|

市场调查报告书

商品编码

1687305

工业润滑油:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Industrial Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

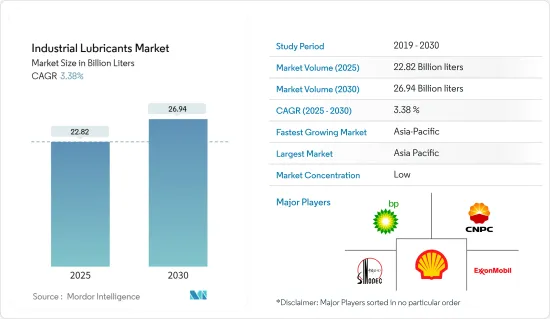

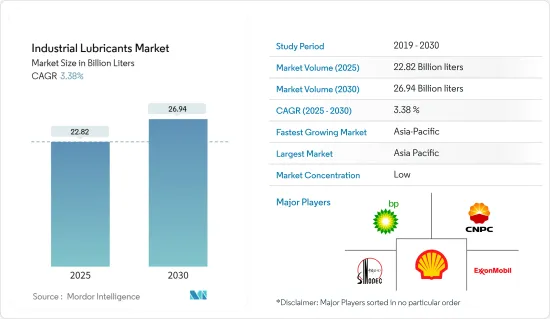

预计2025年工业润滑油市场规模为228.2亿公升,到2030年预计将达到269.4亿公升,预测期内(2025-2030年)的复合年增长率为3.38%。

2020 年,市场受到了新冠疫情的负面影响。然而,这场疫情对大规模工业活动的自动化流程产生了正面影响。疫情导致的人手不足和不同个人防护设备的使用加速了各行各业对自动化的采用。此外,生产率的提高也带来了机器运作和设备速度的提升。这使得设备的适当润滑变得越来越重要和需求。

关键亮点

- 短期内,风力发电领域的需求成长预计将推动市场成长。

- 然而,润滑剂对环境的不利影响可能会阻碍所研究市场的成长。

- 生物润滑剂的兴起和低黏度润滑剂的发展可能为市场带来成长机会。

- 亚太地区占据全球市场主导地位,其中消费量最高的国家是中国、印度和印尼。

工业润滑油市场趋势

发电终端用户产业主导市场

- 发电是全球经济中最重要的终端用户产业之一,如果没有发电,几乎所有的製造业务都可能陷入停顿。製造技术的进步正在推动各种新工厂的建设,从而增加终端用户产业的电力需求。

- 涡轮机在能源领域的发电中发挥着至关重要的作用。 i.无论电力来源为何:风能、太阳能、水力发电或热能,涡轮机都被广泛用于发电。除涡轮机外,发电领域常用的其他主要部件包括泵浦、轴承、风扇、压缩机、齿轮和液压系统。风力发电机受到许多因素的影响,包括湿度、高压、高负荷、振动和温度。齿轮油和涡轮油广泛用于该领域的润滑目的。

- 润滑油成本通常占发电公司总营运支出的不到 5%。根据行业调查,约有58%的公司认为其润滑油选择可以节省5%或更多的成本。然而,不到十分之一(8%)的公司意识到润滑可能会产生高达六倍的影响。

- 在水力发电中,润滑剂用于空气压缩机、齿轮、涡轮机、循环油系统、液压系统、轴承等。消耗的润滑剂包括润滑脂、通用润滑剂、变速箱油、涡轮机油和油压油。在核能发电厂中,润滑油(涡轮机油)主要用于蒸气涡轮,以提高其效率。

- 在燃煤发电厂中,润滑剂用于空气压缩机、液压装置、涡轮机、移动设备、轴承和齿轮。煤炭挖土机系统也使用不同类型的润滑剂,例如齿轮油、润滑脂、变速箱油和液压油。燃煤发电厂使用专为高温和重载设计的润滑剂。

- 此外,根据国际能源总署 (IEA) 的数据,到 2023 年,水力发电和风力发电等可再生能源发电将分别比 2022 年增加约 17.5 吉瓦 (GW) 和 107.8 吉瓦 (GW)。由于对可再生能源发电的投资不断增加,预计这一成长趋势将在预测期内持续下去。预计这将在未来大幅提升发电终端用户产业对工业润滑油的需求,并有助于他们维持市场主导地位。

- 因此,预计所有这些因素和趋势将推动发电终端用户产业对润滑油的需求。

亚太地区占市场主导地位

- 事实证明,亚太地区是工业润滑油消费的主要市场。这是由于中国、印度和印尼等国家的消费量不断增加。

- 目前,中国是润滑油、脂的最大消费国。各行各业的大规模製造活动以及工业和汽车行业的快速成长,帮助该国跻身世界领先的润滑油消费国和生产国。

- 此外,根据 Safeguard Global 的数据,中国、日本、韩国、印度和印尼则名列 2023 年製造业产出最高的十大国家。

- 中国也将重点建设新型基础设施,在不久的将来,建筑业将占固定资产的绝大部分。由于支出增加和政府对基础设施成长的关注,建设活动的成长预计将持续下去。

- 根据国际汽车工业组织(OICA)的数据,中国、日本、印度和韩国则名列世界五大汽车製造国。因此,与世界其他地区相比,亚太地区作为工业润滑油需求量较大的地区,其汽车工业的规模也扮演关键角色。

- 此外,根据Invest India的数据,到2026年,印度汽车零件产业预计将成长到2,000亿美元,2022-23年售后市场销售额将达到106亿美元(上年度100亿美元)。印度和亚太新兴经济体的这些成长趋势预计将显着推动该地区工业润滑油市场的成长。

- 印度是该地区第二大润滑油消费国,也是继美国和中国之后的世界第三大润滑油消费国。该国约占全球润滑油市场需求的7%。儘管工业润滑油市场较为分散,但印度润滑脂市场却高度集中,前五大企业占据了超过 75% 的市场占有率。

- 政府的优惠措施,例如将 FAME-II 计划延长至 2024 年、加强对两轮车的奖励、针对汽车和汽车零部件行业推出生产挂钩奖励(PLI) 计划(价值 2600 亿印度卢比)、针对先进化学电池的 PLI(价值 1800 亿印度卢比),都可能通过先进技术为该行业提供重大的采用力。

- 印尼凭藉其庞大的人口、较高的都市化以及快速崛起的中产阶级,近年来已成为一个极具潜力的润滑油市场。近年来,采矿、纺织和基础设施等产业一直在推动工业润滑油的消费。

- FocusEconomics 预计,2022 年印尼製造业成长率将达到 4.9%,高于去年的 3.4%。此外,根据印尼统计局 (BPS) 的数据,由于需求和产量增加,食品和饮料行业预计到 2022 年以年度为基础增长 4.9%,达到 5,210 万美元。

- 预计印尼将进行整体投资,吸引外国直接投资以增加出口,进而改善经济表现。此外,台湾在食品自动化机械科技及餐饮服务领域已相当发达,国家也开始与台湾合作发展食品饮料产业。

- 因此,所有上述因素都有可能对未来的研究市场产生重大影响。

工业润滑油产业概况

工业润滑油市场本质上是细分的。市场的主要企业(不分先后顺序)包括荷兰皇家壳牌公司、埃克森美孚公司、中国石油化学集团公司、中国石油天然气集团公司和英国石油公司(嘉实多)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 风力发电领域需求增加

- 其他驱动因素

- 限制因素

- 润滑剂对环境的负面影响

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 产品类型

- 机油

- 传动液和液压油

- 金属加工油

- 通用工业用油

- 齿轮油

- 润滑脂

- 加工油

- 其他的

- 最终用户产业

- 发电

- 重型机械

- 饮食

- 冶金与金属加工

- 化学製造

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 菲律宾

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 土耳其

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

- 南美洲其他地区

- 中东

- 沙乌地阿拉伯

- 伊朗

- 伊拉克

- 阿拉伯聯合大公国

- 科威特

- 其他中东地区

- 非洲

- 埃及

- 南非

- 奈及利亚

- 阿尔及利亚

- 摩洛哥

- 其他非洲国家

- 亚太地区

第六章 竞争格局

- 合併、收购、合资、合作和协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AMSOIL INC.

- Bharat Petroleum Corporation Limited

- Blaser Swisslube AG

- BP plc

- Carl Bechem GmbH

- Chevron Corporation

- China National Petroleum Corporation(PetroChina)

- China Petroleum & Chemical Corporation(SINOPEC Group)

- Eni SpA

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil International

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd.

- ROCOL

- ENEOS Corporation

- Kluber Lubrication

- LUKOIL

- PT Pertamina(Persero)

- Petrobras

- Petronas Lubricants International

- Phillips 66 Company

- Repsol

- Shell PLC

- Tide Water Oil Co. (India) Ltd.

- TotalEnergies

- Valvoline

第七章 市场机会与未来趋势

- 人们对生物润滑剂的兴趣日益浓厚

- 低黏度润滑剂的开发

The Industrial Lubricants Market size is estimated at 22.82 billion liters in 2025, and is expected to reach 26.94 billion liters by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. However, the pandemic positively affected the automation process in industrial activities on a large scale. The limited availability of manpower due to the pandemic and the use of various personal protective equipment has accelerated the adoption of automation throughout industries. Moreover, the increase in productivity also increased the run time of the machinery and the speed of the equipment. It increased the importance of adequate lubrication for the equipment, thus enhancing the demand.

Key Highlights

- Over the short term, increasing demand from the wind energy sector is expected to drive the market's growth.

- However, the detrimental effects of lubricants on the environment are likely to hinder the growth of the market studied.

- Nevertheless, the growing prominence of bio-lubricants and the development of low-viscosity lubricants are likely to act as opportunities for the growth of the market studied.

- Asia-Pacific dominates the market across the world, with the most substantial consumption from countries like China, India, and Indonesia.

Industrial Lubricants Market Trends

Power Generation End-user Industry Dominated the Market

- Power generation is one of the most important end-user industries of the global economy, without which almost all manufacturing operations may cease. Advancements in manufacturing technologies are resulting in the building of various new plants, increasing the demand for electricity across end-user industries.

- Turbines play a key role in the energy sector for generating electricity. Irrespective of the source of electricity, i.e., wind, solar, hydro, thermal, and others, turbines are widely used for power generation. In general, other than turbines, the major components used in the power generation sector include pumps, bearings, fans, compressors, gears, and hydraulic systems. Wind turbines are subjected to many factors, such as humidity, high pressure, high loads, vibrations, and temperature. Gear and turbine oils are widely used in this sector for lubrication purposes.

- In general, the cost of lubricants accounts for less than 5% of a power generation company's total operational expenditure. According to an industry survey, about 58% of the companies recognized that lubricant selection could help reduce costs by 5% or more. Still, fewer than 1 in 10 (8%) companies realized that the impact of lubrication could be up to six times more.

- In hydroelectric power generation, lubricants are used for air compressors, gears, turbines, circulating oil systems, hydraulics, and bearings, among other purposes. The lubricants consumed include greases, general lubricating oils, transmission oils, turbine oils, and hydraulic oils, among others. In nuclear power plants, lubricants (turbine oils) are used mainly for steam turbines for better efficiency.

- In coal-fired power plants, lubricants are used for air compressors, hydraulics, turbines, mobile equipment, bearings, and gears. Coal excavator systems also consume different types of lubricants, including gear oils, greases, transmission oils, and hydraulic oils. Coal-fired power plants consume high-temperature and heavy-duty lubricants.

- Moreover, according to the International Energy Agency, in 2023, the volume of renewable electricity generated globally through hydropower and wind increased by about 17.5 gigawatts (GW) and 107.8 gigawatts (GW), respectively, over 2022. Such growth trends are expected to continue during the forecast period because of the growing investment in renewable energy generation. It will substantially boost the demand for industrial lubricants from the power generation end-user industry in the future and help it maintain its market dominance.

- Hence, all such factors and trends are expected to drive the demand for lubricants in the power generation end-user industry.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific was found to be the major market for the consumption of industrial lubricants. It is owing to increasing consumption from countries such as China, India, and Indonesia.

- China is the largest consumer of lubricants and greases in the current scenario. The vast manufacturing activities pertaining to different sectors and the rapid growth in the industrial and automotive sectors pushed the country to stand among the major lubricant consumers and producers in the global landscape.

- Moreover, according to Safeguard Global, China, Japan, South Korea, India, and Indonesia were among the top 10 countries with the highest manufacturing output in 2023.

- In addition, China is focusing on new infrastructure, with construction being the majority type of fixed assets, in the near future. Such growth in construction activity is expected to be witnessed in the future, owing to increased expenditure and the government's focus on infrastructure growth.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), China, Japan, India, and South Korea were among the top 5 largest manufacturers of vehicles in the world. Therefore, the vast size of Asia-Pacific's automotive industry also plays a significant role in the region accounting for such high demand for industrial lubricants compared to other regions worldwide.

- Moreover, according to Invest India, the auto components industry in India is expected to grow to USD 200 billion by 2026, and the aftermarket turnover in FY 2022-23 of the industry stood at USD 10.6 billion as compared to USD 10 billion in the previous year. Such growth trends in India and developing economies of the Asia-Pacific are estimated to significantly boost the industrial lubricants market growth in the region.

- India is the second-largest lubricant consumer in the region and the third-largest in the world, after the United States and China. The country accounts for about 7% of the demand in the global lubricants market. While the industrial lubricants market is fragmented in nature, the Indian grease market is highly consolidated in nature, with the top five players accounting for more than 75% of the market share.

- Favorable government policies, such as the extension of the FAME-II scheme until 2024, the enhancement of incentives for two-wheelers, the launch of the production-linked incentive (PLI) scheme for the auto and auto component sector (worth INR 26,000 crore (~USD 3.20 billion)), and the PLI for advanced chemistry cell worth INR 18,000 crore (~USD 2.22 trillion), are likely to provide significant support to the sector due to the adoption of advanced technologies.

- Indonesia is among the potential lubricants markets in recent years on account of its huge population, high urbanization, and rapidly rising middle class. Sectors such as mining, textile, and infrastructure is driving the consumption of industrial lubricants in the recent past.

- According to FocusEconomics, in 2022, manufacturing growth in Indonesia was 4.9%, up from the 3.4% witnessed in the prior year. Moreover, according to Statistics Indonesia (BPS), the food and beverage industry increased by 4.9% on an annual basis in 2022 to USD 52.1 million as the demand and production increased.

- Indonesia is expected to invest and attract foreign direct investment across industries to boost its exports and, thus, its economic state. Additionally, the country started working with Taiwan to develop its food and beverage industry because Taiwan is quite developed in the field of automated food machine technology and catering services.

- Therefore, all the factors above are likely to significantly impact the market studied in the future.

Industrial Lubricants Industry Overview

The industrial lubricants market is fragmented in nature. Some of the key players in the market (not in any particular order) include Royal Dutch Shell PLC, Exxon Mobil Corporation, China Petroleum & Chemical Corporation, China National Petroleum Corporation, and BP PLC (Castrol), among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Wind Energy Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Detrimental Effects of Lubricants on the Environment

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Hydraulic Fluid

- 5.1.3 Metalworking Fluid

- 5.1.4 General Industrial Oil

- 5.1.5 Gear Oil

- 5.1.6 Grease

- 5.1.7 Process Oil

- 5.1.8 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Heavy Equipment

- 5.2.3 Food and Beverage

- 5.2.4 Metallurgy and Metalworking

- 5.2.5 Chemical Manufacturing

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Philippines

- 5.3.1.6 Indonesia

- 5.3.1.7 Malaysia

- 5.3.1.8 Thailand

- 5.3.1.9 Vietnam

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 Spain

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Chile

- 5.3.4.5 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Iran

- 5.3.5.3 Iraq

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Kuwait

- 5.3.5.6 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 Egypt

- 5.3.6.2 South Africa

- 5.3.6.3 Nigeria

- 5.3.6.4 Algeria

- 5.3.6.5 Morocco

- 5.3.6.6 Rest of Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC.

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 Blaser Swisslube AG

- 6.4.4 BP p.l.c.

- 6.4.5 Carl Bechem GmbH

- 6.4.6 Chevron Corporation

- 6.4.7 China National Petroleum Corporation (PetroChina)

- 6.4.8 China Petroleum & Chemical Corporation (SINOPEC Group)

- 6.4.9 Eni SpA

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 FUCHS

- 6.4.12 Gazprom Neft PJSC

- 6.4.13 Gulf Oil International

- 6.4.14 Hindustan Petroleum Corporation Limited

- 6.4.15 Idemitsu Kosan Co. Ltd

- 6.4.16 Indian Oil Corporation Ltd.

- 6.4.17 ROCOL

- 6.4.18 ENEOS Corporation

- 6.4.19 Kluber Lubrication

- 6.4.20 LUKOIL

- 6.4.21 PT Pertamina(Persero)

- 6.4.22 Petrobras

- 6.4.23 Petronas Lubricants International

- 6.4.24 Phillips 66 Company

- 6.4.25 Repsol

- 6.4.26 Shell PLC

- 6.4.27 Tide Water Oil Co. (India) Ltd.

- 6.4.28 TotalEnergies

- 6.4.29 Valvoline

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Prominence for Bio-Lubricants

- 7.2 Development of Low Viscosity Lubricants