|

市场调查报告书

商品编码

1687247

光纤传输网路-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Optical Transport Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

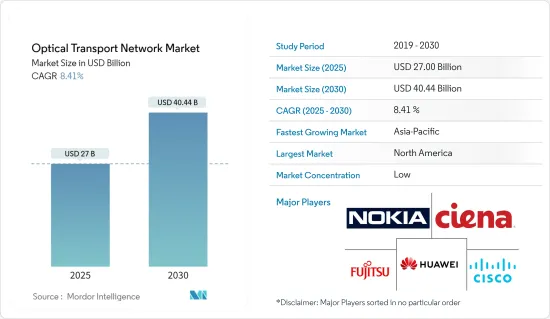

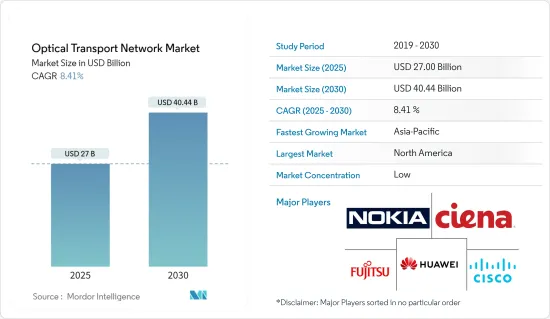

光纤传输网路市场规模预计在 2025 年达到 270 亿美元,到 2030 年将达到 404.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.41%。

关键亮点

- 需求激增推动光纤传输网路市场成长 由于对高速互联网的需求不断增加以及技术的快速进步,光纤传输网路 (OTN) 市场正在经历强劲增长。预计将从 2022 年的 206.8 亿美元成长到 2028 年的 344.1 亿美元,复合年增长率为 8.41%。

- 网路普及推动市场扩张:全球网路使用量的快速成长和对频宽应用的需求不断增加是推动 OTN 市场向前发展的关键因素。

- 增强连接性:思科预测,到 2023 年,全球 66% 的人口将能够存取互联网,全球用户数量将达到 53 亿。

- 设备激增:预计到 2023 年,连网设备数量将达到 293 亿,平均每人拥有 3.6 台设备。

- 中国的角色:到 2021 年底,中国网路用户将达到 10.32 亿,普及率将达到 73%,凸显了对 OTN 基础设施管理不断增长的资料流量的需求日益增长。

- 创新正在改变格局:OTN 解决方案供应商正在透过提高容量和效率的创新来彻底改变市场。

- Ciena 取得突破:WaveLogic 5 Extreme 技术在英国北部海底电缆上实现了创纪录的 800GB/秒。

- 诺基亚在印尼扩张:诺基亚的部署已将爪哇岛莫拉特林多的网路容量增加到 2 Terabyte,将雅加达的网路容量增加到 3 Terabyte。

- 华为的战略愿景专注于优质连接和无处不在的覆盖,华为认为光纤传输解决方案是支持未来服务所需的海量频宽的关键。

- 5G部署将加速市场成长:全球5G网路的快速部署是OTN市场另一个主要成长动力。

- 5G用户成长:爱立信预测,5G用户数将从2021年的1,200万激增至2025年的30亿以上。

- 按地区划分:北美(3.6292亿),其次是西欧(3.2353亿)。

- 5G 革命正在推动对先进 OTN 基础设施日益增长的需求,以跟上资料流量的快速增长。

市场区隔揭示成长机会

关键亮点

- 技术领先地位:分波多工(WDM) 预计将在 2022 年占据市场主导地位,占有 48.08% 的份额,到 2028 年将以 10.68% 的复合年增长率增长。

- 产品供应:预计到 2022 年,零件将占据 58.03% 的市场占有率,预计成长率为 9.57%。

- 终端用户需求:预计到 2022 年,IT 和通讯业将占据 75.85% 的市场占有率,复合年增长率为 9.23%。

- 地理重点:2022 年,北美将占据 35.14% 的最高份额,而亚太地区将以 9.73% 的复合年增长率实现最快增长。

- 这些动态凸显了市场在跨技术、产品和地理领域实施有针对性的成长策略的潜力。

光纤传输网路市场趋势

WDM技术领域预计将占据主要市场占有率

- 主导市场地位:WDM 领域将巩固其作为最大技术领域的地位,到 2022 年将占据 OTN 市场的 48.08%。 WDM 在通讯中发挥关键作用,支援大容量资料传输,对于产业发展至关重要。

- 强劲的成长轨迹:预计 WDM 将保持高成长轨迹,2023-2028 年期间的复合年增长率为 10.68%,推动市场规模从 2022 年的 99.4 亿美元增长到 2028 年的 185.8 亿美元。

- 技术进步:绕过传统传输系统的技术创新,例如将数位连贯光学(DCO)整合到路由器中,正在彻底改变 WDM 的采用,并为网路设计提供更大的灵活性。

- 需求激增:预计到 2021 年中期,全球 54.94% 的人口将上网,亚太地区对 WDM 的需求正在增长,尤其是在中国和印度等高成长市场。

亚太地区将经历最快成长

- 加速市场扩张:亚太地区是 OTN 市场成长最快的地区,预计 2023 年至 2028 年的复合年增长率为 9.73%,市场规模将从 2022 年的 59.2 亿美元增加到 2028 年的 106.1 亿美元。

- 数位转型的努力:中国等国家计划在 2025 年实现 70% 的大型企业数位化,政府主导的倡议正在刺激对先进 OTN 技术的需求。

- 基础设施投资:数位基础设施投资,例如 Biznet 利用 Ciena 的 6500 平台在印尼的扩张,正在推动全部区域的OTN 成长。

- 5G部署和物联网:5G的扩展和物联网设备的激增继续推动对大容量光纤网路的需求,尤其是在中国,2021年物联网设备数量超过20亿。

光纤传输网路产业概况

全球参与企业主导整合的 OTN 市场全球 OTN 市场由参与企业主导,整合程度适中。诺基亚、Ciena、思科、华为和富士通等主要通讯业者引领市场,提供广泛的光纤传输解决方案,以满足日益增长的高速资料传输需求。

创新和伙伴关係推动领导力创新和策略伙伴关係关係是维持市场领导地位的关键。例如,诺基亚和Ciena正在部署600Gbps线速等尖端解决方案,并与通讯业者合作进行大型基础设施计划。

成功策略:为了扩大市场占有率,公司需要专注于投资下一代技术,如 400G光纤传输解决方案,开拓亚太和拉丁美洲的新兴市场,以及面向服务的产品,如网路即服务模式。此外,在产品设计中註重能源效率和永续性可能是保持竞争力的关键。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力模型

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 由于对高速网路的需求,网路普及率不断提高

- OTN 解决方案提供者的创新

- 市场问题

- 初期投资高

第六章市场区隔

- 依技术

- WDM

- DWDM

- 其他的

- 按服务

- 服务

- 网路维护与支援

- 网路设计

- 成分

- 光纤传输

- 光开关

- 光学平台

- 服务

- 按行业

- 资讯科技和电信

- 医疗保健

- 政府

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Nokia Corporation

- Ciena Corporation

- Cisco Systems Incorporation

- Huawei Technologies Co. Ltd

- Fujitsu Ltd

- ZTE Corporation

- Infinera Corporation

- Telefonaktiebolaget LM Ericsson

- NEC Corporation

- Yokogawa Electric Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Optical Transport Network Market size is estimated at USD 27.00 billion in 2025, and is expected to reach USD 40.44 billion by 2030, at a CAGR of 8.41% during the forecast period (2025-2030).

Key Highlights

- Surging Demand Drives Optical Transport Network Market Growth: The Optical Transport Network (OTN) market is witnessing robust growth, spurred by rising demand for high-speed internet and rapid technological advancements. With the market projected to expand from USD 20.68 billion in 2022 to USD 34.41 billion by 2028, the industry is on track to register a CAGR of 8.41%.

- Internet Penetration Fuels Market Expansion: The surge in global internet usage and the rising demand for bandwidth-heavy applications are key factors propelling the OTN market forward.

- Increased connectivity: Cisco anticipates that by 2023, 66% of the global population will have internet access, amounting to 5.3 billion users worldwide.

- Device proliferation: Networked devices are expected to reach 29.3 billion by 2023, averaging 3.6 devices per person.

- China's role: With 1,032 million internet users and a 73% penetration rate by the end of 2021, China highlights the growing demand for OTN infrastructure to manage surging data traffic.

- Technological Innovations Reshape the Landscape: OTN solution providers are revolutionizing the market with innovations that enhance capacity and efficiency.

- Ciena's breakthrough: WaveLogic 5 Extreme technology achieved a record-breaking 800 GB/s on the NO-UK submarine cable.

- Nokia's expansion in Indonesia: Moratelindo's network capacity on Java Island was expanded to 2 terabytes, and to 3 terabytes in Jakarta, via Nokia's deployment.

- Huawei's strategic vision: Focused on premium connectivity and ubiquitous coverage, Huawei is positioning its optical transport solutions as key to supporting the massive bandwidth requirements of future services.

- 5G Deployment Accelerates Market Growth: The rapid global rollout of 5G networks is another significant growth driver for the OTN market.

- 5G subscriber growth: Ericsson projects 5G subscriptions to soar from 12 million in 2021 to over 3 billion by 2025.

- Regional adoption: North East Asia is expected to lead, with 1,460.04 million subscriptions by 2025, followed by significant growth in North America (362.92 million) and Western Europe (323.53 million).

- The 5G revolution is increasing the need for advanced OTN infrastructures capable of handling the exponential rise in data traffic.

Market Segmentation Reveals Growth Opportunities:

Key Highlights

- Technology leadership: Wavelength Division Multiplexing (WDM) dominated the market with a 48.08% share in 2022 and is expected to grow at a CAGR of 10.68% through 2028.

- Product offerings: Components led with a 58.03% market share in 2022, with a projected growth rate of 9.57%.

- End-user demand: The IT and Telecom sectors accounted for 75.85% of the market in 2022, with a forecasted 9.23% CAGR.

- Geographic focus: North America led with a 35.14% share in 2022, while Asia-Pacific is set to experience the fastest growth at a 9.73% CAGR.

- These dynamics highlight the market's potential for targeted growth strategies across technology, product, and geographic segments.

Optical Transport Network Market Trends

WDM Technology Segment is Expected to Hold Significant Market Share

- Dominant market position: The WDM segment solidified its status as the largest technology segment, capturing 48.08% of the OTN market in 2022. Its key role in telecommunications, supporting high-capacity data transmission, is critical in the industry's evolution.

- Robust growth trajectory: WDM is expected to maintain a high growth trajectory, with a projected CAGR of 10.68% from 2023 to 2028, driving its market value from USD 9.94 billion in 2022 to USD 18.58 billion by 2028.

- Technological advancements: Innovations such as the integration of digital coherent optics (DCO) into routers, bypassing traditional transport systems, are revolutionizing WDM adoption, offering greater flexibility in network design.

- Demand surge: The Asia-Pacific region, with 54.94% of the global population online by mid-2021, is driving demand for WDM, particularly in high-growth markets like China and India.

Asia-Pacific to Witness Fastest Growth

- Accelerated market expansion: Asia-Pacific is the fastest-growing region in the OTN market, with a projected CAGR of 9.73% from 2023 to 2028, reflecting a rise in market value from USD 5.92 billion in 2022 to USD 10.61 billion by 2028.

- Digital transformation initiatives: Government-led initiatives in countries like China, which aims to digitalize 70% of large enterprises by 2025, are spurring demand for advanced OTN technologies.

- Infrastructure investments: Investments in digital infrastructure, such as Biznet's expansion with Ciena's 6500 platform in Indonesia, are catalyzing OTN growth across the region.

- 5G rollout and IoT: The expansion of 5G and the proliferation of IoT devices, especially in China where IoT devices surpassed 2 billion in 2021, continue to fuel the demand for high-capacity optical networks.

Optical Transport Network Industry Overview

Global Players Dominate Consolidated OTN Market: The global OTN market is dominated by established players in a moderately consolidated landscape. Major telecoms like Nokia, Ciena, Cisco, Huawei, and Fujitsu lead the market, supplying a wide range of optical transport solutions that cater to growing demand for high-speed data transmission.

Innovation and partnerships drive leadership: Technological innovation and strategic partnerships are key to maintaining market leadership. For instance, Nokia and Ciena have introduced cutting-edge solutions, such as 600 Gbps line rates, and partnered with telecom operators for large-scale infrastructure projects.

Strategies for success: To increase market share, companies must invest in next-gen technologies like 400G optical transport solutions, tap into emerging markets in Asia-Pacific and Latin America, and focus on service-oriented offerings, such as Network-as-a-Service models. Emphasizing energy efficiency and sustainability in product design will also be critical for maintaining a competitive edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Internet Penetration with Demand for High-speed Internet

- 5.1.2 Technological Innovations by OTN Solution Providers

- 5.2 Market Challenges

- 5.2.1 High Initial Investment

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 WDM

- 6.1.2 DWDM

- 6.1.3 Other Technologies

- 6.2 By Offering

- 6.2.1 Service

- 6.2.1.1 Network Maintenance and Support

- 6.2.1.2 Network Design

- 6.2.2 Component

- 6.2.2.1 Optical Transport

- 6.2.2.2 Optical Switch

- 6.2.2.3 Optical Platform

- 6.2.1 Service

- 6.3 By End-user Vertical

- 6.3.1 IT and Telecom

- 6.3.2 Healthcare

- 6.3.3 Government

- 6.3.4 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Ciena Corporation

- 7.1.3 Cisco Systems Incorporation

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 Fujitsu Ltd

- 7.1.6 ZTE Corporation

- 7.1.7 Infinera Corporation

- 7.1.8 Telefonaktiebolaget LM Ericsson

- 7.1.9 NEC Corporation

- 7.1.10 Yokogawa Electric Corporation