanding their manufacturing bases to emerging economies like China, India, and Indonesia. China has shown optimistic growth in the production of fiber drums. In terms of value, it has a strong hold over other countries such as Malaysia and Singapore.

- China is one of the largest economies in the world and is one of the largest trading countries in terms of the sum of its exports and imports. Also known as the world's factory, the country's export trade for manufactured goods is rebounding after a sudden stagnation for a brief period. With the continued growth in the export trade, the market is expected to witness robust demand for bulk and sturdy industrial packaging products.

- Over the last few decades, the industrial sector in China, one of the major market shareholders in Asia-Pacific, witnessed astonishing growth. The sector's growth placed the country among the leading manufacturers and exporters of various goods. According to the National Bureau of Statistics of China, in 2023, the industrial sector contributed 31.7% of the country's GDP.

- Considering the growing demand, several vendors operating in the market are focusing on offering a broad portfolio of industrial packaging products. For instance, Plastene, an Indian company, offers various transport and storage containers (jumbo bags/FIBCs) for both dry and liquid (bulk) goods. Jumbo bags increasingly substitute plastic, paper, and cardboard packaging solutions for industrial customers.

- The chemical packaging market focuses on producing and distributing packaging solutions specifically designed for storing and transporting large volumes of chemicals. These packaging solutions are developed to meet the highest safety and regulatory requirements, guaranteeing the chemical's integrity and stability throughout its life cycle. According to the Reserve Bank of India, the value of chemicals exported from India has almost tripled since 2017, rising upto INR 2435.36 billion (USD 29.11 billion) in 2023. With such growth, the market is expected to witness a surge in demand for intermediate bulk containers, chemical drums, and barrels, which is expected to drive the growth of chemical packaging. These containers are considered optimized cost-saving solutions for the chemical industry, facilitating market-specific requirements.

Industrial Packaging Industry Overview

The industrial packaging market is highly fragmented, with numerous international, regional, and local vendors. Local manufacturers of industrial packaging products cater to unique, innovative solutions at a lower price than international vendors, resulting in an intense price battle.

- In January 2024, Greif Inc., one of the global leaders in industrial packaging products and services, and IonKraft, a barrier technology company specializing in plasma-based coatings, announced a new pilot-project partnership. The collaboration focuses on revolutionizing the challenges of recyclability and sustainability in plastic jerrycan packaging that requires an additional barrier solution.

- In July 2023, Mondi, a leader in the packaging and paper industry, announced an investment of EUR 16 million in new technology to produce a new packaging range called Functional Barrier Paper Ultimate. The solution aims to meet the growing customer demand for sustainable packaging that contributes to a circular economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Geopolitical Scenarios on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Sustainable and Recyclable Packaging Materials

- 5.1.2 Increasing Utilization of the Shipping Containers

- 5.2 Market Restraints

- 5.2.1 Dynamic Changes in Regulatory Standards Due to Increasing Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Intermediate Bulk Containers (IBCs)

- 6.1.2 Sacks

- 6.1.3 Drums

- 6.1.4 Pails

- 6.1.5 Other Products

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Food and Beverage

- 6.2.3 Chemicals and Pharmaceuticals

- 6.2.4 Oil and Gas and Petrochemicals

- 6.2.5 Building and Construction

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 WERIT Kunststoffwerke W. Schneider GmbH & Co.

- 7.1.2 Mondi PLC

- 7.1.3 Greif Inc.

- 7.1.4 Mauser Packaging Solutions

- 7.1.5 Global-Pak Inc.

- 7.1.6 Berry Global Inc.

- 7.1.7 Smurfit Kappa Group PLC

- 7.1.8 Tank Holding Corp.

- 7.1.9 International Paper Company

- 7.1.10 Veritiv Corporation

- 7.1.11 Nefab Group

- 7.1.12 Schutz GmbH & Co. KGaA

- 7.1.13 DS Smith PLC

- 7.1.14 Amcor PLC

- 7.1.15 Packaging Corporation of America

- 7.1.16 Pact Group Holdings Ltd

- 7.1.17 Visy

- 7.1.18 Brambles Ltd (CHEP)

- 7.1.19 Snyder Industries LLC

- 7.1.20 Myers Containers

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219