|

市场调查报告书

商品编码

1687128

光学涂装-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Optical Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

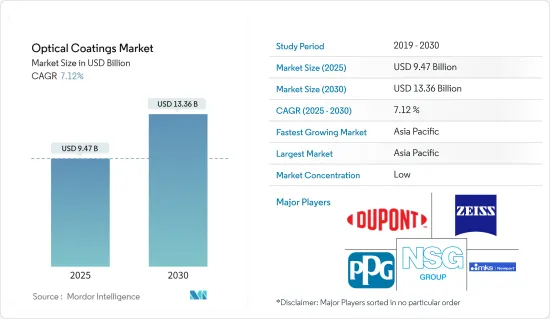

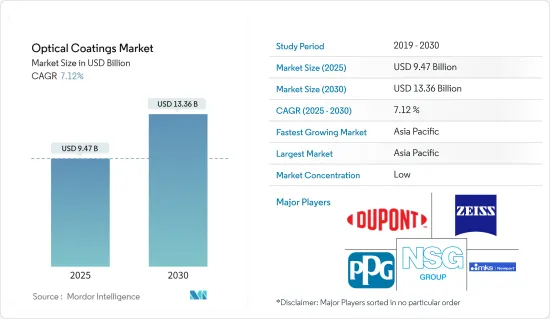

光学涂料市场规模预计在 2025 年为 94.7 亿美元,预计到 2030 年将达到 133.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.12%。

关键亮点

- 短期内,太阳能电池产业对光学涂层的需求不断增长以及光学涂层製程的技术进步预计将推动市场发展。

- 预计光学涂层的高成本和一些限制特性将阻碍市场成长。

- 即将到来的电动车需求可能会在未来几年为市场创造机会。

- 预计亚太地区将主导市场,并可能在预测期内实现最高的复合年增长率。

光学镀膜市场趋势

预计电子半导体领域将占据市场主导地位。

- 光学涂层在电子应用中发挥着至关重要的作用,确保光线无缝穿过光学表面。随着对智慧型手机、平板电脑和穿戴式装置等尖端电子设备的需求激增,对优质光学涂层的需求也随之成长。这些涂层不仅提高了电子显示器的性能,而且使其更加耐用。

- 透明导电涂层也用于电子显示器。消费性电子产品需求的不断增长推动了这个突出的市场。随着设备变得越来越小、越来越紧凑,对专业光学涂层的需求也随之增加。这些涂层可以专业地控制热量、减少眩光并提高小型部件的光学清晰度。

- 半导体产业优先考虑精确、高性能的光学涂层。这些涂层是光刻製程的必需品,是半导体製造的关键步骤,可以提高半导体装置的效率和品质。物联网在各个领域的影响力日益增强,推动了半导体需求的激增,从而促进了光学涂层市场的发展。

- 例如,根据日本电子情报技术产业协会(JEITA)的资料,预计2023年日本电子产业的产值将接近10.7兆日圆(约760亿美元)。包括家用电子电器、工业设备和无数电子元件在内的电子产业预计到2024年将达到3.68兆美元,与前一年同期比较增长9%。

- 世界半导体贸易统计组织2023年12月31日报告称,预计2023年全球半导体市场规模为5268.9亿美元,2024年增长16.0%。

- 根据ZVEI 2024年7月发布的资料,预计2023年德国电子和数位领域的销售额将达到2,380亿欧元(2,592.8亿美元),与前一年同期比较强劲成长10%。

- 鑑于这些动态,市场在不久的将来可能会出现重大波动。

亚太地区可望主导市场

- 预计预测期内亚太地区将引领光学涂料市场。中国、日本、印度和韩国等主要国家正经历电子、半导体、航太和国防等各领域对光学涂层的需求激增。

- 中国民航局2024年7月12日发布的资料显示,2024年上半年旅客运输量超过3.5亿美元,较去年同期成长23.5%,比2019年同期成长9%。

- 此外,2023 年 12 月的《航空 A2Z》报告强调,中国正在采购 17 架国产飞机(中国商飞),并计划在未来两年内交付,这进一步加强了对光学涂层的需求。

- 根据印度品牌资产基金会(IBEF)的数据,到2024年,印度将在可再生能源、风能和太阳能发电能力方面位居全球第四。根据《2023年印度太阳能市场年度更新》,预计到2023年12月底,印度的累积太阳能光电发电能力将达到约135GW,到2025年3月将达到约170GW。

- IBEF也强调,在政府支持和良好经济状况的推动下,可再生能源产业已成为具有吸引力的投资磁铁。印度致力于自给自足,满足其能源需求,预计到 2040 年将达到 15,820 TWh。

- 根据日本电子情报技术产业协会(JEITA)的报告,2023年电子元件及设备为日本电子产业贡献了约6.97兆日圆(约470亿美元),总产值约为10.7兆日圆(约760亿美元)。

- 鑑于这些动态,预计亚太光学涂料市场在预测期内将实现稳定成长。

光学镀膜产业概况

光学涂装市场本质上是高度分散的。该市场的主要企业(不分先后顺序)包括杜邦、蔡司国际、纽波特公司、PPG工业公司和日本板硝子。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 太阳能电池产业需求不断成长

- 光学镀膜製程的技术进步

- 限制因素

- 光学镀膜成本高且具有一些限制特性

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 依产品类型

- 光学滤光片镀膜

- 抗反射膜

- 透明导电涂层

- 镜面涂层(高反射率)

- 分光镜镀膜

- 其他产品类型(温控涂料)

- 依技术

- 化学沉淀

- 离子束溅镀

- 等离子溅镀

- 原子层沉淀

- 亚波长结构表面

- 按最终用户产业

- 航太与国防

- 电子和半导体

- 通讯

- 医疗保健

- 太阳的

- 车

- 其他最终用户产业(军事/国防、医疗)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- Abrisa Technologies

- AccuCoat inc.

- Artemis Optical Ltd

- Edmund Optics Inc.

- DuPont

- Inrad Optics

- Materion Corporation

- Newport Corporation

- Nippon Sheet Glass Co. Ltd

- Optical Coatings Technologies

- PPG Industries Inc.

- Quantum Coating Inc.

- Reynard Corporation

- SIGMAKOKI CO. LTD

- Schott AG

- Zeiss International

- Zygo

第七章 市场机会与未来趋势

- 未来电动车的需求

简介目录

Product Code: 55454

The Optical Coatings Market size is estimated at USD 9.47 billion in 2025, and is expected to reach USD 13.36 billion by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

Key Highlights

- Over the short term, increasing demand for optical coatings from the solar industry and technological advancements in the optical coatings process are expected to drive the market.

- High costs and some limiting properties of optical coatings are expected to hinder the market's growth.

- The upcoming demand for electric vehicles is likely to create opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Optical Coatings Market Trends

The Electronics and Semiconductors Segment is Expected to Dominate the Market

- Optical coatings play a pivotal role in electronic applications, ensuring light seamlessly passes through optical surfaces. With the surging demand for cutting-edge electronic devices such as smartphones, tablets, and wearables, the appetite for premium optical coatings has surged. These coatings not only bolster the performance of electronic displays but also enhance their durability.

- Transparent conductive coatings find their place in electronic displays as well. The market in focus is buoyed by the relentless growth in demand for consumer electronics. As devices shrink in size and become more compact, the need for adept optical coatings grows. These coatings adeptly manage heat, mitigate glare, and elevate the optical clarity of smaller components.

- The semiconductor industry prioritizes precise, high-performance optical coatings. Integral to photolithography-a cornerstone of semiconductor fabrication-these coatings amplify the efficiency and quality of semiconductor devices. With the rising influence of IoT across diverse sectors, semiconductor demand has surged, subsequently propelling the optical coatings market.

- For instance, data from the Japan Electronics and Information Technology Industries Association (JEITA) highlighted that in 2023, Japan's electronics sector achieved a production value nearing JPY 10.7 trillion Japanese (~USD 76 billion). Encompassing consumer electronics, industrial equipment, and myriad electronic components, the industry is projected to touch USD 3.68 trillion by 2024, marking a commendable 9% Y-o-Y growth.

- World Semiconductor Trade Statistics reported on December 31, 2023, that the global semiconductor market was valued at USD 526.89 billion in 2023, with a promising 16.0% growth anticipated in 2024.

- Data from ZVEI in July 2024 indicates that Germany's electronic and digital sector achieved a turnover of EUR 238 billion (USD 259.28 billion) in 2023, reflecting a robust 10% growth from the previous year.

- Given these dynamics, the market is poised for significant movements in the foreseeable future.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is likely to lead the optical coatings market during the forecast period. Leading countries such as China, Japan, India, and South Korea are showcasing a surge in demand for optical coatings across various sectors, including electronics, semiconductors, aerospace, and defense.

- Data from the Civil Aviation Administration of China (CAAC) on July 12, 2024, revealed that passenger traffic in the first half of 2024 exceeded USD 350 million, marking a 23.5% Y-o-Y increase and a 9% rise from the same period in 2019.

- Furthermore, a report by Aviation A2Z in December 2023 highlighted that China would acquire 17 domestically manufactured aircraft (COMAC), with deliveries scheduled over the next two years, further bolstering the demand for optical coatings.

- As per the India Brand Equity Foundation (IBEF), India ranks fourth globally in renewable energy, wind power, and solar power capacity in 2024. The Annual 2023 India Solar Market Update noted that by the end of December 2023, India's cumulative solar capacity reached approximately 135 GW, with projections of hitting around 170 GW by March 2025.

- IBEF also highlighted that bolstered by government support and favorable economics, the renewable sector has become a magnet for investors. With an eye on self-sufficiency, India aims to meet its energy demand, which is projected to hit 15,820 TWh by 2040.

- The Japan Electronics and Information Technology Industries Association (JEITA) reported that in 2023, electronic components and devices contributed approximately JPY 6.97 trillion (USD 47 billion) to the nation's electronics industry, which boasted a total production value of around JPY 10.7 trillion (USD 76 billion).

- Given these dynamics, the optical coatings market in Asia-Pacific is set for steady growth during the forecast period.

Optical Coatings Industry Overview

The optical coatings market is highly fragmented in nature. Some of the key players in the market (not in any particular order) include DuPont, Zeiss International, Newport Corporation, PPG Industries Inc., and Nippon Sheet Glass Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Solar Industry

- 4.1.2 Technological Advancements in the Optical Coatings Process

- 4.2 Restraints

- 4.2.1 High Costs and Some Limiting Properties of Optical Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product Type

- 5.1.1 Optical Filter Coatings

- 5.1.2 Anti-reflective Coatings

- 5.1.3 Transparent Conductive Coatings

- 5.1.4 Mirror Coatings (High Reflective)

- 5.1.5 Beam Splitter Coatings

- 5.1.6 Other Product Types (Temperature Management Coatings)

- 5.2 By Technology

- 5.2.1 Chemical Vapor Deposition

- 5.2.2 Ion-beam Sputtering

- 5.2.3 Plasma Sputtering

- 5.2.4 Atomic Layer Deposition

- 5.2.5 Sub-wavelength Structured Surfaces

- 5.3 By End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Electronics and Semiconductors

- 5.3.3 Telecommunications

- 5.3.4 Healthcare

- 5.3.5 Solar

- 5.3.6 Automotive

- 5.3.7 Other End-user Industries (Military and Defense and Medical)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Qatar

- 5.4.5.4 United Arab Emirates

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Abrisa Technologies

- 6.4.3 AccuCoat inc.

- 6.4.4 Artemis Optical Ltd

- 6.4.5 Edmund Optics Inc.

- 6.4.6 DuPont

- 6.4.7 Inrad Optics

- 6.4.8 Materion Corporation

- 6.4.9 Newport Corporation

- 6.4.10 Nippon Sheet Glass Co. Ltd

- 6.4.11 Optical Coatings Technologies

- 6.4.12 PPG Industries Inc.

- 6.4.13 Quantum Coating Inc.

- 6.4.14 Reynard Corporation

- 6.4.15 SIGMAKOKI CO. LTD

- 6.4.16 Schott AG

- 6.4.17 Zeiss International

- 6.4.18 Zygo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Demand from Electric Vehicles

02-2729-4219

+886-2-2729-4219