|

市场调查报告书

商品编码

1687330

工业电池:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Industrial Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

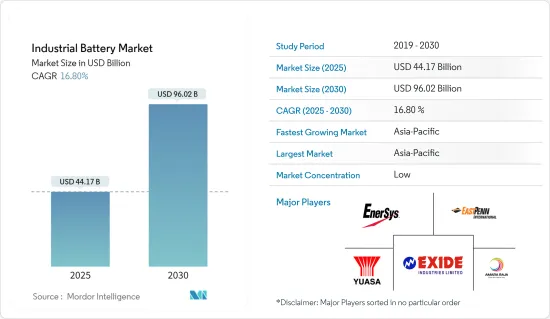

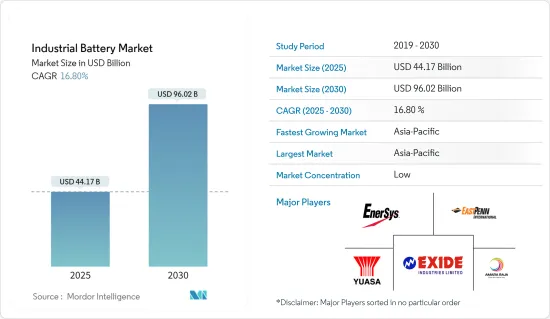

预计 2025 年工业电池市场规模为 441.7 亿美元,到 2030 年将达到 960.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.8%。

从中期来看,锂离子电池价格下跌、资料中心和通讯产业需求增加以及全球可再生能源整合的增加是预计在预测期内推动市场需求的一些主要因素。

另一方面,钴、铅和锂等原料价格的不确定性可能会在预测期内抑制市场成长率。

然而,最终用户和製造商对技术先进的电池的日益关注可能会为电池製造商创造重大机会,使他们能够将投资和资源用于实现突破性的电池技术。

由于对UPS、堆高机和电网级能源储存系统应用的需求不断增长,预计亚太地区将在全球工业电池市场占据主导地位。

工业电池市场趋势

堆高机应用可望主导市场

- 工业电池是为各种设备和机械供电、促进不间断运作和提高整体生产力的关键。在工业电池的各种应用中,堆高机的使用成为市场扩张的关键驱动力。

- 堆高机是物料输送的必备设备,广泛应用于仓库、製造工厂、配送中心和物流业务,并且依靠电池才能有效运作。

- 推动堆高机应用中对工业电池需求的主要因素之一是对高效、环保的物料输送解决方案的需求不断增加。随着对永续性和环境责任的日益重视,该公司正在从传统的内燃机 (ICE) 堆高机转向需要工业电池的电动堆高机。

- 此外,电子商务的兴起和全球供应链的扩大正在刺激对仓库和配送中心的需求。

- 例如,2023 年 7 月,New Warehouse 与 Experioir Global 合作,扩展其电子商务履约能力并创建一家综合电子商务履约公司。此次合作利用了 Experioir 广泛的运输网络和专用于 B2B 分销的仓库。因此,此策略合作伙伴关係将使服务范围从电子商务履约扩展到端到端供应链解决方案,以弥合从港口物流到客户送货上门的差距。

- 高力国际称,美国大型仓储式物流中心的数量自2013年起每年都在增加,到2022年将增加约396个,达到5946个。大型设施是指用于配送的大型工业设施。

- 此外,电池製造商也做出了回应,开发了先进的电池技术,提供更长的运作、更快的充电能力和更高的能源效率,以满足堆高机应用的独特要求。

- 例如,2022年6月,BSLBATT电池宣布与中国一家知名的工业堆高机电池专业经销商签署了一项实质协议。 BSLBATT 利用创新的 BSLBATT 模组化技术,为占地 950,000 平方英尺的大型设施中的物料输送设备提供电源解决方案。

- 此外,电池技术的进步和物联网功能的整合使得工业电池在堆高机领域更具吸引力。随着公司在物料输送业务中优先考虑效率和永续性,堆高机应用预计将继续成为工业电池市场的主要驱动力,为未来几年的创新和成长创造机会。

亚太地区占市场主导地位

- 2022 年,亚太地区占据了工业电池市场的大部分份额,预计在预测期内仍将保持主导地位。中国、印度、日本和韩国是亚太地区工业电池市场的主要推手。

- 以GDP计算,中国是世界第二大经济体。 2022年,该国GDP成长约0.8%,达到17.96兆美元。随着人口老化以及经济从製造业转向服务业、从外需转向内需、从投资转向消费的再平衡,该国的经济成长正在逐渐下降。

- 由于发电、化工、石油和天然气、金属加工、IT和通讯等领域的显着成长,中国有望成为工业电池最大和成长最快的市场之一。此外,由于工业电池在这些行业中发挥着至关重要的作用,预计在预测期内它们将继续以类似的速度成长。

- 此外,中国正在大力投资清洁能源开发,建造先进设施,采用新技术,并创建永续的节能係统。中国已成为世界上最大的清洁能源投资国,但快速成长也使其成为最大的能源消费国。

- 截至 2022 年,中国已成为可再生能源应用的全球领先国家之一。预计2022年可再生能源发电总容量将达1,160.79吉瓦,与前一年同期比较成长约13.7%。水能、风能和太阳能是该国主要的再生能源来源。

- 由于国家电力产业的相关变化,预计未来几年电池能源储存系统係统的采用将会增加。可再生能源基础设施的不断建设和电力行业辅助服务需求的激增极大地推动了工业电池市场的发展。

- 此外,製造业对印度经济贡献巨大。製造业的自动化,包括基于电脑的控制系统、可程式逻辑控制 (PLC) 单元和製程控制应用,正在推动工业设施对 UPS 系统的需求。 UPS 系统在停电期间提供备用电源,并保护设备免受电源骤降、突波、欠压、过压、线路杂讯、频率波动、开关瞬变和谐波失真等电源干扰的影响。製造业包括汽车工业、食品加工工业、半导体工业、钢铁工业等广泛的产业,它们需要UPS系统等电能品质设备来确保平稳运行,因为电力波动和中断会对这些产业造成巨大的经济损失。

- 此外,汽车和钢铁业也是印度重点开发的潜在市场。印度汽车产业正在不断扩张,几家领先的产业参与者正在製定投资计画。例如,乘用车市场领导者之一的玛鲁蒂铃木印度公司宣布,计划在 2028 年将其位于哈里亚纳邦卡尔霍达的新工厂的产量提高约 100 万辆。其中,首批25万台预计于2025年投入营运。此外,为了满足其光伏产品系列日益增长的需求,该公司还决定在2024年将其马内萨尔工厂的产能提高10万台。

- 因此,由于各行业的这些趋势,预计预测期内工业电池的需求将大幅增长。

工业电池产业概况

工业电池市场比较分散。该市场的主要企业(不分先后顺序)包括 EnerSys、Exide Industries Limited、GS Yuasa Corporation、East Penn Manufacturing Company Inc. 和 Amara Raja Batteries Ltd.。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 2029 年市场规模与需求预测

- 2029年电池/原料价格趋势及各主要技术类型预测

- 2023年进出口分析:依关键技术类型及主要国家

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 锂离子电池价格下跌

- 全球可再生能源的采用日益增多

- 限制因素

- 原物料价格的不确定性

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 依技术

- 锂离子电池

- 铅酸电池

- 其他(镍镉、镍氢、锌碳等)

- 按应用

- 堆高机

- 通讯

- UPS

- 其他的

- 按最终用户产业

- 电源(包括ESS、UPS等)

- 石油和天然气

- 製造业

- 电讯

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 马来西亚

- 印尼

- 泰国

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- C&D Technologies Pvt. Ltd.

- East Penn Manufacturing Company Inc.

- Enersys

- Exide Industries Ltd.

- GS Yuasa Corporation

- Amar Raja batteries Ltd.

- Panasonic Corporation

- Saft Groupe SA

- Leoch International Technology Limited Inc.

- JYC Battery Manufacturer Co. Ltd.

- Market Ranking/Share Analysis

第七章 市场机会与未来趋势

- 对技术先进的电池的关注度日益提高

The Industrial Battery Market size is estimated at USD 44.17 billion in 2025, and is expected to reach USD 96.02 billion by 2030, at a CAGR of 16.8% during the forecast period (2025-2030).

Over the medium term, declining lithium-ion battery prices, increasing demand from data centers and the telecom sector, and rising renewable energy integration worldwide are some of the key factors expected to drive the market demand during the forecast period.

On the other hand, uncertainty in raw material prices, such as cobalt, lead, and lithium, is likely to curtail the market growth rate during the forecast period.

Nevertheless, the increasing focus on technologically advanced batteries by end users and manufacturers is likely to create a massive opportunity for battery companies to invest and redirect their resources toward making a breakthrough battery technology.

Asia-Pacific is expected to dominate the industrial battery market across the world, owing to its rising demand for UPS, forklifts, and grid-level energy storage system applications.

Industrial Battery Market Trends

Forklift Application Expected to Dominate the Market

- Industrial batteries are critical in powering a wide range of equipment and machinery, facilitating uninterrupted operations and enhancing overall productivity. Among the various applications of industrial batteries, the use of forklifts stands out as a critical driver for market expansion.

- Forklifts are essential material handling equipment widely employed in warehouses, manufacturing facilities, distribution centers, and logistics operations, and they rely on batteries to function effectively.

- One of the key factors driving the demand for industrial batteries in forklift applications is the increasing need for efficient and eco-friendly material handling solutions. With a growing emphasis on sustainability and environmental responsibility, businesses are transitioning from traditional internal combustion engine (ICE) forklifts to electric ones requiring industrial batteries.

- Furthermore, the rise of e-commerce and the expansion of global supply chains have spurred the demand for warehouses and distribution centers.

- For instance, in July 2023, the New Warehouse partnered with Experioir Global to expand its e-commerce fulfillment capabilities, effectively establishing a comprehensive e-commerce fulfillment enterprise. This partnership capitalizes on Experioir's expansive transportation network and warehouses dedicated to B2B distribution. Consequently, this strategic alliance enables them to extend their services beyond e-commerce fulfillment, encompassing an end-to-end supply chain solution, bridging the gap from port logistics to doorstep delivery for their clientele.

- According to Colliers International, the number of big-box warehouse distribution centers in the United States has grown year-on-year since 2013. In 2022, the number of buildings grew by about 396, reaching 5,946. Big-box facilities refer to extensive industrial facilities used for distribution.

- Furthermore, battery manufacturers have responded by developing advanced battery technologies that offer extended runtime, quick charging capabilities, and improved energy efficiency, addressing the specific requirements of forklift applications.

- For instance, in June 2022, BSLBATT Battery announced that it had finalized a substantial agreement with a prominent distributor specializing in industrial forklift batteries in China. Leveraging its innovative BSLBATT modular technology, BSLBATT will supply power solutions for material handling equipment in expansive facilities covering an impressive 950,000 square feet.

- Moreover, advancements in battery technology and the integration of IoT capabilities are further enhancing the appeal of industrial batteries in the forklift sector. As businesses prioritize efficiency and sustainability in material handling operations, the forklift application is expected to remain a key driver for the industrial battery market, creating opportunities for innovation and growth in the years to come.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for a significant share of the industrial battery market in 2022, and it is expected to continue its dominance over the forecast period. China, India, Japan, and South Korea majorly drive the market for industrial batteries in Asia-Pacific.

- In terms of GDP, China is the second-largest economy in the world. In 2022, the country's GDP grew by about 0.8%, reaching USD 17.96 trillion. The growth in the country is gradually diminishing as the aging population, manufacturing to services, and external to internal demand, and the economy is rebalancing from investment to consumption.

- China is expected to be one of the largest and fastest-growing markets for industrial batteries, owing to the significant growth in its power generation, chemical, oil & gas, metals processing, telecommunication, and other sectors. Further, it is expected to continue to witness similar growth during the forecast period, as industrial batteries play a crucial role in these industries.

- Further, China is heavily investing in clean energy development, constructing advanced facilities, adopting new technologies, and building sustainable and energy-efficient systems. China has emerged as the world's largest investor in clean energy, but its rapid growth has also made it the largest energy consumer.

- As of 2022, China is one of the global leaders in renewable energy deployment. The country's total renewable energy capacity reached 1160.79 GW in 2022, representing an increase of approximately 13.7% compared to the previous year's value. Hydropower, wind, and solar are the major renewable energy sources in the country.

- The deployment of the battery energy storage system is anticipated to augment in the coming years on account of changes associated with the power sector in the country. The increasing development of renewable power infrastructure, coupled with the surging need for ancillary services in the power sector, is a big boost for the industrial battery market.

- Furthermore, the manufacturing sector is one of the significant contributors to the economy of India. Automation in the manufacturing sector involving computer-based control systems, Programmable Logic Control (PLC) units, and process control applications has prompted the need for UPS systems in industrial facilities. UPS systems provide backup in case of electric power failure and protect equipment from power glitches like power sags, surges, under voltage, over-voltage, line noise, frequency variations, and switching transient and harmonic distortions. The manufacturing sector covers a wide range of industries, including the automotive industry, food processing industry, semiconductors, steel manufacturing, and many more, all requiring power quality equipment like UPS systems for smooth operations as fluctuating and disruptive power causes significant monetary losses to the industries.

- Further, the automobile and steel industries are other major potential markets for the market studied in India. The automotive sector in India is expanding owing to the current investment plans made by some of the market leaders in the industry. For instance, one of the passenger vehicle market leaders - Maruti Suzuki India, has announced plans to add an estimated million units from its new factory in Kharkhoda, Haryana, by 2028. Of these, the first 250,000 units will be commissioned by 2025. Additionally, to cater to increased demand for its PV range, the company has also chosen to increase capacity at the Manesar plant by 100,000 units in 2024.

- Hence, with these trends from various industries, the demand for industrial batteries is anticipated to increase significantly during the forecast period.

Industrial Battery Industry Overview

The industrial battery market is fragmented. The key players in this market (in no particular order) include EnerSys, Exide Industries Limited, GS Yuasa Corporation, East Penn Manufacturing Company Inc., and Amara Raja Batteries Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Battery/Raw Material Price Trends and Forecast, by Major Technology Type, till 2029

- 4.4 Import and Export Analysis, by Major Technology Type and Major Countries, in USD million, till 2023

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Declining Lithium-ion Battery Prices

- 4.7.1.2 Rising Renewable Energy Integration Worldwide

- 4.7.2 Restraints

- 4.7.2.1 Uncertainty in Raw Material Prices

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Other Technologies (Nickel Cadmium, Nickel Metal Hydride, Zinc Carbon, etc.)

- 5.2 Application

- 5.2.1 Forklift

- 5.2.2 Telecom

- 5.2.3 UPS

- 5.2.4 Other Applications

- 5.3 End-User Industry

- 5.3.1 Power Sector (incl. ESS, UPS, etc.)

- 5.3.2 Oil & Gas Sector

- 5.3.3 Manufacturing Sector

- 5.3.4 Telecom

- 5.3.5 Other End-User Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Nordic Countries

- 5.4.2.7 Turkey

- 5.4.2.8 Russia

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Malaysis

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Vietnam

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Colombia

- 5.4.4.5 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 C&D Technologies Pvt. Ltd.

- 6.3.2 East Penn Manufacturing Company Inc.

- 6.3.3 Enersys

- 6.3.4 Exide Industries Ltd.

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Amar Raja batteries Ltd.

- 6.3.7 Panasonic Corporation

- 6.3.8 Saft Groupe SA

- 6.3.9 Leoch International Technology Limited Inc.

- 6.3.10 JYC Battery Manufacturer Co. Ltd.

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on Technologically Advanced Batteries