|

市场调查报告书

商品编码

1687324

C5 树脂:市场占有率分析、产业趋势与统计资料、成长预测(2025-2030 年)C5 Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

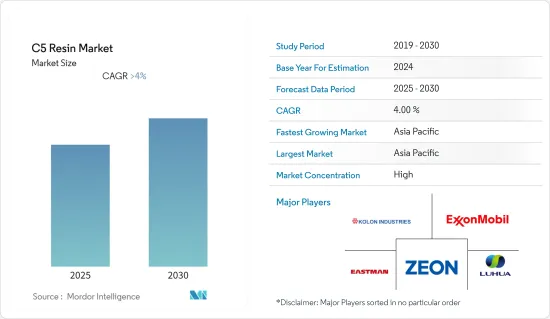

预计预测期内 C5 树脂市场将以超过 4% 的复合年增长率成长。

2021年,新冠疫情对市场产生了负面影响,油漆涂料、印刷油墨、橡胶化合物等的需求下降。不过,预计未来几年市场将恢復成长轨迹。

主要亮点

- 短期内,建设产业的强劲成长和包装行业对热熔胶的需求激增预计将推动市场发展。

- 预计用松香树脂取代石油树脂将阻碍市场成长。

- 预计亚太地区将主导市场。中国的需求最高,其次是印度。

C5树脂市场趋势

对黏合剂和密封剂行业的需求不断增长

- 黏合剂和密封剂是 C5烃类树脂的最大市场。这些树脂具有良好的黏合性能,可用于增粘热熔胶和压敏黏着剂。与大多数基础聚合物、聚合物改质剂和抗氧化剂相容。

- 汽车黏合剂是一种轻质、强力的机械紧固件替代品,可取代螺帽、螺栓、铆钉和焊接等。这一因素推动了电动汽车产业对黏合剂的需求。

- 《全球电动车展望》预测,2021年全球电动车销量将达到675万辆,比2020年成长108%。这个数字包括乘用车、轻型卡车和轻型商用车。

- 电动车(BEV 和 PHEV)在全球轻型车销量中的份额为 8.3%,而 2020 年为 4.2%。 BEV 占电动车总销量的 71%,而 PHEV 占 29%。受新冠疫情影响,2020年全球汽车市场仅成长4.7%。不过,汽车市场目前正在復苏。预计这将导致电动和混合动力汽车製造中黏合剂和密封剂的使用量增加。

- 由于上述因素,预计预测期内黏合剂和密封剂领域对 C5 树脂的需求将会成长。

亚太地区占市场主导地位

- 在全球范围内,中国是油漆和涂料的主要生产国。该国生产的涂料占亚太地区涂料产量的一半以上,拥有 10,000 多家涂料公司。本土製造商占据了国内涂料市场的一半以上。

- 目前,印度有超过550家製造商从事印刷油墨业务。 Huber Group、DIC India、Siegwerk、Sakata、Flint 和 Toyo 是印刷油墨市场的主要参与者,占整个市场的 75% 左右。

- 印度涂料行业的年营业额估计为 5000 亿印度卢比。国内主要的亚洲涂料公司在印度经营 10 家生产设施,而伯杰涂料公司则经营 12 家生产设施。四大涂料製造商占印度涂料和涂料行业总产量的 60% 以上,并且正在大幅提高其生产能力。

- 印度是亚太地区最大的橡胶生产国和消费国之一(仅次于中国)。该国是世界第六大天然橡胶生产国,产量约90万吨。此外,预计到 2025 年底,该国的合成橡胶消费量将达到 120 万吨。各种应用对橡胶的需求不断增长,预计将推动 C5 树脂的产量。

- 因此,预计预测期内亚太地区各种应用对 C5 树脂的需求不断增加将推动市场发展。

C5树脂产业概况

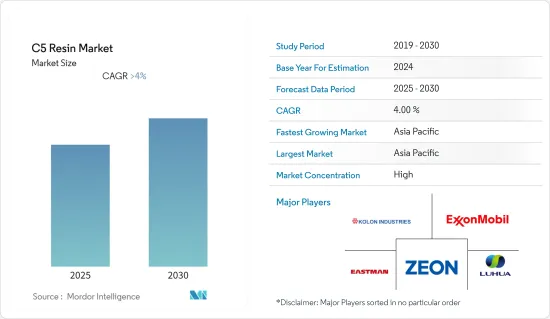

全球C5树脂市场为一体化市场,前五大企业约占50%。该市场的主要企业包括伊士曼化学公司、可隆工业公司、埃克森美孚公司、瑞翁公司和淄博鲁化鸿锦新材料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业对黏合剂和密封剂的需求不断增加

- 建筑业的扩张

- 限制因素

- C5树脂的替代品

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按应用

- 油漆和涂料

- 黏合剂和密封剂

- 印刷油墨

- 橡胶混炼

- 其他用途(纸张施胶剂、塑胶改质剂)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arakawa Chemical Industries Ltd

- Cray Valley

- DuPont

- Eastman Chemical Company

- Eneos Holdings Inc.

- Exxon Mobil Corporation

- Henan Anglxxon Chemical Co. Ltd

- Kolon Industries Inc.

- Lesco Chemical Limited

- Neville Chemical Company

- Puyang Ruisen Petroleum Resins Co. Ltd

- Seacon Corporation

- Shanghai Jinsen Hydrocarbon Resins Co. Limited

- Zibo Luhua Hongjin New Material Co. Ltd

- Zeon Corporation

第七章 市场机会与未来趋势

- 电动车市场正在成长

The C5 Resin Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 pandemic negatively affected the market in 2021. There was a decline in the demand for paints and coatings, printing inks, rubber compounding, etc. However, the market is excepted to regain its growth trajectory in the coming years.

Key Highlights

- In the short term, the strong growth of the construction industry and rapid increase in demand for hot-melt adhesives from the packaging industry are expected to drive the market.

- The replacement of petroleum resins with rosin resins is expected to hinder the growth of the market.

- The Asia-Pacific region is expected to dominate the market. The highest demand may be from China, followed by India.

C5 Resin Market Trends

Growing Demand from Adhesives and Sealants Industry

- Adhesives and sealants are the largest markets for C5 hydrocarbon resins. These resins provide good adhesion and are used to tack in hot-melt and pressure-sensitive adhesives. They are compatible with most base polymers, polymer modifiers, and antioxidants.

- Automotive adhesives are lighter and are strong substitutes for mechanical fasteners like nuts and bolts, rivets, and welds. This factor drives the demand for adhesives from the electric vehicle industry.

- According to Global EV Outlook, EV sales worldwide reached 6.75 million units in 2021, recording an increase of 108 % compared to 2020. This volume includes passenger vehicles, light trucks, and light commercial vehicles.

- The global share of EVs (BEVs and PHEVs) in global light vehicle sales was 8.3 %, compared to 4.2 % in 2020. BEVs accounted for 71 % of the total EV sales, and PHEVs accounted for 29%. The global automotive market grew by only 4.7 % in 2020 due to the impact of COVID-19. However, currently, the automotive market is recovering. This is expected to increase the usage of adhesives and sealants in electric and hybrid vehicle manufacturing.

- Owing to the above-mentioned factors, the demand for C5 resins from the adhesives and sealants segment is expected to grow over the forecast period.

Asia-Pacific Region to Dominate the Market

- Globally, China is the leading producer of paints and coatings. The country produces more than half of all the coatings produced in Asia-Pacific and is home to over 10,000 paint companies. The local producers occupy more than half of the domestic paint market.

- India has over 550 manufacturers currently engaged in the printing inks business. Huber Group, DIC India, Siegwerk, Sakata, and Flint and Toyo are among the leading players in the printing inks market and comprise around 75% of the total market.

- The Indian paint industry is estimated to have an annual turnover of INR 50,000 crore. Asian Paints, the largest domestic player, operates ten production facilities in the country, while Berger Paints operates 12 production facilities. Four major paint producers account for more than 60% of the total output of the Indian paints and coatings industry and have added significant production capacities.

- India is one of the largest producers and consumers of rubber in the Asia-Pacific region (after China). The country is the sixth-largest producer of natural rubber globally and has a production capacity of approximately 900,000 tons. In addition, the country's consumption of synthetic rubber is projected to reach 1.2 million tons by the end of 2025. The rising demand for rubber across several applications is likely to propel the production of C5 resins.

- Thus, the growing demand for C5 resins in various applications in the Asia-Pacific region is expected to drive the market studied during the forecast period.

C5 Resin Industry Overview

The global C5 resin market is consolidated in nature, with the top five players occupying around 50%. Some of the major companies in this market include Eastman Chemical Company, Kolon Industries Inc., ExxonMobil Corporation, Zeon Corporation, and Zibo Luhua Hongjin New Material Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Adhesives and Sealants from the Packaging Industry

- 4.1.2 Expansion of the Construction Industry

- 4.2 Restraints

- 4.2.1 Replacement of C5 Resins

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Paints and Coatings

- 5.1.2 Adhesives and Sealants

- 5.1.3 Printing Inks

- 5.1.4 Rubber Compounding

- 5.1.5 Other Applications (Paper Sizing Agents, Plastic Modifiers)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arakawa Chemical Industries Ltd

- 6.4.2 Cray Valley

- 6.4.3 DuPont

- 6.4.4 Eastman Chemical Company

- 6.4.5 Eneos Holdings Inc.

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Henan Anglxxon Chemical Co. Ltd

- 6.4.8 Kolon Industries Inc.

- 6.4.9 Lesco Chemical Limited

- 6.4.10 Neville Chemical Company

- 6.4.11 Puyang Ruisen Petroleum Resins Co. Ltd

- 6.4.12 Seacon Corporation

- 6.4.13 Shanghai Jinsen Hydrocarbon Resins Co. Limited

- 6.4.14 Zibo Luhua Hongjin New Material Co. Ltd

- 6.4.15 Zeon Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth of the Electric Vehicle Market