|

市场调查报告书

商品编码

1687299

聚四氟乙烯 (PTFE):市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)Polytetrafluoroethylene (PTFE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

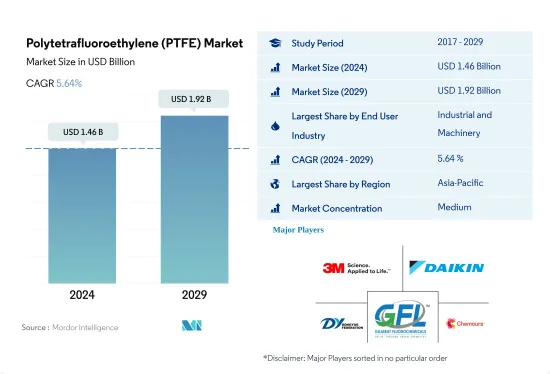

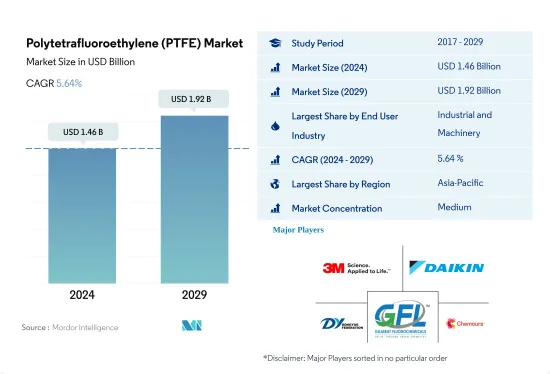

聚四氟乙烯 (PTFE) 市场规模预计在 2024 年将达到 14.6 亿美元,预计到 2029 年将达到 19.2 亿美元,在预测期内(2024-2029 年)的复合年增长率为 5.64%。

工业和机械行业可能主导需求

- 聚四氟乙烯 (PTFE) 是一种光滑的氟聚合物,常用作厨房烹调器具的不沾涂层。它的低摩擦係数和耐化学性、耐热性和耐辐射性使其成为多个终端用户行业的众多应用的理想材料。至2022年,它将占所有氟塑胶树脂总消费量的50.74%。

- 工业和机械行业是 PTFE 的最大终端用户。 PTFE 的耐化学性和不黏特性使其成为製造轴承、密封件、垫圈和各种耐腐蚀流体处理组件和设备的热门选择。 PTFE 可协助製造商满足产品纯度、清洗、耐用性和低维护成本的严格行业标准。预测期内,即 2023 年至 2029 年,多个终端用户产业对 PTFE 的需求预计将达到 3.57% 的复合年增长率(按数量计算)。

- PTFE 的第二大终端使用者产业是电气和电子。 PTFE树脂具有刚性、柔性、疏水性、难燃性和介电性能,适合于电子产品的生产。 PTFE 广泛用于製造印刷电路板、电晶体、半导体元件、微处理器、感测器主体和外壳以及电湿式显示器。 PTFE 在 IT 和通讯应用中具有很高的耐火性和电气性能,这推动了对电缆绝缘和涂层系统生产的需求。鑑于半导体和消费电子产品需求的快速增长,预计该行业将成为 PTFE 增长最快的终端用户,预计在预测期内复合年增长率为 6.22%(按数量计算)。

非洲成长最快的 PTFE 市场

- PTFE 是一种合成氟树脂,通常以品牌名称 Teflon 来命名。 PTFE的主要终端用户产业为工业与机械、电气与电子、汽车等,由于其耐化学性、耐热性、耐低温性、低摩擦係数等性能,占2022年总消费量的74.95%。

- 亚太地区是最大的市场,因为中国、日本、印度和韩国等国家拥有大规模製造业。因此,所有地区总合将占2022年总消费量的约52%。该地区最盈利的终端用户产业包括工业/机械、电气/电子和汽车,到2022年总合贡献总量的80.84%。印度是该地区成长最快的市场,预测期内收益和预计复合年增长率为8.14%。

- 北美是第二大市场,占2022年总消费量的28.58% 。美国、加拿大和墨西哥是北美工业化程度最高的国家。该地区最大的终端用户产业是汽车、工业和机械、电气和电子,占 2022 年总消费量的 67%。预计在预测期内,市场规模的复合年增长率为 4.93%。

- 以金额为准,非洲是成长最快的地区。预计在预测期内(2023-2029 年),它们的复合年增长率将达到 8.23%,这主要归功于经济管治和私营部门的改善。奈及利亚和南非将成为最大的市场,占2022年总消费量的69.68%。

全球聚四氟乙烯 (PTFE) 市场趋势

电子产业的技术进步可能推动成长

- 电子产品技术创新的快速步伐推动着对更新、更快的电气和电子产品的持续需求。 2022年全球电气电子产品销售额将为5.807兆美元,其中亚太地区占74%的市场占有率,其次是欧洲,占13%。预计预测期内全球电气和电子设备市场复合年增长率将达到 6.61%。

- 2018年,亚太地区经济成长强劲,受中国、韩国、日本、印度和东南亚国协快速工业化的推动。 2020年,受晶片短缺、供应链效率低等影响,全球电气电子产品生产放缓,营收与前一年同期比较增0.1%。由于疫情期间人们被迫待在室内,对远距工作和家庭娱乐的消费性电子产品的需求推动了这一增长。

- 预测期内,对数位化、机器人、虚拟实境、扩增实境、物联网 (IoT) 和 5G 连接等先进技术的需求预计会增加。 2027 年全球电气和电子设备产量预计将成长 5.9%。由于技术进步,预测期内对消费性电子产品的需求预计会增加。例如,全球消费性电子产业收益预计将在 2027 年达到约 9,046 亿美元,而 2023 年将达到 7,191 亿美元。因此,预计技术发展将在预测期内推动对电气和电子产品的需求。

聚四氟乙烯(PTFE)产业概况

聚四氟乙烯(PTFE)市场呈现中度整合态势,前五大公司合计占有51.92%的市占率。市场的主要企业是:3M、大金工业株式会社、东岳集团、古吉拉特邦氟化学有限公司(GFL)和科慕公司(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑和施工

- 电气和电子

- 包装

- 进出口趋势

- 聚四氟乙烯(PTFE)贸易

- 塑造趋势

- 法律规范

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中国

- EU

- 印度

- 日本

- 马来西亚

- 墨西哥

- 奈及利亚

- 俄罗斯

- 沙乌地阿拉伯

- 南非

- 韩国

- 阿拉伯聯合大公国

- 英国

- 美国

- 价值链与通路分析

第五章 市场区隔

- 最终用户产业

- 航太

- 车

- 建筑和施工

- 电气和电子

- 工业/机械

- 包装

- 其他最终用户产业

- 地区

- 非洲

- 按国家

- 奈及利亚

- 南非

- 非洲其他地区

- 亚太地区

- 按国家

- 澳洲

- 中国

- 印度

- 日本

- 马来西亚

- 韩国

- 其他亚太地区

- 欧洲

- 按国家

- 法国

- 德国

- 义大利

- 俄罗斯

- 英国

- 其他欧洲国家

- 中东

- 按国家

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 北美洲

- 按国家

- 加拿大

- 墨西哥

- 美国

- 南美洲

- 按国家

- 阿根廷

- 巴西

- 南美洲其他地区

- 非洲

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介.

- 3M

- AGC Inc.

- Daikin Industries, Ltd.

- Dongyue Group

- Gujarat Fluorochemicals Limited(GFL)

- HaloPolymer

- Shanghai Huayi 3F New Materials Co., Ltd.

- Sinochem

- The Chemours Company

- Zhejiang Juhua Co., Ltd.

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 60916

The Polytetrafluoroethylene (PTFE) Market size is estimated at 1.46 billion USD in 2024, and is expected to reach 1.92 billion USD by 2029, growing at a CAGR of 5.64% during the forecast period (2024-2029).

Industrial and machinery sector may dominate the demand

- Polytetrafluoroethylene (PTFE) is a fluoropolymer with slippery nature; it is widely known as a nonstick coating in kitchen cookware. Its low friction coefficient and resistance to chemicals, heat, and radiation make it a desirable material for numerous applications across multiple end-user industries. In 2022, it accounted for 50.74% of the total volume consumption of all fluoropolymer sub-resins combined.

- The industrial and machinery industry is the largest end user of PTFE. PTFE offers chemical resistance and non-stick properties, making it a preferred choice for the production of components such as bearings, seals, gaskets, and various corrosion-resistant fluid handling components and equipment. PTFE helps manufacturers to fulfill stringent industry standards for product purity, cleanability, durability, and low maintenance costs. The demand for PTFE in several end-user industries is expected to record a CAGR of 3.57% (in volume) during the forecast period of 2023-2029.

- The second-largest end-user industry of PTFE is electrical and electronics. PTFE resin offers rigidity, flexibility, hydrophobicity, low flammability, and dielectric properties for the production of electronic goods. PTFE is widely used to produce PCBs, transistors, semiconductor parts, microprocessors, sensor bodies or housings, and electro-wetting displays. Due to its strong fire safety and electrical performance in telecommunications and data transmission applications, it is witnessing growth in the demand for the production of cable insulation and jacketing systems. Considering the rapidly growing demand for semiconductors and consumer electronics, the industry is likely to be the fastest-expanding end-user of PTFE, with an expected CAGR of 6.22% (in volume) during the forecast period.

PTFE market expanding the fastest in Africa

- PTFE is a synthetic fluoropolymer, which is widely known by the brand name Teflon. Its major end-user industries include industrial & machinery, electrical & electronics, and automotive, which collectively accounted for 74.95% of the total volume consumption in 2022, owing to the properties like chemical resistance, good resistance to heat and low temperature, low coefficient of friction, and more.

- Asia-Pacific is the largest market owing to large-scale manufacturing outputs by nations like China, Japan, India, South Korea, and others. This led to around 52% of the overall consumption by all regions combined in 2022. The most profitable end-user industries in the region include industrial & machinery, electrical & electronics, and automotive, collectively contributing to 80.84% of the total value in 2022. India is the region's fastest-growing market, with revenue expected to register a CAGR of 8.14% during the forecast period.

- North America is the second-largest market and accounted for 28.58% of total consumption volume in 2022. The United States, Canada, and Mexico are the most industrialized nations in North America. The biggest end-user industries in the region are automotive, industrial & machinery, and electrical & electronics, which collectively constituted 67% of the total volume consumption in 2022. The market is expected to register a CAGR of 4.93% in terms of volume during the forecast.

- Africa is the fastest-growing region in terms of value for the market. It is expected to grow at a CAGR of 8.23%, respectively, in the forecast (2023-2029), which is mainly driven by improved economic governance and the private sector. Nigeria and South Africa are the largest markets here, constituting 69.68% of the overall volume consumption in 2022.

Global Polytetrafluoroethylene (PTFE) Market Trends

Technological advancements in electronics industry may foster the growth

- The rapid pace of technological innovation in electronic products is driving the consistent demand for new and fast electrical and electronic products. In 2022, the global revenue of electrical and electronics stood at USD 5,807 billion, with Asia-Pacific holding a 74% market share, followed by Europe with a 13% share. The global electrical and electronics market is expected to record a CAGR of 6.61% during the forecast period.

- In 2018, the Asia-Pacific region witnessed strong economic growth owing to rapid industrialization in China, South Korea, Japan, India, and ASEAN countries. In 2020, due to the pandemic, there was a slowdown in global electrical and electronics production due to the shortage of chips and inefficiencies in the supply chain, which led to a stagnant growth rate of 0.1% in revenue compared to the previous year. This growth was driven by the demand for consumer electronics for remote working and home entertainment as people were forced to remain indoors during the pandemic.

- The demand for advanced technologies, such as digitalization, robotics, virtual reality, augmented reality, IoT (Internet of Things), and 5G connectivity, is expected to grow during the forecast period. Global electrical and electronics production is expected to register a growth rate of 5.9% in 2027. As a result of technological advancements, the demand for consumer electronics is expected to rise during the forecast period. For instance, the global consumer electronics industry is projected to witness a revenue reach of around USD 904.6 billion in 2027, compared to USD 719.1 billion in 2023. As a result, technological development is projected to lead the demand for electrical and electronic products during the forecast period.

Polytetrafluoroethylene (PTFE) Industry Overview

The Polytetrafluoroethylene (PTFE) Market is moderately consolidated, with the top five companies occupying 51.92%. The major players in this market are 3M, Daikin Industries, Ltd., Dongyue Group, Gujarat Fluorochemicals Limited (GFL) and The Chemours Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Polytetrafluoroethylene (PTFE) Trade

- 4.3 Form Trends

- 4.4 Regulatory Framework

- 4.4.1 Argentina

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 EU

- 4.4.7 India

- 4.4.8 Japan

- 4.4.9 Malaysia

- 4.4.10 Mexico

- 4.4.11 Nigeria

- 4.4.12 Russia

- 4.4.13 Saudi Arabia

- 4.4.14 South Africa

- 4.4.15 South Korea

- 4.4.16 United Arab Emirates

- 4.4.17 United Kingdom

- 4.4.18 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 By Country

- 5.2.1.1.1 Nigeria

- 5.2.1.1.2 South Africa

- 5.2.1.1.3 Rest of Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 By Country

- 5.2.2.1.1 Australia

- 5.2.2.1.2 China

- 5.2.2.1.3 India

- 5.2.2.1.4 Japan

- 5.2.2.1.5 Malaysia

- 5.2.2.1.6 South Korea

- 5.2.2.1.7 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 By Country

- 5.2.3.1.1 France

- 5.2.3.1.2 Germany

- 5.2.3.1.3 Italy

- 5.2.3.1.4 Russia

- 5.2.3.1.5 United Kingdom

- 5.2.3.1.6 Rest of Europe

- 5.2.4 Middle East

- 5.2.4.1 By Country

- 5.2.4.1.1 Saudi Arabia

- 5.2.4.1.2 United Arab Emirates

- 5.2.4.1.3 Rest of Middle East

- 5.2.5 North America

- 5.2.5.1 By Country

- 5.2.5.1.1 Canada

- 5.2.5.1.2 Mexico

- 5.2.5.1.3 United States

- 5.2.6 South America

- 5.2.6.1 By Country

- 5.2.6.1.1 Argentina

- 5.2.6.1.2 Brazil

- 5.2.6.1.3 Rest of South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Daikin Industries, Ltd.

- 6.4.4 Dongyue Group

- 6.4.5 Gujarat Fluorochemicals Limited (GFL)

- 6.4.6 HaloPolymer

- 6.4.7 Shanghai Huayi 3F New Materials Co., Ltd.

- 6.4.8 Sinochem

- 6.4.9 The Chemours Company

- 6.4.10 Zhejiang Juhua Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219