|

市场调查报告书

商品编码

1687117

英国热电联产 (CHP):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)UK Combined Heat And Power (CHP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

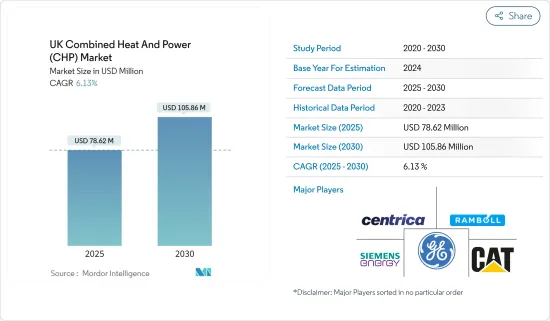

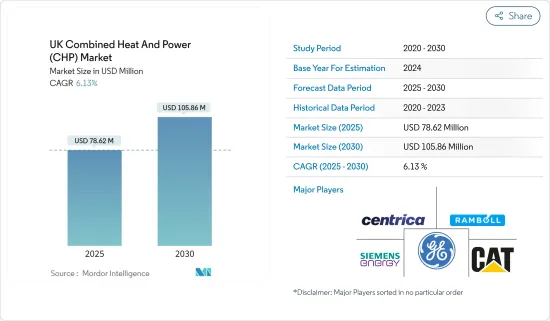

英国热电联产 (CHP) 市场规模预计在 2025 年为 7,862 万美元,预计到 2030 年将达到 1.0586 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.13%。

2020 年,市场受到了新冠疫情的负面影响。目前市场已恢復至疫情前的水准。

主要亮点

- 从中期来看,对节能发电技术的日益重视以及对热电发电工程的投资增加也有望推动所研究市场的成长。

- 另一方面,地缘政治紧张局势和天然气价格上涨预计将对英国热电联产市场构成挑战,这可能会对市场成长产生不利影响,并成为市场的主要限制因素之一。

- 然而,分散式发电和空间加热的需求不断增加,加上技术进步,预计将推动市场参与者的发展并创造巨大的商机。

英国热电联产 (CHP) 市场趋势

商业和运输部门预计将占据市场的大部分份额

- 在商业终端用户领域,热电联产 (CHP) 系统通常安装在饭店、超级市场、办公大楼、体育中心、医院、资料中心、购物中心等,以提供能源独立性和安全性。由于这些系统相对较大且噪音污染不是问题,因此商务用系统主要是电气高效的内燃机热电联产系统。然而,随着成本下降和燃料电池技术效率的提高,基于燃料电池的热电联产系统也被商务用终端用户所采用。

- 随着汽车製造商加紧开发此类动力传动系统,氢基燃料电池(CHP)技术是汽车产业的一个领域,正变得越来越重要。与电动车一样,燃料电池电动车 (FCEV) 也以氢气为动力,被归类为超低排放气体车 (ULEV),因为其排气中排放的唯一物质是水蒸气。

- 由于商业建筑、办公室、饭店、医院等领域的开发和应用日益增多,预计预测期内英国商业终端用户领域将显着采用 CHP 系统。

- 超级市场是商用热电联产系统的主要终端用户之一,超级市场总能耗的大部分来自冷冻、照明和暖通空调系统,其中冷却占总能耗的近三分之一。零售业的能源需求在非运作时段明显较低,且受季节性波动的影响,因此商务用热电联产系统需要适当规模才能满足需求高峰。在超级市场中,热电联产系统(通常基于 ICE)直接安装在机车上,可以覆盖电力负载和热负荷,或至少覆盖其中的一部分。

- 近年来,国内建设活动也有所增加。根据国家统计局的数据,2022 年私人商业领域的新建设订单总额将达到约 179.6 亿美元,比 2020 年增长约 35%。在预测期内,这可能会推动该国热电联产系统的成长。

- 因此,鑑于上述情况,预计商业和运输部门将在预测期内占据英国热电联产 (CHP) 市场的大部分份额。

天然气价格上涨预计将抑制市场需求

- 天然气 是 一种 重要 的能源来源, 它 在燃气引擎上 的 使用 是 所有石化燃料中 二氧化碳排放最低 的 , 这 符合英国减少 温室 气体排放的 目标 .此外,英国商业、能源和工业战略部表示,使用天然气作为热电联产 (CHP) 装置的燃料可减少氮氧化物排放,并且硫和硫氧化物排放,并且硫氧化物含量较低。

- 由于亚洲和南美对天然气的需求突然增加,俄罗斯入侵乌克兰导致俄罗斯对欧洲市场的天然气供应减少,天然气库存减少,以及各种电气设备一系列故障,英国消费者面临天然气价格大幅上涨。依赖天然气的消费者、电力公司和使用热电联产装置的企业都会受到影响。

- 天然气价格上涨的主要原因是全球天然气批发价格的上涨。国内供应满足了英国约40%的需求。同时,其余则从挪威和荷兰等邻国进口。此外,卡达、美国和俄罗斯供应了英国约5%的市场份额。

- 根据英国能源统计摘要(DUKES),2021 年英国约有 2,016 个热电联产站点,与 2020 年相比减少了 236 个热电联产 (CHP) 站点。

- 此外,2022年2月俄罗斯入侵乌克兰,战争升级,导致天然气价格进一步飙升。 2022年3月,英国天然气现货价格为511便士/热量单位,与前一年同期比较去年同期上涨139%。此外,根据英国国家统计局的数据,2022 年英国天然气平均消费者物价指数为 164.7 指数点。

- 因此,鑑于上述情况,预测期内天然气价格上涨可能会阻碍英国热电联产 (CHP) 市场的发展。

英国热电联产 (CHP) 产业概况

英国热电联产(CHP)市场正走向半固体。市场上的主要企业(不分先后顺序)包括通用电气公司、西门子能源股份公司、Ramboll 集团、Centrica PLC 和卡特彼勒公司等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 增加对发电工程的投资

- 政府对热电联产电厂开发和营运的支持政策和奖励

- 限制因素

- 英国天然气价格上涨

- 驱动程式

- 供应链分析

- PESTLE分析

- 2014 年至 2022 年热电联产发电厂统计资料(按数量和容量)

- 热电联产发电厂的燃料消耗统计(按燃料类型和部门)

第五章 市场区隔

- 最终用户

- 产业部门

- 贸易及运输业

- 其他最终用户(例如农业、区域供热、休閒)

- 类型

- 燃气涡轮机

- 蒸气涡轮

- 其他类型(往復式引擎、有机朗肯迴圈热电联产)

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Caterpillar Inc.

- Centrica PLC

- General Electric Company

- Mitsubishi Power Ltd

- Siemens Energy AG

- Ramboll Group

- Helec Limited

- Tedom AS

第七章 市场机会与未来趋势

- 热电联产 (CHP) 系统的技术进步

The UK Combined Heat And Power Market size is estimated at USD 78.62 million in 2025, and is expected to reach USD 105.86 million by 2030, at a CAGR of 6.13% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, growing emphasis on energy-efficient technology that generates electricity and increasing investments in CHP-based power projects are also expected to drive the growth of the market studied.

- On the other hand, geopolitical tensions and increasing natural gas prices are expected to impose challenges on the combined heat and power market in the United Kingdom and may negatively impact the market's growth and are one of the major restraints for the market.

- Nevertheless, increasing demand for distributed power generation and space heating coupled with technological advancements are expected to drive and create significant amount of opportunities for the market players.

UK Combined Heat and Power (CHP) Market Trends

Commercial and Transportation Segment is Expected to have as Significant Share in the Market

- In the commercial end-user segment, the Combined Heat, and Power (CHP) systems are typically installed at hotels, supermarkets, office buildings, sports centers, hospitals, data centers, and shopping centers, providing energy independence and security. As these systems are relatively larger, and noise is a lesser concern, commercial systems are primarily internal combustion engine CHPs with higher electrical efficiency. However, with falling costs and the rising efficiency of fuel cell technology, fuel cell-based CHP systems are also becoming increasingly adopted by commercial end-users.

- The hydrogen-based fuel cell (CHP) technology is an area of the automotive industry that is becoming increasingly essential as manufacturers commit to developing this type of power train. Like electric cars, hydrogen-powered fuel cell electric vehicles (FCEVs) are classed as ultra-low emission vehicles (ULEVs) since water vapor is the only substance that comes from the exhaust.

- The commercial end-user segment in the United Kingdom is expected to witness a notable adoption of CHP systems due to the developments and the rising applications in commercial buildings, offices, hotels, hospitals, etc., during the forecast period.

- Supermarkets are one of the major end-users of commercial CHP systems, which most of the total energy consumption in supermarkets is from refrigeration, lighting, and HVAC systems, with refrigeration responsible for nearly 1/3rd of the total energy consumption. As the energy requirement in the retail sector is significantly lower during non-operational hours and subject to seasonal variations, commercial CHP systems need to be sized accordingly to match demand spikes. In supermarkets, CHP systems (usually based on ICEs) are installed directly in loco, which could cover both electricity and heat loads, or at least a part of them.

- The construction activity around the country has also been increasing in recent times. According to the Office of National Statistics, the total value of of new orders for construction in the private commercial sector increased to about USD 17,960 million in 2022, an increase of around 35% compared to 2020. These are likely to surge the growth of CHP systems in the country during the forecast period.

- Therefore, owing to the above-mentioned points, commercial and transportation segment is expected to have a significant share in the United Kingdom's combined heat and power (CHP) market during the forecast period.

Increasing Natural Gas Price is Expected to Restrain the Market Demand

- Natural Gas is one of the essential sources of energy, and the utilization of natural gas in gas engines is characterized by the lowest carbon dioxide emissions levels of all fossil fuels, which is in line with the United Kingdom's goal to reduce greenhouse gas emissions. In addition, according to the United Kingdom's Department for Business, Energy, and Industrial Strategy, using natural gas as a fuel for Combined Heat and Power (CHP) units reduce nitrogen oxide emissions and virtually contains no sulfur or contaminants.

- Factors such as circumstances, such as soaring demand for natural gas in Asia and South America, diminished gas supply from Russia to the European markets due to the invasion of Russia on Ukraine, low gas stocks, and a series of breakdowns at various electrical facilities, consumers in the United Kingdom faced a significant increase in gas prices. Consumers, utility companies, and businesses using CHP units dependent on natural gas are impacted.

- The primary cause of the natural gas price rise has been a surge in the wholesale price of natural gas globally. Domestic supply covers approximately 40% of the United Kingdom's needs. At the same time, the rest is imported from neighboring countries, such as Norway and the Netherlands. Further, afield in Qatar and the United States, and Russia supplies around 5% of the United Kingdom market.

- According to Digest of UK Energy Statistics (DUKES), the United Kingdom had around 2,016 CHP sites in 2021, witnessing a decrease of 236 combined heat and power (CHP) areas compared to 2020.

- Moreover, In February 2022, Russia's invasion of Ukraine in a horrific escalation of a war that started in February 2022 further spiked the natural gas prices. In March 2022, the Natural Gas spot prices in the United Kingdom were 511 pence/therm witnessing an increase of 139% as compared to the previous year. Further, according to Office for National Statistics (UK), in 2022, the average consumer price index for gas in the United Kingdom stood at 164.7 index points.

- Thus, owing to the above points, increasing natural gas prices will likely hamper the combined heat and power (CHP) market in the United Kingdom during the forecast period.

UK Combined Heat and Power (CHP) Industry Overview

The UK combined heat and power (CHP) market is semi-consolidated. The key players in the market (in no particular order) include General Electric Company, Seimens Energy AG, Ramboll Group, Centrica PLC, and Caterpillar Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investments in the CHP-Based Power Projects

- 4.5.1.2 Supportive Government Policies And Incentives To Develop And Operate CHP Plants

- 4.5.2 Restraints

- 4.5.2.1 Increasing Natural Gas Prices in the United Kingdom

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 CHP Power Plant Statistics, 2014-2022 (by Number and Capacity)

- 4.9 CHP Power Plant Fuel Used Statistics (by Fuel Type and Sector)

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Industrial Sector

- 5.1.2 Commercial and Transportation Sector

- 5.1.3 Other End Users (Agriculture, Community Heating, Leisure, etc.)

- 5.2 Type

- 5.2.1 Gas Turbine

- 5.2.2 Steam Turbine

- 5.2.3 Other Types (Reciprocating Engine and Organic Rankine Cycle CHP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Caterpillar Inc.

- 6.3.2 Centrica PLC

- 6.3.3 General Electric Company

- 6.3.4 Mitsubishi Power Ltd

- 6.3.5 Siemens Energy AG

- 6.3.6 Ramboll Group

- 6.3.7 Helec Limited

- 6.3.8 Tedom AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Combined Heat And Power (CHP) Systems