|

市场调查报告书

商品编码

1687264

海底光缆:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Submarine Optical Fiber Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

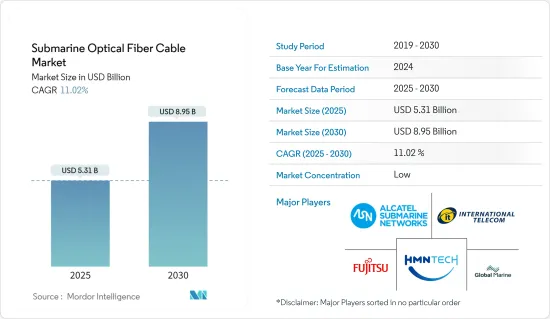

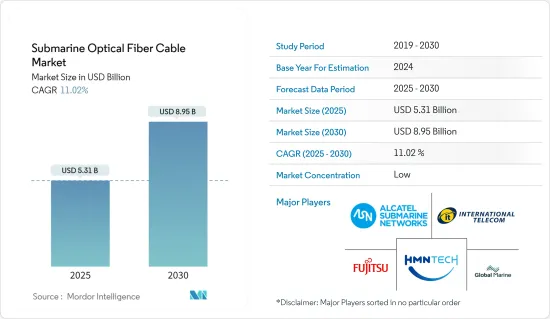

预计 2025 年海底光纤电缆市场规模为 53.1 亿美元,到 2030 年将达到 89.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.02%。

增加对高速互联网基础设施的投资是推动海底光纤电缆市场成长的主要因素之一。全球范围内海量资料的产生和传输不断增加是市场的主要驱动力之一。因此,预计许多网路骨干业者将在预测期内投资海底光缆市场。

关键亮点

- 预计全球离岸风力发电的成长将推动市场成长。全球风能理事会(GWEC)表示,美国是最大的离岸风力发电市场之一。然而,英国、德国、中国、日本和台湾等国家正大力投资开拓离岸风力发电产业,为市场成长创造了有利的条件。

- 随着全球资料使用量的激增,对低延迟、高容量通讯基础设施的需求也日益增长。海底光缆已成为满足高容量、低延迟通讯基础设施需求的首选解决方案。

- 与大多数公共产业使用的传统线路相比,光纤是一种更可靠、更快速、频宽更高的资料传输模式。海底光纤网路透过人类头髮大小的玻璃纤维发送光脉衝来传输资料。数位讯号通过光传输时,不会受到外界干扰,讯号损失也减少。其结果是远距资料传输和网路更加可靠。此外,随着这些网路的扩展,用户流量将持续增加,因此需要建立标准化的光纤测试程序。

- 海底光纤电缆的铺设和维护需要耗费大量的人力和物力,例如船舶、潜水员和安装设备,因此,预计与海底光纤电缆相关的高维护成本将抑制海底光纤电缆市场的成长。这意味着铺设、修理和维护海底光缆的成本很高。

- 全球经济的扩张直接影响对海底光纤连接的需求。随着经济的扩张,对高速网路连线的需求使得海底电缆网路越来越广泛。例如,根据世界银行的估计,北美的GDP在2023年为32.32兆美元,预计在2023-24年间将成长1.5%,这将刺激商业活动的繁荣和海底光缆投资的潜力。

海底光缆市场趋势

智慧型手机普及率的提高和对网路频宽的需求正在推动市场

- 近年来,智慧型手机产业经历了显着成长。数位技术的接受度和采用度不断提高、5G 的出现以及企业的行动优先方法是推动智慧型手机普及的关键因素。爱立信预计,到2028年,全球智慧型手机用户数将达到77.43亿,高于2022年的64.21亿。

- 此外,爱立信表示,东北亚将在智慧型手机用户方面领先(2022 年将达到 19.9 亿),其次是中国(15.7 亿)和东南亚及大洋洲(9.1 亿)。智慧型手机用户数量的增加将对网路消费和资料生成产生积极影响,进而推动对资料中心和其他数位基础设施的需求,而高频宽连接是这些基础设施的关键要求。

- 根据2023年11月发布的爱立信行动报告,全球每部智慧型手机的平均资料消费量预计将持续大幅成长,从2023年的每月21GB增加至2029年的每月56GB。这样的发展对网路频宽需求的不断增长产生了积极影响,进而推动了对海底光缆的需求。

- 更高的频宽、超低延迟和更快的连接将扩展文明、彻底改变行业并从根本上改善我们的日常体验。频宽需求通常每年都会大幅增加。因此,对更高频宽服务的追求呈现持续趋势,推动了海底光纤电缆市场的成长。

- 例如,2024 年 1 月,印度总理莫迪在拉克沙群岛的卡瓦启动了科钦-拉克沙群岛海底光纤连接 (KLI-SOFC)计划,该项目是众多开发计划中之一,总价值超过 115 亿印度卢比(1388 万美元),涉及水资源、医疗保健、技术、能源和教育等广泛领域。

- KLI-SOFC计划将提高网路速度并释放新的可能性和机会。专用海底 OFC 将确保拉克沙群岛通讯基础设施的模式转移,从而实现更快、更可靠的互联网服务、教育计划、数位银行、远端医疗、电子化政府、数位货币采用、数位素养等。

- 这些发展,加上智慧型手机的日益普及以及全球对可靠、低延迟和高速通讯基础设施日益增长的需求,预计将在预测期内推动所研究市场的成长。

跨太平洋地区预计将占据主要市场占有率

- 海底电缆承载着全球 97% 以上的网路流量,几乎每个人的日常业务都使用网路。由于网路能够连接世界各地的人们,国际流量每天都在增加。亚太地区约占全球网路流量的一半,对海底通讯电缆的需求日益增长。由于跨太平洋地区国家缺乏海底通讯电缆系统,该地区对更快网路服务的需求不断增加,促使世界银行和亚洲开发银行为新电缆系统提供资金。

- 根据日本内务部预测,2023年日本的FTTH合约数量将达到3,800万以上。 FTTH于1999年引进日本市场,以相对较低的价格提供宽频、高速的网路存取。

- 截至 2023 年 10 月,根据美国和澳洲的联合协议,Alphabet(Google)营运海底电缆,为太平洋至少八个孤立国家提供网路连线。该计划旨在扩大谷歌在该地区的现有业务。计划包括密克罗尼西亚、吉里巴斯、马绍尔群岛、巴布亚纽几内亚、所罗门群岛、东帝汶、吐瓦鲁和万那杜。

- 2023年1月,Infinera宣布其ICE6 800G连贯光解决方案已部署用于跨太平洋Unity海底电缆系统的现代化和容量扩展。透过升级到 Infinera 的 ICE6 解决方案,Unity 电缆系统的容量将翻倍,每对光纤可提供高达 7.4Tbps 的传输速度。 Unity海底光缆系统由巴帝电信有限公司、Global Transit Limited(时代杂誌完全子公司)、Google、KDDI公司、Telstra和新加坡电信组成的财团联合建设,于2010年4月开通营运。

- 此外,根据Corporate IT报告,智利的Fondo de Infraestructura SA已选择BW Digital的子公司H2 Cable LP作为开发洪堡电缆系统的战略合作伙伴,该电缆系统是第一条连接拉丁美洲与亚太和大洋洲的海底电缆。 14,810 公里长的洪堡电缆系统提供端到端的连接。

海底光缆市场概况

海底光纤电缆市场主要由阿尔卡特海底网路有限公司、富士通有限公司、全球海事集团、HMN 科技公司和 IT 国际电信公司等主要企业组成。市场供应商正在采用伙伴关係、合併、创新和收购等策略来加强其产品供应并获得可持续的竞争优势。

2023年9月,Orange宣布扩大对海底电缆产业的投资,以保持在电缆安装和维护技术的前沿。建造一艘新的电缆船比改造现有船隻的投资更大。但对 Orange 来说,这意味着可以从对环境影响最小、设备齐全、能够满足世界日益增长的连接需求的船舶中受益。 Sophie Germain 号长 100 米,配备:船体采用模型油箱设计和测试,以减少燃料消耗,非常适合电缆维修。将使用最先进的 450kW ROV(遥控潜水器)来切割、检查和埋设电缆,这些电缆存储在船上的专用机库中。

Orange Marine 自行设计并建造了这款 ROV。透过连接岸电,可以减少抛锚时的二氧化碳排放。 「CLEANSHIP」分类(冷媒气体洩漏的受控检测、特殊的防污涂层、大容量废弃物储存等)意味着对环境的影响较小,可减少20%的二氧化碳排放和82%的氮氧化物排放。此外,Orange Marine根据其在海底电缆运作方面的丰富经验定义了这些特性。

2023年9月,NEC完成了采用新型转发器的光缆系统远距现场试验,该系统的传输性能达到世界最高水平,即每秒800Gigabit(Gbps)。这项破纪录的现场试验是使用 NEC 最新的转发器 XF3200 在印尼最大的通讯业者PT Telkom Indonesia (Persero) Tbk (Telkom) 旗下的印尼全球闸道 (IGG) 海底光缆 (*) 上进行的。在现场试验中,800 Gbps 光讯号在 2,100 公里的波长復用距离上传输,这是迄今为止记录的最长距离。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 宏观趋势对产业的影响

- 公司清单(业主、製造商、安装商)

- 海底光缆名称列表

第五章市场动态

- 市场驱动因素

- 智慧型手机普及率和网路频宽需求不断增加

- 新兴地区光纤连接增加

- 市场问题

- 维修成本上升,卫星通讯投资增加

第六章市场区隔

- 按地区

- 跨太平洋

- 跨大西洋

- 美国-拉丁美洲

- 亚洲境内

- 欧洲-亚洲

- 欧洲-撒哈拉以南非洲

第七章竞争格局

- 公司简介

- Alcatel Submarine Networks Ltd

- Fujitsu Ltd

- Global Marine Group

- HMN Technologies Co., Ltd.

- IT International Telecom Inc.

- LS Cable & System Ltd

- PT Communication Cable System Indonesia TBK

- LS Cable & System Ltd

- NEC Corporation

- Nexans SA

- NTT Communications Corporation

- Orange Marine

- Prysmian SPA

- Pt Communication Cable System Indonesia TBK

- SB Submarine Systems Co. Ltd(SBBS)

- Subcom LLC

- Sumitomo Electric Industries Ltd

- Google LLC(Alphabet Inc.)

第八章投资分析

第九章 市场机会与未来趋势

The Submarine Optical Fiber Cable Market size is estimated at USD 5.31 billion in 2025, and is expected to reach USD 8.95 billion by 2030, at a CAGR of 11.02% during the forecast period (2025-2030).

Growing investment in high-speed internet infrastructure is one of the major factors driving the growth of the submarine optical fiber cable market. The continuous increase in the generation and transfer of vast amounts of data worldwide is one of the primary drivers of the market. Hence, many internet backbone operators will invest in the submarine optical fiber cable market during the forecast period.

Key Highlights

- Global offshore wind power growth is expected to fuel market growth. The Global Wind Energy Council (GWEC) has stated that the United States is among the largest offshore wind markets. However, countries like the United Kingdom, Germany, China, Japan, and Taiwan are investing significantly in developing their offshore wind energy industry, creating a favorable scenario for market growth.

- With the rapid growth of data usage worldwide, there is an increasing demand for low-latency, high-capacity communications infrastructure. Submarine under Sea Optical fiber cables have emerged as a preferred solution to address the need for high-capacity, low-latency communication infrastructure.

- Fiber optics provide a more dependable, faster, and higher bandwidth mode of data transfer than traditional lines used by most utilities. Submarine Fiber optic networks send data by pulsing light via glass fiber strands approximately the size of human hair. When digital signals are sent via light, there is no external interference and reduced signal loss. This results in a more dependable data transmission network across vast distances. Furthermore, as these networks expand, user traffic continues to rise, necessitating the creation of standardized fiber testing procedures.

- The higher maintenance cost associated with the submarine optical fiber cable is analyzed to restrain the submarine optical fiber cable market growth, as the laying and maintenance of submarine fiber optical cables require a massive amount of human and material resources, including ships, divers, laying equipment, etc. This translates to a high cost of laying, repairing, and maintaining submarine optical fiber cables.

- The expansion of the world economy directly impacts the need for submerged optical connections. Expanding economies necessitate increasingly extensive undersea cable networks due to the need for high-speed internet connectivity. For instance, according to the World Bank estimate, the North American GDP, which was USD 32.32 trillion in 2023, is predicted to increase by 1.5% in 2023-24, suggesting that corporate activity and possible submarine optical fiber cable investments are projected to flourish.

Submarine Optical Fiber Cable Market Trends

Growing Smartphone Penetration and Increasing Demand for Internet Bandwidth to Drive the Market

- The smartphone industry has witnessed significant growth in recent years. The growing acceptance and prevalence of digital technologies, the advent of 5G, and the mobile-first approach of businesses are among the major factors driving the adoption of smartphones. According to Ericsson, the global number of smartphone subscribers is expected to reach 7.743 billion in 2028 from 6.421 billion in 2022.

- Furthermore, according to Ericsson, Northeast Asia was the leading region in terms of the number of smartphone subscribers (1.990 billion in 2022), followed by China (1.570 billion) and Southeast Asia and Oceania (910 million). All these factors positively contribute to the growth of the market studied, as a higher smartphone subscription positively impacts internet consumption and the amount of data being generated, which, in turn, drives the demand for data centers and other digital infrastructures wherein high bandwidth connectivity is a crucial requirement.

- According to the Ericsson Mobility report released in November 2023, a continued strong surge in global average data consumption per smartphone is expected to increase from 21GB/month in 2023 to 56GB/month by 2029. Such developments have positively influenced the increased demand for internet bandwidth and, in turn, driven the demand for submarine optical fiber cable.

- Increased bandwidth, ultra-low latency, and faster connectivity are expanding civilizations, revolutionizing industries, and radically improving day-to-day experiences. Bandwidth demands typically grow significantly every year. Hence, there is a constant trend toward higher bandwidth services and driving the growth of the submarine optical fiber cable market.

- For instance, in January 2024, Indian Prime Minister Narendra Modi, in Kavaratti, Lakshadweep, inaugurated the Kochi-Lakshadweep islands submarine optical fiber connection (KLI-SOFC) project among various developmental projects worth more than INR 1,150 crore (USD 13.88 million) covering a wide range of sectors, including water resources, healthcare, technology, energy, and education.

- The KLI-SOFC project will boost internet speed, unlocking new possibilities and opportunities. The dedicated submarine OFC will ensure a paradigm shift in communication infrastructure in the Lakshadweep islands, enabling more and faster reliable internet services, educational initiatives, digital banking, telemedicine, e-governance, digital currency usage, digital literacy, etc.

- Such developments, coupled with growing smartphone penetration and a growing need for reliable, low-latency, and high-speed communication infrastructure worldwide, are expected to drive the growth of the market studied during the forecast period.

Trans-Pacific Region is Expected to Hold Significant Market Share

- Submarine cables carry over 97% of all internet traffic worldwide, and nearly everyone uses the Internet for daily tasks. Due to the Internet's ability to connect people worldwide, international traffic is growing daily. Asia-Pacific accounts for about half of all internet traffic worldwide, which in turn is increasing demand for submarine communication cables. The lack of submarine communication cable systems in the countries in this region is to blame for the need for faster internet services in the Transpacific region, which has prompted the World Bank and the Asia Development Bank to fund new cable systems.

- According to the Ministry of Internal Affairs and Communications (Japan), in 2023, the number of fiber-to-the-home (FTTH) subscriptions in Japan reached more than 38 million. In 1999, FTTH was introduced to the Japanese market, providing high bandwidth and high-speed internet access at a comparatively low price.

- As of October 2023, according to a joint US-Australian agreement, Alphabet (Google) operated underwater cables that provided internet connectivity to at least eight isolated Pacific Ocean countries. The project aims to expand Google's existing business activities in the region. Micronesia, Kiribati, the Marshall Islands, Papua New Guinea, the Solomon Islands, Timor-Leste, Tuvalu, and Vanuatu are all included in the project.

- In January 2023, Infinera announced that Infinera's ICE6 800G coherent optical solution had been deployed to modernize and increase capacity on the trans-Pacific Unity submarine cable system. By upgrading to Infinera's ICE6 solution, the Unity cable system will double capacity and deliver up to 7.4 Tbps per fiber pair. The Unity cable system was ready for service in April 2010, jointly built by a consortium comprising Bharti Airtel Limited, Global Transit Limited (a wholly-owned subsidiary of TIME), Google, KDDI Corp., Telstra, and Singtel.

- Moreover, according to Corporate IT, the Fondo de Infraestructura SA of Chile has selected H2 Cable LP, a subsidiary of BW Digital, as a strategic partner for developing the Humboldt Cable System, the first submarine cable connecting Latin America with Asia-Pacific and Oceania. With a projected extension of 14,810 km, the Humboldt Cable System will provide end-to-end connectivity.

Submarine Optical Fiber Cable Market Overview

The submarine optical fiber cable market is fragmented, with the presence of significant players like Alcatel Submarine Networks Ltd, Fujitsu Ltd, Global Marine Group, HMN Technologies Co., Ltd, and IT International Telecom Inc. Vendors in the market are adopting strategies such as partnerships, mergers, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In September 2023, Orange announced expanding its submarine cable industry's investment to remain at the forefront of cable laying and maintenance technologies. Building a new cable ship represents a more significant investment than converting an existing vessel. Still, it means that Orange benefits from a ship with a minimal environmental footprint that is fully equipped to meet growing global connectivity needs. The Sophie Germain is 100 meters long and includes A hull designed and tested in a model tank to reduce fuel consumption optimized for cable repairs. A state-of-the-art 450 kW ROV (Remotely Operated Vehicle) is used to cut, inspect, and bury cables stored on board in a dedicated hangar.

Orange Marine designed and built the ROV in-house. Being connected to an onshore power supply will enable it to reduce its carbon emissions when docked. "CLEANSHIP" classification (controlled detection of refrigerant gas leaks, special anti-fouling coating, large waste storage capacity, etc.) A small environmental footprint, allowing a 20% reduction in CO2 emissions and an 82% reduction in nitrogen oxide emissions. Moreover, Orange Marine has defined all these characteristics based on its extensive experience in submarine cable operations.

In September 2023, NEC Corporation completed a long-distance field trial of an optical submarine cable system using a new transponder that, according to NEC, has the world's highest level of transmission performance of 800 gigabits per second (Gbps). This record-breaking field trial was conducted using the Indonesia Global Gateway (IGG) optical submarine cable(*) owned by PT Telkom Indonesia (Persero) Tbk (Telkom), Indonesia's largest telecommunications carrier, and using NEC's latest transponder, the XF3200. In the field trial, NEC conducted wavelength division optical transmission of 800 Gbps optical signals over 2,100 km, the longest recorded.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Industry (Include Impact of COVID-19)

- 4.5 List of Companies (Owners, Manufacturers, and Installers)

- 4.6 List of Submarine Optical Fiber Cable Name

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Smartphone Penetration and Increasing Demand for Internet Bandwidth

- 5.1.2 Increasing Fiber Connectivity in Emerging Regions

- 5.2 Market Challenges

- 5.2.1 Higher Maintenance Costs and Growing Investment in Satellite Communication

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 Trans-Pacific

- 6.1.2 Trans-Atlantic

- 6.1.3 United States-Latin America

- 6.1.4 Intra-Asia

- 6.1.5 Europe-Asia

- 6.1.6 Europe-Sub Saharan Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alcatel Submarine Networks Ltd

- 7.1.2 Fujitsu Ltd

- 7.1.3 Global Marine Group

- 7.1.4 HMN Technologies Co., Ltd.

- 7.1.5 IT International Telecom Inc.

- 7.1.6 LS Cable & System Ltd

- 7.1.7 PT Communication Cable System Indonesia TBK

- 7.1.8 LS Cable & System Ltd

- 7.1.9 NEC Corporation

- 7.1.10 Nexans SA

- 7.1.11 NTT Communications Corporation

- 7.1.12 Orange Marine

- 7.1.13 Prysmian SPA

- 7.1.14 Pt Communication Cable System Indonesia TBK

- 7.1.15 S.B. Submarine Systems Co. Ltd (SBBS)

- 7.1.16 Subcom LLC

- 7.1.17 Sumitomo Electric Industries Ltd

- 7.1.18 Google LLC (Alphabet Inc.)