|

市场调查报告书

商品编码

1687238

印度锂离子电池:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India Lithium-ion Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

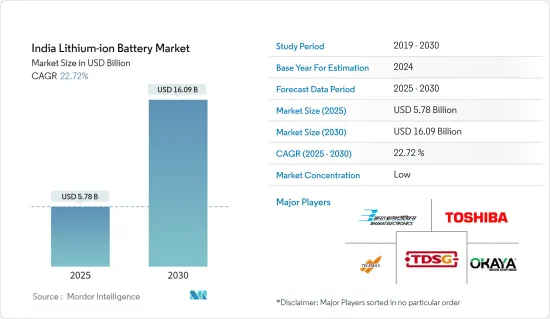

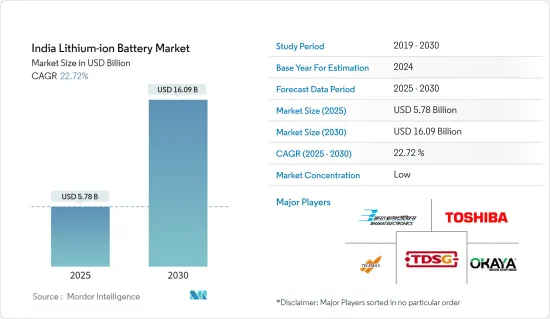

印度锂离子电池市场规模预计在 2025 年为 57.8 亿美元,预计到 2030 年将达到 160.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.72%。

主要亮点

- 从中期来看,预计锂离子电池价格下降和电动车普及率提高等因素将在预测期内推动印度锂离子电池的发展。

- 另一方面,锂等原料的供需不匹配可能会在研究期间阻碍印度锂离子电池市场的成长。

- 然而,在预测期内,印度锂离子电池回收活动的增加和新型储能电池技术的进步可能为印度锂离子电池市场创造有利的成长机会。

印度锂离子电池市场趋势

汽车产业正在经历显着成长

- 由于各国政府推出政策支持製造业发展,印度预计未来几年将成为电池公司的主要投资热点。

- 由于中产阶级和年轻人口的不断增长,两轮车市场占据了主导地位。虽然有组织的公司销售有保固的品牌电池,但无组织的公司不提供任何保固或售后服务,他们销售再生电池,且产品价格比品牌电池便宜 30-35%。印度汽车替换电池市场以铅酸电池市场为主。

- 2022-23 年,印度最大的汽车製造商玛鲁蒂铃木印度公司的批发量创下最高纪录,从 2021-2022 年的 1,652,653 辆增长 19% 至 1,966,164 辆。 2022-23 年国内出货量从上年的 1,414,277 辆成长 21% 至 1,706,831 辆。

- 根据印度公路运输和公路部(MORTH)2023年12月发布的新闻稿,2023年电动车註册数量比2022年增加了134,434辆。两年期间的总销量为1,504,012辆。考虑到印度电池和插电式混合动力汽车市场的蓬勃发展,这为印度电池行业的市场参与者提供了强劲的前景。

- 2023 年 2 月,Okaya Power Pvt.全球领先的VRLA和磷酸铁锂电池製造商印度力士乐公司宣布向印度市场推出一款新型电动两轮车E-Scooter Faast F3,该车续航里程为125公里,配备防水防尘延长的3.53kWh锂离子LFP双电池,并采用切换技术延长电池寿命。

- 由于人口不断增长和融资条件不断改善,汽车行业预计在预测期内将大幅增长。预计电动车(EV)的销售将支撑这一细分市场。

- 由于上述因素,预计该国汽车产业将获得显着发展势头,从而有望在预测期内提振电池市场的发展。

锂离子电池成本下降可望推动市场

- 全球锂离子电池製造商都致力于降低锂离子电池的成本。过去十年来,锂离子电池价格大幅下跌。到 2023 年,锂离子电池的平均价格将约为每千瓦时 139 美元,比 2013 年的价格下降 82% 以上。

- 亚太地区,尤其是印度和中国的锂离子电池製造商的价格甚至低于图表中显示的平均价格。印度价格低廉的主要原因之一是拥有先进的製造设施和熟练的劳动力。

- 此外,随着对电池能源储存系统的需求不断增加,能源储存系统製造商正致力于提高其在印度各地的生产能力。例如,2022年5月,印度电池製造商Exide Industries Limited与瑞士Leclanche SA的合资企业Nexcharge在古吉拉突邦的锂离子电池工厂开始生产。该工厂的装置容量为1.5GWh,将为能源储存和汽车应用供应电池。

- 根据国际能源总署(IEA)的预测,2024年,全球锂离子电池价格在不到15年的时间内下降了90%以上,新型锂电池将彻底改变电动车和能源领域。锂离子电池价格将超过铅酸电池,从2010年的每千瓦时1,400美元降至2023年的139美元。

- 印度政府也正在帮助矿业公司和电池製造商扩大用于电池储能係统和电动车(EV)应用的矿物的国内生产,以与中国竞争对手竞争。

- 根据国际能源总署 (IEA) 的数据,2023 年锂离子电池的平均价格与 2021 年相比下降了 14.2%,包括电池组类型。此外,2023 年 5 月,印度地质调查局 (GSI) 在拉贾斯坦邦纳高尔区德加纳的黎凡特山发现了锂蕴藏量。预计这些蕴藏量可以满足该国80%的需求。这些发展预计将推动印度 ESS 应用的锂离子电池市场的发展。

- 此外,快速且持续的成本降低和发展可能会增强锂离子作为所有国内终端用户应用的首选电池化学成分的地位。预计这些因素将在预测期内推动印度锂离子电池市场的发展。

印度锂离子电池市场

印度锂离子电池市场比较分散。市场的主要企业(不分先后顺序)包括 TDS Lithium-Ion Battery Gujarat Private Limited (TDSG)、Bharat Electronics Limited (BEL)、Telemax India Industries Pvt Ltd、东芝公司、Okaya Power Group 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 锂离子电池价格趋势分析、全球趋势、至 2029 年

- 最新趋势和发展

- 政府法规和政策

- 投资机会

- 市场动态

- 驱动程式

- 锂离子电池成本下降

- 电动车日益普及

- 限制因素

- 电池製造原料的需求与供应

- 驱动程式

- 供应链分析

- PESTLE分析

- 成本分析

- 定价分析

第五章 市场区隔

- 按应用

- 可携式的

- 车

- 其他用途

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- TDS Lithium-Ion Battery Gujarat Private Limited(TDSG)

- Bharat Electronics Limited(BEL)

- Telemax India Industries Pvt. Ltd.

- Future Hi-Tech Batteries

- Amperex Technology Limited

- Nexcharge(JV:Leclanche and Exide Industries)

- Exicom Tele-Systems Limited

- Inverted Energy Private Limited

- Vision Mechatronics Pvt. Ltd.

- Toshiba Corporation

- Trontek Group

- Okaya Power Group

- iPower Batteries Pvt. Ltd.

- 市场排名分析

第七章 市场机会与未来趋势

- 日本锂离子电池回收活动活性化

The India Lithium-ion Battery Market size is estimated at USD 5.78 billion in 2025, and is expected to reach USD 16.09 billion by 2030, at a CAGR of 22.72% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and increasing adoption of electric vehicles are likely to drive the India lithium-ion battery during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials like lithium, will likely hinder the growth of the Indian lithium-ion battery market in the studied period.

- However, increasing recycling activities of lithium-ion batteries in the country and technological advancements in new battery technologies to store energy will likely create lucrative growth opportunities for the India lithium-ion battery market during the forecast period.

India Lithium-ion Battery Market Trends

The Automotive Segment to Witness Significant Growth

- India is expected to be a major investment hotspot for battery companies in the coming years because of policy-level support from the respective governments encouraging the manufacturing sector.

- The two-wheeler segment dominates the automotive market owing to a growing middle class and a young population. Organized companies sell branded batteries with warranties, while unorganized companies provide no warranty or after-sales, sell recycled batteries, and offer products at a 30-35% discount to branded ones. The Indian automotive replacement battery market is leading the lead-acid battery market.

- In 2022-23, Maruti Suzuki India, the country's largest automaker, had its greatest wholesales, up 19% from 165,265,3 units in 2021-2022 to 196,616,4 units. Domestic shipments climbed by 21% in 2022-23 to 170,683,1 units from 141,427,7 units the previous fiscal year.

- According to the Indian Ministry of Road Transport and Highways (MORTH) press release in December 2023, the registration of EV's in 2023, increased by 1,34,434 units in 2023 compared to 2022. The total sales in two years stood at 15,04,012 units. Considering the battery and plug in hybrid vehicle market booming in India, this will offer strong future potential to the battery industry market players in India.

- In February 2023, Okaya Power Pvt. Ltd, a world-class VRLA and Lithium-Ion phosphate battery manufacturing company announced the launching of a new electric- two-wheeler, E-Scooter Faast F3, for the Indian market, capable of providing a range of 125 kms and equipped with a waterproof and dust resistant 3.53 kWh Lithium-ion LFP dual batteries with switchable technology to extend battery life. the new Li-ion battery can be charged in 4 to 5 hours as per the company.

- With an increasing population and accessible financing facilities, the automobile sector is expected to grow significantly during the forecast period. Electric vehicle (EV) sales are expected to support the segment.

- The factors above are expected to help the automotive segment gain significant momentum in the country, which, in turn, is expected to help the battery market grow during the forecast period.

Declining Cost of Lithium-ion Batteries Likely to Drive the Market

- Global lithium-ion battery manufacturers are focusing on reducing the cost of Lithium-ion batteries. The price of lithium-ion batteries has declined steeply over the past 10 years. In 2023, the price of an average lithium-ion battery was around USD 139 per kWh, a decrease of more than 82% compared to 2013.

- The lithium-ion battery manufacturers in Asia-Pacific, particularly in India and China, have even lower prices than the average prices mentioned in the graph. One of the major causes of lower prices in India is the availability of advanced manufacturing facilities and skilled workforce.

- Additionally, with the rising demand for battery energy storage systems, energy storage systems manufacturers are focused on increasing their capacity across India. For instance, in May 2022, Nexcharge, a joint venture of Indian battery manufacturer Exide Industries Limited and Switzerland's Leclanche SA, commenced production at a lithium-ion battery plant in Gujarat. The plant includes an installed capacity of 1.5 GWh that is expected to deliver batteries for energy storage applications and automobiles.

- According to the International Energy Agency in 2024, global lithium-ion battery prices have declined by over 90% in less than 15 years, and the upcoming new lithium battery will revolutionize electric-driven mobility and the energy sector. Prices of li-ion batteries have outclassed lead acid batteries, and declined from USD 1,400 per kWh in 2010 to USD 139 kWh in 2023.

- The Government of India is also working to help the miners and battery makers expand the domestic production of minerals used for BESS and electric vehicles (EV) applications and counter the Chinese competitors.

- According to the International Energy Agency, in 2023, the average lithium-ion battery prices for both cell and pack types reduced to 14.2% compared to 2021. Additionally, in May 2023, the Geological Survey of India (GSI) discovered lithium reserves on Revant Hill in Degana in Rajasthan's Nagaur district. It is considered that these reserves can fulfill 80% of the country's demand. Such moves are expected to boost the lithium-ion battery market for ESS applications in India.

- Moreover, the sharp and sustained cost reduction and developments may help strengthen lithium-ion as the battery chemistry of choice among all the end-users applications across the country. These factors are expected to drive the Indian lithium-ion battery market during the forecast period.

India Lithium-ion Battery Market

The Indian lithium-ion battery market is fragmented. Some of the major players in the market (in no particular order) include TDS Lithium-Ion Battery Gujarat Private Limited (TDSG), Bharat Electronics Limited (BEL), Telemax India Industries Pvt Ltd, Toshiba Corporation, and Okaya Power Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Lithium-ion Battery Price Trend Analysis, Global, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Investment Opportunities

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Declining Cost Of Lithium-ion Batteries

- 4.7.1.2 Increasing Adoption of Electric Vehicles

- 4.7.2 Restraints

- 4.7.2.1 Demand and Supply of Raw Materials for Battery Manufacturing

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

- 4.10 Cost Analysis

- 4.11 Price Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Portable

- 5.1.2 Automotive

- 5.1.3 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 TDS Lithium-Ion Battery Gujarat Private Limited (TDSG)

- 6.3.2 Bharat Electronics Limited (BEL)

- 6.3.3 Telemax India Industries Pvt. Ltd.

- 6.3.4 Future Hi-Tech Batteries

- 6.3.5 Amperex Technology Limited

- 6.3.6 Nexcharge (JV: Leclanche and Exide Industries)

- 6.3.7 Exicom Tele-Systems Limited

- 6.3.8 Inverted Energy Private Limited

- 6.3.9 Vision Mechatronics Pvt. Ltd.

- 6.3.10 Toshiba Corporation

- 6.3.11 Trontek Group

- 6.3.12 Okaya Power Group

- 6.3.13 iPower Batteries Pvt. Ltd.

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Recycling Activities of Lithium-Ion Batteries in the Country