|

市场调查报告书

商品编码

1687151

锂:市场占有率分析、产业趋势和统计数据、成长预测(2025-2030 年)Lithium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

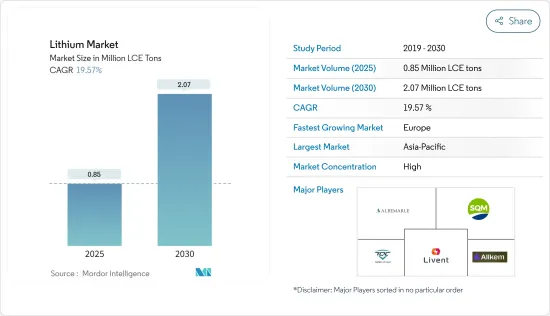

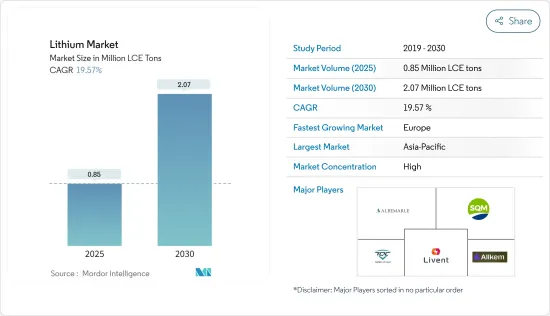

预计 2025 年锂市场规模为 85 万吨,2030 年将达到 207 万吨,预测期间(2025-2030 年)的复合年增长率为 19.57%。

2020 年,汽车市场受到新冠疫情的严重打击,上半年受到封锁影响,自 2 月以来月度汽车销量出现前所未有的下降。目前市场已恢復至疫情前的水准。

关键亮点

- 短期内,电动车需求加速成长以及可携式家用电子电器的使用和需求增加是推动市场发展的关键因素。

- 然而,对锂市场供需缺口的日益担忧可能会阻碍市场成长。

- 在预测期内,智慧电网电力的日益普及可能会为全球锂市场带来重大机会。

- 亚太地区在全球市场占据主导地位,其中消费量最高的国家是中国、韩国和日本。

锂市场趋势

电池应用领域占据市场主导地位

- 锂主要用于生产锂电池。电池应用领域占全球锂市场的最大份额。

- 锂电池可分为一次性电池和可充电电池两类。一次性锂电池使用金属锂作为负极。与其他标准电池相比,这些电池的寿命更长、充电密度更高。这些电池用于心臟起搏器和其他需要长期使用的电子医疗设备等关键设备。

- 可充电锂电池有两种类型:锂离子电池和锂离子聚合物电池。锂离子电池装在硬壳中,而锂聚合物电池装在柔性聚合物壳中。此外,锂聚合物电池的比能量比锂离子电池略高。锂聚合物电池使用聚合物作为电解质,而不是锂离子电池中使用的标准液体电解质。

- 在锂离子电池中,金属锂构成正极,锂与电解接触时发生的化学反应表征了电池的特性。然而,锂单独用于电池装置时非常不稳定。因此,锂和氧的组合(称为氧化锂)已作为正极投入实用化。这使得氧化锂成为比元素锂更稳定的化合物。

- 锂离子电池用途广泛,包括通讯设备和家用电子电器产品。锂离子电池重量轻、能量密度高、可充电,是便携式电子设备的理想选择。锂离子和锂聚合物充电电池由于能量密度高且无“记忆效应”,是行动电话、笔记型电脑和其他便携式电子设备最有效的电源。

- 这些电池在电动车 (EV)、行动电话、笔记型电脑、电源备份/UPS、平板电脑、电动工具、视讯游戏、玩具和电动自行车等产品中需求量很大。除此之外,锂电池也在能源储存系统中得到应用,考虑到风能等各种可再生能源领域的成长,使用锂离子电池的能源储存系统的需求正在以相当快的速度成长。

- 锂离子电池之所以受到欢迎,主要是因为与其他类型的电池相比,其容量重量比更佳。推动锂离子电池普及的其他因素包括效能的提高(寿命更长、维护成本更低)和价格的下降。

- 全球主要锂离子电池製造商包括LG化学、宁德时代、松下、三星SDI、比亚迪等。

- 由于上述因素,电池应用领域对锂的需求预计会增加。

亚太地区占市场主导地位

- 由于中国、韩国和日本等国家的锂消费量不断增加,亚太地区已成为锂消费的主要市场。

- 随着消费者越来越倾向于电池驱动的汽车,该国的汽车产业正在经历趋势的转变。电动车,包括Scooter、汽车和巴士等轻型商用车,在该国越来越受欢迎。根据中国乘用车市场资讯联席会(CPCA)预测,2021年中国汽车销量将超过330万辆,较2020年成长约169%。

- 中国政府预测未来五年电动车普及率将达20%。因此,汽车电池的生产和消费预计将会增加。中国电池製造商 CATL 控制着全球 30% 以上的电动车电池市场。钴专业供应商 Darton Commodities 估计,中国炼油厂供应了全球 85% 的电池钴,有助于提高锂离子电池的稳定性。

- 根据国家锂电池蓝图,预计到 2025 年中国锂电池产量将达到 1,811 吉瓦。中国是全球最大的电动车市场,并主导锂离子电池製造供应链,其中包括矿物和原料加工。

- 韩国最大的产业是电子、汽车、通讯、造船、化工和钢铁。韩国是最大的电子产品和半导体製造国之一,拥有三星电子、海力士半导体等全球知名品牌。

- 根据韩国汽车技术研究院(KAII)的资料,2021 年前 9 个月,韩国电动车销量成长 96%,达到 71,006 辆。

- 随着消费者对替代燃料技术的需求不断增长,日本的电动车销售未来可能会增加。不过,2021年日本内燃机汽车销量下降了3%以上,至4,448,340辆。日本汽车经销商协会称,660cc以上新车销量下降2.9%至2,795,818辆。根据轻型汽车协会统计,同年轻型汽车销量下降3.8%至1,652,522辆。

- 预计所有这些因素都将在预测期内推动锂市场的成长。

锂行业概况

全球锂市场呈现整合态势,前五大公司占全球产量的80%以上。市场的主要企业包括(不分先后顺序)Albemarle Corporation、SQM SA、天齐锂业、Livent 和 Allkem Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电动车需求不断成长

- 可携式家用电子电器的使用和需求不断增加

- 其他驱动因素

- 限制因素

- 锂市场供需缺口

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 定价分析

- 技术简介

第五章市场区隔

- 类型

- 金属

- 化合物

- 碳酸盐

- 氯化物

- 氢氧化物

- 合金

- 应用

- 电池

- 润滑脂

- 空气处理

- 製药

- 玻璃/陶瓷(包括玻璃料)

- 聚合物

- 其他的

- 最终用户产业

- 工业的

- 消费性电子产品

- 能源储存

- 医疗保健

- 车

- 其他的

- 地区

- 生产及蕴藏量分析

- 澳洲

- 智利

- 中国

- 阿根廷

- 辛巴威

- 美国

- 其他中东和非洲地区

- 消费分析

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 生产及蕴藏量分析

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介(概况、财务状况、产品与服务、最新发展)

- Albemarle Corporation

- Allkem Limited

- Ganfeng Lithium Co. Ltd

- Lithium Australia NL

- Livent

- Mineral Resources

- Morella Corporation Limited

- Sichuan Yahua Industrial Group Co. Ltd

- SQM SA

- Tianqi Lithium

- Avalon Advanced Materials Inc.

- Pilbara Minerals

第七章 市场机会与未来趋势

- 扩大智慧电网的使用

- 其他机会

The Lithium Market size is estimated at 0.85 million lce tons in 2025, and is expected to reach 2.07 million lce tons by 2030, at a CAGR of 19.57% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020, as the first half of the year was affected by the lockdowns, causing unprecedented declines in monthly vehicle sales from February. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the major factors driving the market studied are the accelerating demand for electric vehicles and increasing usage and demand for portable consumer electronics.

- However, rising concern over the demand-supply gap in the lithium market may hamper the market growth.

- Nevertheless, the growing adoption of smart grid electricity is likely to be a major opportunity in the global lithium market over the forecast period.

- Asia-Pacific dominates the market across the world, with the most substantial consumption from countries like China, South Korea, and Japan.

Lithium Market Trends

The Battery Application Segment to Dominate the Market

- Lithium is majorly used for the production of lithium batteries. The battery application segment accounted for the largest share of the global lithium market.

- Lithium batteries can be categorized into two segments, namely, disposable and rechargeable. Disposable lithium batteries use lithium in the metallic form as an anode. These batteries have a longer life and higher charge density when compared to other standard batteries. These batteries find applications in critical devices, such as pacemakers and other electronic medical devices intended for long-term use.

- Rechargeable lithium batteries are of two types, i.e., lithium-ion batteries and lithium-ion polymer batteries. Li-ion battery is packed in a rigid case, whereas the Li-po battery comes in a flexible polymer casing. Also, a Li-po battery has a slightly higher specific energy when compared to a Li-ion battery. The Li-po battery uses a polymer as an electrolyte instead of the standard liquid electrolyte used in a Li-ion battery.

- In the case of a Li-ion battery, the metal lithium forms the cathode, and it is the chemical reactions of lithium upon contact with the electrolyte that makes these batteries characteristic. However, elemental lithium is highly unstable when used inside a battery's apparatus. Hence, a combination of lithium and oxygen together, called lithium oxide, is used as the cathode for practical purposes. Thereby, lithium oxide is a much more stable compound as opposed to elemental lithium.

- Lithium-ion batteries are employed in several applications, including telecommunication devices and consumer electronics. The light weight of lithium-ion batteries, coupled with their high energy density and rechargeability, makes them a good fit for portable electronics. Due to their energy density and lack of 'memory effect,' lithium-ion and lithium-polymer rechargeable batteries are the most efficient power sources for cell phones, laptops, and other portable electronic devices.

- These batteries are in great demand in products such as electric vehicles (EVs), cell phones, laptops, power backups/UPS, tablets, power tools, video games, toys, and e-bikes. Apart from these, lithium-based batteries find one of their applications in energy storage systems, and the demand for lithium-ion battery-based energy storage systems is growing at a significant pace, considering the growth in various renewable energy sectors, including wind and others.

- Li-ion batteries are gaining more popularity compared to other battery types, majorly due to their favorable capacity-to-weight ratio. The other factors that contribute to its adoption include its better performance (long life and low maintenance) and decreasing price.

- Some of the key global lithium-ion battery manufacturers include LG Chem, Contemporary Amperex Technology Co., Limited (CATL), Panasonic, Samsung SDI, and BYD, among other companies.

- All the above-said factors are expected to increase the demand for lithium in the battery application segment.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific was found to be the major market for the consumption of lithium, owing to increasing consumption from countries such as China, South Korea, and Japan.

- The automobile industry in the country is witnessing switching trends as the consumer inclination toward battery-operated vehicles is on the higher side. Electric vehicles, including scooters, passenger cars, and light commercial vehicles like buses, are gaining popularity in the country. According to the China Passenger Car Association (CPCA), the country sold over 3.3 million units in 2021, indicating an increase of about 169% compared to 2020.

- The government of China estimates a 20% penetration rate of electric vehicle production over the next five years. Hence, this is anticipated to increase the production and consumption of batteries for vehicles. Chinese battery maker CATL controls over 30% of the world's EV battery market. The cobalt specialist supplier, Darton Commodities, estimated that Chinese refineries supplied 85% of the world's battery-ready cobalt, a mineral that helps in improving the stability of lithium-ion batteries.

- According to the National Blueprint for Lithium Batteries, China is projected to have 1,811 GWh of lithium cell production by 2025. China is the largest global EV market and dominates the supply chain for the manufacture of lithium-ion batteries, including the processing of minerals and raw materials.

- South Korea's largest industries are electronics, automobiles, telecommunications, shipbuilding, chemicals, and steel. The country is among the largest manufacturers of electronic goods as well as semiconductors, with globally popular brands, such as Samsung Electronics Co. Ltd and Hynix Semiconductor.

- According to the data collected by the Korea Automotive Technology Institute (KAII), the sales of electric vehicles in the country surged by 96% to 71,006 units in the first nine months of 2021.

- Electric vehicle sales in Japan are likely to ascend in the future with rising consumer demand for alternate fuel technology. However, ICE-based automobile sales in the country dropped by over 3% to 4,448,340 units in 2021. The Japan Automobile Dealers Association reported that sales of new vehicles larger than 660 CC slipped by 2.9% to 2,795,818 units. The Japan Light Motor Vehicle and Motorcycle Association reported that sales of mini-vehicles fell by 3.8% to 1,652,522 units in the same year.

- All these factors are expected to facilitate the growth of the lithium market over the forecast years.

Lithium Industry Overview

The global lithium market is consolidated in nature, with the top five players holding more than 80% share of the global production outputs. Some of the major players in the market include (not in any particular order) Albemarle Corporation, SQM SA, Tianqi Lithium, Livent, and Allkem Limited, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Accelerating Demand for Electric Vehicles

- 4.1.2 Increasing Usage and Demand by Portable Consumer Electronics

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Demand-supply Gap in the Lithium Market

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Pricing Analysis

- 4.6 Technological Snapshot

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Metal

- 5.1.2 Compound

- 5.1.2.1 Carbonate

- 5.1.2.2 Chloride

- 5.1.2.3 Hydroxide

- 5.1.3 Alloy

- 5.2 Application

- 5.2.1 Battery

- 5.2.2 Grease

- 5.2.3 Air Treatment

- 5.2.4 Pharmaceuticals

- 5.2.5 Glass/Ceramic (Including Frits)

- 5.2.6 Polymer

- 5.2.7 Other Applications

- 5.3 End-user Industry

- 5.3.1 Industrial

- 5.3.2 Consumer Electronics

- 5.3.3 Energy Storage

- 5.3.4 Medical

- 5.3.5 Automotive

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Production and Reserve Analysis

- 5.4.1.1 Australia

- 5.4.1.2 Chile

- 5.4.1.3 China

- 5.4.1.4 Argentina

- 5.4.1.5 Zimbabwe

- 5.4.1.6 United States

- 5.4.1.7 Other Regions

- 5.4.2 Consumption Analysis

- 5.4.2.1 Asia-Pacific

- 5.4.2.1.1 China

- 5.4.2.1.2 India

- 5.4.2.1.3 Japan

- 5.4.2.1.4 South Korea

- 5.4.2.1.5 Australia & New Zealand

- 5.4.2.1.6 Rest of Asia-Pacific

- 5.4.2.2 North America

- 5.4.2.2.1 United States

- 5.4.2.2.2 Canada

- 5.4.2.2.3 Mexico

- 5.4.2.3 Europe

- 5.4.2.3.1 Germany

- 5.4.2.3.2 United Kingdom

- 5.4.2.3.3 France

- 5.4.2.3.4 Italy

- 5.4.2.3.5 Nordic Countries

- 5.4.2.3.6 Rest of Europe

- 5.4.2.4 South America

- 5.4.2.4.1 Brazil

- 5.4.2.4.2 Argentina

- 5.4.2.4.3 Rest of South America

- 5.4.2.5 Middle East and Africa

- 5.4.2.5.1 Saudi Arabia

- 5.4.2.5.2 South Africa

- 5.4.2.5.3 Rest of Middle East and Africa

- 5.4.1 Production and Reserve Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 Albemarle Corporation

- 6.4.2 Allkem Limited

- 6.4.3 Ganfeng Lithium Co. Ltd

- 6.4.4 Lithium Australia NL

- 6.4.5 Livent

- 6.4.6 Mineral Resources

- 6.4.7 Morella Corporation Limited

- 6.4.8 Sichuan Yahua Industrial Group Co. Ltd

- 6.4.9 SQM SA

- 6.4.10 Tianqi Lithium

- 6.4.11 Avalon Advanced Materials Inc.

- 6.4.12 Pilbara Minerals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption in Smart Grid Electricity

- 7.2 Other Opportunities