|

市场调查报告书

商品编码

1687258

过氧化氢:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Hydrogen Peroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

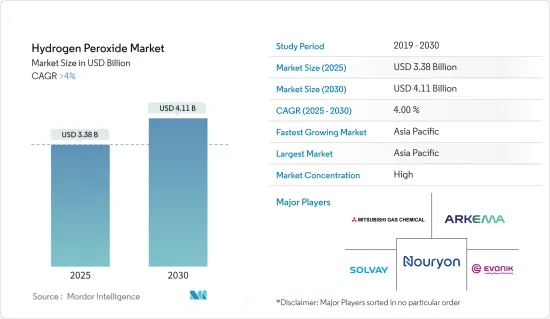

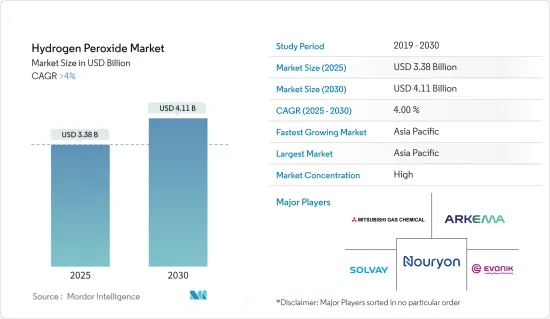

过氧化氢市场规模预计在 2025 年为 33.8 亿美元,预计到 2030 年将达到 41.1 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4%。

主要亮点

- 从中期来看,造纸和纸浆行业的需求不断增长,以及作为环氧丙烷生产(HPPO 製程)原料的过氧化氢消耗量的增加,预计将推动市场成长。

- 另一方面,接触过氧化氢所带来的健康危害和副作用可能会阻碍市场的成长。

- 然而,过氧化氢在污水处理中的新兴机会以及亚洲新兴国家电子产业的成长等因素可能成为市场的成长机会。

- 预计亚太地区将主导市场并在预测期内呈现最高的复合年增长率。

过氧化氢市场趋势

造纸和纸浆产业的需求不断增长

- 在造纸和纸浆工业中,过氧化氢被广泛用作漂白剂,用于生产各种类型的纺织品,包括机械纺织品、合成纺织品和再生纺织品。

- 在这些行业中,过氧化氢也用于优化纸浆漂白。过氧化氢也用于废纸回收,而不是替代漂白剂,因为它有助于降低漂白成本并减少废水的颜色。

- 美国和中国主要纸浆和纸製品市场的线上销售不断增长,这在一定程度上促进了包装创新的需要,以透过网路购物改善产品在货架上的摆放位置。原材料和瓦楞纸箱需求的增加是导致这一增长的原因。

- 根据巴西纸浆和造纸公司Suzano Papel e Celulose估计,2032年全球纸浆消费量将达到约4.76亿吨。

- 美国成为世界第二大纸张生产国。美国、中国(世界第一)、日本(世界第三)三国合计占世界纸张产量的一半以上。这里有几家大型造纸製造商,包括国际纸业、乔治亚太平洋和 Westrock。根据粮农组织的资料,美国纸浆和造纸业每年生产超过 7,000 万吨纸和纸板。

- 预计到 2024 年,印度纸张和纸製品市场规模将达到 134 亿美元。这将在预测期内为市场创造机会。

- 因此,由于所有这些趋势,预计对纸张和纸浆的需求将会增加,并且未来几年对过氧化氢的需求预计也会增加。

亚太地区可望主导市场

- 亚太地区、印度和中国是实现显着成长的关键国家,而这一趋势很可能在预测期内持续下去。

- 根据中国国家统计局发布的资料,预计2023年纸及纸板产量将增加约5.89%,达到1.4531亿吨。

- 根据《中国纸浆造纸年度报告2022》发布的资料显示,纸浆、纸及纸製品产业总产量2.8391亿吨,年增1.32%。

- 化妆品和个人护理行业是该国成长最快的行业之一。此外,日益成熟的消费者、不断壮大的中阶和持续增长的人口使中国成为全球第二大个人护理市场,这也推动了个人护理和皮肤护理产品的需求。

- 根据中国国家统计局的数据,2023年化妆品累积零售额将成长约7.09%至25,885.3亿元(约3,662.8亿美元)。

- 中国是世界最大电子国家。智慧型手机、OLED 电视和平板电脑等消费性电子产品占据了市场的最高成长。根据国务院金融管理局资料显示,2023年我国电子资讯製造业固定资产投资与前一年同期比较增约9.3%。

- 由于本土需求的持续成长,印度在全球纸张消费量中的份额正在扩大。预计未来几年,对薄纸、滤纸、茶包、轻质线上涂布纸、医用涂布纸以及透过有组织零售销售的快速消费品包装等产品的需求将推动印度纸张和纸製品市场的发展。

- 印度的食品业是该国最大的产业之一。人口成长也预计将推动食品产业的需求,进而有望促进印度水处理化学品市场的发展。印度食品加工工业部已批准在24个邦建立42个大型食品园区,目前这些园区正处于不同的实施阶段。

- 因此,由于所有此类应用和地区的需求强劲,预计亚太地区将成为预测期内最大的市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 造纸和纸浆产业的需求不断增长

- 作为氧化丙烯生产(HPPO 製程)原料的过氧化氢消耗量增加

- 其他驱动因素

- 限制因素

- 长期接触过氧化氢的健康危害

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术简介

- 生产流程

- 技术授权和专利分析

- 贸易分析

- 定价分析

- 供应情景

- 监理政策

第五章 市场区隔

- 产品特性

- 消毒剂

- 漂白

- 氧化剂

- 其他产品特性(清洗剂)

- 最终用户产业

- 纸浆和造纸

- 化学合成

- 污水处理

- 矿业

- 饮食

- 化妆品和保健品

- 纺织品

- 其他终端用户产业(运输、电子、半导体、无菌包装等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- BASF SE

- Chang Chun Group

- Dow

- Evonik Industries AG

- Guangdong Zhongcheng Chemicals Inc. Ltd

- Gujarat Alkalies and Chemicals Limited

- Hodogaya Chemical Co. Ltd

- Kemira

- Kingboard Chemical Holdings Limited(Kingboard)

- MITSUBISHI GAS CHEMICAL COMPANY INC.

- National Peroxide Limited

- Nouryon

- Qingdao LaSheng Co. Ltd

- Solvay

第七章 市场机会与未来趋势

- 过氧化氢在污水处理的新机会

- 亚洲新兴国家电子产业的成长

简介目录

Product Code: 57240

The Hydrogen Peroxide Market size is estimated at USD 3.38 billion in 2025, and is expected to reach USD 4.11 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising demand from the paper and pulp industry and increasing consumption of hydrogen peroxide as raw material for propylene oxide production (HPPO process) are expected to drive market growth.

- On the flip side, health hazards and side effects associated with exposure to hydrogen peroxide are likely to hinder the market's growth.

- However, factors such as newer opportunities for hydrogen peroxide in wastewater treatment and the growth of the electronic industry in developing Asian countries are likely to act as growth opportunities for the market.

- Asia-Pacific is expected to dominate the market and will witness the highest CAGR during the forecast period.

Hydrogen Peroxide Market Trends

Increasing Demand for the Paper and Pulp Industry

- In the paper and pulp industry, hydrogen peroxide is widely used as a bleaching agent to manufacture various types of fibers, including mechanical, chemical, or recyclable.

- In these industries, hydrogen peroxide is also used to optimize the bleaching of the pulp. As it helps reduce bleaching costs and decrease the color of effluents, hydrogen peroxide is also used to recirculate waste paper over another bleaching agent.

- An increase in online sales in the leading pulp and paper products markets, namely the United States and China, is partly due to the need for package innovation to improve product placement on shelves due to online shopping. Improved demand for raw materials and cardboard boxes is the reason for this increase.

- According to Brazilian paper and pulp company Suzano Papel e Celulose estimates, global pulp consumption will be valued at around 476 million metric tons by 2032.

- The United States stands to be the world's second-largest paper-producing country. The United States, China (the world's largest), and Japan (the third largest) account for more than half of the world's total paper production. Several major paper manufacturers, like International Paper, Georgia-Pacific, Westrock, etc., operate in the country. The pulp and paper industry in the United States produces more than 70 million tons of paper and board yearly, as per the FAO data.

- The market for paper and paper products in India is estimated to reach USD 13.4 billion by 2024. This opens opportunities for the market during the forecast period.

- Therefore, the demand for paper and pulp is expected to increase due to all these trends, and it is also predicted that there will be an increased demand for hydrogen peroxide in the coming years.

The Asia-Pacific Region is expected to Dominate the Market

- Asia-Pacific, India, and China are the significant countries observing significant growth, and this trend is likely to be sustained during the forecast period.

- According to data released by the National Bureau of Statistics of China, the production of processed paper and cardboard in 2023 increased by about 5.89% and was valued at 145.31 million metric tons.

- According to the data released by the China Pulp and Paper Annual Report 2022, the total output of the pulp, paper, and paper products industry increased by 1.32% and was valued at 283.91 million tons.

- The cosmetics and personal care industry is one of the fastest-growing sectors in the country. Moreover, China is the world's second-largest personal care products market due to increasingly sophisticated consumers, a large middle-class section of people, and continuous growth in population, which is another factor fueling the demand for personal care and skin care products.

- According to the National Bureau of Statistics of China, the cumulative retail value of cosmetic products in 2023 increased by about 7.09% and was valued at CNY 2,588.53 billion (~USD 366.28 billion).

- China has the largest electronics industry in the world. Consumer electronic products, such as smartphones, OLED TVs, and tablets, account for the highest growth in the market. According to data from the General Office of the State Council Operation, fixed-asset investment in China's electronic information manufacturing industry increased by about 9.3% Y-o-Y in 2023.

- India's share in global paper consumption is growing owing to the continuous rise in local demand. The demand for products such as tissue paper, filter paper, tea bags, lightweight online coated paper, and medical-grade coated paper, along with packaging of FMCG products marketed through organized retail, is expected to drive the paper and paper products market in India in the coming years.

- The Indian food industry is one of the prominent industries in the country. The increasing population is another factor boosting the demand for the food industry, which, in turn, is estimated to boost India's water treatment chemicals market. The Ministry of Food Processing Industry has sanctioned 42 mega food parks located in 24 states of India, and they are in different stages of implementation.

- Hence, with all such applications and robust demand in the region, Asia-Pacific is expected to be the largest market during the forecast period.

Hydrogen Peroxide Industry Overview

The hydrogen peroxide market is consolidated. The major players (not in any particular order) include Solvay, Evonik Industries AG, MITSUBISHI GAS CHEMICAL COMPANY INC., Arkema, and Kemira.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Paper and Pulp Industry

- 4.1.2 Increasing Consumption of Hydrogen Peroxide as Raw Material for Propylene Oxide Production (HPPO Process)

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Health Hazards Associated with Long-term Exposure of Hydrogen Peroxide

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.5.1 Production Process

- 4.5.2 Technology Licensing and Patent Analysis

- 4.6 Trade Analysis

- 4.7 Price Analysis

- 4.8 Supply Scenario

- 4.9 Regulatory Policies

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Function

- 5.1.1 Disinfectant

- 5.1.2 Bleaching

- 5.1.3 Oxidant

- 5.1.4 Other Product Functions (Cleaning Agent)

- 5.2 End-user Industry

- 5.2.1 Pulp and Paper

- 5.2.2 Chemical Synthesis

- 5.2.3 Wastewater Treatment

- 5.2.4 Mining

- 5.2.5 Food and Beverage

- 5.2.6 Cosmetics and Healthcare

- 5.2.7 Textiles

- 5.2.8 Other End-user Industries (Transportation, Electronics, Semiconductors, Aseptic Packaging, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 Chang Chun Group

- 6.4.4 Dow

- 6.4.5 Evonik Industries AG

- 6.4.6 Guangdong Zhongcheng Chemicals Inc. Ltd

- 6.4.7 Gujarat Alkalies and Chemicals Limited

- 6.4.8 Hodogaya Chemical Co. Ltd

- 6.4.9 Kemira

- 6.4.10 Kingboard Chemical Holdings Limited (Kingboard)

- 6.4.11 MITSUBISHI GAS CHEMICAL COMPANY INC.

- 6.4.12 National Peroxide Limited

- 6.4.13 Nouryon

- 6.4.14 Qingdao LaSheng Co. Ltd

- 6.4.15 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Newer Opportunities for Hydrogen Peroxide in Wastewater Treatment

- 7.2 Growth of the Electronic Industry in Developing Asian Countries

02-2729-4219

+886-2-2729-4219