|

市场调查报告书

商品编码

1687273

光耦合器:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Optocouplers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

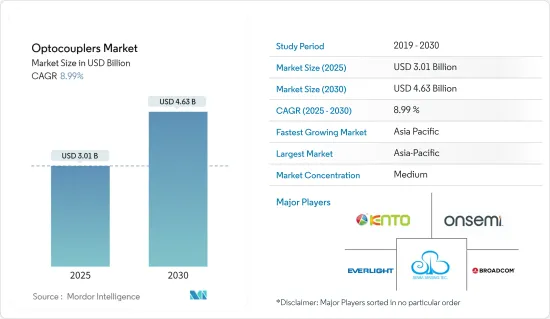

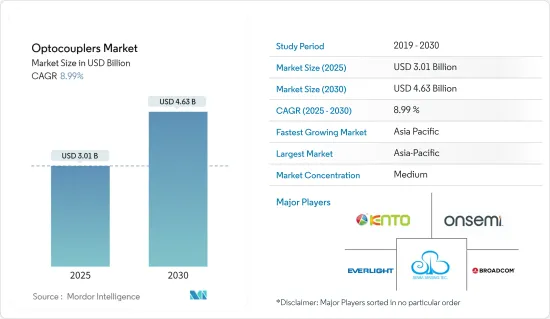

光耦合器市场规模预计在 2025 年为 30.1 亿美元,预计到 2030 年将达到 46.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.99%。

工业自动化的扩展和许多最终用户行业对讯号隔离解决方案的日益采用是预测期内市场研究的主要驱动力。光学无线系统的快速发展、电动和混合动力汽车需求的不断增长以及数位光耦合器的出现可能会为光耦合器製造商带来进一步的机会。

关键亮点

- 由于汽车、通讯和工业领域的需求不断增长,光耦合器市场正在迅速扩张。由于光耦合器在通讯产业的应用日益广泛,光耦合器市场也不断扩大。

- 光耦合器通常会传输数位讯号,但在某些情况下也可以传输类比讯号。家用电子电器产品、智慧家用电子电器、电脑辅助设备等正在推动对光耦合器的需求。

- 由于无线设备、电动车需求不断增长以及自动化等工业趋势,光耦合器市场正在成长。公司正在投资光耦合器以提高其产品的性能。

- 预计有几个关键因素将推动市场成长,包括工业自动化的扩张和讯号隔离解决方案的日益普及。随着光学无线系统的快速发展、电动和混合动力汽车汽车需求的不断增长以及数位光耦合器的出现,光耦合器製造商将面临更多的机会。

- 光耦合器的可靠性受到挑战。虽然 LED 故障可能是主要问题,但也提到了其他问题,例如界面污染和由于吸收水分而导致的热机械应力。这些因素会导致光耦合器过早磨损。

光耦合器市场趋势

工业自动化的成长推动了市场

- 工业领域传统上一直是先进技术的领导采用者。随着各行各业正在经历新的技术变革,人工智慧、物联网、机器学习、自动化和机器人等先进技术的采用显着增加。 「工业4.0」概念正在推动该领域的数位转型,使产业能够实现即时决策,提高生产力、灵活性和敏捷性。

- 这种趋势的转变为研究市场的成长创造了良好的市场前景,因为需要安装大量电气和电子设备和电路来支援此类基础设施。光耦合器旨在保护敏感的控制电路免受电压波动、不必要的杂讯和电磁干扰的影响。光耦合器还可在工业应用中提供隔离,包括伺服自动化系统和工业机器人中的马达控制电路、电源和光伏 (PV) 逆变器以及资料通讯和数位逻辑介面电路。

- 此外,在工业自动化应用中,光耦合器负责跨隔离屏障传输资料,同时滤除不必要的杂讯。如果该元件无法滤除不需要的噪声,则可能会发生资料传输错误。影响 CMR 定义的因素包括共模电压 (VCM) 以及瞬态讯号的上升和下降时间 (dv/dt)。透过增加 VCM 或 dv/dt 直到光耦合器输出讯号处于相反的逻辑状态来确定故障点。

- 在工业自动化通讯,印度、中国等开发中国家对光耦合器的需求正在增加。此外,由于光耦合器是自动化过程不可或缺的一部分,製造业越来越多地采用自动化也推动了市场的发展。

- 安装数量最多的地区是亚洲和澳大利亚,预计2020年已安装26.6万台。预计2024年亚洲和澳洲将安装37万台工业机器人。

- 工业机器人由机械臂、人机介面(HMI)面板、控制板组成,因此需要对各个机器人零件和介面进行隔离,以确保整个机器人系统的安全运作。光耦合器是提供两个电路之间电气隔离的有效解决方案之一,可协助机器人系统促进各个功能单元之间的有效通讯。

亚太地区可望成为成长最快的市场

- 光耦合器最常用于提供安全隔离,以符合国家和国际监管要求。半导体产业的大量投资以及工业领域对高效光电元件不断增长的需求正在推动亚太地区光耦合器的成长。

- 东亚是创新节能产品和汽车领域的主要贡献者。然而,光耦合器还具有一个经常被忽视的优点:隔离电气杂讯。中国凭藉其在半导体市场的强大支柱,成为该地区的主要影响者之一。该地区也是全球汽车产业和智慧型能源产品市场的主要贡献者之一。

- 印度政府正在采取适当倡议,透过加大对製造业的关注来促进国家经济发展。印度电子产业在出口和生产方面都取得了显着的成长。工业领域对高效光电元件的需求不断增加,加上半导体产业的大量投资,预计将推动该地区光耦合器的销售。此外,政府鼓励本地半导体市场成长的努力预计将吸引新参与企业。

- 在印度,为打造电子製造群,政府宣布了19个EMC(电子製造群),其中3个分配给安得拉邦政府。

- 根据中国国家统计局的数据,到2023年,工业业增加值将占中国国内生产总值的31.7%左右。工业 4.0,也称为第四次工业革命,是製造业的自动化和工业实践的升级,推动了工业领域对光耦合器的需求。

- 光耦合器可用作开关设备或与其他电子设备配合使用,以隔离低电压和高压电路。在电子设备中,嵌入式系统通常依赖光耦合器接收来自外部感测器或开关的输入讯号。印度政府最近宣布了一项为期四年、总额为 7,325 亿卢比(8.882 亿美元)的生产挂钩激励 (PLI) 计划,面向国内笔记型电脑、平板电脑、个人电脑和伺服器製造商。未来四年内,PLI 计画预计将透过生产赚取 3.26 兆印度卢比(395 亿美元),透过出口赚取 2.45 兆印度卢比(297 亿美元)。

光耦合器产业概况

光耦合器市场是一个半固定市场,主要参与者包括深圳健拓电子、亿光电子、森霸感测科技、安森美半导体公司和博通。该市场的参与企业正在采取伙伴关係、创新和收购等策略来加强其产品供应并获得可持续的竞争优势。

2022 年 11 月 Vishay Intertechnology Inc. (VSH) 正在采取重大倡议,使其分离产品线多样化,以巩固其在快速成长的光耦合器市场中的地位。该公司推出了线性光耦合器VOA300。汽车级VOA300元件具有业界领先的5300Vrms隔离电压。

2022 年 8 月,东芝公司电子元件及储存设备扩大了其智慧闸极驱动器和光电耦合器的产品线。 2.5A输出智慧闸极驱动器光电耦合器「TLP5222」具有内建保护操作自动恢復功能。该系列还包括“TLP5212”、“TLP5214”和“TLP5214A”,它们不具备自动恢復功能,但可以透过向 LED 输入讯号恢復正常运作。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响

- 光耦合器全球出货量

第五章市场动态

- 市场驱动因素

- 混合动力电动车的需求不断增长

- 提高工业自动化

- 市场限制

- 内在磨损

- 法规环境

第六章市场区隔

- 依产品类型

- 基于光电晶体管的光耦合器

- 基于光达林顿电晶体的光耦合器

- 基于光三端双向可控硅的光耦合器

- 光控硅光电耦合器

- 其他的

- 按最终用户产业

- 车

- 家用电子电器

- 通讯设备

- 工业的

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Shenzhen Kento Electronic Co. Ltd

- Everlight Electronics Co. Ltd

- Senba Sensing Technology Co. Ltd

- ON Semiconductor Corporation

- Broadcom Inc.

- Vishay Intertechnology Inc.

- Renesas Electronics Corporation

- Toshiba Electronic Devices & Storage Corporation(Toshiba Corp.)

- Isocom Components Ltd

- Panasonic Corporation

- Standex Electronics Inc.

- Skyworks Solutions Inc.

- Sharp Devices Europe

- LITE-ON Technology Inc.(Lite-On Technology Corporation)

第八章投资分析

第九章:市场的未来

The Optocouplers Market size is estimated at USD 3.01 billion in 2025, and is expected to reach USD 4.63 billion by 2030, at a CAGR of 8.99% during the forecast period (2025-2030).

The growing industrial automation and increasing adoption of signal isolation solutions across many end-user industries are major factors driving the market studied over the forecast period. Rapid advancements in optical wireless systems, the increasing demand for electric and hybrid vehicles, and the emergence of the digital optocoupler are likely to create more opportunities for optocoupler manufacturers.

Key Highlights

- The optocoupler market is expanding at a rapid rate due to large part to rising demand from the automotive, telecommunication, and industrial sectors. The optocoupler market is expanding due to the growing applications of optocouplers in the communication industry.

- The optocoupler typically transmits digital signals, though it can also transmit analog signals in a few specific circumstances. Consumer electronics, smart home appliances, and computer auxiliary devices are to blame for the rise in demand for optocouplers.

- The optocouplers market is growing due to trends in industries like wireless equipment, rising demand for electric vehicles, and automation. To enhance the performance of the products based on optocouplers, businesses have been investing in them.

- The market is expected to grow due to several key factors, including expanding industrial automation and the rising popularity of signal isolation solutions. There will probably be more opportunities for optocoupler manufacturers due to the quick development of optical wireless systems, the increasing demand for electric and hybrid vehicles, and the emergence of the digital optocoupler.

- Optocouplers struggle with reliability. The failure of the LED may be the main issue, but it mentions other issues like interface contamination and thermo-mechanical stress brought on by moisture absorption. These factors lead to early intrinsic wear-out of optocouplers..

Optocouplers Market Trends

Increasing Industrial Automation to Drive the Market

- The industrial sector has traditionally been among the leading adopters of advanced technologies. As the industry is going through another technological shift, the adoption of advanced technologies such as AI, IoT, ML, automation, and robotics has grown significantly. The "Industry 4.0" concept is driving the digital transformation of the field, enabling industries to deliver real-time decision-making, enhanced productivity, flexibility and agility.

- As many electrical and electronic devices and circuits need to be installed to support this infrastructure, this shift in trend is creating a favorable market outlook for the growth of the studied market. Optocouplers are designed to protect sensitive control circuitry from voltage fluctuations and unwanted noise or electromagnetic interference. Additionally, optocouplers also enable isolation in industrial applications ranging from the motor control circuit of servo automation systems and industrial robots, power supply, and photovoltaic (PV) inverters to data communication and digital logic interface circuits, the growing adoption of automation solutions is expected to drive their demand during the forecast period.

- Furthermore, in industrial automation applications, the optocoupler is responsible for transmitting data across the isolation barrier while filtering out unwanted noise. Failure of the component to reject unwanted noise can lead to data-transmission errors. The factors involved in defining CMR are the common-mode voltage (VCM ) and the rise and fall times of the transient signal (dv/dt). The failure point is determined by increasing either VCM or the dv/dt until the optocoupler's output signal crosses into the opposite logic state.

- Industrial automation communication is witnessing increased demand for optocouplers in developing nations such as India, China, and others. Additionally, the increased adoption of automation in the manufacturing sector is also driving the market as optocouplers forms an integral part of the automation process.

- The region with the most installations was Asia and Australia; an estimated 266,000 units had already been installed by 2020. In Asia and Australia, it is expected that there will be 370,000 Industrial Robots installed by 2024.

- As an industrial robot consists of a robot arm, a Human Machine Interface (HMI) panel, and a control cabinet, different robot components and interfaces must be isolated to ensure the safe operation of the complete robot systems. As optocouplers are among the effective solutions to impart isolation among electrical isolation between two circuits and help the robotic systems facilitate effective communication among various functional units, the increasing adoption of robotics and other automation solutions is expected to drive their demand during the forecast period.

Asia Pacific is Expected to be the Fastest Growing Market

- Optocouplers have most commonly been utilized to provide safety isolation for compliance with domestic and international regulatory requirements. Significant investments in the semiconductor industry, coupled with the increasing demand for efficient optoelectronic components in the industrial sector, bolstered the growth of optocouplers in the Asia-Pacific region.

- East Asia significantly contributes to innovative energy-efficient products and the automotive sector. However, optocouplers also offer another often-overlooked benefit: isolation from electrical noise. China is one of the major influencing factors in the region, owing to its strong foothold in the semiconductor market. The region is also one of the significant contributors to the global automotive sector and the smart energy-efficient products market.

- The Government of India has the right initiatives to boost the country's economy through deluging interest in manufacturing. In terms of export and production, the electronic industry in India is making remarkable growth. The increasing demand for efficient optoelectronic components in the industrial sector, coupled with substantial investments in the semiconductor industry, is estimated to bolster the sales of optocouplers in the region. Moreover, government initiatives encouraging the growth of the local semiconductor market are projected to attract new players.

- In India, To create electronic manufacturing clusters, the government has announced 19 EMCs (electronic manufacturing clusters), three of which have been allotted to the Andhra Pradesh government.

- According to the National Bureau of Statistics of China, The industrial sector accounted for around 31.7 % of China's gross domestic product by 2023. Industry 4.0, also known as the Fourth Industrial revolution, is the manufacturing automation and upgrading industry practices, thus driving the demand for optocouplers in the industrial sector.

- Optocouplers can either be used as a switching device or with other electronic devices to isolate low and high-voltage circuits. In electronics, embedded systems often rely on optocouplers to receive input signals from external sensors or switches. The Indian government has recently announced an INR 7,325 crore (USD 888.2 million) PLI Scheme (Production Linked Incentive) for domestic manufacturers of laptops, tablets, personal computers, and servers for four years. This PLI scheme may get INR 3.26 lakh crore (USD 39.5 billion) in production and INR 2.45 lakh crore (USD 29.7 million) in exports over the next four years.

Optocouplers Industry Overview

The Optocouplers Market is Semi-Consolidated with the presence of major players like Shenzhen Kento Electronic Co. Ltd, Everlight Electronics Co. Ltd, Senba Sensing Technology Co. Ltd, ON Semiconductor Corporation, and Broadcom Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022 - Vishay IntertechnologyInc. (VSH) is making significant efforts to diversify its discrete product line to strengthen its position in the burgeoning optocouplers market. The company introduced the linear optocoupler VOA300. The automotive-grade VOA300 device has a 5300 Vrmsisolation voltage, among the highest in the industry.

In August 2022 - Toshiba Electronic Devices & Storage Corporation expanded its smart gate driver photocouplers lineup. "TLP5222," a 2.5A output smart gate driver photocoupler, has a built-in automatic recovery function from protective operations. The lineup also includes TLP5212, TLP5214, and TLP5214A, which do not have a built-in automatic recovery function but reset to their normal operation by a signal input to their LED.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Global Optocoupler Shipments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Hybrid Electric Vehicles

- 5.1.2 Increasing Industrial Automation

- 5.2 Market Restraints

- 5.2.1 Intrinsic Wear-out

- 5.3 Regulatory Environment

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Phototransistor-based Optocoupler

- 6.1.2 Optocoupler based on the Photo Darlington Transistor

- 6.1.3 Optocoupler based on Photo TRIAC

- 6.1.4 Optocoupler with Photo SCR

- 6.1.5 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communication

- 6.2.4 Industrial

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Shenzhen Kento Electronic Co. Ltd

- 7.1.2 Everlight Electronics Co. Ltd

- 7.1.3 Senba Sensing Technology Co. Ltd

- 7.1.4 ON Semiconductor Corporation

- 7.1.5 Broadcom Inc.

- 7.1.6 Vishay Intertechnology Inc.

- 7.1.7 Renesas Electronics Corporation

- 7.1.8 Toshiba Electronic Devices & Storage Corporation (Toshiba Corp.)

- 7.1.9 Isocom Components Ltd

- 7.1.10 Panasonic Corporation

- 7.1.11 Standex Electronics Inc.

- 7.1.12 Skyworks Solutions Inc.

- 7.1.13 Sharp Devices Europe

- 7.1.14 LITE-ON Technology Inc. (Lite-On Technology Corporation)