|

市场调查报告书

商品编码

1687241

商业卫星图像:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Commercial Satellite Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

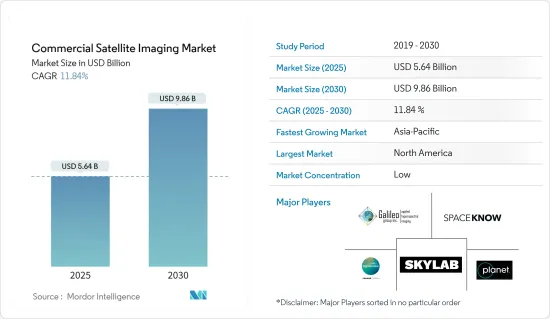

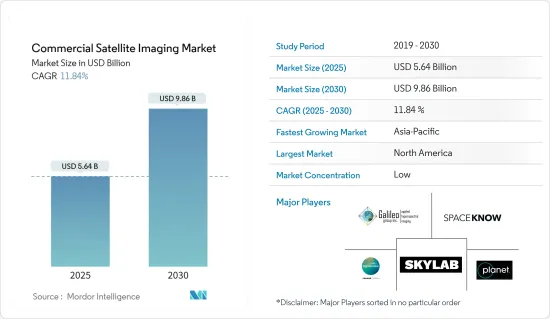

预计 2025 年商业卫星影像市场规模为 56.4 亿美元,到 2030 年将达到 98.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.84%。

由世界各国政府和公司营运的成像卫星拍摄的地球影像称为卫星影像,有时也称为地球观测影像、太空摄影或简称为卫星摄影。气象、海洋学、渔业、农业、生物多样性保护、林业、景观、地质学、製图、区域规划、教育、资讯和战争只是卫星影像应用的几个领域。

主要亮点

- 此成像方法利用配有光学装备的卫星产生原始影像资料。由于距离物体较近,航空影像比卫星影像具有更高的影像解析度。地面成像最经济,并提供最高的影像分辨率,但受到地理限制。与其他成像技术相比,卫星更受青睐,因为它们能够快速提供影像资料,并且覆盖范围广泛。此外,成像服务一旦开始运作就具有经济效益,能够长期支持产业成长。

- 大面积高效监控的需求日益增长是商业卫星市场的主要驱动力之一。卫星影像和资料提供有关土地使用、植被和其他特征的详细而准确的信息,可用于广泛的应用,包括农业、城市规划、自然资源管理和环境监测。

- 智慧城市计画的兴起也推动了商业卫星市场的发展。智慧城市使用多种技术,包括物联网 (IoT) 和卫星影像,来收集和分析资料,以改善公民的生活品质并减少都市区对环境的影响。卫星图像在智慧城市计画中发挥关键作用,它提供有关建筑环境的详细和准确的信息,包括建筑物、道路和其他基础设施的位置和状况。这些资讯可以促进城市规划、交通和公共服务的改善。

- 此外,一些领先的公司正专注于投资卫星成像技术,以保持竞争优势。例如,Accenture于 2022 年 8 月宣布将对 Pixxel 进行策略性投资,以监测地球的健康状况。 Pixel 正在建构全球分辨率最高的高光谱遥测影像卫星星系,为业界提供人工智慧观测,以传统卫星成本的一小部分发现、解决和预测气候问题。

- 同样,Pixel 于 2022 年 4 月透过 SpaceX Falcon 9 号共乘任务发射了印度首颗私人商业成像卫星 Shakuntala,这是计画中的 36 颗卫星星系的一部分。

- 来自不同国家的开放原始码资料的可用性可能会对商业卫星图像市场构成挑战。开放原始码资料是指卫星图像和其他免费资料,通常由政府机构或组织提供。

- 在后疫情市场中,随着限制的解除,企业和政府机构正在为创新转变做准备,以便快速评估和修改供应链。例如,2022年5月,欧洲太空总署(ESA)、美国航太总署(NASA)(负责民用航太计画和航空航太研究的美国联邦政府独立机构)宣布建立合作伙伴关係,结合地球观测卫星的科学力量,记录全球环境和人类社会的变化。

商业卫星图像市场的趋势

军事和国防部门预计将占据较大的市场占有率

- 军事和防御应用是商业卫星影像最广泛的终端用户应用。该部门的成长归因于安全和监视活动,这是所有国防组织的关键职能。卫星军事通讯的使用对全球防御努力变得越来越重要。随着对可靠和安全通讯的需求不断增加,满足这项需求的技术也取得了长足的进步。卫星通讯是军事行动的理想解决方案,因为它能够即时安全地传输关键资料和通讯,即使在最恶劣和最偏远的环境中也是如此。

- 各国持有卫星绕地球运行,提供多种功能。然而,由于其他国家的安全担忧,进入国际空域通常受到限制。在极端情况下,国家可能会实施百叶窗法,迫使其当地领空的外国卫星关闭其拍摄设备。

- 鑑于这些世界政府的禁令,其他国家经常会取得有关外国的地理资讯。政府可以规范商业性图像的品质和清晰度等特性,并在某些地方实施禁令。但军事机构总是倾向有一个备用计画。

- 因此,有大量的地理资讯是根据不同客户的需求进行客製化的。随着卫星影像(例如高光谱遥测影像)的变化,商业部门越来越多地获取专门用于军事目的的资料和为普通公众修改的资料。

- 商业图像对于满足新兴的安全和情报需求至关重要。目前,各国的军事能力正在不断增强,对应对全球恐怖主义威胁的兴趣也不断增加。商业卫星公司提供对国防和国家安全至关重要的资料。随着外太空变得越来越容易进入,商业航太提供了巨大的经济效益,但政府资助的使用卫星影像进行恐怖主义监视的成本过于昂贵。

- 预计大多数国家增加军事开支和国防预算将有助于所调查市场的成长。例如,2022年7月,欧盟委员会宣布计划向欧洲防务基金(EDF)首次公开招标中选出的61个联合国防研究和开发计划提供总额约12亿欧元(13亿美元)的资金。

- 此外,利用卫星成像技术的最新进展可以让军队洞察敌人的活动、计画和位置。它也可用于空中侦察和识别武器系统的潜在目标。

亚太地区可望创下最快成长

- 预计亚太市场在整个预测期内将显着成长。政府加大对卫星影像的倡议以吸引全球和国内公司是该地区市场成长的另一个重要原因。

- 新兴国家商业卫星营运的发展正在影响全球商业卫星成像产业。高通量卫星(HTS)技术的持续扩展为亚太地区各个垂直领域带来了新的可能性和能力。

- 例如,2022年5月,中国四维太空技术有限公司高维卫星一号01、02颗成像卫星搭载长征系列火箭成功发射。这些卫星在中国四维空间现有的50公分解析度SuperView-1卫星星系的基础上进行了改进,为需要额外超高解析度影像通道的客户提供30公分影像。

- 该地区的终端用户垂直行业正在以指数级增长的速度采用新技术,从而增强了商业卫星图像市场的成长。该地区的各国政府也正在投资可望塑造成像卫星未来的先进技术。

- 例如,印度太空研究组织的极地卫星运载火箭C-53(PSLV C-53)从印度斯里哈里科塔航太港发射,搭载三颗新加坡商业卫星。 PSLV 轨道实验舱(也称为 POEM DS-EO)包含电光频谱有效载荷,以满足人道主义援助和救灾要求。此有效载荷为土地分类提供了全彩图像。

商业卫星图像产业概况

商业卫星成像市场高度分散,主要参与者包括 DigitalGlobe Inc.、Galileo Group Inc.、Planet Labs Inc.、SpaceKnow Inc. 和 Skylab Analytics。市场参与者正在采取联盟、合併、创新、投资和收购等策略来增强其产品供应并获得永续的竞争优势。

2023 年 5 月,欧洲太空成像公司 (EUSI) 和空中巴士宣布建立战略伙伴关係,为欧洲海事安全局 (EMSA) 提供极高解析度 (VHR) 光学卫星影像。空中巴士公司将提供其 Pleiades 和 Pleiades Neo 卫星收集的图像。 SPOT 和 EUSI 将提供目前 Maxar卫星星系的图像以及其他附加价值服务。

2023 年 3 月,L3Harris Technologies 宣布已获得 NASA 一份价值 7.65 亿美元的合同,用于设计和建造 NOAA 地球静止扩展观测卫星系统的下一代高分辨率成像仪。 GeoXO 成像仪可能会提供先进的红外线和可见光影像、更精确的观测和改进的水蒸气测量,从而显着提高西半球天气预报的准确性和及时性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 大面积高效率监控的需求日益增加

- 智慧城市概念的兴起

- 巨量资料与影像分析

- 市场限制

- 其他成像技术提供的高解析度影像

- 市场挑战

- 各国开放原始码资料的可用性

第六章 市场细分

- 按应用

- 地理空间资料撷取和映射

- 自然资源管理

- 监控与安全

- 自然保育与研究

- 建设与发展

- 灾害管理

- 国防和情报

- 按最终用户产业

- 政府

- 建造

- 运输和物流

- 军事和国防

- 活力

- 林业和农业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- DigitalGlobe Inc.

- Galileo Group Inc.

- Planet Labs Inc.

- SpaceKnow Inc.

- Skylab Analytics

- L3Harris Corporation Inc.

- BlackSky Global LLC

- ImageSat International NV

- European Space Imaging(EUSI)GmbH

- UrtheCast Corp.

第八章投资分析

第九章:市场的未来

The Commercial Satellite Imaging Market size is estimated at USD 5.64 billion in 2025, and is expected to reach USD 9.86 billion by 2030, at a CAGR of 11.84% during the forecast period (2025-2030).

Images of the Earth taken by imaging satellites run by governments and companies worldwide are known as satellite images, sometimes known as Earth observation imagery, spaceborne photography, or simply satellite photos. Meteorology, oceanography, fisheries, agriculture, biodiversity protection, forestry, landscape, geology, cartography, regional planning, education, intelligence, and warfare are just a few fields where satellite photos are used.

Key Highlights

- The imaging method generates raw image data using optically equipped satellites. Since it is closer to the object, aeronautical imaging delivers a higher image resolution than satellite imaging. The most economical and greatest image resolution is provided by terrestrial imaging; however, it has geographical limitations. Because of their quick supply of image data and wide coverage, satellites are favored over other imaging techniques. Additionally, imaging services are economical once they are in orbit, supporting industry growth over time.

- The increasing requirement for efficient monitoring of vast land areas is one of the key drivers for the commercial satellite market. The use of satellite imagery and data can provide detailed and accurate information about land use, vegetation, and other features, which can be used for a wide range of applications such as agriculture, urban planning, natural resource management, and environmental monitoring.

- The rising smart city initiatives are also driving the commercial satellite market. Smart cities utilize various technologies, such as the Internet of Things (IoT) and satellite imagery, to collect and analyze data to improve citizens' quality of life and decrease the environmental impact of urban areas. Satellite imagery plays a key role in smart city initiatives by providing detailed and accurate information about the built environment, such as the location and condition of buildings, roads, and other infrastructure. This information can improve urban planning, transportation, and public services.

- Furthermore, several leading players are focusing on investing in satellite imaging technology to stay ahead of the competition. For instance, in August 2022, Accenture announced to make a strategic investment in Pixxel to monitor Earth's health. Pixxel is building the world's highest-resolution hyperspectral imaging satellite constellation to provide industry AI-powered observations that discover, solve, and predict climate issues at a fraction of the cost of traditional satellites.

- Similarly, in April 2022, Pixxel launched India's first private commercial imaging satellite, "Shakuntala," as a part of its planned 36-satellite constellation aboard a SpaceX Falcon-9 rideshare mission.

- The availability of open-source data for various countries can challenge the commercial satellite imaging market. Open-source data refers to satellite imagery and other freely available data to the public, often provided by government agencies or organizations.

- In the post-COVID-19 market, businesses and government organizations are preparing for an innovation shift since the restrictions are lifted to evaluate and modify their supply chains quickly. For instance, in May 2022, the European Space Agency (ESA), Japan Aerospace Exploration Agency (JAXA), and the National Aeronautics and Space Administration (NASA), an independent agency of the U.S. Federal Government that is in charge of the civilian space program as well as aeronautics and space research, announced that they had teamed up to use the combined scientific power of their earth-observing satellites to document global changes in the environment and human society.

Commercial Satellite Imaging Market Trends

Military and Defense is Expected to Hold Significant Market Share

- Military and defense applications are the most extensive end-user application of commercial satellite imagery. The segment's expansion is attributed to the security and surveillance activities, which are crucial functions of every defense organization. The utilization of satellite-based military communications has grown progressively crucial for defense operations worldwide. As the requirement for reliable and secure communications rises, the technology to fulfill this demand has made considerable progress. Satellite communications present an optimal resolution for military operations, as they offer real-time, secure transmission of vital data and communications, even in the most hostile and remote surroundings.

- Various nations have satellites circling the Earth, providing numerous functions. However, because of the security concerns of other countries, they usually have limited access to international airspace. In extreme circumstances, countries might execute shutter control laws that force satellites of foreign countries in regional airspace to turn off their photographic equipment.

- Considering all these global government prohibitions, other parties often obtain geographical information regarding foreign nations. Governments can regulate the characteristics such as quality and clarity of commercially accessible images and impose a ban on a specific place. However, military agencies always tend to have backup plans.

- Therefore, there is a massive diversity of geographical information that is principally customized to various customers' demands. With changes in satellite imagery (such as hyperspectral imaging), the commercial realm is progressively acquiring data that is only used for military purposes and the data modified for the general public.

- Commercial imaging is vital to meeting the needs of both new security and intelligence concerns. This is due to countries' increased attention to evolving their military capabilities and dealing with terrorism threats worldwide. Commercial satellite firms offer vital data for defense and national security. Commercial aerospace has a substantial economic benefit as space becomes more accessible, but government-funded terrorist monitoring using satellite imagery is too expensive.

- Growing military expenditure and defense budgets in most nations are anticipated to aid the growth of the market under study. For instance, in July 2022, the European Commission announced plans to provide a total of around EUR 1.2 billion (USD 1.3 billion) in funding for 61 collaborative defense research and development projects chosen from the first-ever calls for proposals under the European Defense Fund (EDF).

- Furthermore, by leveraging the latest advancements in satellite imaging technology, military forces can gain insight into enemy activities, plans, and locations. Moreover, it can also be used to identify potential targets for aerial reconnaissance and weapons systems.

Asia-Pacific Expected to Register Fastest Growth

- The Asia-Pacific market is expected to grow considerably throughout the forecast period. Increasing government initiatives for satellite imaging to entice global and domestic firms are other vital reasons for the region's market growth.

- The ASEAN countries' developing commercial satellite business is affecting the worldwide commercial satellite imaging industry. The continuing expansion of High Throughput Satellite (HTS) technology is bringing new possibilities and capabilities in various APAC vertical areas.

- For instance, in May 2022, The SuperView Neo-1 01 and 02 imaging satellites from China Siwei were successfully launched by a Long March rocket. They improved China Siwei's already-existing 50 cm resolution SuperView-1 constellation of satellites and offered 30 cm images to clients needing extra channels of extremely high-resolution imaging.

- The region's end-user verticals are adopting new technologies at an exponentially expanding rate, which is bolstering the growth of the commercial satellite imaging market. Governments across the region are also investing in advanced technologies that are expected to shape the future of imaging satellites.

- For instance, the Polar Satellite Launch Vehicle C-53, or PSLV C-53, of the Indian Space Research Organization, was launched from the Sriharikota, India spaceport carrying three Singaporean commercial satellites. The PSLV Orbital Experimental Module, also known as POEM DS-EO, includes an electro-optic, multi-spectral payload to satisfy the demands of humanitarian aid and disaster relief. This payload will give full-color images for land categorization.

Commercial Satellite Imaging Industry Overview

The commercial satellite imaging market is highly fragmented, with the presence of major players like DigitalGlobe Inc., Galileo Group Inc., Planet Labs Inc., SpaceKnow Inc., and Skylab Analytics. among others. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In May 2023, European Space Imaging (EUSI) and Airbus announced a strategic partnership to provide the European Maritime Safety Agency (EMSA) with Very High Resolution (VHR) optical satellite imagery. Airbus will be providing imagery collected by Pleiades and Pleiades Neo satellites. SPOT and EUSI will likely be supplying imagery from the current Maxar satellite constellation and other value-added services.

In March 2023, L3Harris Technologies announced it received a USD 765 million contract from NASA to design and build the next-generation, high-resolution imager for NOAA's Geostationary Extended Observations satellite system. The GeoXO Imager will likely provide advanced infrared and visible imagery, more precise observations, and improved water vapor measurements to significantly improve the accuracy and timeliness of weather forecasting in the Western Hemisphere.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Imapct of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Requirement for Efficient Monitoring of Vast Land Areas

- 5.1.2 Rising Smart City Initiatives

- 5.1.3 Big Data and Imagery Analytics

- 5.2 Market Restraints

- 5.2.1 High-resolution Images Offered by Other Imaging Technologies

- 5.3 Market Challenges

- 5.3.1 Availability of Open-Source Data for Various Countries

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Geospatial Data Acquisition and Mapping

- 6.1.2 Natural Resource Management

- 6.1.3 Surveillance and Security

- 6.1.4 Conservation and Research

- 6.1.5 Construction and Development

- 6.1.6 Disaster Management

- 6.1.7 Defense and Intelligence

- 6.2 By End-user Vertical

- 6.2.1 Government

- 6.2.2 Construction

- 6.2.3 Transportation and Logistics

- 6.2.4 Military and Defense

- 6.2.5 Energy

- 6.2.6 Forestry and Agriculture

- 6.2.7 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DigitalGlobe Inc.

- 7.1.2 Galileo Group Inc.

- 7.1.3 Planet Labs Inc.

- 7.1.4 SpaceKnow Inc.

- 7.1.5 Skylab Analytics

- 7.1.6 L3Harris Corporation Inc.

- 7.1.7 BlackSky Global LLC

- 7.1.8 ImageSat International NV

- 7.1.9 European Space Imaging (EUSI) GmbH

- 7.1.10 UrtheCast Corp.