|

市场调查报告书

商品编码

1687214

亚太地区油漆和涂料:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Asia-Pacific Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

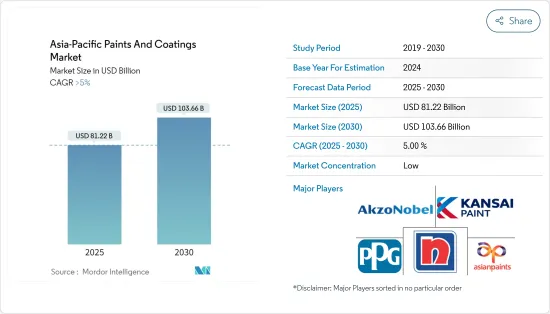

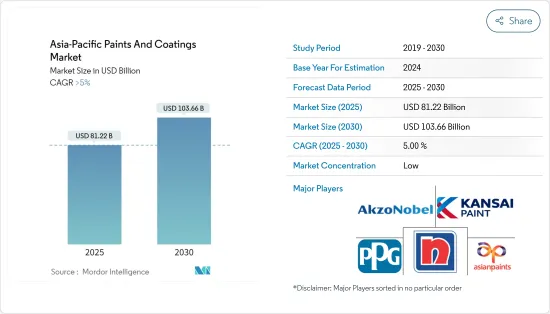

亚太地区油漆和涂料市场规模预计在 2025 年达到 812.2 亿美元,预计到 2030 年将达到 1,036.6 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5%。

COVID-19 疫情导致全国停工,扰乱了全球的製造活动和供应链。然而,这种情况将在 2021 年开始发生变化,预计亚太地区油漆和涂料市场的成长将在预测期内恢復。

关键亮点

- 短期内,马来西亚建筑业的成长和对保护涂料的需求增加预计将推动市场成长。

- 然而,严格的VOC排放法规是预测期内限制市场成长的主要因素。

- 环保涂料和耐腐蚀树脂的兴起预计将为亚太市场提供丰厚的成长机会。

- 由于油漆和涂料在终端用户工业领域的广泛应用,预计预测期内中国油漆和涂料市场将出现健康成长。

亚太地区涂料市场趋势

建筑业对油漆和被覆剂的使用日益增加,推动了市场

- 建筑涂料和油漆产业是亚太市场最大的涂料和油漆消费领域。建筑涂料用于粉刷建筑物和住宅,有特定用途,如屋顶漆、墙面漆、甲板漆等。

- 建筑涂料用于各种商业设施,包括办公大楼、仓库、便利商店、购物中心和住宅。这些涂料可用于外部或内部表面,还可以包括密封剂和特殊产品。

- 印度政府过去几年一直在投资各种建设基础设施计划。

- 2015年至2035年间,萨加玛拉计画将实施超过574个计划。这些倡议旨在实现港口现代化和建设新港口、加强港口连通性、促进港口相关产业发展以及振兴沿海社区。

- 马来西亚是该地区近年来投资各类建设计划的主要国家之一。根据马来西亚统计局发布的资料,预计 2023 年住宅建筑价值约为 287.8 亿马来西亚林吉特(约 60.1 亿美元),而 2022 年为 277 亿马来西亚林吉特(约 57.9 亿美元)。

- 在日本,根据统计局公布的资料,2023年总建筑面积约为111,214,000平方公尺,而2022年则为119,466,000平方公尺。

- 全部区域正在建造许多大型住宅和商业计划,新兴国家也正在规划新的计划。这将导致油漆和被覆剂的需求激增。

- 2024 年 3 月,努沙登加拉首都管理局 (OIKN) 宣布计划在印尼即将建成的首都建造 70 栋住宅大楼。预计该工程将于 2025 年或 2026 年完工。

- Minh Mont Kiara:该计划计划于 2023 年第四季开工,位于吉隆坡,占地 2.50 公顷,包括两栋 42 层高的住宅大楼,共 496 个单元。预计 2027 年第四季完工。

- Persiaran Lemak 住宅综合体:该计划计划于 2023 年第四季度开工,将在吉隆坡的两座塔楼中开发 1,040 个多用户住宅。预计 2025 年第四季完工。

- 2023年3月,印度领先房地产公司DLF宣布将在未来四年内投资约4.2144亿美元在古尔冈建设一个新的豪华住宅计划。 DLF 将开发一个新的集团住宅计划“The Arbour”,该项目由五座塔楼组成,占地 25 英亩,共有 1,137 套豪华公寓。

- 韩国政府也概述了实施大规模重建计划的计划,旨在到2025年在首尔和其他城市提供83万套住宅。该计画要求在首尔建造32.3万套新住宅,在京畿道和仁川建造29.3万套新住宅。釜山、大邱和大田等大城市也将受益于2025年计画兴建的22万套新住宅。

- 预计所有这些因素都将在预测期内推动亚太地区油漆和涂料市场的需求。

中国占市场主导地位

- 中国的建筑业繁荣得到了全世界的认可。廉租住宅和商用的需求是近年来增长的原因。

- 中国正在推动和推动持续都市化进程,目标是2030年都市化率达70%。都市化带来的都市区生活空间需求的增加,以及中等收入城镇居民改善居住环境的愿望,将对住宅市场产生重大影响,从而增加中国的住宅,这反过来可能会对油漆和涂料市场产生积极影响。

- 中国的油漆和涂料市场受到发达的住宅和商业建筑行业以及经济成长的支持。近期,香港住宅委员会推出多项措施,鼓励兴建经济适用住宅。当局的目标是到 2030 年提供 301,000 套公共住宅。

- 基础设施也是油漆和被覆剂的主要消耗者,用于防止损坏和延长表面寿命。中国正在进行的重大基础建设计划包括:

- 佛山地铁四号线第一期(69.84亿美元):广东省佛山正在兴建一条56公里长的地铁线。该计划旨在加强公共交通系统,提供更快捷、更可靠、更环保的交通。该项目预计于 2022 年第一季开工,并于 2026 年第四季完工。

- 上海地铁21号线第一期(57.15亿美元):上海正在兴建一条连接川沙路站和洞井路站的28公里地铁线。该计划旨在加强该地区的交通系统并减少旅行距离和时间。预计建设将于 2022 年第一季开始,并于 2027 年第四季完工。

- 中国是世界第二大石油和天然气消费量,但生产国仅第六大。中国作为石油消费大国,石油消费量逐年增加,成长波动。但石油供应仍无法满足需求,因此中国主要依赖进口。

- 如今,汽车业也是油漆和被覆剂的主要消费者。根据中国工业协会(CAAM)发布的资料,2023年国内汽车企业保有量约3,016万辆,与前一年同期比较成长约11.6%。

- 预计这些因素将在预测期内影响该国对油漆和被覆剂的需求。

亚太地区油漆和涂料行业概况

亚太地区的油漆和涂料市场本质上是高度细分的。主要参与企业包括日本涂料控股公司、亚洲涂料公司、关西涂料公司、阿克苏诺贝尔公司和 PPG 工业公司(排名不分先后)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑业加速成长

- 马来西亚对防护涂料的需求不断增加

- 其他驱动因素

- 限制因素

- 更严格的VOC排放法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 科技

- 水性

- 溶剂型

- 粉末

- 其他技术(UV/EB、高固体等)

- 树脂类型

- 丙烯酸纤维

- 醇酸

- 聚氨酯

- 环氧树脂

- 聚酯纤维

- 其他树脂类型(酚醛树脂、酮树脂等)

- 最终用户产业

- 建筑/装饰

- 车

- 木头

- 保护

- 一般工业

- 运输

- 包装

- 其他终端用户产业(塑胶涂料、农业、建筑和土木机械等)

- 地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 印尼

- 泰国

- 马来西亚

- 越南

- 菲律宾

- 新加坡

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- 3 Trees

- Akzo Nobel NV

- Asian Paints

- Avian Brands

- Axalta Coating Systems

- BASF SE

- Berger Paints India Limited

- Boysen Paints

- Davies Paints Philippines Inc.

- Hempel AS

- Jotun

- Kansai Paint Co. Ltd

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- PT. Propan Raya

- The Sherwin-Williams Company

- TOA Paint Public Company Limited

第七章 市场机会与未来趋势

- 环保涂料和耐腐蚀树脂的出现

- 其他机会

The Asia-Pacific Paints And Coatings Market size is estimated at USD 81.22 billion in 2025, and is expected to reach USD 103.66 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

Due to the COVID-19 pandemic, nationwide lockdowns disrupted manufacturing activities and supply chains worldwide. However, conditions started changing in 2021, with the growth of the Asia-Pacific paints and coatings market expected to be restored during the forecast period.

Key Highlights

- Over the short term, the increasing growth of the construction industry and the rise in demand for protective coatings in Malaysia are some of the factors projected to drive the growth of the market studied.

- However, tightening regulations on VOC emissions is a key factor anticipated to restrain the market's growth over the forecast period.

- Nevertheless, emerging eco-friendly paint and coating resins are expected to create lucrative growth opportunities for the Asia-Pacific market.

- The Chinese paints and coatings market is estimated to witness healthy growth over the forecast period due to the wide usage of paints and coatings in the end-user industry segments.

Asia-Pacific Paints and Coatings Market Trends

Increasing Usage of Paints and Coatings in the Construction Industry Set to Drive the Market

- The architectural paints and coatings segment is the largest consumer of paints and coatings in the Asia-Pacific market. They are used to coat buildings and homes and are designated for specific uses, such as roof coatings, wall paints, or deck finishes.

- Architectural coatings are used in various commercial buildings such as office buildings, warehouses, retail convenience stores, shopping malls, and residential buildings. Such coatings can be applied on outer surfaces and inner surfaces and include sealers or specialty products.

- The Indian government has invested in various construction and infrastructure projects over the past few years.

- Under the Sagarmala Program, over 574 projects are slated for execution from 2015 to 2035. These initiatives aim to modernize and establish new ports, enhance port connectivity, stimulate port-related industrial growth, and uplift coastal communities.

- Malaysia is one of the major countries in the region that has invested in various construction projects in recent times. According to the data released by the Malaysian Department of Statistics, the value of residential building construction in 2023 was around MYR 28.78 billion (~USD 6.01 billion) compared to MYR 27.7 billion (~USD 5.79 billion) in 2022.

- In Japan, according to data released by Statistics of Japan, the total number of building constructions in 2023 was around 1,11,214 thousand square meters compared to 1,19,466 thousand square meters in 2022.

- Numerous large-scale residential and commercial projects are underway across the region, and new projects are planned in developing countries. This will lead to a surge in the need for paints and coatings.

- In March 2024, the Authority for the Nusantara Capital City (OIKN) unveiled plans to kick off the construction of 70 residential towers in the forthcoming capital city of Indonesia. The construction is to be completed by 2025 or 2026.

- The Minh Mont Kiara: The project started in Q4 2023 and involves the construction of two 42-story residential towers comprising 496 units on 2.50 ha of land in Kuala Lumpur. It is expected to be completed in Q4 2027.

- Persiaran Lemak Residential Complex: The project commenced in Q4 2023 and involves the construction of a residential complex comprising two towers with 1,040 units in Kuala Lumpur. It is expected to finish in Q4 2025.

- In March 2023, a major Indian realty giant, DLF, announced an investment of around USD 421.44 million over the next four years to construct a new luxury housing project in Gurugram. DLF will develop a new group housing project, ' The Arbour,' spread over 25 acres, comprising five towers with 1,137 premium apartments.

- The South Korean government also outlined its plan to execute large-scale redevelopment projects aimed at supplying 830,000 housing units in Seoul and other cities of the country by 2025. From the planned construction, Seoul will be getting 323,000 new houses, and 293,000 houses will be built near Gyeonggi Province and Incheon. Major cities like Busan, Daegu, and Daejeon will also benefit from the planned 220,000 new houses by 2025.

- All these factors are expected to propel the demand for the Asia-Pacific paints and coatings market during the forecast period.

China to Dominate the Market

- China is globally recognized for its architectural boom. The demand for low-cost housing and commercial housing has been the reason for its growth in recent years.

- China is promoting and undergoing a process of continuous urbanization, with a target rate of 70% for 2030. The increase in living spaces required in urban areas resulting from urbanization and the desire of middle-income group urban residents to improve their living conditions may have a profound effect on the housing market and thereby increase residential construction in the country, which, in turn, will have a positive impact on the paints and coatings market.

- The Chinese paints and coatings market has been majorly driven by ample developments in the residential and commercial construction sectors and supported by the growing economy. In recent times, the housing authorities of Hong Kong launched several measures to boost the construction of low-cost housing. The officials aim to provide 301,000 public housing units by 2030.

- Infrastructure is another major industry that consumes paints and coatings in order to help prevent damage and extend the life of surfaces. Some of the major ongoing infrastructure projects in China are:

- Foshan Metro Line 4 Phase I Worth USD 6,984 Million: In Foshan, Guangdong, a 56 km metro railway line is under construction. This project aims to bolster the public transport system, offering a quicker, more dependable, and eco-friendly transportation option. Construction commenced in Q1 2022, with an anticipated completion in Q4 2026.

- Shanghai Metro Line 21 Phase I Worth USD 5,715 Million: In Shanghai, a 28 km metro rail line is being constructed, connecting Chuansha Road Station to Dongjing Road Station. This initiative seeks to enhance the region's traffic system, aiming to shorten both travel distance and time. Construction began in Q1 2022 and is slated for completion by Q4 2027.

- China is the world's second-largest consumer of oil and gas but only the sixth-largest producer of the same. As a big oil consumer, China's oil consumption is increasing annually with fluctuating growth rates. However, as the oil supply still cannot meet the demand, China mainly relies on imports.

- The automotive industry has been another major consumer of paints and coatings in recent times. According to the data released by the China Association of Automobile Manufacturers (CAAM), the total number of vehicle manufacturers in the country in 2023 was around 30.16 million units, about 11.6% higher than the previous year.

- These factors, in turn, are expected to affect the demand for paints and coatings in the country during the forecast period.

Asia-Pacific Paints and Coatings Industry Overview

The Asia-Pacific paints and coatings market is highly fragmented in nature. The major players include (not in any particular order) Nippon Paint Holdings Co. Ltd, Asian Paints, Kansai Paint Co. Ltd, Akzo Nobel NV, and PPG Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Accelerating Growth of the Construction Industry

- 4.1.2 Increasing Demand for Protective Coatings in Malaysia

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Tightening Regulations on VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Water-borne

- 5.1.2 Solvent-borne

- 5.1.3 Powder

- 5.1.4 Other Technologies (UV/EB, High-solids, etc.)

- 5.2 Resin Type

- 5.2.1 Acrylic

- 5.2.2 Alkyd

- 5.2.3 Polyurethane

- 5.2.4 Epoxy

- 5.2.5 Polyester

- 5.2.6 Other Resin Types (Phenolic, Ketonic, and Others)

- 5.3 End-user Industry

- 5.3.1 Architectural/Decorative

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.3.8 Other End-user Industries (Plastic Coatings, Agriculture, Construction and Earthmoving Equipment, and Others)

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Australia and New Zealand

- 5.4.6 Indonesia

- 5.4.7 Thailand

- 5.4.8 Malaysia

- 5.4.9 Vietnam

- 5.4.10 Philippines

- 5.4.11 Singapore

- 5.4.12 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3 Trees

- 6.4.2 Akzo Nobel NV

- 6.4.3 Asian Paints

- 6.4.4 Avian Brands

- 6.4.5 Axalta Coating Systems

- 6.4.6 BASF SE

- 6.4.7 Berger Paints India Limited

- 6.4.8 Boysen Paints

- 6.4.9 Davies Paints Philippines Inc.

- 6.4.10 Hempel AS

- 6.4.11 Jotun

- 6.4.12 Kansai Paint Co. Ltd

- 6.4.13 Nippon Paint Holdings Co. Ltd

- 6.4.14 PPG Industries Inc.

- 6.4.15 PT. Propan Raya

- 6.4.16 The Sherwin-Williams Company

- 6.4.17 TOA Paint Public Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of Environment-friendly Paint and Coating Resins

- 7.2 Other Opportunities