|

市场调查报告书

商品编码

1687344

雷射:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

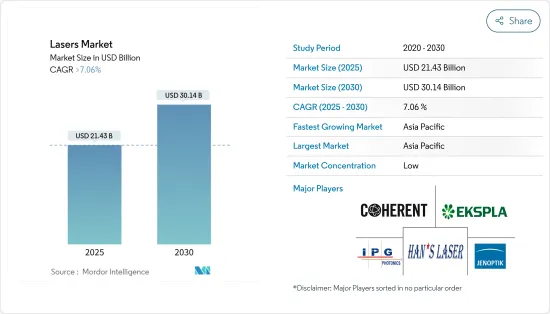

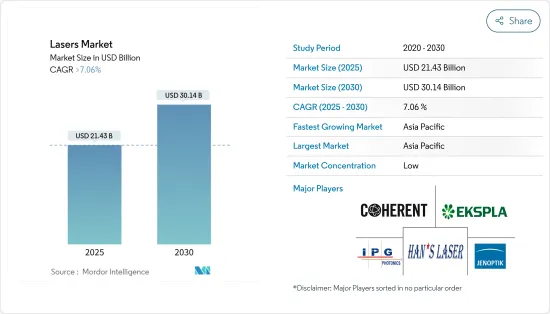

预计 2025 年雷射市场规模为 214.3 亿美元,到 2030 年将达到 301.4 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 7.06%。

主要亮点

- 快速发展的电子产业依靠雷射技术来确保零件和组件製造的精确性、小型化和复杂性。雷射以非接触式和高精度的方式切割、标记和构造电子元件。这减少了材料浪费并最大限度地减少了潜在的损害。在处理电子设备中的敏感材料和复杂设计时,这种能力尤其重要。

- 此外,雷射技术对于电子领域的微电子和元件製造至关重要。该技术有利于设备小型化,确保高生产产量比率,并实现现代电子产品不可或缺的复杂电路设计。

- 对创新电子设备的需求不断增长、电动车普及率激增以及人工智慧在各个领域的广泛融合等因素正在推动晶片设计和製造市场的发展。这种势头正在为雷射市场创造成长机会。

- 然而,小型企业和新兴企业往往受到预算紧张的限制,并且由于雷射打标机所需的高额初始投资而面临挑战。这些机器的初始成本很高,取决于雷射的位置、所需的功率、标记区域的大小以及附加功能。因此,高昂的前期成本可能会阻碍市场成长。

- 人工智慧增强型雷射系统的采用使得焊接过程中的即时品质监控成为可能,从而改变了市场。这项技术创新将降低生产成本并提高产品质量,从而支持预测期内的整体市场成长。

雷射市场趋势

雷射感测器是电子和航空领域的新前沿

- 电子产品製造商越来越多地将雷射感测器用于各种应用。这包括确保产品公差、简化分类流程和增强零件识别系统。雷射感测器可测量压力感测器中的隔膜位移、检查印刷电路基板的特性以及测量助听器组件中的外壳轮廓。电子製造中越来越流行的感测器类型包括共焦感测器、共焦位移感测器、三角测量感测器和雷射多普勒感测器 (LDS)。

- 例如,2024 年 1 月,基恩士扩展了其 CL-3000 系列共焦位移感测器。共焦位移感测器以其高精度的距离测量而闻名,在自动化品管中发挥着至关重要的作用。感测器透过分析反射光的强度来测量到物体的距离。为了实现这一点,感测器会发射激光,然后分裂光束。

- 航空业不断突破技术界限,要求无与伦比的精度和解析度。飞行时间等技术利用远距雷射距离感测器来测量光的传输时间,并利用光的恆定速度来确定距离。此外,航空业越来越依赖高解析度系统,凸显了雷射雷达系统日益增长的重要性。同时,无人机的发展正在推动航空应用的快速成长。

- 例如,2024年3月,JOUAV发布了其最新的专为无人机设计的LiDAR感测器JoLiDAR-1000。此次公告增强了 JOUAV 的高性能、低成本 LiDAR 感测器产品组合,以进一步推进民用无人机 (UAV) 的应用,包括 GIS、测量和精密电力线检查。

- 因此,受雷射感测器需求不断增长和技术创新的推动,各个终端用途领域的强劲进步预计将在预测期内推动市场成长。

亚太地区成长强劲

- 中国引领全球雷射市场很大程度上得益于其强大的基础设施、成熟的工业生态系统以及对技术改进的不懈关注。该市场因其对汽车、家电、製造业和可再生能源行业的重大贡献而闻名。随着自动化数位化的提高,在「中国製造2025」等重要措施的支持下,中国对基于雷射的解决方案的需求预计将快速增长。

- 印度製造业在各种措施和优惠政策的推动下蓬勃发展。 「印度製造」计画已将印度定位为全球製造地,并为该国经济赢得了国际讚誉。该计划旨在提高国内製造能力、吸引外国投资并在全国创造就业机会。 2024年,印度将成为世界第五大製造业国家,反映出其在全球製造业领域的影响力日益增强。

- 日本与先进工业、医疗和技术生态系统的紧密融合使其成为全球雷射市场的杰出参与企业。日本在全球製造业中,特别是在汽车、医疗保健和电子产业中的关键作用证明了其重要性。日本以其精密工程和技术创新而闻名,继续成为全球雷射产业的重要市场。

- 面对劳动成本上升和製造业就业减少的问题,韩国越来越多地将基于雷射的机器人纳入生产过程。这种转变不仅将取代传统劳动力,还将提高製造效率和生产力。因此,韩国已成为机器人密度的全球领导者,并展示了其对工业自动化和技术进步的承诺。

- 亚太地区其他雷射市场正在经历强劲成长。这种快速增长很大程度上归功于该地区的电子和汽车製造基础以及不断增长的消费者购买力。此外,随着智慧型手机的普及和商业的数位化不断提高,对各种雷射应用的需求也在不断增长,尤其是在蓬勃发展的家电和汽车领域。其他亚太地区包括印尼、新加坡和澳洲。

雷射行业概况

市场由大型供应商和较小的区域参与者构成,每个参与者都迎合自己的客户群。这些供应商依靠研究、创新和产品开发作为其主要成长策略来增加其在市场上的占有率。

市场资本密集的特征意味着小型企业面临较高的退出壁垒,往往导致被大公司收购。再加上企业集中度适中,加剧了竞争公司之间的竞争。

随着市场进入以收购和合併为标誌的整合阶段,显着的发展已经出现。此外,市场的主要企业正在扩大其区域影响力,并与生态系统合作伙伴合作,深入研究超快雷射的新应用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电子产业对雷射系统的需求不断增长

- 工业 4.0 和智慧製造实务的采用率不断提高

- 限制因素

- 高资本投入

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按类型

- 光纤雷射

- 二极体雷射

- CO/CO2雷射

- 固体雷射

- 其他的

- 按应用

- 通讯

- 材料加工

- 医疗和化妆品

- 光刻

- 研究与开发

- 军事和国防

- 感应器

- 展示

- 其他用途(标记、光学储存、印刷)

- 按地区

- 亚洲

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 澳洲和纽西兰

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 南美洲

- 中东

- 亚洲

第六章竞争格局

- 公司简介

- Coherent Corp.

- EKSPLA

- Hans Laser Technology Industry Group Co., Ltd.

- IPG Photonics Corporation

- Jenoptik AG

- Keyence Corporation

- Lumentum Holdings Inc.

- Lumibird SA

- Maxphotonics Co., Ltd.

- nLIGHT, Inc.

- Novanta, Inc.

- TRUMPF SE+Co. KG

- Wuhan Raycus Fiber Laser Technologies Co. Ltd

- 併购、合资、合作与协议

- 市场占有率分析

- 主要企业策略

第七章 市场机会与未来趋势

- LiDAR技术

The Lasers Market size is estimated at USD 21.43 billion in 2025, and is expected to reach USD 30.14 billion by 2030, at a CAGR of greater than 7.06% during the forecast period (2025-2030).

Key Highlights

- The rapidly evolving electronics industry relies on laser technology to ensure precision, miniaturization, and complexity in manufacturing components and assemblies. Lasers cut, mark, and structure electronic parts using a non-contact and highly accurate approach. This reduces material waste and minimizes potential damage. Such capabilities are especially crucial when handling sensitive materials and intricate designs in electronic devices.

- Additionally, laser technology is crucial in producing microelectronics and components in the electronics sector. This technology facilitates the miniaturization of devices, guarantees high production yields, and allows for intricate circuit designs vital to contemporary electronics.

- Factors such as the rising demand for innovative electronics, the surge in electric vehicle adoption, and the widespread integration of artificial intelligence across various sectors drive the chip design and fabrication market. This momentum is creating growth opportunities for the laser market.

- However, small businesses and startups, often constrained by tight budgets, face challenges due to the high initial investment required for laser marking machines. These machines have a significant upfront cost, influenced by laser placement, power requirements, marking area size, and added functionalities. As a result, this steep initial expense could stifle market growth.

- The market has been transformed by adopting AI-enhanced laser systems, enabling real-time quality monitoring during welding. This innovation reduces production costs and enhances product quality, supporting the overall market growth during the forecast period.

Laser Market Trends

Laser Sensors to be the New Frontier in Electronics and Aviation

- Electronic manufacturers are increasingly turning to laser sensors for a variety of applications. These include ensuring product tolerances, streamlining sorting processes, and enhancing part recognition systems. Laser sensors measure diaphragm displacement in pressure transducers, inspect features on printed circuit boards, and gauge housing profiles for hearing aid assemblies. Among the types of sensors gaining traction in electronic manufacturing are confocal sensors, confocal displacement sensors, triangulation sensors, and Laser Doppler Sensors (LDS).

- For instance, in January 2024, 'Keyence expanded its CL-3000 Series of Confocal Displacement Sensors. Confocal displacement sensors, known for their high-precision distance measurements, play a pivotal role in automated quality control. These sensors gauge the distance to an object by analyzing the intensity of reflected light. To achieve this, the sensor emits a laser light and subsequently splits the beam.

- The aviation sector consistently pushes technological boundaries, demanding unparalleled accuracy and resolution. Technologies like Time-of-Flight leverage long-range laser distance sensors, measuring light's transit time and employing the constant speed of light to determine distances. Moreover, the aviation industry's growing reliance on high-resolution systems underscores the rising significance of LiDAR systems. Meanwhile, the evolution of unmanned aerial vehicles (UAVs) is witnessing a surge in aerial applications.

- For instance, in March 2024, JOUAV unveiled its newest LiDAR sensor, the JoLiDAR-1000, designed specifically for drones. This launch bolsters JOUAV's already impressive range of high-performance, budget-friendly LiDAR sensors, furthering the evolution of civilian unmanned aerial vehicle (UAV) uses, including GIS, surveying, and meticulous power line inspections.

- As a result, robust advancements across diverse end-use sectors are poised to propel market growth during the forecast period, driven by increasing demand and innovation for laser-based sensors.

Asia Pacific to Register Major Growth

- China leads the world laser market in large part because of its strong infrastructure, established industrial ecosystem, and relentless focus on technological improvements. The market is distinguished by its substantial contributions to the automobile, consumer electronics, manufacturing, and renewable energy industries. As automation and digitalization increase, China's need for laser-based solutions is anticipated to develop rapidly, supported by major initiatives like "Made in China 2025".

- India's manufacturing sector is witnessing rapid growth, driven by various initiatives and favorable policies. The 'Make in India' initiative has positioned the nation as a global manufacturing hub, garnering international acclaim for its economy. This program aims to boost domestic manufacturing capabilities, attract foreign investments, and create employment opportunities across the country. In 2024, India ascended to become the world's fifth-largest manufacturing nation, reflecting its growing prominence in the global manufacturing landscape.

- Japan's strong integration into advanced industrial, medical, and technological ecosystems establishes it as a distinguished participant in the global laser market. Its critical role in global manufacturing, particularly in the automotive, healthcare, and electronics industries, underpins its significance. Renowned for its precision engineering and innovation, Japan remains a vital market within the global laser industry.

- South Korea, facing rising labor wages and a dip in manufacturing employment, is increasingly adopting laser-based robotics in its production processes. This transition not only replaces traditional labor but also enhances efficiency and productivity in manufacturing. As a result, South Korea has emerged as one of the global leaders in robot density, showcasing its commitment to industrial automation and technological advancement.

- Robust growth characterizes the laser market in the Rest of Asia-Pacific region. This surge is primarily attributed to the region's electronics and automobile manufacturing stronghold and rising consumer purchasing power. Furthermore, as smartphone adoption accelerates and businesses digitize, there's a heightened demand for various laser applications, especially in the flourishing consumer electronics and automotive sectors. The Rest of the Asia-Pacific region consists of countries like Indonesia, Singapore, and Australia, under the scope of the study, where the studied market is gaining considerable traction.

Laser Industry Overview

Large vendors and smaller regional players populate the market, each catering to their respective clientele. These vendors emphasize research, innovation, and product development as key growth strategies, bolstering their market presence.

The capital-intensive nature of the market means that smaller companies face heightened exit barriers, often leading to acquisitions by larger firms. This, combined with moderate firm concentration, amplifies the competitive rivalry.

Notable moves have already been made as the market heads towards a consolidation phase marked by acquisitions and mergers. Additionally, major players in the market are expanding their regional footprint and collaborating with ecosystem partners, delving into novel applications for ultrafast lasers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Laser Systems from the Electronics Industry

- 4.1.2 Increasing Adoption of Industry 4.0 and Smart Manufacturing Practices

- 4.2 Restraints

- 4.2.1 High Capital Investment

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Fiber Lasers

- 5.1.2 Diode Lasers

- 5.1.3 CO/CO2 Lasers

- 5.1.4 Solid State Lasers

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Communications

- 5.2.2 Materials Processing

- 5.2.3 Medical and Cosmetics

- 5.2.4 Lithography

- 5.2.5 Research and Development

- 5.2.6 Military and Defense

- 5.2.7 Sensors

- 5.2.8 Displays

- 5.2.9 Other Applications (Marking, Optical Storage, Printing)

- 5.3 Geography

- 5.3.1 Asia

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia and New Zealand

- 5.3.2 Australia and New Zealand

- 5.3.3 North America

- 5.3.3.1 United States

- 5.3.3.2 Canada

- 5.3.3.3 Mexico

- 5.3.4 Europe

- 5.3.4.1 Germany

- 5.3.4.2 United Kingdom

- 5.3.4.3 France

- 5.3.4.4 Italy

- 5.3.5 South America

- 5.3.6 Middle East

- 5.3.1 Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Coherent Corp.

- 6.1.2 EKSPLA

- 6.1.3 Hans Laser Technology Industry Group Co., Ltd.

- 6.1.4 IPG Photonics Corporation

- 6.1.5 Jenoptik AG

- 6.1.6 Keyence Corporation

- 6.1.7 Lumentum Holdings Inc.

- 6.1.8 Lumibird SA

- 6.1.9 Maxphotonics Co., Ltd.

- 6.1.10 nLIGHT, Inc.

- 6.1.11 Novanta, Inc.

- 6.1.12 TRUMPF SE + Co. KG

- 6.1.13 Wuhan Raycus Fiber Laser Technologies Co. Ltd

- 6.2 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.3 Market Share Analysis

- 6.4 Strategies Adopted by Leading Players

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 LiDAR Technology