|

市场调查报告书

商品编码

1687198

活性碳:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Activated Carbon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

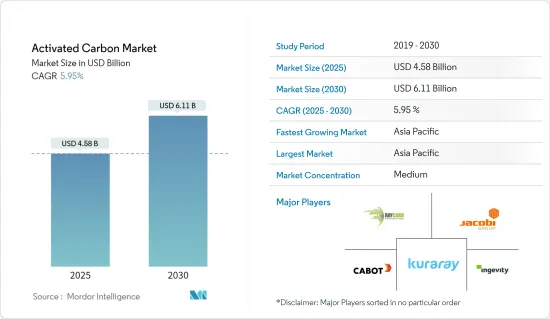

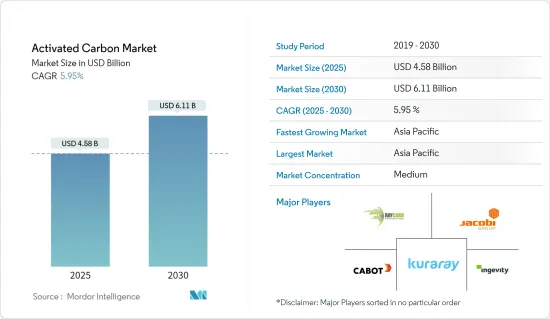

2025 年活性碳市场价值预估为 45.8 亿美元,预计到 2030 年将达到 61.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.95%。

考虑到COVID-19疫情导致金属采矿等各终端用户产业的活动暂时停止,需求下降,市场受到负面影响。然而,自疫情消退以来,所调查市场的需求已开始加速,预计未来几年将大幅成长。

主要亮点

- 中期推动市场发展的主要因素是美国水处理应用中严格的环境法规的遵守以及防止空气污染(尤其是去除汞)的重要性日益增加。

- 某些等级的活性碳成本的上升、硅胶等替代品的威胁以及由于更好的替代品的开发而导致的新兴市场的萎缩预计会阻碍市场的成长。

- 医疗和製药领域的新兴应用可能为市场提供积极的机会。

- 亚太地区贡献了最大的市场占有率,预计将在预测期内占据市场主导地位。

活性碳市场趋势

水处理产业占市场主导地位

- 水处理是活性碳的常见用途。大多数水处理过滤器由颗粒活性碳製成。活性碳用于去除有机化学物质和着色剂并减少化学物质和其他物质的痕迹。使用活性碳是处理市政/工业污水最有效的方法之一。活性碳通常以颗粒形式使用,以去除各种污染物,包括非生物分解的有机化合物、可吸收的有机卤素、着色化合物和染料以及杀虫剂。

- 污水和压舱水、地下水净化、地表水库、地下水和事故洩漏净化是活性碳的其他活动。活性碳还可以帮助去除污水厂的异味,污水处理厂的生物活动会产生硫化氢 (H2S)、氨 (NH3) 和挥发性有机化合物 (VOC)。

- 此外,由环保署(EPA)协调的联邦政策计画(包括《安全饮用水法》和《清洁水法》)为创新水和污水处理技术的运作和应用提供了处理和排放法规、资金计画和框架。因此,水处理领域对活性碳的需求预计将进一步增加。

- 中国拥有10113座水处理厂,处理95%城市和30%农村地区的污水。此外,中国在2021年3月发布的「十四五」规划中公布了污水再利用的新指南,规定到2025年,必须将经处理达到再利用标准的污水比例提高到25%。

- 水处理是活性碳的常见用途。大多数水处理过滤器由颗粒活性碳製成。它用于去除有机化学物质和色素并减少化学物质和其他物质的痕迹。使用活性碳是处理市政/工业污水最有效的方法之一。活性碳通常以颗粒形式使用,以去除各种污染物,包括非生物分解的有机化合物、可吸收的有机卤素、有色化合物和染料以及杀虫剂。

- 德国的水处理技术市场是欧洲最大的市场,并且正在快速成长。根据欧盟统计局和德国联邦统计局的数据,德国用水和污水、废水和废弃物管理产业在 2022 年创造了 996.3 亿美元的收益。

- 因此,考虑到世界各地区水处理和各种计划的不断增长趋势,水处理行业很可能占据市场主导地位,从而在预测期内增加对活性碳的需求。

亚太地区占市场主导地位

- 2022 年,亚太地区占据活性碳市场的主导地位,占有相当大的份额,预计在预测期内仍将保持主导地位。

- 近年来,中国加大了处理水的使用量,以减少对淡水的依赖。在中国五年计画(FYP)中,严格的法律规范和水再利用重要性的日益提升,推动中国水处理产业快速发展,实现永续发展。

- 据国际贸易局称,中国计划在2021年至2025年间新建或维修8万公里污水收集管网,增加污水处理能力2000万立方米/日。

- 中国是公认的医药市场,也是活性碳崛起最快的市场。该国国内製药业规模庞大且种类繁多,拥有约 5,000 家製造商,其中许多是中小型製造商。

- 在印度,班加罗尔用水和污水委员会选择苏伊士来支持该市并改善其污水基础设施。集团计划对现有工厂维修,新建一座处理能力为15万立方米/日的污水处理厂,并建造一座污水污泥回收利用厂,以处理两座工厂产生的污泥。预计该国对水处理的兴趣日益浓厚将推动活性碳市场的成长。

- 根据印度品牌股权基金会(IBEF)的数据,该国22财年的汽车年产量约为2,293万辆。汽车生产占印度GDP的49%,该产业的成长可能会增加印度对活性碳的需求。

- 印度食品工业是该国主导产业之一。人口成长预计也将推动食品产业的需求,进而预计将促进印度活性碳市场的发展。在印度,目前已有42个大型食品园区获得食品加工工业部批准,遍布24个邦,目前这些园区正处于实施阶段。

- 因此,上述原因可能在预测期内推动亚太地区活性碳市场的成长。

活性碳产业概况

活性碳市场部分合併,有几家公司在全球和区域层面运作。市场的主要企业包括 Kuraray、Cabot Corporation、Ingevity、Jacobi Carbons Group 和 Haycarb (Pvt.) Ltd(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 遵守美国针对水处理应用的严格环境法规

- 更重视空气污染防治(特别是汞去除)

- 限制因素

- 由于部分等级活性碳成本上涨,市场萎缩

- 硅胶等替代品的威胁以及更好替代品的开发

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 依产品类型

- 粉状活性碳 (PAC)

- 颗粒活性碳(GAC)

- 挤压或颗粒状活性碳

- 按应用

- 气体净化

- 水净化

- 金属提取

- 药品

- 其他用途

- 按最终用户产业

- 水疗

- 饮食

- 卫生保健

- 车

- 工业加工

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Advanced Emissions Solutions Inc.

- Albemarle Corporation

- Cabot Corporation

- Carbon Activated Corporation

- CARBOTECH

- CPL Activated Carbons

- Donau Carbon GmbH

- Evoqua Water Technologies LLC

- Haycarb(Pvt.)Ltd

- Ingevity

- Jacobi Carbons Group

- Kuraray Co. Ltd

- Kureha Corporation

- Puragen Activated Carbons

- Silcarbon Aktivkohle GmbH

- Veolia(Veolia Water Technologies)

第七章 市场机会与未来趋势

- 医疗和製药领域的新应用

The Activated Carbon Market size is estimated at USD 4.58 billion in 2025, and is expected to reach USD 6.11 billion by 2030, at a CAGR of 5.95% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic as the demand was reduced, considering the temporary halt of activities in various end-user industries, such as metal extraction and others. However, since the end of the pandemic, the demand for the market studied has picked up the pace and is likely to grow at a significant rate in the coming years.

Key Highlights

- In the medium term, major factors driving the market are conformance to stringent environmental regulations in water treatment applications in the United States and the increasing prominence of air pollution control (especially mercury removal).

- Narrower markets, due to the increased costs of some grades of activated carbon, the threat of substitutes like silica gel, and the development of better alternatives, are expected to hinder the growth of the market.

- Emerging applications in the medical and pharmaceutical sectors is likely to act as an opportunity for the market.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Activated Carbon Market Trends

Water Treatment Industry to Dominate the Market

- Water treatment is a popular application of activated carbon. Most water treatment filters are made of granular activated carbon. It is used to remove organic-chemical substances and colorants and reduce trace substances, such as chemicals.The usage of activated carbon is one of the most effective methods for the treatment of municipal/industrial wastewater. Activated carbon is normally used in granular form to remove a wide variety of contaminants, such as nonbiodegradable organic compounds, absorbable organic halogens, color compounds and dyestuffs, and pesticides.

- Wastewater and ballast water treatment, groundwater remediation, surface impoundments, and cleanup of groundwater and accidental spills are other applications of activated carbon. Activated carbon also helps in the removal of odors that occur in wastewater plants, where biological activity creates hydrogen sulfide (H2S), ammonia (NH3), VOCs, etc.

- In addition, federal policy programs, including the Safe Drinking Water Act and the Clean Water Act coordinated by the Environmental Protection Agency (EPA), provide treatment and discharge regulations, funding programs, and frameworks for operating and applying innovative water and wastewater treatment technologies. Hence, this is further expected to boost the demand for activated carbons from the water treatment segment.

- China has 10,113 water treatment plants that treat wastewater for 95% of municipalities and 30% of rural areas. Moreover, in the 14th Five-year Plan, released in March 2021, China published new guidelines for wastewater reuse, which mandated raising the proportion of sewage that must be treated to reuse standards to 25% by 2025.

- Water treatment is a popular application of activated carbon. Most water treatment filters are made of granular activated carbon. It is used to remove organic-chemical substances and colorants and reduce trace substances such as chemicals. The usage of activated carbon is one of the most effective methods for the treatment of municipal/industrial wastewater. Activated carbon is normally used in granular form to remove a wide variety of contaminants, such as nonbiodegradable organic compounds, absorbable organic halogens, color compounds and dyestuffs, and pesticides.

- The German water treatment technology market is the largest in Europe and is growing considerably. According to the Eurostat and Statistisches Bundesamt, the revenue of Germany's water supply, sewerage, and waste management industry generated USD 99.63 billion in 2022.

- Therefore, considering the growth trends and various projects of water treatment in different regions worldwide, the water treatment industry is likely to dominate the market, which, in turn, is expected to enhance the demand for activated carbon during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the activated carbon market in 2022 with a considerable volume share, and it is expected to maintain its dominance during the forecast period.

- In recent years, China has increased the use of treated water to reduce its dependency on fresh water. With a tough regulatory framework and the increasing importance of water reuse in China's five-year plans (FYPs), the country is rapidly moving toward enhancing its water treatment industry for a sustainable future.

- According to the International Trade Administration, China plans to build or renovate 80,000 km of sewage collection pipeline networks and increase sewage treatment capacity by 20 million cubic meters/day between 2021 and 2025.

- China has a recognized market for pharmaceuticals and is the fastest emerging market for activated carbons. The country has a large and diverse domestic drug industry, comprising around 5,000 manufacturers, of which many are small- or medium-sized.

- In India, the Water Supply and Sewerage Board of Bangalore selected SUEZ to support the city and improve wastewater infrastructures. The group is expected to build a new wastewater treatment plant of 150,000 m3/day capacity, including the rehabilitation of an existing plant, with a capacity of 150,000 m3/day and the building of a sewage sludge recycling and recovery plant, for the sludge coming from these two plants. This increase in focus on water treatment in the country is expected to drive the activated carbon market growth.

- As per the India Brand Equity Foundation (IBEF), the country's annual production of automobiles in FY 2022 was nearly 22.93 million. Automotive production accounts for 49% of the country's GDP, and hence, the growth in this sector is liable to increase the demand for activated carbon in India.

- The Indian food industry is one the prominent industries in the country. The increasing population is another factor boosting the demand for the food industry, which, in turn, is estimated to boost the activated carbon market in India. There are 42 mega food parks located in 24 states in India, sanctioned by the Ministry of Food Processing Industry, which are in different stages of implementation.

- Thus, the reasons mentioned above are likely to fuel the growth of the activated carbon market in Asia-Pacific during the forecast period.

Activated Carbon Industry Overview

The activated carbon market is partially consolidated, with several companies operating on both global and regional levels. Some of the major players in the market (not in any particular order) include Kuraray Co. Ltd, Cabot Corporation, Ingevity, Jacobi Carbons Group, and Haycarb (Pvt.) Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Conformance to Stringent Environmental Regulations in Water Treatment Applications in the United States

- 4.1.2 Augmenting Prominence for Air Pollution Control (Especially Mercury Removal)

- 4.2 Restraints

- 4.2.1 Narrower Markets Due to Increased Costs of Some Grades of Activated Carbon

- 4.2.2 Threat of Substitutes Like Silica Gel and Development of Better Alternatives

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Product Type

- 5.1.1 Powdered Activated Carbons (PAC)

- 5.1.2 Granular Activated Carbons (GAC)

- 5.1.3 Extruded or Pelletized Activated Carbon

- 5.2 By Application

- 5.2.1 Gas Purification

- 5.2.2 Water Purification

- 5.2.3 Metal Extraction

- 5.2.4 Medicine

- 5.2.5 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Water Treatment

- 5.3.2 Food and Beverage

- 5.3.3 Healthcare

- 5.3.4 Automotive

- 5.3.5 Industrial Processing

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Advanced Emissions Solutions Inc.

- 6.4.2 Albemarle Corporation

- 6.4.3 Cabot Corporation

- 6.4.4 Carbon Activated Corporation

- 6.4.5 CARBOTECH

- 6.4.6 CPL Activated Carbons

- 6.4.7 Donau Carbon GmbH

- 6.4.8 Evoqua Water Technologies LLC

- 6.4.9 Haycarb (Pvt.) Ltd

- 6.4.10 Ingevity

- 6.4.11 Jacobi Carbons Group

- 6.4.12 Kuraray Co. Ltd

- 6.4.13 Kureha Corporation

- 6.4.14 Puragen Activated Carbons

- 6.4.15 Silcarbon Aktivkohle GmbH

- 6.4.16 Veolia (Veolia Water Technologies)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications in the Medical and Pharmaceutical Sectors