|

市场调查报告书

商品编码

1687319

铂族金属:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Platinum Group Metals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

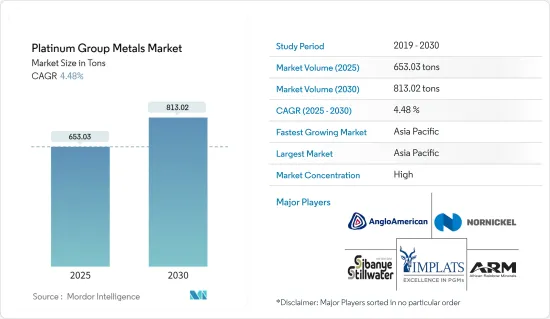

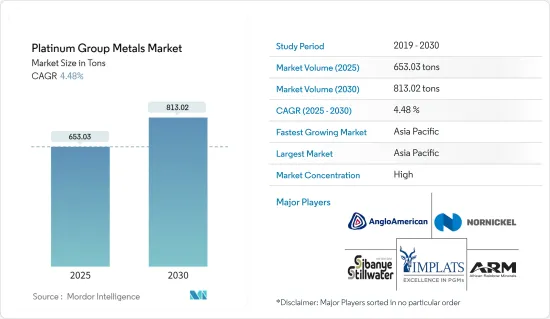

预计 2025 年铂族金属市场规模为 653.03 吨,到 2030 年将达到 813.02 吨,预测期内(2025-2030 年)的复合年增长率为 4.48%。

主要亮点

- 2020 年,新冠疫情对市场产生了负面影响。不过,预计市场将达到疫情前的水平,并在预测期内稳定成长。

- 短期内,预计市场成长将受到汽车产业对触媒转换器需求的增加、电子产业对铂、钯和钌需求的增加以及亚太国家珠宝饰品消费量的增加的推动。

- 然而,生产和维护铂族金属的高成本预计会阻碍市场成长。

- 然而,铂金在绿色技术中的应用以及非洲国家对铂金产业投资的增加可能会在预测期内为市场提供机会。

- 预计预测期内亚太地区将主导全球市场。预计在预测期内其复合年增长率将达到最高,这主要是由于汽车催化剂和珠宝饰品应用对锑的需求不断增加。

铂族金属市场趋势

汽车触媒领域占据市场主导地位

- 铂族元素或铂族金属(PGM),包括铂、钯和铑,在汽车工业中广泛用作汽车催化剂。汽车触媒或触媒转换器是安装在汽车排气系统中用于减少有害排放气体的装置。

- 这些金属被放置在引擎和消音器之间的排气系统中,当引擎加热金属时,它会中和过程中的污染物。

- 2022 年,铂金受益于汽车产量的成长,因为经济型汽车製造商越来越多地寻求用更昂贵的钯金取代铂金。柴油触媒转换器优先使用铂金,而瓦斯车辆优先使用钯金。然而,在柴油和燃气引擎车辆中,当一种金属更昂贵时,用另一种金属取代一种金属是很常见的。

- 根据OICA(国际汽车製造商组织:Internationale des Constructeurs d'Automobiles)的数据,2022年全球所有汽车的销量将为8162万辆,而2021年为8275万辆。根据OICA的数据,2022年所有机动车的总产量统计数据为8502万辆,而2021年为8021万辆。

- 根据世界贸易组织(WTO)预测,2022年美国将超越日本成为第二大汽车出口国。中国则名列十大出口国之列,出口量增加了30%。製造业的一个显着发展是,中国2023年11月汽车产品出口与前一年同期比较增7%。

- 印度汽车产业的投资不断增加和进步预计将推动汽车催化剂市场的需求。汽车业贡献了印度製造业GDP的49%和GDP总量的7.1%。印度汽车市场预计在2022年超越日本成为世界第三大汽车市场,并在2023年成为全球第四大商用车製造市场。

- 预计所有上述因素都将推动汽车催化剂领域发展,并在预测期内增加对铂族金属的需求。

亚太地区占市场主导地位

- 亚太地区占据铂族金属市场的最大份额,占全球份额的近一半。预计它将成为成长最快的市场。

- 在电子工业中,铂、钯、铑和铱用于涂覆电极。大多数微处理器和印刷电路基板都含有钯金属。工业界主要将铂金用于电脑、电视和行动电话等电子元件。

- 中国智慧型手机用户数量正在增加。到2023年,中国智慧型手机用户将达到8.682亿。

- 同样,印度的电子产品市场预计在未来三年内将达到 4,000 亿美元。此外,预计到2025年,印度将成为全球第五大家电和电子产业国。

- 此外,根据国际铂金协会(PGI)的数据,日本的铂金销售额将在2022年14年来首次突破1兆日圆(100亿美元)。中国仍然是人均铂金消费量最大的市场。

- 日本目前被认为是仅次于美国的世界第二大珠宝饰品市场。日本也是世界第二大铂金消费国,其中珠宝饰品金14.06吨。

- 因此,预计所有上述因素都将在预测期内增加铂族金属市场的需求。

铂族金属产业概况

铂族金属市场本质上是整合的。主要企业(排名不分先后)包括英美铂业有限公司、诺里尔斯克镍业、Implats铂业有限公司、Sibanye-Stillwater、非洲彩虹矿产有限公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 汽车产业对触媒转换器的需求不断增加

- 电子业对铂、钯和钌的需求不断增加

- 亚太国家珠宝饰品消费成长

- 限制因素

- 高成本

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按金属类型

- 铂

- 钯

- 铑

- 铱

- 钌

- 钡

- 按应用

- 汽车触媒

- 电气和电子

- 燃料电池

- 玻璃、陶瓷、颜料

- 珠宝饰品

- 医疗(牙科和製药)

- 工业

- 其他应用(飞机涡轮机、水处理、感应器、摄影、萤幕、法医学检查)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- African Rainbow Minerals Limited

- ANGLO AMERICAN PLATINUM LIMITED

- GLENCORE

- Implats Platinum Limited

- Johnson Matthey

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Platinum Group Metals Ltd

- Sibanye-Stillwater

- Vale

第七章 市场机会与未来趋势

- 铂金在绿色科技的应用

- 增加对非洲国家的投资

简介目录

Product Code: 61254

The Platinum Group Metals Market size is estimated at 653.03 tons in 2025, and is expected to reach 813.02 tons by 2030, at a CAGR of 4.48% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and grow steadily during the forecast period.

- Over the short term, the growing demand for catalytic converters from the automotive industry, increasing demand for platinum, palladium, and ruthenium from the electronics industry, and growing jewelry consumption in Asia-Pacific countries are expected to drive market growth.

- However, the high costs involved in production and maintaining platinum group metals are expected to hinder the market's growth.

- Nevertheless, the usage of platinum in green technology and increasing investment in the platinum industry in African countries are likely to create opportunities for the market during the forecast period.

- Asia-Pacific is expected to dominate the global market during the forecast period. It is also expected to register the highest CAGR during the forecast period due to rising demand for antimony, mainly in autocatalysts and jewelry applications.

Platinum Group Metals Market Trends

Autocatalysts Segment to Dominate the Market

- Platinum group elements or platinum group metals (PGMs), including platinum, palladium, and rhodium, are widely used as autocatalysts in the automotive industry. Autocatalysts, or catalytic converters, are devices integrated into the exhaust systems of vehicles to reduce harmful emissions.

- These metals are placed in the exhaust system between the engine and the muffler, and when the engine heats the metals, the process neutralizes the pollutants.

- Platinum profited from increased car manufacture in 2022 as economical automakers increasingly attempt to swap it for more expensive palladium. Platinum is preferred in diesel catalytic converters, while palladium is preferred in gas-powered automobiles. Nevertheless, both metals may be exchanged, one for the other, in diesel- and gas-powered vehicles, which is common when one of the metals is somewhat expensive.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA) (International Organization of Motor Vehicle Manufacturers), global sales of all vehicles in 2022 were 81.62 million, compared to 82.75 million in 2021. According to the OICA, total production statistics for all vehicles was 85.02 million in 2022, compared to 80.21 million in 2021.

- According to the World Trade Organization, the United States overtook Japan as the second-largest automotive exporter in 2022. China increased its exports the most among the top ten exporters by 30%. One notable development in the manufacturing sector is that China increased the value of its automotive product exports by 7% year on year in November 2023.

- Increased investments and advancements in the Indian automobile industry are expected to boost demand for the automotive catalyst market. The automobile industry accounts for 49 percent of India's manufacturing GDP and 7.1 percent of its overall GDP. The Indian auto market was ranked third in the world, surpassing Japan in 2022 and fourth in commercial vehicle manufacturing in 2023.

- All the factors above are expected to drive the autocatalysts segment, enhancing the demand for platinum group metals during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region accounted for the largest share in the market for platinum group metals, with almost half of the global share. It is expected to be the fastest-growing market.

- In the electronics industry, platinum, palladium, rhodium, and iridium are used to coat electrodes, the tiny components in all the electronic products that help in controlling the flow of electricity. Palladium metal is contained in most microprocessors and printed circuit boards. The industry majorly uses platinum in electronic components of computers, televisions, mobile phones, and others.

- The number of smartphone users in China is increasing. By 2023, the country's smartphone user base had risen to 868.2 million.

- Similarly, the Indian electronics market is expected to reach USD 400 billion over the next three years. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025.

- Additionally, according to Platinum Guild International (PGI), in 2022, the sales of platinum in Japan exceeded the mark of JPY one trillion (USD 10 billion) for the first time in 14 years. The country remains the biggest platinum market per capita.

- Japan is now considered the second largest jewelry market in the world, after only the United States. The country is also the world's second-largest consumer of platinum, with 14.06 tons of the metal used for jewelry creation.

- Thus, all the above factors will likely increase the demand for the platinum group metals market during the forecast period.

Platinum Group Metals Industry Overview

The platinum group metals market is consolidated in nature. The major players (not in any particular order) include Anglo American Platinum Limited, Norilsk Nickel, Implats Platinum Limited, Sibanye-Stillwater, and African Rainbow Minerals Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Catalytic Converters from the Automotive Industry

- 4.1.2 Increasing Demand for Platinum, Palladium, and Ruthenium from the Electronics Industry

- 4.1.3 Growing Jewelry Consumption in Asia-Pacific Countries

- 4.2 Restraints

- 4.2.1 High Costs Involved in Production and Maintenance

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Metal Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Iridium

- 5.1.5 Ruthenium

- 5.1.6 Osmium

- 5.2 Application

- 5.2.1 Auto Catalysts

- 5.2.2 Electrical and Electronics

- 5.2.3 Fuel Cells

- 5.2.4 Glass, Ceramics, and Pigments

- 5.2.5 Jewellery

- 5.2.6 Medical (Dental and Pharmaceuticals)

- 5.2.7 Chemical Industry

- 5.2.8 Other Applications (Aircraft Turbines, Water Treatment, Sensors, Photography, Screens, and Forensic straining)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 African Rainbow Minerals Limited

- 6.4.2 ANGLO AMERICAN PLATINUM LIMITED

- 6.4.3 GLENCORE

- 6.4.4 Implats Platinum Limited

- 6.4.5 Johnson Matthey

- 6.4.6 Norilsk Nickel

- 6.4.7 Northam Platinum Holdings Limited

- 6.4.8 Platinum Group Metals Ltd

- 6.4.9 Sibanye-Stillwater

- 6.4.10 Vale

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage of Platinum in Green Technology

- 7.2 Increasing Investment in the African Countries

02-2729-4219

+886-2-2729-4219