|

市场调查报告书

商品编码

1687210

汽车煞车系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive Brake System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

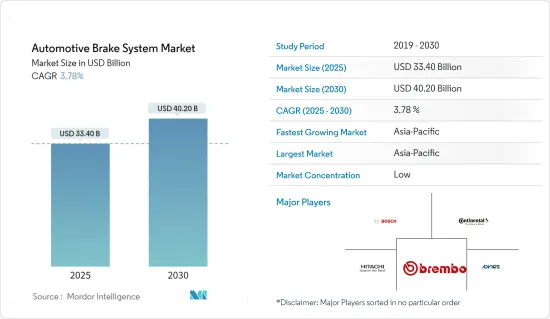

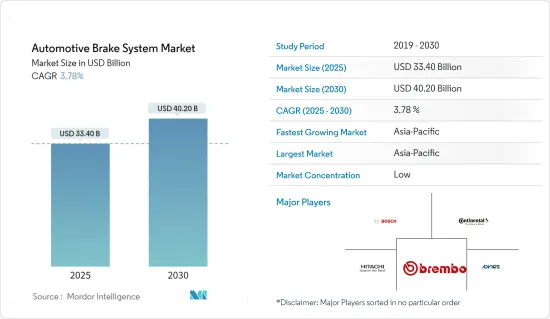

汽车煞车系统市场规模预计在 2025 年为 334 亿美元,预计到 2030 年将达到 402 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.78%。

由于几个关键因素,汽车煞车系统市场正在经历强劲成长。其中一个主要因素是全球汽车产量和销售量的成长。汽车产量的增加直接增加了对汽车煞车系统的需求,因为每辆汽车都需要可靠、高效的煞车系统来确保安全性和性能。

政府法规在加速汽车煞车系统市场的成长方面发挥关键作用。在美国,美国国家公路交通安全管理局(NHTSA)和运输部(DOT)正在提案规则,要求到2029年所有新型乘用车和轻型卡车必须配备自动紧急煞车(AEB)。这些规定旨在提高道路安全性,并减少因煞车反应延迟而导致的事故。

同样,欧盟的《通用安全法规》(GSR)要求,到2024年7月,新车必须配备包括AEB在内的先进安全功能。这些严格的安全标准迫使汽车製造商在其车辆中采用先进的煞车技术,从而推高了对汽车煞车系统的需求。

其他市场推动要素包括由于道路事故增加而导致的对安全和平稳驾驶的意识不断增强、对减轻车辆重量和摩擦的先进技术的需求以及主要製造商的研发活动。另一方面,电动车的日益普及和对自动驾驶汽车的日益关注预计将很快提升製造公司的商业性成长潜力。

汽车产业的成长也可能推动未来几年研究市场的发展。

汽车煞车系统市场趋势

预计预测期内OEM部门将出现显着成长

汽车公司不断生产新的和改进的产品,以使驾驶汽车更加舒适和安全。本公司提供整合式电子稳定控制(ESC)的防锁死煞车系统,以防止打滑并保持车辆控制。因此,汽车安全功能的技术进步是汽车煞车系统市场的潜在成长要素。

根据国际汽车工业组织(OICA)预测,2023年全球汽车产量将达到9511万辆,较上年的下滑有明显復苏。随着汽车产量的增加,对作为製造过程重要组成部分的OEM煞车系统的需求也随之增加。这种需求进一步受到消费者对先进煞车技术的日益增长的偏好所推动,例如 ABS(防锁死煞车系统)和 EBD(电子煞车力道分配),这些技术主要由OEM提供。

此外,预计到 2030 年电动车将占全球汽车销量的 42% 至 58%,而电动车需要专门的煞车系统来回收能量并提高安全性,这一趋势也将推动OEM领域发展。

随着人们对速度的要求不断提高,煞车已经成为任何汽车确保安全的重要组成部分,因此一些主要企业和汽车製造商都倾向于采用高品质的煞车系统。由于这种趋势, OEM正在与汽车製造商签订煞车系统供应合约。

预计亚太地区在预测期内将大幅成长

亚太地区继续占据市场主导地位,该地区的製造商享有低成本的劳动力和原材料,从而能够实现高成本节约。该地区由中国和印度等前景看好的国家组成,汽车产量分别为3,016万辆和585万辆,约占全球汽车产量的38.5%。主动煞车系统日益普及,推动了豪华和高檔汽车的销售。

公司主要致力于开发环保、可靠且坚固的煞车系统。领先的公司正在大力投资研发,以扩大市场占有率并确保健康成长。

- 2023年12月,Hella GmbH & Co. KGaA(海拉)宣布有意收购TMD Friction 的合资企业 Hella Pagid 50% 的股份,海拉将成为唯一股东。此举将于 2024 年 10 月 1 日起生效,符合 TMD Friction 的策略,即将 HELLA 的煞车产品整合到自有品牌下,同时专注于扩大 Pagid 品牌的销售。

- 2023年11月,采埃孚(ZF)将推出纯电子机械煞车系统。这种不使用液压部件的「干式」煞车系统可以显着缩短煞车距离并提高煞车能量回收效果,这对电动车尤其有利。该技术有望透过改善能源回收将电动车的续航里程提高 17%,并在煞车效率方面树立了新的标准。

此外,全球事故数量的不断增加也使得车辆,尤其是中阶车型的安全性能亟待提升。这一趋势在印度等国家尤为明显,为了减少交通事故,印度政府已要求从 2019 年 4 月起所有车辆必须配备防锁死煞车系统 (ABS)。这项监管倡议对汽车煞车系统市场产生了重大影响,迫使汽车製造商采用先进的煞车技术。

这些发展正在推动市场需求。因此,预计亚太地区在预测期内将出现成长。

汽车煞车系统产业概况

汽车煞车系统市场比较分散,拥有许多不同的参与者。市场的主要企业包括 Advics、Bosch Mobility Solutions、Continental AG、Brembo SpA 和 Hitachi Astemo。

主要企业正在积极投资新的製造设施以扩大生产能力。此次扩张旨在提高生产能力,透过将生产地点设在更靠近主要市场的地方来降低物流成本并提高供应链效率。这些新工厂的建立往往伴随着先进製造技术的采用,以提高生产效率和产品品质。

- 2024年2月,领先的先进煞车系统开发商ASK Automotive宣布计画在印度卡纳塔克邦建立新的製造工厂,投资额为2.19亿印度卢比。该工厂预计将于 2025 年第四季度运作,并将提高 ASK Automotive 的煞车板组件、煞车蹄片和其他关键煞车零件的生产能力。

- 2024年1月,总部位于中国的Winhair在泰国罗勇府开始建造新工厂,实现了重大扩张。该工厂专门生产煞车盘和煞车皮,旨在加强泰国作为汽车零件行业主要供应商的地位。该计划预计于 2025 年初完工,将增强 Winhair 在国内和国际市场的生产能力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 汽车产量增加

- 市场限制

- 全球贸易动态

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 依产品类型

- 碟式煞车

- 鼓式煞车

- 煞车皮材料类型

- 有机的

- 金属

- 陶瓷製品

- 按销售管道

- 目标商标产品製造商(OEM)

- 售后市场

- 按车型

- 商用车

- 搭乘用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 南非

- 其他国家

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Akebono Brake Industry Co. Ltd

- Brembo NV

- Robert Bosch GmbH

- Continental AG

- Disc Brakes Australia(DBA)

- Aptiv PLC

- Federal-Mogul Holding Co.

- Hella Pagid GmbH

- Performance Friction Corporation(PFC)Brakes

- Sundaram Brake Linings(SBL)

- ZF TRW Co.

- Advics Co. Ltd

- Hitachi Automotive Systems

第七章 市场机会与未来趋势

- 物联网在汽车煞车系统市场的运用

The Automotive Brake System Market size is estimated at USD 33.40 billion in 2025, and is expected to reach USD 40.20 billion by 2030, at a CAGR of 3.78% during the forecast period (2025-2030).

The automotive brake system market is experiencing robust growth, driven by several key factors. One of the primary drivers is the increasing production and sales of vehicles worldwide. This growth in vehicle production directly boosts the demand for automotive brake systems, as every vehicle requires a reliable and efficient braking system for safety and performance.

Government regulations play a crucial role in accelerating the growth of the automotive brake system market. In the United States, the National Highway Traffic Safety Administration (NHTSA) and the Department of Transportation (DOT) have proposed rules mandating the inclusion of automatic emergency braking (AEB) in all new passenger cars and light trucks by 2029. These regulations are designed to improve road safety and reduce accidents caused by delayed braking responses.

Similarly, the European Union's General Safety Regulation (GSR) mandated advanced safety features, including AEB, in new vehicles in July 2024. These stringent safety standards compel automakers to integrate advanced braking technologies into their vehicles, driving the demand for automotive brake systems.

Some other factors driving the market are growing awareness about safe and smooth driving in the wake of increasing road accidents, the demand for advanced technology to reduce weight and friction generated in vehicles, and R&D activities by major players. On the other hand, the increasing adoption of electric cars and the rising focus on autonomous vehicles are expected to boost the commercial growth potential of manufacturing companies shortly.

The growth in the automotive segment may also drive the studied market in the coming years.

Automotive Brake System Market Trends

The OEM Segment is Expected to Witness Prominent Growth During the Forecast Period

Automobile companies are constantly producing new and enhanced products for the comfortable and safe driving of vehicles. Companies are providing anti-lock braking systems integrated with electronic stability control (ESC) to prevent skidding, thus bringing vehicles under control. Therefore, technological advancements in vehicle safety features are a potential driver for the growth of the automotive brake system market.

According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached 95.11 million units in 2023, marking a significant recovery from the previous year's decline. As vehicle production rises, the demand for OEM brake systems, which are integral to the manufacturing process, also increases. This demand is further amplified by the growing consumer preference for advanced braking technologies such as ABS (anti-lock braking system) and EBD (electronic brakeforce distribution), which are predominantly supplied by OEMs.

Additionally, the rising trend of electric vehicles, which are expected to constitute between 42% and 58% of car sales in the global vehicle market by 2030, also boosts the OEM segment, as EVs require specialized braking systems for energy regeneration and enhanced safety.

As brakes have become a crucial part of any vehicle to ensure safety when the demand for speed is increasing consistently, several key companies and automakers are inclined toward embedding high-quality brake systems. This trend has resulted in OEMs signing contracts with automobile manufacturers to supply braking systems.

Asia-Pacific is Anticipated to Grow Significantly During the Forecast Period

Asia-Pacific continues to dominate the market, and manufacturers in the region offer high-cost reductions due to the availability of low-cost labor and raw materials. The region comprises some high-potential countries, such as China and India, which accounted for 30.16 million and 5.85 million of vehicle production, respectively, i.e., approximately 38.5% of the total global vehicle production. The increasing popularity of active braking systems boosts the sales of luxury and premium vehicles.

The companies are primarily focused on developing eco-friendly, reliable, and robust braking systems. The key players have made heavy investments in research and development to increase their market shares and ensure healthy growth.

- In December 2023, Hella GmbH & Co. KGaA (HELLA) announced its intent to acquire TMD Friction's 50% share in their joint venture, Hella Pagid, making HELLA the sole shareholder. This move, effective from October 1, 2024, aligns with HELLA's strategy to consolidate its brake product offerings under its brand while TMD Friction focuses on expanding its Pagid brand sales.

- In November 2023, ZF Friedrichshafen (ZF) launched a purely electro-mechanical brake system. This "dry" brake system, devoid of hydraulic components, allows for significantly shorter braking distances and enhanced recovery of braking energy, which is particularly beneficial for electric vehicles. This technology promises up to 17% more range for electric vehicles through improved energy recovery, setting a new standard in braking efficiency.

The growing number of accidents globally has also necessitated the enhancement of safety features in vehicles, particularly in mid-segment models. This trend is evident in countries such as India, where the government mandated the installation of anti-lock braking systems (ABS) in all vehicles starting in April 2019 to reduce road accidents. This regulatory push has significantly impacted the automotive brake system market, compelling automakers to adopt advanced braking technologies.

Such developments drive demand in the market. Hence, Asia-Pacific is expected to have enhanced growth during the forecast period.

Automotive Brake System Industry Overview

The automotive brake system market is fragmented, with the presence of various players. Some of the key players in the market include Advics Co. Ltd, Bosch Mobility Solutions, Continental AG, Brembo SpA, and Hitachi Astemo Ltd.

Key players are actively investing in new manufacturing facilities to expand their production capabilities. This expansion is about increasing volume and situating production closer to key markets to reduce logistics costs and improve supply chain efficiency. Establishing these new facilities often comes with adopting advanced manufacturing technologies that increase production efficiency and product quality.

- In February 2024, ASK Automotive, a leading developer of advanced braking systems, announced its plans to set up a new manufacturing facility in Karnataka, India, with an investment of INR 2.19 lakh. Scheduled to be operational by Q4 2025, this facility will bolster ASK Automotive's production capabilities in brake panel assemblies, brake shoes, and other critical braking components.

- In January 2024, China-based Winhere marked a significant expansion by initiating the construction of a new factory in Rayong, Thailand. This facility, focusing on manufacturing brake discs and pads, aims to strengthen Thailand's role as a major supplier in the automotive parts industry. The project is expected to be completed in early 2025, enhancing Winhere's production capacity for both the domestic and international markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Vehicle Production

- 4.2 Market Restraints

- 4.2.1 Global Trade Dynamics

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Product Type

- 5.1.1 Disc Brakes

- 5.1.2 Drum Brakes

- 5.2 By Brake Pad Material Type

- 5.2.1 Organic

- 5.2.2 Metallic

- 5.2.3 Ceramic

- 5.3 By Sales Channel

- 5.3.1 Original Equipment Manufacturers (OEMs)

- 5.3.2 Aftermarket

- 5.4 By Vehicle Type

- 5.4.1 Commercial Vehicles

- 5.4.2 Passenger Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 South Africa

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Akebono Brake Industry Co. Ltd

- 6.2.2 Brembo NV

- 6.2.3 Robert Bosch GmbH

- 6.2.4 Continental AG

- 6.2.5 Disc Brakes Australia (DBA)

- 6.2.6 Aptiv PLC

- 6.2.7 Federal-Mogul Holding Co.

- 6.2.8 Hella Pagid GmbH

- 6.2.9 Performance Friction Corporation (PFC) Brakes

- 6.2.10 Sundaram Brake Linings (SBL)

- 6.2.11 ZF TRW Co.

- 6.2.12 Advics Co. Ltd

- 6.2.13 Hitachi Automotive Systems

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of IoT in the Automotive Brake System Market