|

市场调查报告书

商品编码

1687334

超级电脑:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Supercomputers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

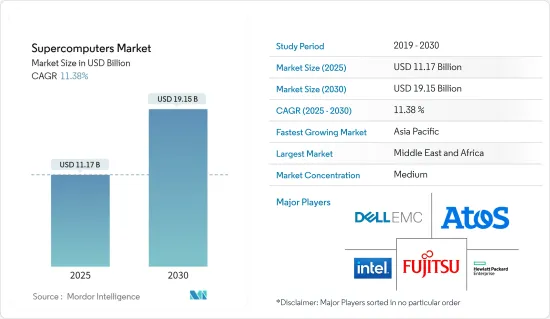

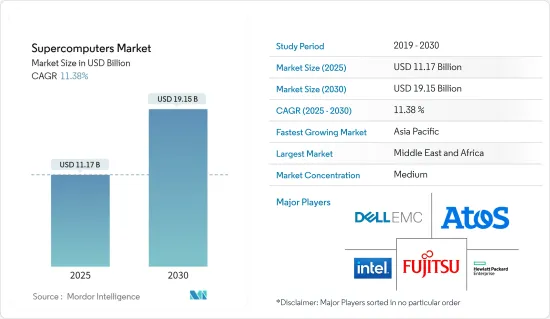

超级电脑市场规模预计在 2025 年为 111.7 亿美元,预计到 2030 年将达到 191.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.38%。

超级电脑凭藉其高效能的处理能力,作为运行人工智慧(AI)程式的核心设备正变得越来越重要。其架构擅长处理人工智慧和机器学习应用的大量资料需求。

全球范围内对高效能运算 (HPC) 应用的日益普及正在推动市场

主要亮点

- 超级电脑以其强大的运算能力和速度而闻名,在高效能运算 (HPC) 系统中发挥关键作用。由于其性能,它已成为 HPC 领域不可或缺的一部分。随着科学研究转向基于模拟的技术并且机器学习(ML)变得越来越重要,超级电脑的市场需求正在显着增加。

- 此外,2024 年 10 月,受市场对其最新超级运算 AI 晶片 Blackwell 强劲需求的乐观情绪推动,NVIDIA 股价创下历史新高。这凸显了超级电脑良好的成长轨迹,有助于推动整体市场扩张。

- 随着组织处理复杂的资料和分析工作负载,对超级电脑的需求可能会成长。对于学术和研究机构来说,超级电脑变得越来越容易获得且具有成本效益。此外,运算能力民主化的趋势日益增长,特别是透过云端运算的平台即服务模式,也正在进一步推动市场的发展。

超级运算系统初始成本高是市场成长的主要阻碍因素

主要亮点

- 高昂的拥有成本(包括设备价格、住房基础设施和营运费用)使得超级电脑价格昂贵,并成为市场成长的障碍。例如,2024年3月,微软与OpenAI联合打造了一台价值约1000亿美元的基于AI的超级电脑。这表明这种超级电脑主要面向大型企业,不适用于中小型企业。

国家之间的地缘政治衝突可能会影响市场成长

主要亮点

- 国防部门对超级电脑加强网路防御和攻击的需求正在支持政府部门的市场成长。此外,2024 年 4 月,美国国务院网路安全负责人检测到异常活动,显示中国已经开发出一台量子超级电脑。这种演变能够破解所有西方加密,从而摧毁网路防御。

超级电脑市场趋势

商业业是最大的终端用户

- 汽车公司正迅速拥抱商用超级电脑。全球供应商和汽车公司客製化这些应用程式以满足特定产业需求。超级电脑在汽车领域的主要应用包括碰撞分析、结构分析和计算流体力学。这些显着提高了产品质量,降低了成本,并使我们能够应对以前无法克服的挑战。鑑于业界竞争激烈,采用超级电脑已成为全球汽车产业供应商的必要条件。

- 例如,特斯拉在2024年2月宣布,将投资5亿美元,将其Dojo超级电脑安置在纽约州水牛城的Riverbend Gigafactory。这超级电脑将训练特斯拉的人工智慧(AI)系统,这对于自动驾驶至关重要。预计它将成为训练机器学习模型和处理特斯拉电动车产生的大量资料的主要计算平台。

- 在能源领域,超级电脑,尤其是配备加速器的超级超级电脑,使高效能运算 (HPC) 工作负载更加节能。正在开发新的演算法来处理庞大的资料集并获取更高解析度的图像。这项进步将有助于确定地下碳氢化合物的位置,特别是在巴西、墨西哥湾、安哥拉和地中海东部等恶劣的地质环境中。透过更早评估勘探区块和资产机会,公司可以更有选择地开展业务。

亚太地区预计将显着成长

- 亚太地区正在迅速崛起,成为技术进步的领导者,尤其是在超级运算系统的发展方面,中国和日本等国家做出了重大贡献。

- 在亚太地区,快速的经济成长、对研发 (R&D) 的大量投资以及对先进运算能力不断增长的需求正在刺激高效能运算 (HPC) 的持续采用和发展。

- 中国研究人员团队研发了一种量子电脑原型,可以透过随机取样高斯粒子来区分多达 76 个光子。中国研究人员正在挑战Google、亚马逊和微软等美国巨头,争夺这项前沿技术的主导地位。印度在亚太舞台上也取得了显着进展。该国已启动国家超级运算任务,目标是到2023年建造一个拥有73个高效能运算设施的超级运算网格,预计投资额为7.3亿美元。

- 2024 年 2 月,中国悄悄推出了名为「天河三号」的超级电脑,据称它是世界上最强大的机器。该机器由广州国家超级电脑计算中心开发,由于其神秘性质引发了许多猜测。天河三号超级电脑名为星仪,是中国国防科技大学建造的系列超级电脑中的最新一台。

- 2024年9月,印度推出Paraludra超级运算系统,标誌着其技术旅程取得重大飞跃。该先进设施由先进运算发展中心(C-DAC)开发,将增强印度的高效能运算能力,特别是在天气和气候运算方面。

- 新加坡政府于 2024 年 10 月宣布将拨款 2.7 亿新元(2.017 亿美元)用于加强国家的超级运算基础设施。这项投资旨在加强新加坡国家超级计算中心(NSCC)的能力并确保对当地研究倡议的支持。这项消息是由该国副总理兼国家研究基金会 (NRF) 主席在 ASPIRE 2A 和 2A+ 系统正式发布时宣布的。这些先进的研究超级电脑由 NSCC 管理。预计这些发展将在预测期内推动该地区超级电脑市场的成长。

超级电脑产业概况

该市场由多家全球和地区参与者组成,它们都在激烈的竞争中争夺关注。然而,它主要由拥有巨大市场占有率的大型供应商主导,它们竞相在各个地理市场站稳脚跟并成为先驱。

供应商正在采取竞争策略,利用其创新能力和研发投资能力来巩固其在市场上的地位。因此,这项策略将加剧市场竞争。

分销管道、现有业务关係、更好的供应链知识以及高效能运算解决方案的开发使现有的科技巨头比新参与企业拥有市场优势。总体而言,供应商竞争激烈,预计在预测期内仍将保持这种状态。

主要市场参与者包括 Atos SE、英特尔公司、惠普企业公司、戴尔 EMC(戴尔科技公司)和富士通有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 对更高处理能力的需求不断增加

- 增加研究投入

- 市场限制

- 初始设定成本高

- 安装空间大

第六章市场区隔

- 按最终用户

- 商业行业

- 政府

- 研究所

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Atos SE

- Intel Corporation

- Hewlett Packard Enterprise

- Dell EMC(Dell Technologies Inc.)

- Fujitsu Ltd

- IBM Corporation

- Lenovo Group Limited

- NEC Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Supercomputers Market size is estimated at USD 11.17 billion in 2025, and is expected to reach USD 19.15 billion by 2030, at a CAGR of 11.38% during the forecast period (2025-2030).

Supercomputers, with their high-performance processing capabilities, are increasingly becoming the backbone for running artificial intelligence (AI) programs. Their architecture is adept at handling the extensive data requirements of AI and machine learning applications.

The Growth In The Usage Of High-performance Computing (HPC) Applications Worldwide Will Drive The Market

Key Highlights

- Supercomputers, known for their immense computational power and speed, play a crucial role in high-performance computing (HPC) systems. Their capabilities make them indispensable in the HPC landscape. With scientific research leaning more towards simulation-based techniques and the rising importance of machine learning (ML), the market demand for supercomputers has seen a notable uptick.

- Additionally, in October 2024, NVIDIA's shares reached an all-time high, fueled by rising optimism regarding the robust demand for its latest supercomputing AI chips, Blackwell. This underscores the promising growth trajectory of supercomputers, bolstering the overall market expansion.

- As organizations grapple with complex data sets and analytics workloads, the demand for supercomputers will rise. Supercomputers are now becoming more accessible and cost-effective for educational research institutions. Furthermore, the growing trend of democratizing computing power, especially through cloud-computing-enabled platform-as-service models, is set to boost the market further.

The High Initial Cost Of Supercomputing Systems Is The Major Hindrance To Market Growth

Key Highlights

- High ownership costs, encompassing the device's price, housing infrastructure, and operational expenses, render supercomputers expensive and challenge market growth. For example, in March 2024, Microsoft and OpenAI collaborated to build an AI-based supercomputer costing approximately USD 100 billion. This shows that such supercomputers cater predominantly to large corporations, making them unfeasible for small and medium-sized enterprises.

The Impact Of Geopolitical Conflicts Among Countries Can Impact The Market Growth

Key Highlights

- The demand for supercomputers in defense departments to increase cyber defense and attack supports the government sector's market growth. Additionally, in April 2024, a cybersecurity official at the US State Department detected unusual activity, revealing that China had developed a quantum supercomputer. This advancement can destroy all Western encryption, thereby nullifying their cyber defenses.

Supercomputers Market Trends

Commercial Industries to be the Largest End Users

- Automotive companies are rapidly utilizing commercial supercomputers in their applications. Global vendors and automobile companies have tailored these applications to cater to the industry's unique needs. Key applications of supercomputers in the automotive sector include crash analysis, structural analysis, and computational fluid dynamics. These have significantly enhanced product quality, reduced costs, and tackled previously insurmountable tasks. Given the industry's fierce competitiveness, the adoption of supercomputers has become essential for vendors in the global automotive sector.

- For instance, in February 2024, Tesla announced a USD 500 million investment to install a Dojo supercomputer at its Riverbend Gigafactory in Buffalo, New York. This supercomputer will train Tesla's Artificial Intelligence (AI) systems, crucial for autonomous driving. Anticipated as a major computing platform, it will train machine learning models and process vast data volumes from Tesla's electric vehicles.

- In the energy sector, supercomputers, especially those with attached accelerators, enhance energy efficiency in High-performance Computing (HPC) workloads. New algorithms are being developed to process extensive datasets, yielding higher-resolution images. This advancement aids in accurately locating hydrocarbons underground, particularly in challenging geological environments like Brazil, the Gulf of Mexico, Angola, and the Eastern Mediterranean. Companies can be more selective in their ventures by assessing exploration acreage and asset opportunities early.

Asia Pacific Expected to Witness Significant Growth

- Asia Pacific is rapidly emerging as a leader in technological advancements, particularly in the development of supercomputing systems, with significant contributions from nations like China and Japan.

- In the Asia-Pacific, rapid economic growth, substantial investments in research and development (R&D), and an increasing demand for advanced computational capabilities have fueled the region's consistent adoption and development of high-performance computing (HPC).

- Researchers in China have crafted a prototype quantum computer that can identify up to 76 photons via random sampling of Gaussian bosons. In a bid for dominance in this avant-garde technology, China's researchers are challenging major US firms such as Google, Amazon, and Microsoft. India is also making notable advancements in the Asia-Pacific arena. The nation has initiated the National Supercomputing Mission, targeting the creation of a supercomputing grid with 73 high-performance computing facilities, backed by a projected investment of USD 730 million by 2023.

- In February 2024, China discreetly unveiled the Tianhe-3 supercomputer, touted as the world's most powerful machine. Developed for the National Supercomputer Center in Guangzhou, the machine's secretive nature has fueled widespread speculation. Dubbed "Xingyi," Tianhe-3 is the latest addition to a series of supercomputers crafted by China's National University of Defense Technology.

- In September 2024, India launched the Param Rudra Supercomputing System, a significant leap in its technological journey. This advanced facility, crafted by the Centre for Development of Advanced Computing (C-DAC), bolsters India's high-performance computing prowess, especially in weather and climate computing.

- In October 2024, the Singapore government unveiled its commitment of SGD 270 million (USD 201.7 million) towards the enhancement of its national supercomputing infrastructure. This investment aims to bolster the capabilities of the National Supercomputing Centre (NSCC) in Singapore, ensuring robust support for local research initiatives. The announcement was made by the country's Deputy Prime Minister, who also chairs the National Research Foundation (NRF), during the official launch of the ASPIRE 2A and 2A+ systems. These advanced research supercomputers are under the management of NSCC. These developments are set to bolster the growth of the supercomputer market in the region during the forecast period.

Supercomputers Industry Overview

The market comprises several global and regional players vying for attention in a contested space. However, it is dominated by major vendors that cover a significant market share and compete to gain a foothold and become pioneers in different regional markets.

Vendors adopt competitive strategies to gain a foothold in the market with innovation and the capability to invest in R&D, which is on the higher side. Thus, this strategy intensifies the competition in the market.

Access to distribution channels, existing business relationships, better supply chain knowledge, and the development of high-performance computing solutions give established tech giants a market advantage over new competitors. Overall, the intensity of competitive rivalry among the vendors is expected to be high and remain the same during the forecasted period.

Some of the major market players are Atos SE, Intel Corporation, Hewlett Packard Enterprise Company, Dell EMC (Dell Technologies Inc.), and Fujitsu Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment Of The Impact Of Macroeconomic Factors On The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Higher Processing Power

- 5.1.2 Increasing Investments in Research

- 5.2 Market Restraints

- 5.2.1 High Initial Setup Cost

- 5.2.2 Large Installation Space

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Commercial Industries

- 6.1.2 Government Entities

- 6.1.3 Research Institutions

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atos SE

- 7.1.2 Intel Corporation

- 7.1.3 Hewlett Packard Enterprise

- 7.1.4 Dell EMC (Dell Technologies Inc.)

- 7.1.5 Fujitsu Ltd

- 7.1.6 IBM Corporation

- 7.1.7 Lenovo Group Limited

- 7.1.8 NEC Corporation