|

市场调查报告书

商品编码

1687146

汽车 TPMS:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Automotive TPMS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

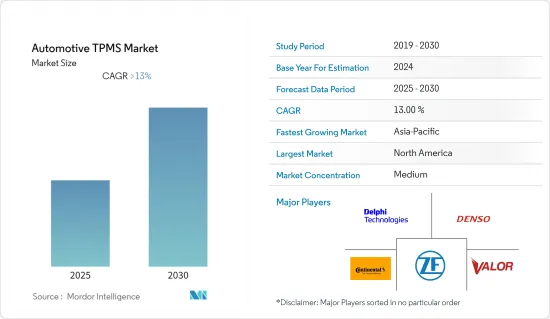

预计预测期内汽车 TPMS 市场将以超过 13% 的复合年增长率成长。

COVID-19 疫情导致全球组装停摆、社交距离规定实施以及严格封锁。市场回落,需求减少。然而,疫情过后,预测期内汽车销售的成长预计将支撑市场需求。领先的公司正在形成策略联盟并专注于开发新产品。例如

关键亮点

- 2022 年 10 月:Volvo集团、Qamcom 集团和发明家 Roman Lustin 创立了新兴企业Fyrqom AB。本文介绍了重型车辆轮胎压力监测系统(TPMS)的自动校准系统。

从长远来看,消费者对 ADAS(高级驾驶辅助系统)的偏好预计将在汽车 TPMS 市场的成长中发挥关键作用。此外,配备 TPMS 的高檔汽车销售激增预计将在预测期内推动汽车 TPMS 的成长。虽然 TPMS 的需求最初是由豪华和高檔汽车领域推动的,但中阶单轮胎汽车也满足了市场需求,因为它们配备了这种监控系统。例如

关键亮点

- 2022 年 6 月:大众推出 2022 年 Virtus,配备单轮胎 TSI Comfortline 车型。轿车部分提供超过 40 种功能和感测器,包括轮胎压力监测系统。

亚太地区预计将成为汽车 TPMS 的最大市场,其中日本、印度和中国是主要的汽车中心。预计印度汽车 TPMS 市场将受到消费者意识增强、TPMS 售后安装以及高檔汽车需求成长的推动。例如

关键亮点

- 2022年9月,吉利汽车、力帆科技旗下换电汽车品牌重庆力帆汽车科技股份有限公司(力帆汽车)推出两款新车型。配备8吋LCD主机萤幕、胎压监测系统(TPMS)、坡道保持控制(HHC)系统。

汽车TPMS市场趋势

汽车中 TPMS 的普及将推动市场成长

TPMS 最常用于乘用车,其中轮胎压力管理被视为关键的安全系统。汽车产业正持续致力于推出能够降低事故严重程度、减少人员死亡和提高车辆整体安全性的功能。预计这将在预测期内推动汽车 TPMS 市场的成长。

例如,Dill Air Control 目前为丰田、雷克萨斯、宝马、大众、现代、克莱斯勒、吉普和劳斯莱斯的高端车型生产 TPMS 系统。目前,各大汽车製造商的运动型、高级型和豪华型乘用车均标配 TPMS,可在仪錶板显示器上显示轮胎压力。随着消费者对配备先进安全功能的车辆的需求不断增加,TPMS 预计将成为 C-Class掀背车、轿车和 SUV 的标准配备。

此外,由于该系统具有许多优点,乘用车领域的几家汽车製造商正在其提案的车辆中安装 TPMS。例如

- 2022 年 5 月:新款 2022 年奥迪 A6 配备了先进的轮胎压力监测系统。该功能于 2022 年 A6 上推出,但 2021 年车型上没有提供。

- 2022 年 5 月:与上一代车型相比,新推出的 2022 年混合动力高檔中型轿车本田思域配备了轮胎压力监测系统 (TMPS)。

随着汽车製造商将这些功能添加到其新推出的车辆中,预计整个预测期内该市场对乘用车的需求将保持积极态势。

预计亚太地区在预测期内将大幅成长

预计亚太汽车 TPMS 市场将在预测期内成长,占据全球汽车 TPMS 市场的巨大份额。

预计中国和印度将成为该地区的市场领导。高檔汽车市场渗透率不断上升以及每辆车的安全功能数量不断增加(由于政府/机构采用的安全法规)等因素正在推动对 TPMS 和其他 ADAS 的需求。日本、韩国、南美、新加坡等亚洲已开发国家紧凑型及中型汽车上组装的TPMS等安全系统较为先进,普遍与北美、欧洲相当。

亚太地区高檔和中阶汽车销售的成长是采用 TMPS 的关键成长要素。多家汽车厂商正加快乘用车销售步伐,推出新产品。例如

- 2022年8月:上汽荣威中型电动MPV iMAX8 EV亮相。该车共推出 5 款车型,补贴后售价区间为 25.98 万元-35.98 万元。配备轮胎压力监测系统。

- 2022 年 5 月:吉利缤瑞 COOL 轿车轿跑车在中国上市,售价 14,000 美元,在中型轿车领域引起轰动。该车配备了主动安全功能、胎压监测系统和 2 级 ADAS 功能。

此外,现代和日产等主要区域汽车OEM正在策略性地製造先进的汽车 TPMS 技术,并将其与其安全系统相结合,以增加收益。目前,TPMS 的区域市场相当有限,但预计未来五年将会成长。

汽车TPMS产业概况

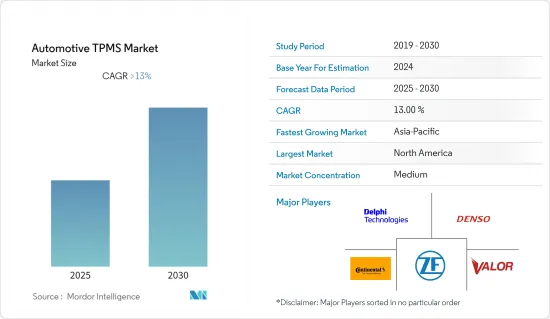

汽车TPMS与多家全球供应商、层级供应商、层级供应商适度整合。然而,在OEM供应方面,Sensata Technologies、Huf Electronics、Continental、Infineon Technology、Lear Corporation 和 ZF TRW 等公司占据市场主导地位。

- 2022 年 6 月:大陆集团是轮胎压力监测系统、TPMS 诊断工具和原始设备製造商和售后市场替换零件的领先创新者和供应商,该公司公布了其下一代 REDI-Sensor 多应用 TPMS 感测器的全新包装设计。这是大陆集团在该领域进行广泛研究和开发的成果。

- 2021 年 11 月:KRAIBURG Austria 宣布推出其基于网路的新型轮胎压力监测系统「TYLOGIC」。 TYLOGIC 能够可靠地检测出气压的逐渐或突然损失、卡车车轴或煞车的潜在机械损坏、或常规轮胎里程的结束。

此外,汽车製造商青睐大型製造商产品的主要原因之一是对高品质和耐用产品的需求。此外,这些领先的製造商已成倍增加了研发支出,以将汽车 TPMS 与其他安全相关解决方案相结合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 直接式胎压监测系统

- 间接式胎压监测系统

- 分销管道

- OEM

- 售后市场

- 车

- 搭乘用车

- 商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Delphi Automotive

- DENSO Corporation

- Continental AG

- ZF TRW

- Valor TPMS

- Pacific Industrial

- Schrader Electronics

- Hella KGaA Hueck & Co.

- Valeo

- ALLIGATOR Ventilfabrik GmbH

- Advantage PressurePro Enterprises Inc.

- Alps Electric Co. Ltd

- Sensata Technologies

- Huf Electronics

第七章 市场机会与未来趋势

The Automotive TPMS Market is expected to register a CAGR of greater than 13% during the forecast period.

The COVID-19 pandemic resulted in the shutdown of assembly lines, social distancing norms, and stringent lockdowns worldwide. The market took a step back and saw a decline in demand. However, following the pandemic, rising vehicle sales are expected to support market demand over the forecast period. Major players are forming strategic alliances and focusing on developing new products. For instance,

Key Highlights

- October 2022: Volvo Group, Qamcom Group, and the inventor Roman Lustin formed a new start-up company, Fyrqom AB. It will provide an automated system for calibrating heavy-duty vehicles' tire pressure monitoring systems (TPMS).

Over the long term, consumer preference for advanced driver assistance systems is expected to play a significant role in the automotive TPMS market growth. Furthermore, a surge in the sales of luxury vehicles equipped with TPMS will propel the automotive TPMS growth during the forecast period. Though demand for TPMS was initially driven by the luxury and premium car segments, well-equipped with this monitoring system, mid-segment one-tire vehicles meet market demand. For instance,

Key Highlights

- June 2022: Volkswagen debuted the 2022 Virtus with a 1-tire TSI Comfortline variant. More than 40 features and sensors are available in the sedan segment, including a tire pressure monitoring system.

The Asia-Pacific region is expected to be the largest market for automotive TPMS, with Japan, India, and China serving as major automotive hubs. The Indian automotive TPMS market is expected to be driven by rising consumer awareness, aftermarket TPMS installation, and rising demand for luxury vehicles. For instance,

Key Highlights

- September 2022: Chongqing Livan Automotive Technology Co., Ltd. (Livan Auto), a battery-swappable car brand supported by Geely Automobile and Lifan Technology, introduced two new models. It includes a central console screen with an 8-inch LCD, a Tire Pressure Monitoring System (TPMS), and a Hill Hold Control (HHC) system.

Automotive TPMS Market Trends

Increasing Adoption of TPMS in Vehicles to Enhance Growth of Market

TPMS is most commonly used in passenger vehicles, where tire pressure management is regarded as a critical safety system. The automotive industry is stepping up its efforts to introduce features that reduce the collision's impact, reduce fatalities, and improve overall vehicle safety. It will fuel the growth of the automotive TPMS market during the forecast period.

Dill Air Control, for example, is now producing TPMS systems for high-end models from Toyota, Lexus, BMW, Volkswagen, Hyundai, Chrysler, Jeep, and Rolls Royce. Significant automakers' sports, premium, and luxury segment passenger cars now include TPMS as standard equipment, with tire pressure displayed in the instrument panel display. With increasing consumer demand for vehicles with advanced safety features, TPMS is expected to become standard in C-segment hatchbacks, Sedans, and SUVs.

Furthermore, due to this system's numerous benefits, several automakers in the passenger car segment are offering the installed TPMS in their proposed fleet. For instance:

- May 2022: the newly released Audi A6 2022 model includes a sophisticated tire pressure monitoring system. This feature was introduced in the 2022 model A6 but was unavailable in the 2021 models.

- May 2022: Compared to the older model, the newly launched 2022 hybrid premium midsize sedan Honda City includes a tire pressure monitoring system (TMPS).

Due to these additions to automakers' newly launched fleets, demand for passenger vehicles in the market is expected to remain positive throughout the forecast period.

Asia-Pacific Region Anticipated to Grow at Significant Level During the Forecast Period

The Asia-Pacific automotive TPMS market is expected to grow and hold a significant share of the global automotive TPMS market during the forecast period.

China and India are expected to be the region's market leaders. Factors such as rising premium car market penetration and increased safety installations per vehicle (due to the safety regulations adopted by governments/agencies) drive up demand for TPMS and other ADAS. Safety systems, such as automotive TPMS, found in compact and mid-sized vehicles in advanced Asian economies such as Japan, South Korea, and Singapore, are progressive and typically on par with those found in Europe and North America.

Growth in premium and mid-segment car sales in Asia-Pacific is a critical growth factor for TMPS adoption. Several automakers are pushing the pace of passenger vehicle sales even faster and launching new products. For instance:

- August 2022: The iMAX8 EV, a mid-sized electric MPV from SAIC Roewe, was unveiled. It is available in five variants, with prices ranging from CNY 259,800 (USD 37316.32) to CNY 359,800 (USD 51679.80) after subsidies. Tire Pressure Monitoring System is one of the vehicle's features.

- May 2022: Geely Binrui COOL Sedan Coupe was launched in China for USD 14,000 and is considered the racing storm in the mid-sedan segment. The car includes active safety features, a tire pressure monitoring system, and Level 2 ADAS functions.

Furthermore, critical regional automotive OEMs such as Hyundai and Nissan intend to increase revenue by strategically manufacturing and integrating advanced automotive TPMS technology with safety systems. Although the regional market for TPMS is currently quite limited, it is expected to increase over the next five years.

Automotive TPMS Industry Overview

The automotive TPMS is moderately consolidated due to several global, tier-2, and tier-3 suppliers. However, regarding OEM supply, companies like Sensata Technologies, Huf Electronics, Continental, Infineon Technology, Lear Corporation, and ZF TRW dominate the market.

- June 2022: Continental, a leading innovation and supplier of OE and aftermarket for tire pressure monitoring systems, TPMS diagnostic tools, and replacement parts, introduced a new packaging design for its next generation of REDI-Sensor Multi-Application TPMS Sensors. It came from the exhaustive research and development conducted by Continental AG in this segment.

- November 2021: KRAIBURG Austria announced the launch of a new, web-based tire pressure monitoring system called TYLOGIC, which reliably detects gradual or abrupt pressure loss, possible mechanical damage to axles or brakes of the truck, or the imminent end of the regular tire mileage.

Furthermore, one of the primary reasons that automakers prefer products from major manufacturers is the demand for high-quality and durable products. Moreover, these significant players increased R&D spending exponentially to integrate automotive TPMS with other safety-related solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Type

- 5.1.1 Direct TPMS

- 5.1.2 Indirect TPMS

- 5.2 Sales Channel Type

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of the Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Delphi Automotive

- 6.2.2 DENSO Corporation

- 6.2.3 Continental AG

- 6.2.4 ZF TRW

- 6.2.5 Valor TPMS

- 6.2.6 Pacific Industrial

- 6.2.7 Schrader Electronics

- 6.2.8 Hella KGaA Hueck & Co.

- 6.2.9 Valeo

- 6.2.10 ALLIGATOR Ventilfabrik GmbH

- 6.2.11 Advantage PressurePro Enterprises Inc.

- 6.2.12 Alps Electric Co. Ltd

- 6.2.13 Sensata Technologies

- 6.2.14 Huf Electronics