|

市场调查报告书

商品编码

1687343

松脂化学:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Pine Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

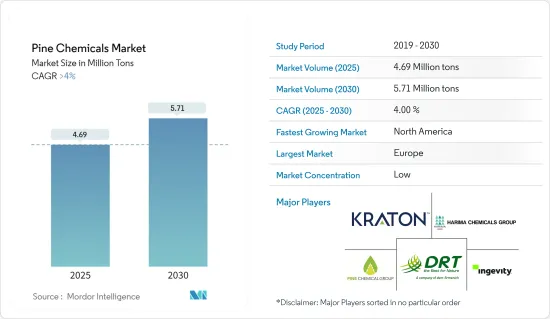

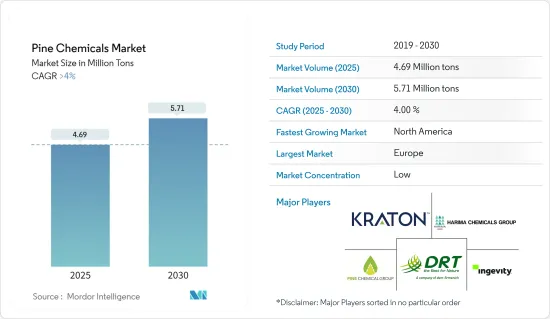

松脂化学市场规模预计在 2025 年为 469 万吨,预计在 2030 年达到 571 万吨,预测期内(2025-2030 年)的复合年增长率将超过 4%。

COVID-19 对松脂化学市场产生了多方面的影响。最初,由于供应链中断、工业活动放缓和消费者支出下降,需求下降。这导致松脂化学生产和销售暂时放缓。然而,随着疫情的进展,某些松树衍生产品的需求增加,特别是用于消毒剂、杀菌剂和药品的产品。

采矿业和香料产业对松脂化学的需求不断增加是推动松脂化学市场发展的主要因素。

然而,廉价替代品的出现和原材料价格的波动预计会阻碍松脂化学市场的成长。

松脂化学在各个终端用户产业的应用不断扩大,预计将为松脂化学市场创造新的机会。

预计欧洲将主导全球松脂化学市场,其中德国和义大利等国家的消费量最高。

松脂化学市场趋势

黏合剂和密封剂预计将占据市场主导地位

松脂化学,特别是松香及其衍生物,具有优异的黏合性能,是生产黏合剂和密封剂的理想原料。这些产品可提高黏合强度和内聚力,从而提高性能和耐用性。

松木衍生的化学品广泛应用于建筑、汽车、包装、木工和电子等行业的各种黏合剂和密封剂配方。它用于压敏黏着剂、热熔胶和橡胶基胶粘剂等产品中。

此外,建设产业的成长推动了黏合剂和密封剂的消费,从而促进了松脂化学市场的成长。中国是世界上最大的建筑市场之一。根据国家统计局数据显示,中国建设产业商务活动指数从2023年11月的55.9上升至12月的56.9。

松脂化学是建筑填缝、接缝密封和防风雨用密封配方中的关键成分。Tall oil基密封剂对混凝土、砖石、玻璃和金属等多种基材具有优异的附着力,可用于密封建筑物外部、窗户、门和屋顶的缝隙、裂缝和接缝。

预计到 2025 年,印度建筑业的规模将成长到 1.4 兆美元。到 2030 年,预计将有 6 亿人居住在城市中心,从而需要额外 2,500 万套中高端住宅。根据国家投资计画(NIP),印度的基础设施投资预算为1.4兆美元,其中24%用于可再生能源、道路、高速公路和城市基础设施,12%用于铁路。

因此,预计未来几年汽车和建筑行业中黏合剂和密封剂的应用将持续增加,从而推动市场研究。

欧洲主导市场

欧洲有大片松树林,尤其是瑞典、芬兰、俄罗斯和波罗的海国家。这些森林是松脂的丰富来源,而鬆脂是生产松脂化学产品的原料。拥有丰富且永续的松树资源使欧洲生产商在全球市场上具有竞争优势。

欧洲公司服务于使用松脂化学的众多行业和应用,包括黏合剂、密封剂、油漆和被覆剂、印刷油墨、个人保健产品和药品。多样化的终端使用产业确保了该地区对松脂化学的稳定需求。

此外,松木树脂通常用作建筑胶黏剂中的黏合剂。这些黏合剂用于黏合各种建筑材料,包括木材、金属、混凝土和塑胶。这些黏合剂坚固耐用,非常适合建筑结构和非结构应用。

根据欧盟统计局发布的最新估计,2023年12月欧元区建设业产量与2022年12月相比成长了1.9%,欧洲成长了2.4%。

德国是欧洲最大的通用橡胶製品(GRG)和轮胎生产国之一。大陆汽车集团、邓禄普有限公司、米其林轮胎股份公司、倍耐力德国有限公司和科德宝集团是德国领先的轮胎和非轮胎产品製造商。

根据德国联邦统计局(Statistisches Bundesamt)2023年6月发布的估计数据,截至2022年,德国建设业的销售额将超过土木工程和专业建设业的销售额。土木工程项目的最大营业额来自公路和铁路建设,营业额超过 210 亿欧元(228.3 亿美元),其次是公共工程,营业额为 120 亿欧元(130.4 亿美元)。

因此,预计上述因素将主要推动欧洲地区对松脂化学市场的需求。

松脂化学行业概况

松脂化学市场较为分散,前五大公司占据相当大的市场占有率。市场的主要企业(不分先后顺序)包括 KRATON CORPORATION、Ingevity Corporation、DRT、Harima Chemicals Group Inc.、Pine Chemical Group 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 采矿、浮选化学品和润滑剂对松脂化学的需求不断增加

- 香水产业的需求不断成长

- 限制因素

- 政府激励措施推动将原煤焦油转化为生生质燃料

- 廉价替代品越来越多

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 产品类型

- Tall oil

- 粗Tall oil(CTO)

- Tall oil脂肪酸 (TOFA)

- 蒸馏Tall oil(DTO)

- Tall oil沥青 (TOP)

- 松香

- Tall oil松香

- 松香

- 木松香

- 松节油

- 胶木松节油

- 粗鬆节油硫酸盐

- 其他松节油

- 应用

- 黏合剂和密封剂

- 画

- 印刷油墨

- 润滑剂和添加剂

- 生质燃料

- 纸张大小

- 橡皮

- 肥皂和清洁剂

- 其他用途(油田化学物质、化学添加物、口香糖、食品添加物)

- Tall oil

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率排名分析

- 主要企业策略

- 公司简介(概况、财务状况、产品与服务、最新发展)

- Arakawa Chemical Industries Ltd

- DRT(Derives Resiniques et Terpeniques)

- Forchem Oyj

- Harima Chemicals Group Inc.

- Ingevity Corporation

- Kraton Corporation

- Mercer International

- OOO Torgoviy Dom Lesokhimik

- Pine Chemical Group

- Respol Resinas SA

- Sunpine AB

- Synthomer Plc.

第七章 市场机会与未来趋势

- 松脂化学的新用途(DTO、TOFA、CTO、TOP、木松香)

- 黏合剂和密封剂的食品和包装安全法规

The Pine Chemicals Market size is estimated at 4.69 million tons in 2025, and is expected to reach 5.71 million tons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

COVID-19 has had mixed effects on the pine chemicals market. Initially, demand decreased due to disruptions in supply chains, reduced industrial activity, and lower consumer spending. This led to temporary slowdowns in the production and sales of pine chemicals. However, as the pandemic progressed, there was an increased demand for certain pine-derived products, particularly those used in disinfectants, sanitizers, and pharmaceuticals.

Increasing demand for pine chemicals from the mining sector and the flavors and fragrances industry are the major factors driving the pine chemicals market.

However, an increase in the availability of cheaper substitutes and fluctuations in the price of raw materials are expected to hamper the growth of the pine chemicals market.

The expanding applications of pine chemicals in various end-user industries are expected to unveil new opportunities for the pine chemicals market.

Europe is expected to dominate the pine chemicals market globally, with the most significant consumption coming from countries such as Germany and Italy.

Pine Chemicals Market Trends

The Adhesives and Sealants Segment is expected to Dominate the Market

Pine chemicals, particularly rosin and its derivatives, exhibit excellent tackifying properties, making them ideal ingredients for adhesives and sealants. They enhance the adhesion strength and cohesion of these products, improving their performance and durability.

Pine-derived chemicals are used in a diverse range of adhesives and sealant formulations across industries such as construction, automotive, packaging, woodworking, and electronics. They are utilized in products like pressure-sensitive adhesives, hot-melt adhesives, rubber-based adhesives, and more.

Furthermore, the growth in the construction industry has propelled the consumption of adhesives and sealants, thus propelling the growth of the pine chemicals market. China is one of the world's largest construction markets. According to the National Bureau of Statistics (NBS), the construction industry's business activity index in China rose to 56.9 as of December 2023 from 55.9 in November 2023.

Pine chemicals are the key ingredient in the formulation of sealants used for caulking, joint sealing, and weatherproofing in construction. Tall oil-based sealants offer excellent adhesion to a wide range of substrates such as concrete, masonry, glass, and metal, making them practical for sealing gaps, cracks, and joints in building envelopes, windows, doors, and roofing systems.

India's construction Industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% of the budget earmarked for renewable energy, roads & highways, urban infrastructure, and 12% for railways.

Thus, the rising application of adhesives and sealants in the automotive and construction industries is expected to boost the market studied in the coming years.

Europe Region to Dominate the Market

Europe has extensive pine forests, particularly in countries like Sweden, Finland, Russia, and the Baltic States. These forests provide a rich source of pine resin, which serves as the raw material for pine chemical production. The availability of abundant and sustainable pine resources gives European producers a competitive advantage in the global market.

European companies cater to a wide range of industries and applications that utilize pine chemicals, including adhesives, sealants, paints, coatings, printing inks, personal care products, pharmaceuticals, and more. The diversity of end-use industries ensures a stable demand for pine chemicals within the region.

Further, pine-derived resins are commonly used as tackifiers in construction adhesives. These adhesives are then used to bond various construction materials, including wood, metal, concrete, and plastics. They provide strong and durable bonds, making them ideal for structural and non-structural applications in construction.

According to the latest estimate published by Eurostat, in December 2023, compared with December 2022, production in construction increased by 1.9% in the euro area and by 2.4% in Europe.

Germany is one of Europe's largest producers of general rubber goods (GRG) and tires. Continental AG, Dunlop GmbH, Michelin Tire Werke AG & Co. KGaA, Pirelli Deutschland GmbH, and Freudenberg Group are some of the significant manufacturers of tire and non-tire products in the country.

According to the estimate released by the Statistisches Bundesamt in June 2023, as of 2022, the turnover of the construction industry in Germany was higher than that of any civil engineering or specific construction sector. The highest turnover in civil engineering activities was for road and railway construction, at more than EUR 21 billion (USD 22.83 billion), and utility projects, which amounted to EUR 12 billion (USD 13.04 billion).

Thus, the factors mentioned above are expected to drive the market demand for pine chemicals, mainly from the European region.

Pine Chemicals Industry Overview

The pine chemicals market is fragmented, with the top five players accounting for a significant market share. The major players in the market (not in any particular order include) KRATON CORPORATION, Ingevity Corporation, DRT, Harima Chemicals Group Inc., and Pine Chemical Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Pine Chemicals in Mining and Flotation Chemicals and Lubricants

- 4.1.2 Increasing Demand from the Flavors and Fragrances Industry

- 4.2 Restraints

- 4.2.1 Diversion of CTO to Biofuels due to Government Incentives

- 4.2.2 Increase in the Availability of Cheaper Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Threat of New Entrants

- 4.4.3 Threat of Substitute Products and Services

- 4.4.4 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Tall Oil

- 5.1.1.1 Crude Tall Oil (CTO)

- 5.1.1.2 Tall Oil Fatty Acid (TOFA)

- 5.1.1.3 Distilled Tall Oil (DTO)

- 5.1.1.4 Tall Oil Pitch (TOP)

- 5.1.2 Rosin

- 5.1.2.1 Tall Oil Rosin

- 5.1.2.2 Gum Rosin

- 5.1.2.3 Wood Rosin

- 5.1.3 Turpentine

- 5.1.3.1 Gum/Wood Turpentine

- 5.1.3.2 Crude Sulphate Turpentine

- 5.1.3.3 Other Turpentines

- 5.1.4 Application

- 5.1.4.1 Adhesives and Sealants

- 5.1.4.2 Coatings

- 5.1.4.3 Printing Inks

- 5.1.4.4 Lubricants and Lubricity Additives

- 5.1.4.5 Biofuels

- 5.1.4.6 Paper Sizing

- 5.1.4.7 Rubber

- 5.1.4.8 Soaps and Detergents

- 5.1.4.9 Other Applications (Oil Field Chemicals, Chemical additives, Chewing Gums, and Food Additives)

- 5.1.1 Tall Oil

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles(Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 Arakawa Chemical Industries Ltd

- 6.4.2 DRT (Derives Resiniques et Terpeniques)

- 6.4.3 Forchem Oyj

- 6.4.4 Harima Chemicals Group Inc.

- 6.4.5 Ingevity Corporation

- 6.4.6 Kraton Corporation

- 6.4.7 Mercer International

- 6.4.8 OOO Torgoviy Dom Lesokhimik

- 6.4.9 Pine Chemical Group

- 6.4.10 Respol Resinas SA

- 6.4.11 Sunpine AB

- 6.4.12 Synthomer Plc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications of Pine Chemicals (DTO, TOFA, CTO, TOP, and Wood Rosin)

- 7.2 Food and Packaging Safety Regulations of Adhesives and Sealants