|

市场调查报告书

商品编码

1687217

汽车前端模组:市场占有率分析、产业趋势与成长预测(2025-2030 年)Automotive Front End Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

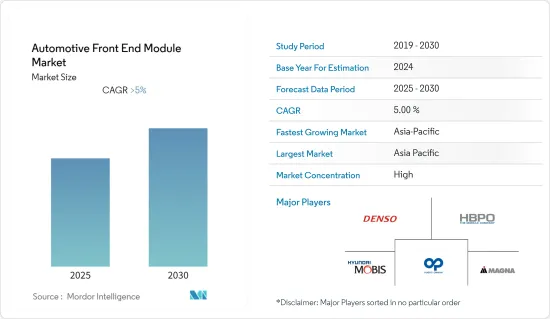

预计预测期内汽车前端模组市场将以超过 5% 的复合年增长率成长。

由于製造工厂关闭和停工,2020 年全球汽车产量和销量下降,COVID-19 疫情阻碍了汽车及前端模组市场等相关零件行业的成长。然而,到了2021年上半年,随着主要市场的开放以及主要企业采取短期策略重振各国业务,市场重新获得动力。

从中期来看,汽车产业的扩张和全球主要地区对汽车安全的认识不断提高预计将推动市场需求。此外,对轻型汽车的需求不断增长以及对技术先进的轻型前端模组的需求不断增长可能会为市场参与企业提供有利可图的机会。然而,由于消费者对汽车前端模组的兴趣日益增加,製造商选择在产品中实现小型化,因此汽车前端模组市场支出不断增加,这可能会在预测期内限制市场成长。

此外,各大汽车製造商正在积极将最新的前端模组融入其汽车中,以在未来几年参与竞争并支持市场成长。此外,ADAS 技术和自动驾驶汽车的兴起将推动整个市场的成长,因为它们将比传统汽车配备更多的感测器。

继亚太地区和欧洲之后,北美预计将在预测期内在市场发展中发挥重要作用。此外,该地区主要汽车OEM製造商推出的最新前端模组创新和新产品预计将刺激市场成长。

汽车前端模组市场趋势

轻量化汽车前端模组需求不断成长

对轻型车辆日益增长的需求也推动了汽车前端模组 (FEM) 市场的发展。轻量汽车零件可减轻车辆的整体重量,从而减少二氧化碳排放和成本。因此,世界各国政府纷纷推出严格的排放气体和燃油经济法规,如企业平均燃油经济性 (CAFE) 和 BS-VI 标准,推动汽车OEM增加轻质金属、复合材料和塑胶等轻量材料的使用。汽车零件前端模组材料的试验正在为减轻汽车重量20%至30%做出重大贡献。

目前,重型钢铁载体正在被轻型零件所取代,这有助于提高燃油效率和车辆性能。常用的轻质热塑性材料有聚丙烯和尼龙。例如

- 2020年7月,美国宾州匹兹堡朗盛公司生产的自由流动玻璃纤维增强尼龙6 Durethan BKV30H2.0EF和钢板将用于为福特Kuga SUV生产采用「混合」塑胶金属复合技术製成的高密度垫枕。支撑架和完整组装的前端模组由汽车行业全球系统供应商德国 Montaplast 开发和生产。

复合材料金属混合设计是重型车辆的首选。绿色倡议的环境法规和消费者的数位化生活方式也在增加对轻型车辆以及复合/混合前端模组(FEM)的需求方面发挥关键作用。例如

- 2021年4月,伟巴斯特在上海马达上发表了一款概念车,展现了对未来出行的愿景。概念车汇集了自动驾驶、电气化和舒适性的众多技术解决方案,包括具有激活光达和激活摄像头的车顶传感器模组、大型开放式全景天窗、智能轻量化前端模组、电池和充电解决方案以及集成的温度控管系统。

目前市场上有几款车辆配备了复合前端模组。现代和梅赛德斯最近推出的两款小型车采用轻量化前端结构,可在零件中内建附加功能,从而减少组装时间、成本和品质。这三款车型的载体均采用射出成型颗粒型LFT-PP製成。

- 其搭载一台 1.5 升涡轮增压汽油发动机,并配备集成在发动机前端附件驱动装置 (FEAD) 中的 48 伏皮带起动发电机 (BSG)、48 伏-12 DC/DC 转换器、48 伏锂离子电池模组和电池管理系统 (BMS)、能量回收制动系统以及混合模组控制系统。

考虑到这些新兴的市场趋势和技术,汽车零件轻量化趋势有望鼓励製造商为客户提供创新的解决方案。由于这些趋势,预计市场在预测期内将出现温和的成长率。

亚太地区预计将经历强劲成长

由于日本、韩国、中国和印度等主要前端模组製造商的强大影响力,亚太地区预计将主导汽车前端模组市场。该地区主要国家的汽车产量不断增长,以及各汽车OEM对轻型车的关注度不断提高,也推动了市场的需求。

- 中国工业协会数据显示,2022年7月汽车业PMI上涨52.0%,优于整体製造业PMI。 7月份,汽车产销分别完成245.5万辆和242万辆,较去年同期分别成长31.5%和29.7%。乘用车产销221万辆,较去年成长42.6%;销量217.4万辆,较去年同期成长40.0%。 1-7月,乘用车产销分别完成1,264.5万辆及1,252.9万辆,较上年同期分别成长10.9%及8.3%。

- 根据 SIAM 统计,印度乘用车总销量从 2,711,457 辆增至 3,069,499 辆,同期厢型车销量为 113,265 辆(2020 年 4 月至 2021 年 3 月:108,841 辆),市场积极趋势。

除了中国和印度之外,由于日产等大型汽车公司的存在,韩国和日本也变得越来越重要。预计该地区的汽车前端模组(FEM)市场将呈现两位数的复合年增长率。此外,预计市场需求将受到主要企业扩大策略、生产设施扩建等因素的支持。例如

- 2022 年 3 月,马来西亚首款 CKD 保时捷卡宴在吉打州组装林的森那美组装厂下线。基本款卡宴是目前唯一一款在本地以 CKD 形式生产的车款。将在当地采购的六个主要模组包括中央控制台和驾驶座(Clarion)、前后轴(ZF)和前端模组组件。

预测期内市场前景预期乐观。

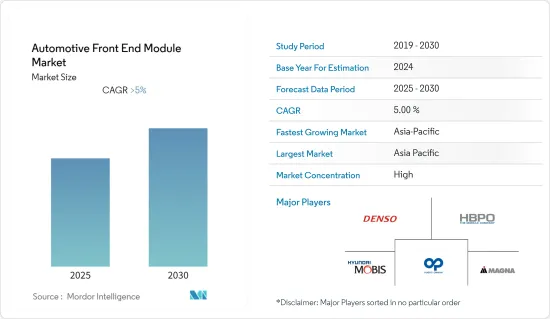

汽车前端模组产业概况

汽车前端模组市场适度整合,电装公司、佛吉亚集团、麦格纳国际和彼欧集团等主要参与者占据市场主导地位。全球各地的各种参与企业都在投资新的研发计划并建立合资企业和伙伴关係关係,以保持竞争优势。

- 2021年5月,Mother son Group将透过其子公司Samvardhana Motherson Reflectec收购土耳其Plast Met Group的多数股权。

- 2020年10月,Plastic Omnium宣布推出多项针对100%电动车的新计画。 Plastic Omnium 为特斯拉 Model 3 和 Model Y 提供前后保险桿和前端模组,这些车型在中国和北美生产。我们也为大众 ID.3 和 ID.4 提供前端模组、中央控制台、前后保险桿。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 重型商用车

- 依原料类型

- 金属

- 复合材料

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 其他的

- 南美洲

- 中东和非洲

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Denso Corporation

- Hirschvogel Automotive Group

- HYUNDAI MOBIS CO. LTD

- Magna International Inc.

- Hanon Systems

- Compagnie Plastic Omnium SA

- SL Corporation

- Valeo SA

- Marelli Corporation

- MAHLE GmbH

- Calsonic Kansei Corporation

第七章 市场机会与未来趋势

The Automotive Front End Module Market is expected to register a CAGR of greater than 5% during the forecast period.

The COVID-19 pandemic hindered the growth of the automotive industry and associated component industry like the front-end module market as lockdowns and shutdown of manufacturing facilities in 2020 resulted in the decline of vehicle production and sales worldwide. However, key markets opening up by the first half of 2021 and key players' short-term strategies to revive their business operations across various countries have helped the market to regain its momentum.

Over the medium term, expanding the automotive industry and growing awareness about safety in vehicles across all major regions in the world are expected to drive demand in the market. In addition, the rising need for vehicle weight reduction and increasing demand for technically advanced lightweight front-end modules are likely to offer lucrative opportunities for players in the market. However, heavy expenditures are being made in the automotive front-end module market as manufacturers choose to miniaturize their goods in response to rising consumer interest in vehicle front-end modules likely to restrict market growth during the forecast period.

Further, as key automotive players are actively looking to adopt the latest front-end modules in their vehicles to gain competitive edge to support market growth in coming years. Besides, these rise in ADAS technology and autonomous cars to enhance overall market growth as they accomodate more sensors than conventional vehicles and hence more opportunity for conducting extensive research activities in this regard.

Asia-Pacific, Europe followed by North America region expected to play key role in the development of the market during the forecast period as growth across these regions is supported by notable vehicle production both passenger cars and commercial vehicles. In addition, the growth of market is likely to be spurred by key automotive OEM launches with latest front module innovations and key manufacturers in the region.

Automotive Front End Module Market Trends

Increasing Demand for Lightweight Automotive Front-End Modules

The growing demand for lightweight vehicles is also the driving force for the automotive front-end module (FEM) market. As lightweight auto parts reduce the overall weight of the vehicles, they can, in turn, reduce CO2 emissions and cost. So, as several governments across the globe have introduced stringent emission and fuel economy regulations such as corporate average fuel economy (CAFE), BS-VI norms, etc. such regulations are likely to encourage automotive OEMs to increase the usage of lightweight materials such as lightweight metals, composites, and plastics. Experimenting with front-end module materials in auto parts has predominately contributed to achieving 20%-30% of vehicle weight reduction.

Nowadays instead of heavy steel and iron carriers, lightweight components are used which are responsible for fuel efficiency and vehicle performance enhancement. Commonly used materials for lightweight thermoplastics are polypropylene and nylon. For instance,

- In July 2020, a highly integrated bolster produced with a 'hybrid' plastic-metal composite technology for the Ford Kuga SUV, is produced with steel panels and Durethan BKV30H2.0EF, an easy-flowing, fiberglass-reinforced nylon 6 from Lanxess, Pittsburgh, Penn. The bolster and the fully assembled front-end module were developed and are produced by Germany's Montaplast GmbH, a global system supplier of the automotive industry.

Hybrid composite/metal designs are preferably used for heavy-end vehicles. Environmental regulations for green initiatives and the digital lifestyle of consumers is also playing a vital part in increasing demand for lightweight vehicles and in turn the demand for composite/ hybrid front-end module (FEM). For example,

- In April 2021, Webasto announced that, at Auto Shanghai, it is presenting a concept vehicle as a vision of the mobility of the future. The concept car brings together numerous technical solutions for autonomous driving, electrification and comfort: roof sensor module with a working lidar and working camera, a large openable panorama roof, a smart lightweight front-end module, a battery and charging solution, and an integrated thermal management system.

Currently, several vehicles are launched in the market with front-end modules made of composite materials. The recently launched Hyundai and two small segment cars from Mercedes use a lightweight front-end construction that allows for the integration of additional functionality in components, which in turn saves assembly time, reduces costs, and lowers mass. Carriers for all three vehicles make use of injection-molded pelletized LFT-PP. For instance,

- In February 2020, Geely Philippines introduced its very own gasoline-electric hybrid technology into its upcoming compact SUV, which will pair with a 1.5-liter turbo-charged gasoline engine, complemented by a 48-volt belt-starter generator (BSG) integrated in the Front-End Accessory Drive (FEAD) of the engine, a 48-volt to 12 DC/DC converter, a 48-volt lithium-ion battery module and battery management system (BMS), along with a recuperation braking system and a hybrid module control system.

Considering such developments and technologies in the market, the trend of light weight components in vehicles anticipated to push manufacturers to offer innovative solutions for their customers. Owing to such trends , the market expected to grow at decent rate during the forecast period.

Asia-Pacific Region Expected to Witness Significant Growth in the Market

The Asia-Pacific region is expected to dominate the automotive front-end module market -owing to the strong presence of key front-end module manufacturers in Japan, South Korea, China, and India. The demand in the market is further supported by growing vehicle production across key countries in the region coupled with the growing focus of various automotive OEMs to produce lightweight vehicles. For instance,

- According to CAAM, the China Association of Automobile Manufacturers (CAAM) stated that in July 2022, the PMI of the automobile industry was higher than 52.0%, which was better than that of the overall manufacturing industry. Overall vehicle production and sales in July totaled 2.455 million units and 2.42 million units, representing a 31.5% and 29.7% y/y increase, respectively. Passenger vehicle production reached 2.21 million units, up 42.6% y/y, while sales were 2.174 million units, up 40.0% y/y. Passenger vehicle production for the January to July period totaled 12.645 million units, up 10.9% y/y, while sales were 12.529 million units, up 8.3% y/y.

- According to SIAM, total Passenger Vehicle Sales in India increased from 2,711,457 to 3,069,499 units and during the same period 113,265 units of Vans were sold compared to 108,841 units in April 2020 to March 2021 indicating positive trends in the market.

Apart from China and India South Korea, Japan are also gaining the importance owing to the presence of big players of automobile industry like Nissan. This region is expected to show strong double digit CAGR for the automotive front end module (FEM) market. Further, demand in the market expected to be supported by key players expansion strategy, production facilities expansion, etc. For instance,

- In March 2022, the first ever Malaysia-assembled CKD unit of Porsche Cayenne has rolled off the production line at Sime Darby's assembly plant in Kulim, Kedah, the first assembly facility for Porsche outside of Europe. The base Cayenne is currently the only model being produced locally in CKD form. Six key modules sourced locally include center console and cockpit (Clarion), front and rear axles (ZF), and the front-end module assembly.

Such developments, anticipated to create positive outlook for the market during the forecast period.

Automotive Front End Module Industry Overview

The Automotive front-end module market is moderately consolidated and the majority share of the market is dominated by major players, such as Denso Corporation, Faurecia SA, Group, Magna International, and Plastic Omnium Group, among others. Various players around the world are investing in new R&D projects, making joint ventures, and partnerships for being ahead of the competition. For instance,

- In May 2021, Mother son Group completes the acquisition of a majority stake in Turkey's Plast Met Group through its subsidiary Samvardhana Motherson Reflectec With the successful closure of this acquisition, Motherson Group now has access to the significant Turkish automotive market.

- In October 2020, Plastic Omnium announced that numerous new programs for 100% electric vehicles are coming on stream. Plastic Omnium equips the Tesla Model 3 and Model Y with front and rear bumpers and front-end modules. These models are manufactured in China and North America. It also provides front-end module, centre console, front and rear bumpers for VW ID.3 and ID.4.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD billion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicle

- 5.1.3 Heavy Commercial Vehicle

- 5.2 By Raw Material Type

- 5.2.1 Metal

- 5.2.2 Composite

- 5.2.3 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Denso Corporation

- 6.2.2 Hirschvogel Automotive Group

- 6.2.3 HYUNDAI MOBIS CO. LTD

- 6.2.4 Magna International Inc.

- 6.2.5 Hanon Systems

- 6.2.6 Compagnie Plastic Omnium SA

- 6.2.7 SL Corporation

- 6.2.8 Valeo SA

- 6.2.9 Marelli Corporation

- 6.2.10 MAHLE GmbH

- 6.2.11 Calsonic Kansei Corporation