|

市场调查报告书

商品编码

1687318

苯乙烯嵌段共聚物(SBC):市场占有率分析、产业趋势与统计、成长预测(2025-2030)Styrenic Block Copolymers (SBCs) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

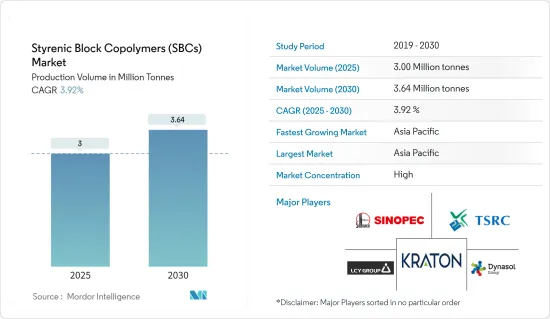

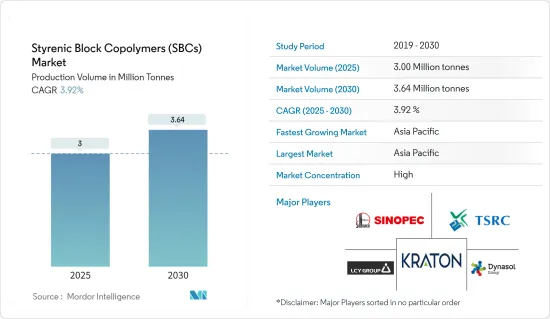

根据产量计算,苯乙烯嵌段共聚物市场规模预计将从 2025 年的 300 万吨增长到 2030 年的 364 万吨,预测期内(2025-2030 年)的复合年增长率为 3.92%。

COVID-19 疫情阻碍了苯乙烯嵌段共聚物市场的发展。考虑到这种情况,在封锁期间,建筑和建设活动暂时停止,以遏制病毒的传播。根据欧盟统计局的数据,欧盟19国建设业下降了28.4%,欧盟27国建筑业下降了24%,导致对聚丁二烯(SBS)的需求减少。然而,放鬆管制后,由于沥青改质(铺路和屋顶)和鞋类行业的需求增加,市场实现了显着的成长率。

短期内,沥青改质应用的增加和鞋类产业的日益普及预计将推动市场需求。

然而,对非沥青道路和屋顶建设的日益关注预计将抑制市场成长。

热熔胶的成长机会很可能在未来几年创造市场机会。

预计亚太地区将主导市场,并在预测期内实现最高的复合年增长率。

苯乙烯嵌段共聚物(SBC)市场趋势

沥青改质领域占据市场主导地位

- 沥青是道路、机场跑道、滑行道、自行车道等的重要建筑材料。

- 黏合剂改质剂(SBC) 等改质剂可提高沥青路面对热开裂、车辙和剥落等路面缺陷的抵抗力,从而改善沥青路面的性能和使用寿命。

- 近年来,用于沥青的改质沥青的需求量稳定成长。这项需求与正在进行的道路建设活动直接相关。道路和人行道每天都要承受重载,因此承受着持续的压力。它们需要维护并且不时进行维修。此外,道路的建造和维护方式极大地影响在路面上行驶的车辆所消耗的能量。

- 世界各国政府都出资在已开发国家修復或拓宽现有道路,在开发中国家兴建新道路。

- 例如,2022年9月,欧盟委员会透过「连接欧洲基金」(CEF)拨款50亿欧元(52.9亿美元)用于包括道路和人行道在内的基础设施计划,主要针对全欧洲运输网路(TEN-T网路)和多式联运。

- 此外,公共资助的高速公路计划占美国沥青路面市场的 65%,住宅和非住宅建筑占剩余的 35%。各级政府(联邦/州/地方)在高速公路、道路和桥樑上的资本支出每年约为 800 亿美元,其中约一半资金来自联邦政府。

- 此外,美国联邦公路管理局 (FHWA) 并未追踪普遍使用 SBC 的 189 万英里地方道路上的路面类型。

- 根据印度品牌股权基金会(IBEF)的报告,印度的高速公路建设里程从2022年的10,457公里增加到2023年的10,993公里。

- 预计所有这些因素将增加对沥青改质的需求,进而将在预测期内促进苯乙烯嵌段共聚物的成长。

亚太地区占市场主导地位

- 亚太地区是全球最大的苯乙烯嵌段共聚物区域市场。该地区苯乙烯嵌段共聚物消费的主要国家为中国、印度和日本。

- 近期,中国各大城市爆发新冠肺炎疫情,为稳定经济,中国正在加强投资和高速公路建设。根据国家统计局数据显示,2023年前8个月,中国资本投资达28.59兆元(3.91兆美元),比2022年同期成长6.8%。

- 国家发展改革委、运输部在联合记者会上表示,到2035年,中国将建成功能齐全、运作高效、安全的高速公路网。此外,中国计划在2035年建成46.1万公里高速公路网,2050年进入世界前列。

- 中国是最大的鞋类生产国、消费国和供应国。根据《世界鞋类年鑑2023》预测,2022年中国将生产约130.47亿双鞋,消费量约39.30亿双,占全球鞋类消费量的17.9%。同年,印度出口了约93.08亿双鞋类,约占世界鞋类出口的61.3%。

- 印度道路运输和公路部长表示,印度建筑业目前是世界第三大产业,未来五年可望成为世界最大建筑业。据印度国家投资促进和便利化局称,预计到 2025 年,印度建筑业的规模将达到 1.4 兆美元,这将支持该行业对苯乙烯嵌段共聚物的需求。

- 根据印度包装工业协会(PIAI)的数据,印度的包装产业是经济体中第五大产业。该协会预测,到 2025 年,包装产业规模将达到 2,048.1 亿美元。这一情况可能会在预测期内刺激市场需求。

- 预计未来几年日本的包装产业(包括食品和药品包装)将会成长。在目前的市场情势下,日本是全球人均包装材料消费量量最高的国家。在亚洲,日本的包装食品消费份额则位居第二,仅次于中国。这对于食品和饮料包装专业人士来说是一个巨大的商机。

- 根据日本包装协会(JPI)预测,2022年日本包装产业总出货收益将达到约6.58兆日圆,而前一年约为6.17兆日圆。根据Statista的预测,食品和饮料产业预计在2024年达到6,271万美元,在2027年达到8,053万美元。食品和饮料行业的这些趋势预计将在未来几年推动市场对包装和聚合物改质应用的需求。

- 由于上述因素,亚太地区的苯乙烯嵌段共聚物市场预计将在预测期内大幅成长。

苯乙烯嵌段共聚物(SBC)产业概览

苯乙烯嵌段共聚物(SBC)市场本质上是部分整合的。市场的主要企业包括中国石油化学集团公司(SINOPEC)、李长荣集团、台橡股份有限公司、Dynasol集团和科腾公司(排名不分先后)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 沥青改质应用日益增多

- 鞋类产业招募增加

- 限制因素

- 越来越重视道路和屋顶的无沥青建设

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格概览(2019-2029)

第五章市场区隔

- 按类型

- 聚丁二烯(SBS)

- 苯乙烯-异戊二烯-苯乙烯(SIS)

- 氢化SBC(HSBC)

- 按应用

- 沥青改质(铺路和屋顶)

- 鞋类

- 聚合物改性

- 黏合剂和密封剂

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 西班牙

- 土耳其

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 埃及

- 奈及利亚

- 南非

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Avient Corporation

- China Petrochemical Corporation(Sinopec)

- Grupo Dynasol

- INEOS

- Kraton Corporation

- Kuraray Co. Ltd

- LCY Group

- LG Chem

- TSRC

- Versalis SPA

- Zeon Corporation

第七章 市场机会与未来趋势

- 热熔胶的成长机会

The Styrenic Block Copolymers Market size in terms of production volume is expected to grow from 3.00 million tonnes in 2025 to 3.64 million tonnes by 2030, at a CAGR of 3.92% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the styrenic block copolymers market. Considering this scenario, building and construction activities were stopped temporarily during the lockdown to curb the spread of the virus. According to Eurostat, the construction industry declined by 28.4% in the EU-19 countries and by 24% in the European Union (EU-27) countries, thereby witnessing a reduction in demand for styrene-butadiene-styrene (SBS). However, the market registered a significant growth rate after the restrictions were lifted due to the increasing demand from asphalt modification (paving and roofing) and footwear industries.

Over the short term, increasing applications in bitumen modification and the rising adoption in the footwear industry are expected to stimulate market demand.

However, the growing focus on asphalt-free construction of roads and roofing is expected to restrain market growth.

Growth opportunities in hot-melt adhesives are likely to create market opportunities in the coming years.

Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Styrenic Block Copolymers (SBCs) Market Trends

The Asphalt Modification Segment to Dominate the Market

- Asphalt is an important construction material for roads, airport runways, taxiways, bicycle paths, etc.

- Modifiers, such as binder modifiers (SBCs), improve the performance of asphalt pavements by increasing their resistance to pavement distresses, such as thermal cracking, rutting, stripping, etc., thereby prolonging their service life.

- In recent years, the demand for modified bitumen used in asphalt has been witnessing steady growth. This demand directly correlates with ongoing road construction activities. Roadways and walkways are under continuous stress as they are subjected to heavy loads daily. They require maintenance and are subject to repair from time to time. Moreover, how roads are built and maintained significantly impacts the energy that is burned by the vehicles that roll or crawl on the surface.

- Governments worldwide are spending money to restore or expand existing roadways in the developed world and construct entirely new ones in the developing world.

- For instance, in September 2022, the European Commission released EUR 5 billion (USD 5.29 billion) through the Connecting Europe Facility (CEF) in infrastructure projects, which will include roadways and walkways, targeting mainly the trans-European transport network (TEN-T network) and multimodal transport.

- Moreover, 65% of the asphalt pavement market in the United States can be accounted for publicly funded highway projects, with residential and non-residential construction making up the remaining 35%. Capital spending on highways, roads, and bridges by all levels of government (federal/state/local) is around USD 80 billion annually, about half of which comes from federal funding.

- Furthermore, the Federal Highway Administration (FHWA) does not track pavement type for 1.89 million miles of local roads where the use of SBC is significant.

- As per the report of the Indian Brand Equity Foundation (IBEF), highway construction in India increased from 10,457 km in 2022 to 10,993 km in 2023.

- All such factors are likely to increase the demand for asphalt modification, which will, in turn, increase the growth of styrenic block copolymers during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific represents the largest regional market for styrenic block copolymers market globally. The major countries responsible for the consumption of styrenic block copolymers in the region include China, India, and Japan.

- China is stepping up investment and highway construction as it scrambles to stabilize its economy following the recent outbreak of COVID-19 in major Chinese cities. According to the National Bureau of Statistics, China's capital investment reached CNY 28.59 trillion (~USD 3.91 trillion) in the first eight months of 2023, up by 6.8% compared to the same period in 2022.

- The National Development and Reform Commission (NDRC) and the Ministry of Transport announced in a joint news briefing that they would build a highway network that is fully functional, efficient, and safe by 2035. Moreover, China plans to build a 461,000 km highway network by 2035 and expand it into a world-class network by 2050.

- China is the largest manufacturer, consumer, and supplier of footwear. According to the World Footwear Yearbook 2023, in 2022, the country produced about 13,047 million pairs of footwear, while consumption was about 3,930 million, representing 17.9% of the total global footwear consumption. In the same year, the country exported about 9,308 million pairs of footwear, representing about 61.3% of the global exports of footwear.

- The construction sector in India, which is currently the third largest in the world, has the capability to become the largest in the world in the next 5 years, as per the Union Minister for Road Transport & Highways. According to the National Investment Promotion and Facilitation Agency, the construction Industry in India is expected to reach USD 1.4 trillion by 2025, thus supporting the demand for styrenic block copolymers from the industry.

- According to the Packaging Industry Association of India (PIAI), the country's packaging sector is the fifth largest sector in its economy. The association has predicted that the packaging sector will reach USD 204.81 billion by 2025. This scenario may boost the demand for the market studied during the forecast period.

- The Japanese packaging industry, including food and pharmaceutical packaging, is expected to grow in the coming years. In the present market scenario, Japan has the world's highest per capita consumption of packaging materials. In Asia, Japan holds the second-highest packaged food consumption share, next to China. This is a good business opportunity for food and beverage packaging professionals.

- As per the Japan Packaging Institute (JPI), the total shipment value of the Japanese packaging industry was around JPY 6.58 trillion (~USD 0.05 trillion) in 2022 compared to around JPY 6.17 trillion (~USD 0.05 trillion) in the previous year. The food and beverage industry is expected to reach USD 62.71 million in 2024 and is projected to reach USD 80.53 million by 2027, as per Statista forecast. Such trends in the food and beverage industry are expected to boost the demand for packaging, uplifting the polymer modification application of the market studied in the coming years.

- Owing to the factors mentioned above, the market for styrenic block copolymers in Asia-Pacific is projected to grow significantly during the forecast period.

Styrenic Block Copolymers (SBCs) Industry Overview

The styrenic block copolymers (SBCs) market is partially consolidated in nature. Some of the major players in the market include China Petrochemical Corporation (SINOPEC), LCY Group, TSRC Corporation, Dynasol Group, and Kraton Corporation (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Bitumen Modification

- 4.1.2 Rising Adoption in the Footwear Industry

- 4.2 Restraints

- 4.2.1 Growing Focus on Asphalt-free Construction of Roads and Roofing

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Overview (2019-2029)

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Styrene-Butadiene-Styrene (SBS)

- 5.1.2 Styrene-Isoprene-Styrene (SIS)

- 5.1.3 Hydrogenated SBC (HSBC)

- 5.2 Application

- 5.2.1 Asphalt Modification (Paving and Roofing)

- 5.2.2 Footwear

- 5.2.3 Polymer Modification

- 5.2.4 Adhesives and Sealants

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Spain

- 5.3.3.7 Turkey

- 5.3.3.8 Nordic Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avient Corporation

- 6.4.2 China Petrochemical Corporation (Sinopec)

- 6.4.3 Grupo Dynasol

- 6.4.4 INEOS

- 6.4.5 Kraton Corporation

- 6.4.6 Kuraray Co. Ltd

- 6.4.7 LCY Group

- 6.4.8 LG Chem

- 6.4.9 TSRC

- 6.4.10 Versalis SPA

- 6.4.11 Zeon Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth Opportunities in Hot-melt Adhesives