|

市场调查报告书

商品编码

1687154

非洲油田服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Africa Oilfield Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

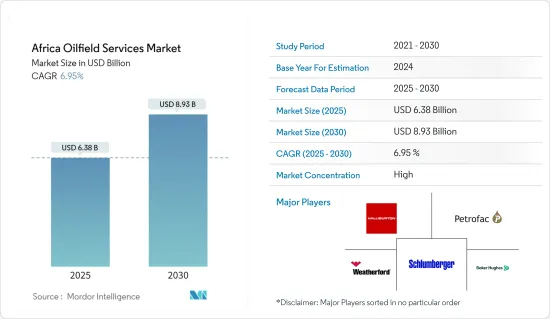

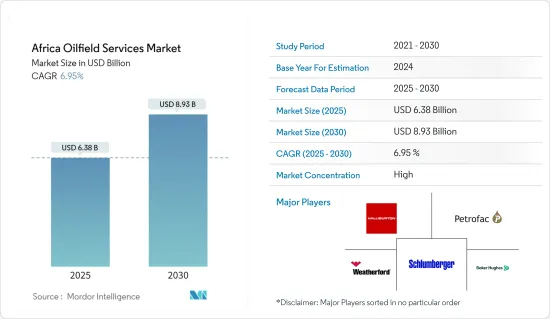

预计 2025 年非洲油田服务市场规模为 63.8 亿美元,到 2030 年将达到 89.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.95%。

2020年市场受到了新冠疫情的负面影响。目前市场已经恢復到疫情前的水准。

从长远来看,由于对原油和天然气的需求增加,预计探勘和生产活动的活性化将在预测期内推动非洲油田服务市场的发展。

另一方面,油气价格的波动为油气业者带来了不确定性,这可能会抑制未来几年非洲油田服务市场的成长。

此外,预计未来几年该地区深水和超深水钻井活动的增加以及初级能源消耗的上升将为市场参与者提供充足的机会。

由于探勘活动的活性化和最近发现的石油弥补了其他地区油田产量的下降,预计尼日利亚将主导市场。

非洲油田服务市场趋势

钻井服务占市场主导地位

在油田服务领域,钻井完井服务占50%以上的市场。

非洲海上探勘和生产(E&P)活动的成长很大程度上得益于该地区各国政府的努力,这不仅增加了对尼日利亚、加纳等国海上活动感兴趣的全球石油和燃气公司名单,而且还提供了重大奖励以释放投资机会。

随着原油价格上涨,上游投资不断增加,多个计划正在运作,预计将推动市场成长。

截至 2022 年 5 月,阿尔及利亚运作的石油和天然气钻井钻机数量最多,为 34 座,其次是奈及利亚,为 11 座。石油钻机的增加反过来将支持全部区域油田服务的成长。

此外,2022 年 4 月,Saipem 获得了 Eni SPA 的一份合同,将使用超深水钻井船 Saipem 12000 在西北非洲进行钻探宣传活动。根据与 Eni 签订的合同,作业计划于 2022 年 4 月开始,并将继续当前的活动。

此外,2022 年 3 月,Sonatrach 宣布计画于 2023 年开始在阿尔及利亚首次海上石油钻探。预计这将在未来几年增加该国对海上油田服务的需求。

因此,预计预测期内钻井服务部门将主导非洲油田服务市场。

尼日利亚占据市场主导地位

由于油田老化和现有油田碳氢化合物产量减少,尼日利亚的石油和天然气产量一直在下降,预计这将提振市场。

截至 2021 年,该国是非洲领先的石油生产国之一。石油产量将达到约 7,800 万吨(MMT)。紧随其后的是利比亚、阿尔及利亚和安哥拉,产量均超过 5,000 万吨 (MMT)。此外,2022 年 11 月,该国记录了 12 个海上石油钻机。海上钻机的增加可能会导致全国油田服务的成长。

此外,2022 年 10 月,石油钻探公司 Dolphin Drilling 与奈及利亚 General 碳氢化合物 Limited (GHL) 签署了一份为期一年的海上钻油平臺合约。该合约价值9600万美元。

2022年11月,奈及利亚总统穆罕默杜·布哈里开设了该国首个石油钻井站。此外,尼日利亚上游石油监管委员会宣布计划拍卖七个深水油田区块。该油田位于尼日利亚西南部拉各斯海岸,水深在 1,200 公尺(3,936 英尺)至 3,100 公尺之间。

因此,预计上述因素将在预测期内推动尼日利亚市场的成长。

非洲油田服务业概况

非洲油田服务市场较为分散,有多家大大小小的参与者。该市场的主要企业(不分先后顺序)包括斯伦贝谢有限公司、佩特罗法有限公司、威德福国际有限公司、贝克休斯公司和哈里伯顿公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模与需求预测

- 最新趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 服务类型

- 钻井服务

- 完工服务

- 生产服务

- 其他服务

- 地点

- 陆上

- 海上

- 地区

- 奈及利亚

- 安哥拉

- 阿尔及利亚

- 其他非洲地区

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Transocean Ltd

- Basic Energy Services Inc.

- China Oilfield Services Ltd

- ENSCO International Inc.

- Weatherford International PLC

- Nabors Industries Inc.

- Schlumberger Limited

- Baker Hughes Company

- Petrofac Ltd

- Halliburton Company

- TechnipFMC PLC

第七章 市场机会与未来趋势

The Africa Oilfield Services Market size is estimated at USD 6.38 billion in 2025, and is expected to reach USD 8.93 billion by 2030, at a CAGR of 6.95% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Over the long term, increasing exploration and production activities due to rising crude oil and natural gas demand will likely drive the African oilfield services market during the forecast period.

On the other hand, volatile oil and gas prices are leading to uncertainty among oil and gas operators, which is likely to restrain the growth of the African oilfield services market in the coming years.

In addition, advancements in the region's deepwater and ultra-deepwater drilling activities and increasing primary energy consumption are expected to create ample opportunities for market players in the coming years.

Nigeria is expected to dominate the market, owing to increased exploration activity to compensate for declining fields elsewhere and recent oil discoveries.

Africa Oilfield Services Market Trends

Drilling Services to Dominate the Market

Oilfield services are dominated by drilling and completion services, which make up more than 50% of the market.

The growth of Africa's offshore exploration and production (E&P) activities has been mainly driven by the efforts of governments in the region to provide key incentives to unlock the investment opportunity, as well as to increase the list of global oil and gas companies interested in offshore activities in countries, such as Nigeria, Ghana, etc.

As crude oil prices rise, upstream investment is expected to increase, and several projects will come online, resulting in market growth.

As of May 2022, Algeria had the most active oil and gas rigs in Africa, with 34, followed by Nigeria with 11. The growing oil rigs will, in turn, support the growth of oilfield services across the region.

Moreover, in April 2022, Saipem won a contract with Eni SPA for the drilling campaign to be conducted using the ultra-deep-water drillship Saipem 12000 in North-West Africa. The operations under the contract with Eni are expected to start in April 2022 in continuity with previous activities.

Furthermore, in March 2022, Sonatrach announced its plan to start its first offshore oil drilling in Algeria in 2023. This is, in turn, expected to increase the demand for offshore oilfield services in the country in the coming years.

Therefore, the drilling service segment is expected to dominate the African oilfield services market during the forecast period.

Nigeria to Dominate the Market

Oil and gas production in Nigeria is declining due to aging fields and reduced hydrocarbon production from existing fields, which is expected to boost the market.

The country was the leading oil producer in Africa as of 2021. Oil production amounted to roughly 78 million metric tons (MMT). Libya, Algeria, and Angola followed, each with an output above 50 million metric tons (MMT). Also, in November 2022, the country recorded 12 offshore oil rigs. The growing offshore rigs will culminate in the growth of oilfield services across the country.

Moreover, in October 2022, oil drilling company Dolphin Drilling secured a 1-year offshore drilling rig contract with Nigeria-based General Hydrocarbons Limited (GHL). The contract is worth USD 96 million.

Furthermore, in November 2022, Nigerian President Muhammadu Buhari opened the first oil drilling site in the country. Also, the Nigerian Upstream Petroleum Regulatory Commission has announced plans to auction seven deep offshore oil blocks. The oil blocks, located off the city of Lagos in southwestern Nigeria, are between 1,200 meters (3,936 feet) and 3,100 meters in depth.

Therefore, the aforementioned factors are expected to help the market grow in Nigeria during the forecast period.

Africa Oilfield Services Industry Overview

The African oilfield services market is partially fragmented, with several small and big players operating in the market. Some of the key players in this market (in no particular order) include Schlumberger Limited, Petrofac Ltd, Weatherford International PLC, Baker Hughes Company, and Halliburton Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Drilling Services

- 5.1.2 Completion Services

- 5.1.3 Production Services

- 5.1.4 Other Services

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 Nigeria

- 5.3.2 Angola

- 5.3.3 Algeria

- 5.3.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Transocean Ltd

- 6.3.2 Basic Energy Services Inc.

- 6.3.3 China Oilfield Services Ltd

- 6.3.4 ENSCO International Inc.

- 6.3.5 Weatherford International PLC

- 6.3.6 Nabors Industries Inc.

- 6.3.7 Schlumberger Limited

- 6.3.8 Baker Hughes Company

- 6.3.9 Petrofac Ltd

- 6.3.10 Halliburton Company

- 6.3.11 TechnipFMC PLC