|

市场调查报告书

商品编码

1687232

离心式压缩机-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Centrifugal Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

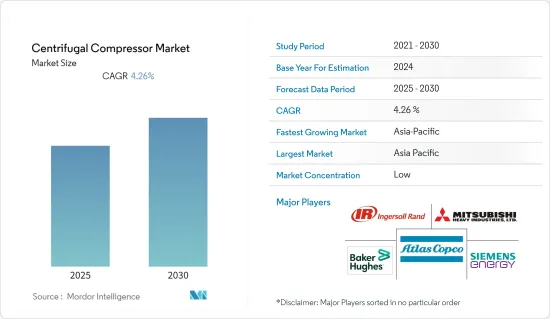

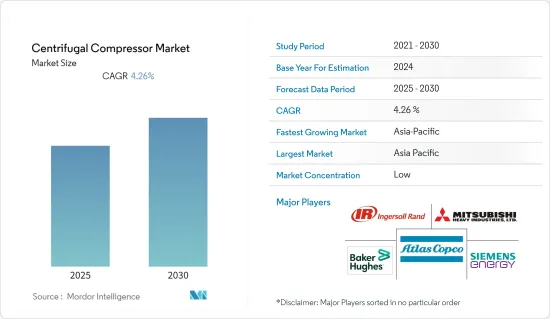

预计预测期内离心式压缩机市场的复合年增长率将达到 4.26%。

2020年,新冠疫情对市场产生了负面影响,但目前已恢復至疫情前的水准。

关键亮点

- 从中期来看,天然气正在取代石油和煤炭,成为发电和运输领域的能源来源。为了满足日益增长的天然气需求,世界各国政府正计划投资扩大基础设施。预计这将在预测期内推动离心式压缩机的需求。

- 可再生能源发电成本下降和投资增加将阻碍天然气发电的需求,从而对发电行业对离心式压缩机的需求产生负面影响。

- 随着最终用户需求的增加和能源效率标准的变化,一些离心式压缩机製造商正在致力于开发更节能的产品。预计此因素将在预测期内为市场创造若干机会。

- 亚太地区在全球市场占据主导地位,其中中国和印度占据主要份额,这主要是由于电力需求不断增长。

离心式压缩机市场趋势

预计石油和天然气领域将主导市场

- 在石油和天然气产业,离心式压缩机在上游、中游和下游领域的应用越来越广泛。离心式压缩机在整个石油和天然气工业中有多种应用,包括气体运输、注气压缩、气体收集和气举。

- 气举用于上游石油和天然气工艺,其中低压气体(3-7 巴)被压缩为高压,并通过指定深度的气举阀在井壳和油管环空中循环,从而减轻油管中的液柱。

- 离心式压缩机在后期用于维持或增加进入天然气田管路系统的气体流量。气体再注入用于提高采收率(EOR),以弥补油田产量的自然下降。

- 随着过去十年环保意识的不断增强,大多数国家都推出了从煤炭发电转向天然气发电的计划,以减少二氧化碳排放。预计天然气产量和发电消费量的持续增加将支持石油和天然气行业对离心式压缩机的需求。

- 随着新管道计划的开发,全球石油和天然气中游产业正在成长。在中游领域,离心式压缩机用于天然气输送,以增加压力并克服因管道基础设施摩擦而导致的管道压力下降。

- 2022 年 10 月,Cairn India 计画在 2025-26 年投资约 50 亿美元扩大在印度的业务。其中,30亿美元将投资于拉贾斯坦邦区块。预计此类投资将在预测期内推动离心式压缩机的需求。

- 2021年6月,印度跨国企业INOXCVA为苏格兰MOWI公司在苏格兰凯莱金试运行英国首个多功能迷你LNG接收站。 INOXCVA 製造了迷你LNG接收站,并将其作为承包提供给该公司。该计划包括两个1000立方米真空储存槽、300米真空夹套管道、一个船舶燃料库、一个拖车装载站以及一套适用于鱼饲料厂天然气消耗的汽化系统。这个小型LNG接收站不仅能够接收拖车和国际海事组织货柜中的液化天然气,还可以接收小型船舶中的液化天然气。

- 此外,2021 年 2 月,卡达同意对北油田酵母计划(NFE) 做出最终投资决定。该计划将由四条大型液化天然气列车组成,每条列车的产能为800万吨/年,营运成本预计为287.5亿美元。该 33 MTPA计划预计将于 2025 年第四季投产,届时卡达的液化天然气产量将在 2026 年底和 2027 年初提升至约 110 MTPA。随着液化天然气需求的增加,类似的计划预计将支持石油和天然气领域离心式压缩机的成长。

- 因此,由于上述因素,预计石油和天然气产业将在预测期内主导离心压缩机市场。

亚太地区可望主导市场

- 2021 年,亚太地区占据了全球市场占有率的主导地位。石油天然气和电力产业仍然是该地区这些压缩机的最大终端用户。预计未来四年亚太地区将有多个 FPSO(浮体式生产储货运设施)计划投入使用。 FPSO计划数量的增加预计将为该市场创造重大机会。

- 亚太地区工业基础设施普遍发展,电力需求激增。由于持续的电力供应对于工业运作至关重要,因此需要开发新的发电厂。因此,预计发电厂(尤其是燃气发电厂)的持续发展将在预测期内推动对离心式压缩机的需求。

- 中国承诺在未来十年加强其石油和天然气管道网络,并增加无污染燃料在国家能源结构中的份额。根据国家发展和改革委员会预测,到2025年,全国天然气管道总长度预计将达到12.3万公里。由于离心式压缩机是远距天然气管道最常用的动力来源设备之一,预计预测期内管道网路的成长将推动离心式压缩机的需求。

- 作为世界第二大石油消费国和第六大石油生产国,中国2021年进口了其近50%的碳氢化合物需求。因此,石油和天然气的进口、加工和加工基础设施集中在中国东部沿海地区。预计石油和天然气需求的不断增长以及相关的进口、加工和加工基础设施将对该国的离心式压缩机产生巨大的需求。

- 此外,在印度,政府计划透过「印度製造」计画将印度打造为全球製造地。根据印度品牌资产基金会的数据,到 2025 年,印度製造业的产值可能达到 1 兆美元。因此,在研究期间,离心式压缩机的需求可能会增加。

- 因此,由于上述因素,预计亚太地区将在预测期内主导离心压缩机市场。

离心式压缩机产业概况

离心式压缩机市场是细分的。市场的主要企业(不分先后顺序)包括英格索兰公司、贝克休斯公司、西门子能源股份公司、三菱重工有限公司和阿特拉斯·科普柯公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章执行摘要

第三章调查方法

第四章 市场动态

- 介绍

- 2027 年市场规模与需求预测

- 近期趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按最终用户

- 石油和天然气

- 电力业

- 石油化学工业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 南美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Atlas Copco AB

- Ingersoll Rand Inc.

- Baker Hughes Company

- Sundyne

- EllIoTt Group

- Howden Group

- Mitsubishi Heavy Industries Ltd

- HMS Group

- Borsig GmbH

- Kobe Steel Ltd

- Boldrocchi

- Shenyang Blower Works Group Corporation

- Hitachi Ltd

- MAN Energy Solutions

- Johnson Controls Inc.

- Siemens Energy AG

- Kirloskar Pneumatic Company Limited

第七章 市场机会与未来趋势

简介目录

Product Code: 56861

The Centrifugal Compressor Market is expected to register a CAGR of 4.26% during the forecast period.

Though COVID-19 negatively impacted the market in 2020, it has reached pre-pandemic levels.

Key Highlights

- Over the medium term, natural gas is increasingly replacing oil and coal as an energy source in the power generation and transportation sectors. To fulfill the increasing demand for gas, governments worldwide are planning to invest in expanding the infrastructure. This is likely to boost the demand for centrifugal compressors during the forecast period.

- Declining costs and increasing investments in renewable power generation hamper the demand for natural gas-fired power generation, negatively impacting the demand for centrifugal compressors in the power generation industry.

- Nevertheless, several centrifugal compressor manufacturers strive to develop more energy-efficient products during rising end-user demands and changing energy efficiency standards. This factor is expected to create several opportunities for the market during the forecast period.

- The Asia-Pacific dominated the global market, with China and India accounting for a significant share, mainly driven by the increasing demand for electricity.

Centrifugal Compressor Market Trends

The Oil and Gas Segment is Expected to Dominate the Market

- The oil and gas industry offers widespread applications for centrifugal compressors across the upstream, midstream, and downstream sectors. Centrifugal compressors serve various purposes across the oil and gas industry, such as gas transportation, compression for gas injection, gas gathering, gas lift, etc.

- In oil and gas upstream operations, gas lifts are used, in which low-pressure gas (3 to 7 bar) is compressed to a higher pressure and recycled down the well casing-tubing annulus through a gas lift valve at a predetermined depth that enables lightening the liquid column in the tubing.

- Centrifugal compressors are used in later phases to maintain or increase gas flow into the pipeline systems in gas fields, as the reservoir pressure tends to decrease over time. The gas reinjection is used for enhanced oil recovery (EOR) to compensate for the natural decline in production from the oil fields.

- With increasing environmental awareness over the last decade, most countries introduced plans to lower carbon emissions by shifting from coal-based electricity generation to gas-based energy generation concept, which, in turn, supported the increase in production of natural gas globally during 2010-2021, by 28.14%. The increase in natural gas production and its consumption for power generation is likely to continue, which is expected to support the demand for centrifugal compressors from the oil and gas industry.

- The oil and gas midstream sector across the world is growing on account of the development of new pipeline projects. In the midstream sector, centrifugal compressors are used for gas transportation to boost the pressure and to overcome pressure drop caused in the pipeline due to friction in the pipeline infrastructure.

- In October 2022, Cairn India planned to invest nearly USD 5 billion by 2025-26 on the expansion of its operations in India. Out of the total, USD 3 billion is expected to be on Rajasthan block. Such investments are expected to increase the demand for centrifugal compressors during the forecast period.

- In June 2021, INOXCVA, an Indian multinational company, commissioned the United Kingdom's first-ever multifunctional mini-LNG terminal in Kyleakin, Scotland, for MOWI Scotland. INOXCVA manufactured and supplied the mini-LNG terminal on a turnkey supply basis to the company. The project includes two 1000 cubic meters of vacuum insulated storage tanks, 300-meter vacuum jacketed piping, a ship bunkering station, a trailer loading station, and a vaporization system suitable for natural gas consumption by a fish feed factory. The mini-LNG terminal is capable of taking LNG through small-scale vessels as well as by semi-trailers and IMO containers.

- Furthermore, in February 2021, Qatar reached FID on the North Field East Project (NFE), comprising of four mega LNG trains of 8 MTPA each, at an estimated cost of USD 28.75 billion. The 33 MTPA project is expected to start production in Q4 2025 and will raise Qatar's LNG production to approximately 110 MTPA by late-2026 or early 2027. With the growing demand for LNG, similar projects are expected to support the growth of centrifugal compressors in the oil and gas sector.

- Therefore, owing to the abovementioned factors, the oil and gas segment is expected to dominate the centrifugal compressor market during the forecast period.

The Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific dominated the global market share in 2021. The oil and gas and power industries remain the largest end users of these compressors in the region. Several floating production storage and offloading (FPSOs) projects in the Asia-Pacific are expected to begin operations over the next four years. Increasing FPSO projects are expected to create tremendous opportunities in the market studied.

- The Asia-Pacific is witnessing a widespread development of industrial infrastructure, leading to a surge in demand for power. New power plants need to be developed as the requirement of continuous power supply is imperative for industrial operations. Therefore, the increase in the development of power generation plants, particularly gas-fired generation plants, is expected to drive the demand for centrifugal compressors during the forecast period.

- China is committed to strengthening its oil and natural gas pipeline network in the next ten years to boost the clean fuel's share in the country's energy mix. According to the National Development and Reform Commission, the country's natural gas pipelines are expected to reach 123,000 km by 2025. As centrifugal compressors are one of the most commonly used equipment is powering long distance natural gas pipelines, the growth in pipeline networks are expected to drive the demand for centrifugal compressors during the forecast period.

- As China was the world's second largest consumer and the sixth largest producer of oil, it imported nearly 50% of its hydrocarbon demand in 2021. Thus, the oil and gas import, handling, and processing infrastructures are concentrated along the coastal regions in East China. The rising demand for oil and gas and related imports, handling, and processing infrastructure is expected to provide significant demand for centrifugal compressors in the country.

- Further, in India, under the Make in India program, the government plans to place the country on the world map as a manufacturing hub. According to the Indian Brand Equity Foundation, the manufacturing sector in the country has the potential to reach USD 1 trillion by 2025. It is likely to increase the demand for centrifugal compressors during the study period.

- Therefore, owing to the abovementioned factors, the Asia-Pacific is expected to dominate the centrifugal compressor market during the forecast period.

Centrifugal Compressor Industry Overview

The centrifugal compressor market is fragmented. Some of the major players (in no particular order) in the market include Ingersoll Rand Inc., Baker Hughes Company, Siemens Energy AG, Mitsubishi Heavy Industries Ltd, and Atlas Copco AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET DYNAMICS

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Oil and Gas

- 5.1.2 Power Sector

- 5.1.3 Petrochemical and Chemical Industries

- 5.1.4 Other End Users

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Middle East & Africa

- 5.2.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco AB

- 6.3.2 Ingersoll Rand Inc.

- 6.3.3 Baker Hughes Company

- 6.3.4 Sundyne

- 6.3.5 Elliott Group

- 6.3.6 Howden Group

- 6.3.7 Mitsubishi Heavy Industries Ltd

- 6.3.8 HMS Group

- 6.3.9 Borsig GmbH

- 6.3.10 Kobe Steel Ltd

- 6.3.11 Boldrocchi

- 6.3.12 Shenyang Blower Works Group Corporation

- 6.3.13 Hitachi Ltd

- 6.3.14 MAN Energy Solutions

- 6.3.15 Johnson Controls Inc.

- 6.3.16 Siemens Energy AG

- 6.3.17 Kirloskar Pneumatic Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219